In the digital age, when screens dominate our lives however, the attraction of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons such as creative projects or just adding some personal flair to your area, Interest Paid On Home Loan Tax Deduction India are now a vital source. Through this post, we'll take a dive deeper into "Interest Paid On Home Loan Tax Deduction India," exploring the benefits of them, where to locate them, and how they can enhance various aspects of your daily life.

Get Latest Interest Paid On Home Loan Tax Deduction India Below

Interest Paid On Home Loan Tax Deduction India

Interest Paid On Home Loan Tax Deduction India -

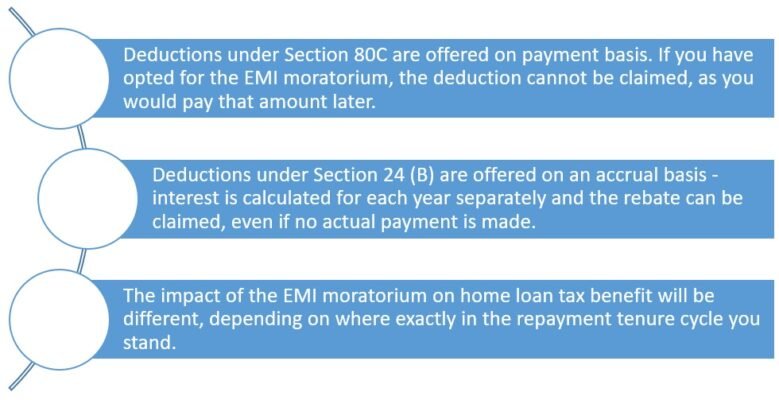

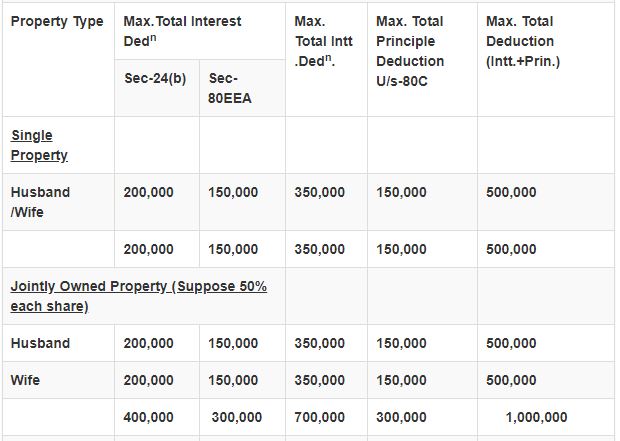

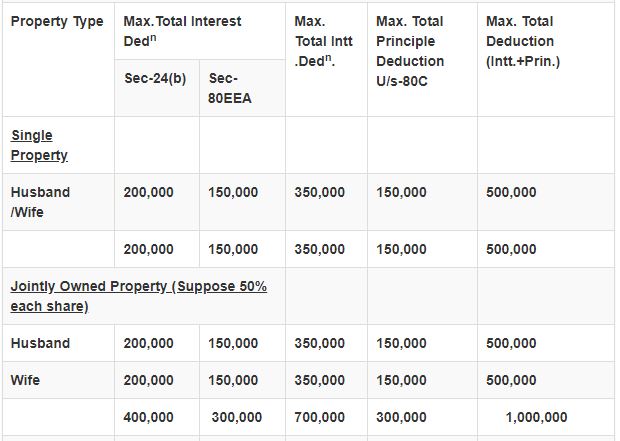

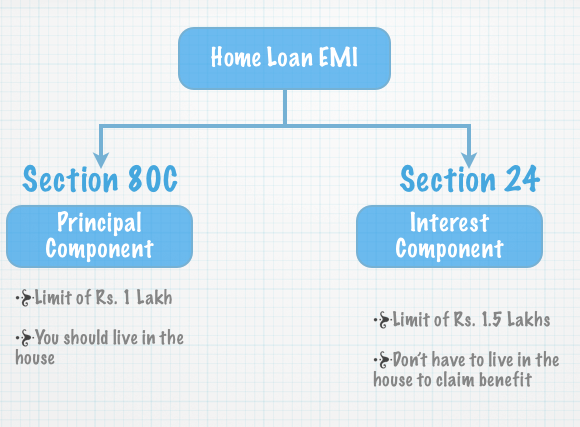

You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh can be claimed from your gross

Section 80EE allows Income Tax Benefits on Interest on Home Loan to first time buyers in the following events This deduction will be provided only if the cost of the property acquired is not more than Rs

Printables for free include a vast collection of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and more. The appealingness of Interest Paid On Home Loan Tax Deduction India lies in their versatility as well as accessibility.

More of Interest Paid On Home Loan Tax Deduction India

EMI Housing News

EMI Housing News

To provide interest deduction on home loans section 80EEA has been introduced The older provision of Section 80EE allowed a deduction of up to Rs 50 000 for interest paid by first time home

The maximum deduction allowable is 50 000 The deduction of up to Rs 50 000 under section 80EE is over and above the deduction of up to Rs 2 00 000 available under section 24 for interest

Interest Paid On Home Loan Tax Deduction India have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor printables to your specific needs such as designing invitations as well as organizing your calendar, or decorating your home.

-

Educational value: Printables for education that are free are designed to appeal to students of all ages, making them a useful instrument for parents and teachers.

-

Affordability: Quick access to the vast array of design and templates cuts down on time and efforts.

Where to Find more Interest Paid On Home Loan Tax Deduction India

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while

We hope we've stimulated your interest in Interest Paid On Home Loan Tax Deduction India Let's see where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection in Interest Paid On Home Loan Tax Deduction India for different needs.

- Explore categories like home decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free, flashcards, and learning tools.

- The perfect resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing Interest Paid On Home Loan Tax Deduction India

Here are some inventive ways ensure you get the very most use of Interest Paid On Home Loan Tax Deduction India:

1. Home Decor

- Print and frame gorgeous artwork, quotes or decorations for the holidays to beautify your living areas.

2. Education

- Use these printable worksheets free of charge to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars or to-do lists. meal planners.

Conclusion

Interest Paid On Home Loan Tax Deduction India are a treasure trove of fun and practical tools that cater to various needs and interests. Their access and versatility makes them a wonderful addition to your professional and personal life. Explore the endless world of Interest Paid On Home Loan Tax Deduction India to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really cost-free?

- Yes you can! You can print and download these files for free.

-

Can I use the free printouts for commercial usage?

- It depends on the specific terms of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may contain restrictions in their usage. You should read the conditions and terms of use provided by the designer.

-

How do I print Interest Paid On Home Loan Tax Deduction India?

- Print them at home with either a printer at home or in a local print shop to purchase the highest quality prints.

-

What program do I require to open Interest Paid On Home Loan Tax Deduction India?

- The majority of printables are as PDF files, which can be opened using free software such as Adobe Reader.

What Is The Apr On A Home Loan

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Check more sample of Interest Paid On Home Loan Tax Deduction India below

Higher Income Tax Deduction On NPS Likely For Private Sector Employees

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Home Loan Tax Deductions India

Types Of Mortgages To Choose From Know The Many Options Available To You

Section 80EE Income Tax Deduction For Interest On Home Loan

Pin P Home Improvement And Construction Blogs

https://tax2win.in/guide/section-80ee

Section 80EE allows Income Tax Benefits on Interest on Home Loan to first time buyers in the following events This deduction will be provided only if the cost of the property acquired is not more than Rs

https://economictimes.indiatimes.com/wealth/tax/...

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a

Section 80EE allows Income Tax Benefits on Interest on Home Loan to first time buyers in the following events This deduction will be provided only if the cost of the property acquired is not more than Rs

Presently under Section 24 a home loan borrower who pays interest on the loan may deduct that interest from his or her gross annual income up to a

Types Of Mortgages To Choose From Know The Many Options Available To You

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

Section 80EE Income Tax Deduction For Interest On Home Loan

Pin P Home Improvement And Construction Blogs

How Will Your Home Loan Save Income Tax By Vinita Solanki Medium

Deduction For Interest Paid On Loan Is Limited To Rs 30000

Deduction For Interest Paid On Loan Is Limited To Rs 30000

What Are The Tax Benefit On Home Loan FY 2020 2021