In the age of digital, in which screens are the norm and the appeal of physical printed objects isn't diminished. It doesn't matter if it's for educational reasons as well as creative projects or simply to add the personal touch to your area, Investment Rebate On Income Tax are now a useful source. This article will take a dive deep into the realm of "Investment Rebate On Income Tax," exploring their purpose, where they can be found, and how they can be used to enhance different aspects of your life.

Get Latest Investment Rebate On Income Tax Below

Investment Rebate On Income Tax

Investment Rebate On Income Tax - Investment Rebate On Income Tax In Bangladesh, Investment Rebate In Income Tax, Investment Exemption For Tax, Rebate On Investment In Income Tax Bangladesh 2023, Investment Eligible For 80c Deduction, How To Get Rebate On Tax, What Are Investment Under 80c

Web 10 oct 2021 nbsp 0183 32 If your annual income is less than Tk15 lakh you will get 15 tax exemption of total investment and donation Tax exemption at the rate of 10 will be available if it

Web 15 juil 2020 nbsp 0183 32 The tax rate on capital gains for most assets held for more than one year is 0 15 or 20 Capital gains taxes on most assets held for less than a year

Printables for free include a vast variety of printable, downloadable resources available online for download at no cost. These resources come in various forms, like worksheets coloring pages, templates and much more. The beauty of Investment Rebate On Income Tax is in their versatility and accessibility.

More of Investment Rebate On Income Tax

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Web 27 avr 2023 nbsp 0183 32 Individuals can claim up to Rs 1 5 lakh spent on such investments as tax waivers on total annual income under Section 80C of the Income Tax Act Tax

Web 5 Tax Rebate for investment Section 44 2 only allowable for Resident Non Resident Bangladeshi a Rate of Rebate Amount of allowable investment is actual

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization We can customize printables to fit your particular needs in designing invitations, organizing your schedule, or decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages, making them an essential resource for educators and parents.

-

Simple: You have instant access various designs and templates, which saves time as well as effort.

Where to Find more Investment Rebate On Income Tax

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Web 11 juin 2021 nbsp 0183 32 The maximum ceiling on investment to claim a tax rebate was Tk 1 5 crore or 25 per cent of taxable income in the outgoing fiscal year The reduction is going to

Web 30 ao 251 t 2023 nbsp 0183 32 Maximum Exemption Limit in Salary Income Investment Rebate Calculation and Exemption of interest income on PF according to Income Tax Act 2023

We hope we've stimulated your curiosity about Investment Rebate On Income Tax Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Investment Rebate On Income Tax for all uses.

- Explore categories like design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- These blogs cover a wide spectrum of interests, starting from DIY projects to party planning.

Maximizing Investment Rebate On Income Tax

Here are some new ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars or to-do lists. meal planners.

Conclusion

Investment Rebate On Income Tax are a treasure trove of innovative and useful resources designed to meet a range of needs and desires. Their access and versatility makes them a fantastic addition to the professional and personal lives of both. Explore the vast world that is Investment Rebate On Income Tax today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can print and download these materials for free.

-

Can I download free printables to make commercial products?

- It's based on the usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables could be restricted on usage. Be sure to read the terms of service and conditions provided by the designer.

-

How can I print Investment Rebate On Income Tax?

- Print them at home with printing equipment or visit the local print shops for more high-quality prints.

-

What software do I require to open printables at no cost?

- Many printables are offered in PDF format. These can be opened using free software like Adobe Reader.

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

Check more sample of Investment Rebate On Income Tax below

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Section 87A Tax Rebate For Income Tax Payers In Budget 2019

Tax Rebate Under Section 87A Investor Guruji Tax Planning

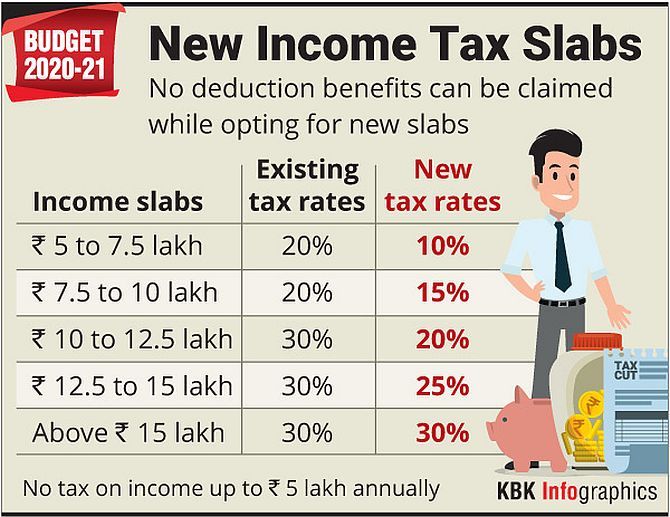

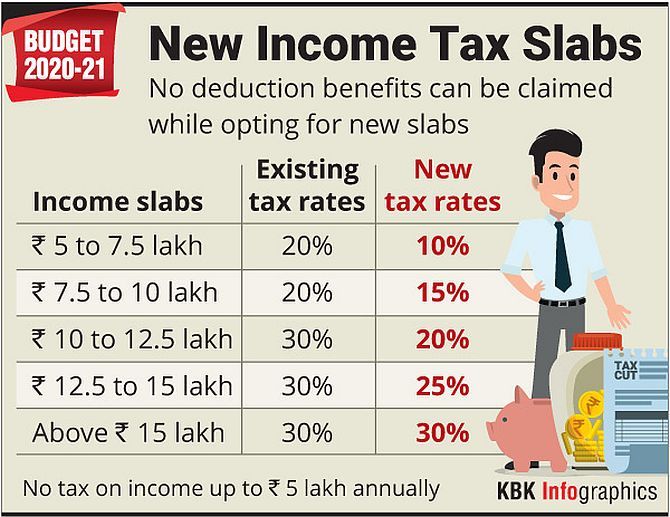

Income Tax Rates Cut Only If You Give Up Exemptions Rediff Business

https://www.nerdwallet.com/article/taxes/investment-taxes-basics-invest…

Web 15 juil 2020 nbsp 0183 32 The tax rate on capital gains for most assets held for more than one year is 0 15 or 20 Capital gains taxes on most assets held for less than a year

https://citywire.com/new-model-adviser/news/hmrc-issues-fresh-guidance...

Web 16 avr 2014 nbsp 0183 32 HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance

Web 15 juil 2020 nbsp 0183 32 The tax rate on capital gains for most assets held for more than one year is 0 15 or 20 Capital gains taxes on most assets held for less than a year

Web 16 avr 2014 nbsp 0183 32 HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance

Section 87A Tax Rebate For Income Tax Payers In Budget 2019

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Income Tax Rates Cut Only If You Give Up Exemptions Rediff Business

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20