In this day and age where screens have become the dominant feature of our lives, the charm of tangible printed material hasn't diminished. Whatever the reason, whether for education, creative projects, or simply to add an individual touch to your area, Investment Tax Credit Inflation Reduction Act have proven to be a valuable source. We'll dive deeper into "Investment Tax Credit Inflation Reduction Act," exploring what they are, how to find them and how they can be used to enhance different aspects of your lives.

Get Latest Investment Tax Credit Inflation Reduction Act Below

Investment Tax Credit Inflation Reduction Act

Investment Tax Credit Inflation Reduction Act -

President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC

The Act allows tax credit recipients to monetize the credits in two new ways via the direct pay option set forth in Section 6417 or by transferring all or any portion of the tax credit to another taxpayer under Section 6418

Investment Tax Credit Inflation Reduction Act encompass a wide assortment of printable materials that are accessible online for free cost. They are available in a variety of forms, like worksheets coloring pages, templates and much more. The great thing about Investment Tax Credit Inflation Reduction Act is in their versatility and accessibility.

More of Investment Tax Credit Inflation Reduction Act

Inflation Reduction Act Gridmatic

Inflation Reduction Act Gridmatic

Over the next decade the Inflation Reduction Act s investments will enable the IRS to further crack down on wealthy and corporate tax cheats and collect over 400 billion in additional revenue

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide a 30 percent credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient

Investment Tax Credit Inflation Reduction Act have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

customization They can make the templates to meet your individual needs when it comes to designing invitations planning your schedule or decorating your home.

-

Educational value: Free educational printables cater to learners from all ages, making them a useful tool for parents and teachers.

-

An easy way to access HTML0: immediate access various designs and templates will save you time and effort.

Where to Find more Investment Tax Credit Inflation Reduction Act

The Inflation Reduction Act Investment Tax Credit

The Inflation Reduction Act Investment Tax Credit

Extension of Energy Investment Tax Credit Section 48 Extends the existing energy investment tax credit for applicable energy projects This tech specific ITC ends in 2024 for most technologies and is replaced by the new tech neutral Clean Electricity ITC 48E which begins in 2025

The Inflation Reduction Act allows tax exempt and governmental entities to receive elective payments for 12 clean energy tax credits including the major Investment and Production Tax credits as well as tax credits for electric vehicles and charging stations

Since we've got your curiosity about Investment Tax Credit Inflation Reduction Act Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Investment Tax Credit Inflation Reduction Act for different reasons.

- Explore categories like home decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast spectrum of interests, all the way from DIY projects to party planning.

Maximizing Investment Tax Credit Inflation Reduction Act

Here are some ideas that you can make use use of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home also in the classes.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Investment Tax Credit Inflation Reduction Act are an abundance of creative and practical resources which cater to a wide range of needs and hobbies. Their access and versatility makes they a beneficial addition to both personal and professional life. Explore the many options of Investment Tax Credit Inflation Reduction Act today and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Investment Tax Credit Inflation Reduction Act really absolutely free?

- Yes you can! You can download and print these free resources for no cost.

-

Do I have the right to use free printables for commercial purposes?

- It's based on the conditions of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted on their use. Always read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using an printer, or go to any local print store for higher quality prints.

-

What program do I need to run Investment Tax Credit Inflation Reduction Act?

- The majority of PDF documents are provided with PDF formats, which can be opened using free software, such as Adobe Reader.

Inflation Reduction Act Health Insurance Broker Raleigh

What You Need To Know About The Inflation Reduction Act Traders

Check more sample of Investment Tax Credit Inflation Reduction Act below

Inflation Reduction Act IRA Of 2022 HBE

Inflation Reduction Act May Have Little Impact On Inflation AP News

Inflation Reduction Act Of 2022 The Hollander Group

Inflation Is A Tax Vskills Blog

The Inflation Reduction Act And Residential Energy Certasun

Warning Under The Inflation Reduction Act The IRS Is About To Go

https://www.foley.com › insights › publications

The Act allows tax credit recipients to monetize the credits in two new ways via the direct pay option set forth in Section 6417 or by transferring all or any portion of the tax credit to another taxpayer under Section 6418

https://www.irs.gov

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as

The Act allows tax credit recipients to monetize the credits in two new ways via the direct pay option set forth in Section 6417 or by transferring all or any portion of the tax credit to another taxpayer under Section 6418

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as

Inflation Is A Tax Vskills Blog

Inflation Reduction Act May Have Little Impact On Inflation AP News

The Inflation Reduction Act And Residential Energy Certasun

Warning Under The Inflation Reduction Act The IRS Is About To Go

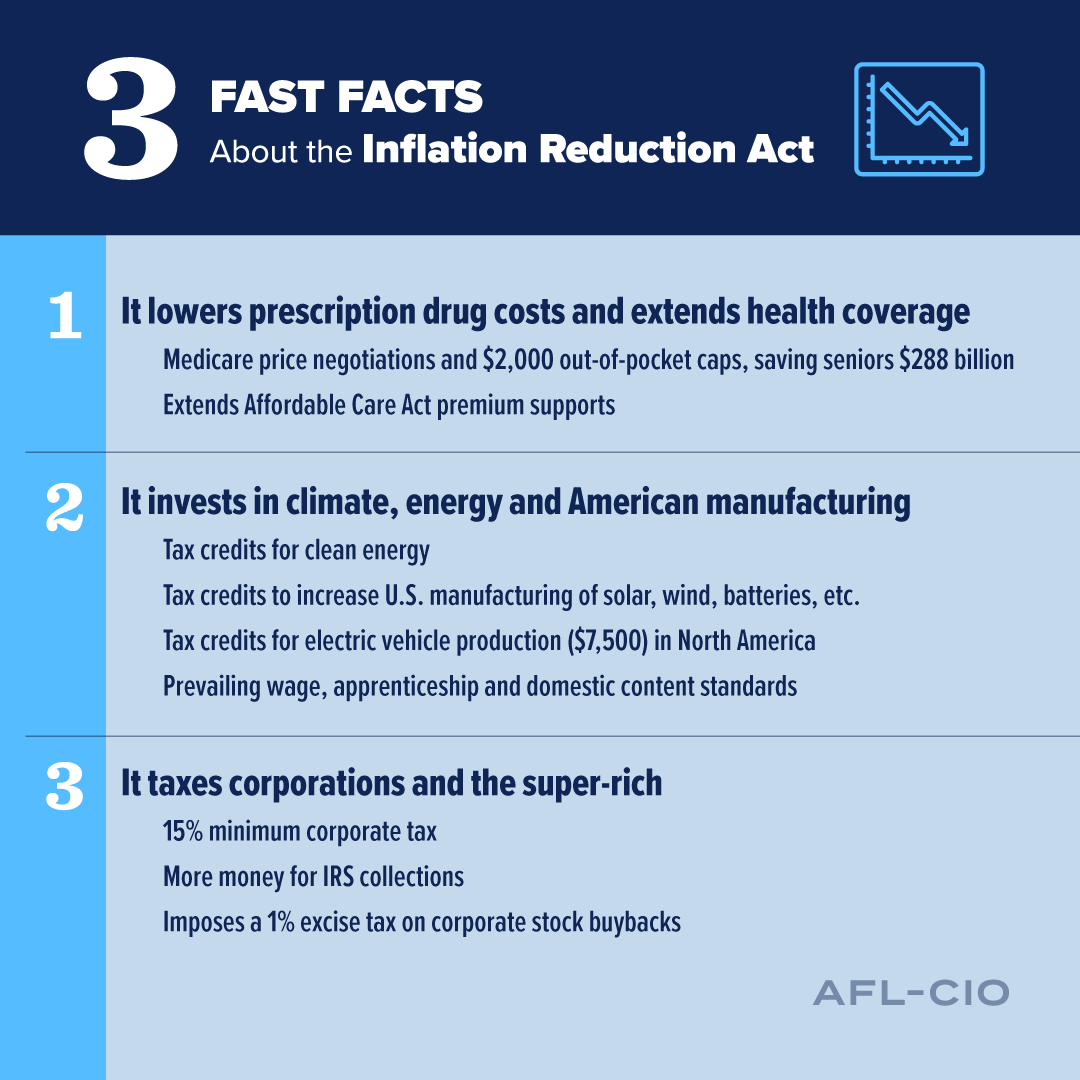

The Inflation Reduction Act Is A Victory For Working People AFL CIO

Machinists Union Pledges Support For Inflation Reduction Act IAMAW

Machinists Union Pledges Support For Inflation Reduction Act IAMAW

Inflation Reduction Act Of 2022 Significantly Changes 179D And 45L