In a world when screens dominate our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education for creative projects, just adding an individual touch to the home, printables for free have become a valuable source. For this piece, we'll take a dive deeper into "Ira Donation Tax Break," exploring the benefits of them, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Ira Donation Tax Break Below

Ira Donation Tax Break

Ira Donation Tax Break -

Tax breaks for charitable donations come in many flavors and this year Congress has a new one for seniors called an IRA charitable gift annuity It allows older

For a retiree in the 24 tax bracket an IRA charitable contribution of 5 000 could reduce your income tax bill by 1 200 Even

The Ira Donation Tax Break are a huge range of downloadable, printable materials online, at no cost. These resources come in many formats, such as worksheets, templates, coloring pages and more. The appealingness of Ira Donation Tax Break is in their versatility and accessibility.

More of Ira Donation Tax Break

How IRA Tax Break Works YouTube

How IRA Tax Break Works YouTube

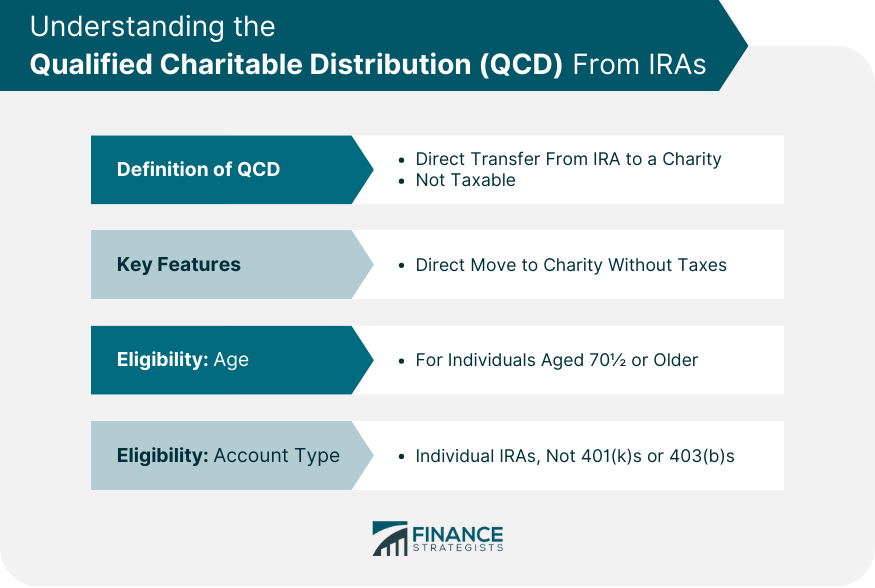

SECURE 2 0 permits a taxpayer to make a one time 50 000 distribution directly from an IRA or IRAs to a charitable remainder trust or a charitable annuity and

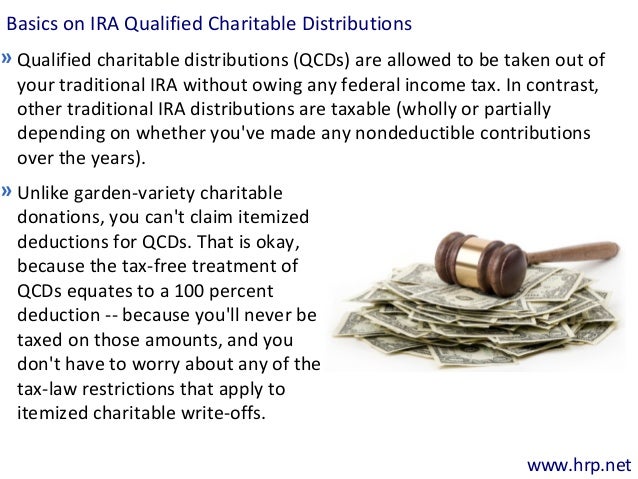

There s no shortage of ways to give to charity but donating individual retirement account funds may offer a special tax break If you re age 70 or older you

Ira Donation Tax Break have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Modifications: We can customize printed materials to meet your requirements whether it's making invitations as well as organizing your calendar, or even decorating your house.

-

Education Value Downloads of educational content for free provide for students of all ages, making them a valuable device for teachers and parents.

-

It's easy: Quick access to many designs and templates helps save time and effort.

Where to Find more Ira Donation Tax Break

Fiscal Cliff Law Extends IRA Donation Tax Break Can You Benefit

Fiscal Cliff Law Extends IRA Donation Tax Break Can You Benefit

Taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using Schedule A of Form 1040 Charitable

The standard deductions for all types of filers went up a bit in 2024 meaning there is a higher threshold to reach to be eligible for a charitable donation tax break

In the event that we've stirred your interest in printables for free and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of Ira Donation Tax Break designed for a variety objectives.

- Explore categories like design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning tools.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- The blogs covered cover a wide variety of topics, all the way from DIY projects to party planning.

Maximizing Ira Donation Tax Break

Here are some new ways to make the most use of Ira Donation Tax Break:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print free worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Ira Donation Tax Break are an abundance of practical and innovative resources catering to different needs and needs and. Their availability and versatility make they a beneficial addition to both professional and personal life. Explore the endless world of printables for free today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can download and print the resources for free.

-

Can I make use of free printables in commercial projects?

- It's based on specific conditions of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright issues when you download Ira Donation Tax Break?

- Certain printables may be subject to restrictions regarding usage. Check the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with either a printer or go to a print shop in your area for better quality prints.

-

What program do I need to open printables for free?

- The majority are printed in the PDF format, and can be opened using free software like Adobe Reader.

The IRA Tax Break Explained Traditional IRA Tax Deduction

IRA Donations American SPCC

Check more sample of Ira Donation Tax Break below

The IRA Tax Break Explained Traditional IRA Tax Deduction

Fiscal Cliff Law Extends IRA Donation Tax Break Can You Benefit

A Charitable IRA Donation Can Be A Powerful Tool For Tax Planning And

Make Charitable Donation Get Tax Break

Using IRA Charitable Donations As An Alternative To Required Taxable

IRA Charitable Distributions GLO CPAs LLLP

https://money.usnews.com/money/retir…

For a retiree in the 24 tax bracket an IRA charitable contribution of 5 000 could reduce your income tax bill by 1 200 Even

https://www.fidelitycharitable.org/guidance...

It is always possible to donate retirement assets including IRAs 401 k s and 403 b s 1 by cashing them out paying the income tax attributable to the distribution and then

For a retiree in the 24 tax bracket an IRA charitable contribution of 5 000 could reduce your income tax bill by 1 200 Even

It is always possible to donate retirement assets including IRAs 401 k s and 403 b s 1 by cashing them out paying the income tax attributable to the distribution and then

Make Charitable Donation Get Tax Break

Fiscal Cliff Law Extends IRA Donation Tax Break Can You Benefit

Using IRA Charitable Donations As An Alternative To Required Taxable

IRA Charitable Distributions GLO CPAs LLLP

IRS Announces 2023 HSA Limits Blog Medcom Benefits

Charitable Gifts From Your IRA Total Wealth Planning

Charitable Gifts From Your IRA Total Wealth Planning

Can You Make A Charitable Donation From Your IRA