In this age of electronic devices, where screens rule our lives but the value of tangible printed items hasn't gone away. Be it for educational use or creative projects, or simply to add personal touches to your home, printables for free are a great source. With this guide, you'll take a dive into the world of "Ira Induction Stove Tax Credit," exploring what they are, where they are available, and ways they can help you improve many aspects of your lives.

Get Latest Ira Induction Stove Tax Credit Below

Ira Induction Stove Tax Credit

Ira Induction Stove Tax Credit -

The Inflation Reduction Act represents a momentous extension of solar tax credits for renewable energy system owners It also introduces several new investments for clean energy manufacturing and industry advancement

From 2023 a 1 200 annual tax credit limit will replace the old 500 lifetime limit The tax credit will be equal to 30 of the costs for all eligible home improvements made during the year

Printables for free cover a broad assortment of printable material that is available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and much more. The value of Ira Induction Stove Tax Credit is their versatility and accessibility.

More of Ira Induction Stove Tax Credit

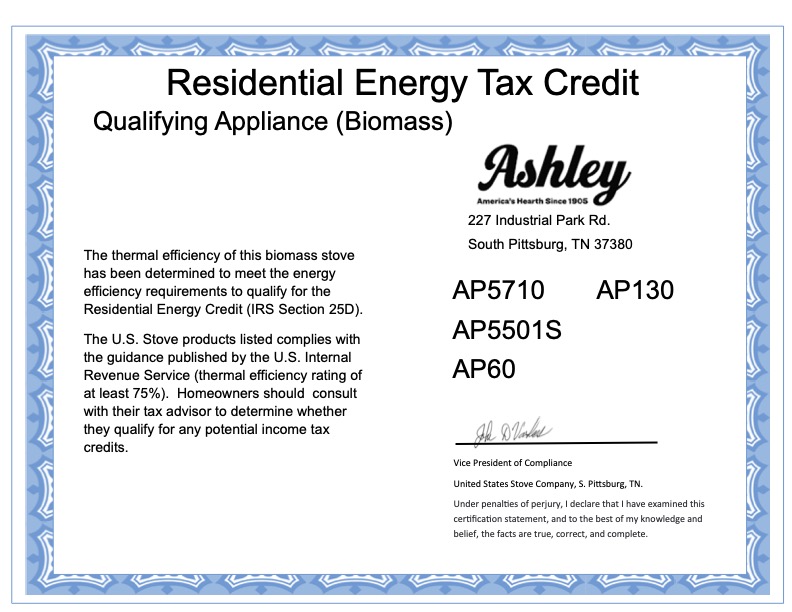

Save The Biomass Stove Tax Credit

Save The Biomass Stove Tax Credit

The Inflation Reduction Act offers a rebate of up to 840 for an electric including induction stove cooktop range or oven Learn more Consumer Reports What the Inflation Reduction Act Could Mean for Your Next Appliance Purchase Save 1 600 by Sealing Drafty Windows

Tax credits are available through the IRS for certain qualifying home energy efficiency improvements including insulation heating equipment and others Visit the IRS online at https www irs gov inflation reduction act of 2022 and consult your tax professional for more information

Ira Induction Stove Tax Credit have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: You can tailor designs to suit your personal needs be it designing invitations or arranging your schedule or decorating your home.

-

Educational Value: Printing educational materials for no cost provide for students of all ages, which makes the perfect aid for parents as well as educators.

-

Accessibility: Access to a plethora of designs and templates is time-saving and saves effort.

Where to Find more Ira Induction Stove Tax Credit

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

The 25C and 25D tax credits incentivize household electrification by lowering the total cost of qualified electrification upgrades 25C provides a capped 30 percent tax credit for air source heat pumps heat pump water heaters HPWHs qualifying electrical panel upgrades select weatherization measures and energy audits 25D provides an

The IRA provides a tax credit of up to 2 000 to install heat pumps for homeowners who don t qualify for the rebate and installing an induction stove or new energy efficient windows and

We've now piqued your interest in Ira Induction Stove Tax Credit Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Ira Induction Stove Tax Credit to suit a variety of reasons.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- The blogs covered cover a wide selection of subjects, starting from DIY projects to party planning.

Maximizing Ira Induction Stove Tax Credit

Here are some ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars as well as to-do lists and meal planners.

Conclusion

Ira Induction Stove Tax Credit are an abundance filled with creative and practical information that meet a variety of needs and pursuits. Their access and versatility makes them a wonderful addition to each day life. Explore the many options of Ira Induction Stove Tax Credit today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can download and print these items for free.

-

Can I download free templates for commercial use?

- It's based on specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables may come with restrictions regarding usage. Be sure to review the terms of service and conditions provided by the author.

-

How can I print Ira Induction Stove Tax Credit?

- You can print them at home with an printer, or go to a local print shop to purchase top quality prints.

-

What program do I need in order to open printables that are free?

- The majority are printed in PDF format, which can be opened using free software like Adobe Reader.

Wood Burning Stove Tax Credit

![]()

Feens Financing Promotions And Sales

Check more sample of Ira Induction Stove Tax Credit below

Green Mountain 80 HearthStone Stoves

Tax Credit For Wood Stove 2021 Revised Info On Federal Credit What

The Homeowner s Guide To The Inflation Pearl Certification

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

Get A 300 Tax Credit For Qualifying Wood Stoves Milford CT The Cozy

Learn More About The New Wood Pellet Stove Tax Credit Energy Center

https://electrek.co/2022/08/19/us-tax-credits-rebates-climate-law

From 2023 a 1 200 annual tax credit limit will replace the old 500 lifetime limit The tax credit will be equal to 30 of the costs for all eligible home improvements made during the year

https://energizect.com/IRA-FAQ

Q Does the IRA offer tax credits A Yes the Act extends and increases certain tax credits that are available to consumers who reduce energy use and emissions from their homes by investing in energy efficiency and renewable energy Q Can I claim a tax credit for eligible home improvements under the IRA

From 2023 a 1 200 annual tax credit limit will replace the old 500 lifetime limit The tax credit will be equal to 30 of the costs for all eligible home improvements made during the year

Q Does the IRA offer tax credits A Yes the Act extends and increases certain tax credits that are available to consumers who reduce energy use and emissions from their homes by investing in energy efficiency and renewable energy Q Can I claim a tax credit for eligible home improvements under the IRA

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

Tax Credit For Wood Stove 2021 Revised Info On Federal Credit What

Get A 300 Tax Credit For Qualifying Wood Stoves Milford CT The Cozy

Learn More About The New Wood Pellet Stove Tax Credit Energy Center

Heritage HearthStone Stoves

Tax Credit Ambiance

Tax Credit Ambiance

Heated Up Consumers Can Now Rely On Almost All Stove Tax Credit