In this day and age where screens have become the dominant feature of our lives yet the appeal of tangible printed material hasn't diminished. For educational purposes project ideas, artistic or simply adding the personal touch to your space, Irs Child Tax Credit 2021 Amount are now a useful resource. For this piece, we'll dive into the world "Irs Child Tax Credit 2021 Amount," exploring what they are, how you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Irs Child Tax Credit 2021 Amount Below

Irs Child Tax Credit 2021 Amount

Irs Child Tax Credit 2021 Amount -

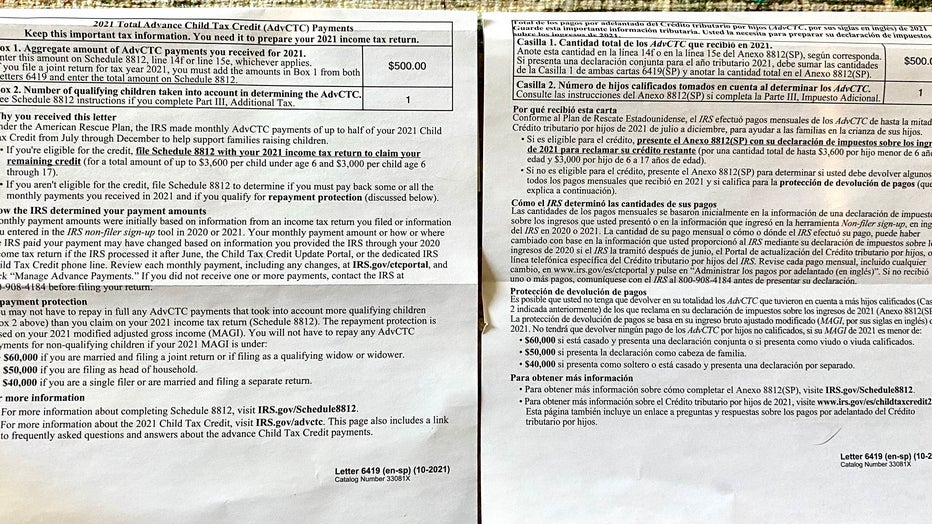

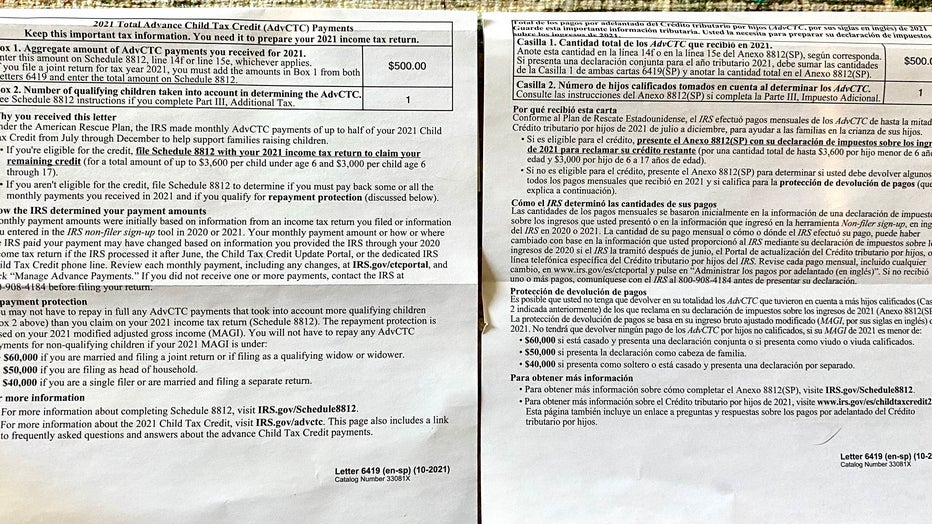

The IRS determined your advance Child Tax Credit payment amounts by estimating the amount of the Child Tax Credit that you will be eligible to claim on your 2021 tax return during the 2022 tax filing season

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022 tax filing season

Irs Child Tax Credit 2021 Amount encompass a wide range of printable, free material that is available online at no cost. They come in many forms, like worksheets templates, coloring pages and many more. The great thing about Irs Child Tax Credit 2021 Amount is their flexibility and accessibility.

More of Irs Child Tax Credit 2021 Amount

New Child Tax Credit Explained IRS Child Tax Credit 2021 What To

New Child Tax Credit Explained IRS Child Tax Credit 2021 What To

The IRS will continue to provide materials on how to claim the 2021 Child Tax Credit as well as how to reconcile your advance Child Tax Credit payments with the amount of 2021 Child Tax Credit for which you are eligible

The American Rescue Plan Act expands the child tax credit for tax year 2021 The maximum credit amount has increased to 3 000 per qualifying child between ages 6 and 17 and 3 600 per qualifying child under age 6

Irs Child Tax Credit 2021 Amount have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Flexible: There is the possibility of tailoring the design to meet your needs for invitations, whether that's creating them and schedules, or decorating your home.

-

Educational Use: These Irs Child Tax Credit 2021 Amount are designed to appeal to students from all ages, making the perfect tool for parents and teachers.

-

It's easy: instant access many designs and templates saves time and effort.

Where to Find more Irs Child Tax Credit 2021 Amount

IRS Updates FAQs For 2021 Child Tax Credit And Advance Child Tax Credit

IRS Updates FAQs For 2021 Child Tax Credit And Advance Child Tax Credit

If you are eligible for the Child Tax Credit but did not receive part or all of your advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season

For 2021 the credit amount is 3 000 for qualifying children between age 6 to 17 years old 3 600 for qualifying children age 5 and under The increased amounts are reduced phased out for modified adjusted gross income AGI over 150 000 for married taxpayers filing a joint return and qualifying widows or widowers

After we've peaked your interest in printables for free Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection and Irs Child Tax Credit 2021 Amount for a variety objectives.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning materials.

- This is a great resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs covered cover a wide selection of subjects, from DIY projects to planning a party.

Maximizing Irs Child Tax Credit 2021 Amount

Here are some inventive ways of making the most of Irs Child Tax Credit 2021 Amount:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets to enhance learning at home for the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Irs Child Tax Credit 2021 Amount are an abundance of useful and creative resources which cater to a wide range of needs and passions. Their availability and versatility make they a beneficial addition to both professional and personal lives. Explore the vast collection that is Irs Child Tax Credit 2021 Amount today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Child Tax Credit 2021 Amount truly absolutely free?

- Yes they are! You can download and print these materials for free.

-

Can I use the free printouts for commercial usage?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Are there any copyright problems with Irs Child Tax Credit 2021 Amount?

- Some printables could have limitations concerning their use. Be sure to review the terms and condition of use as provided by the author.

-

How can I print printables for free?

- You can print them at home using an printer, or go to an in-store print shop to get superior prints.

-

What software must I use to open Irs Child Tax Credit 2021 Amount?

- The majority of printed documents are with PDF formats, which can be opened with free software, such as Adobe Reader.

IRS Child Tax Credit Payments Information Summary Update 2021 YouTube

Eic Worksheet A Instructions 2021 Tripmart

Check more sample of Irs Child Tax Credit 2021 Amount below

Tax Credit Income Limits 2021 Yabtio

Earned Income Credit 2022 Calculator INCOMEBAU

Child Tax Credit September 2021 Delay Jule Seibert

Irs Child Tax Credit 2021 Be Such A Good Blook Photogallery

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Irs Child Tax Credit Problems Gorgeously Chatroom Picture Show

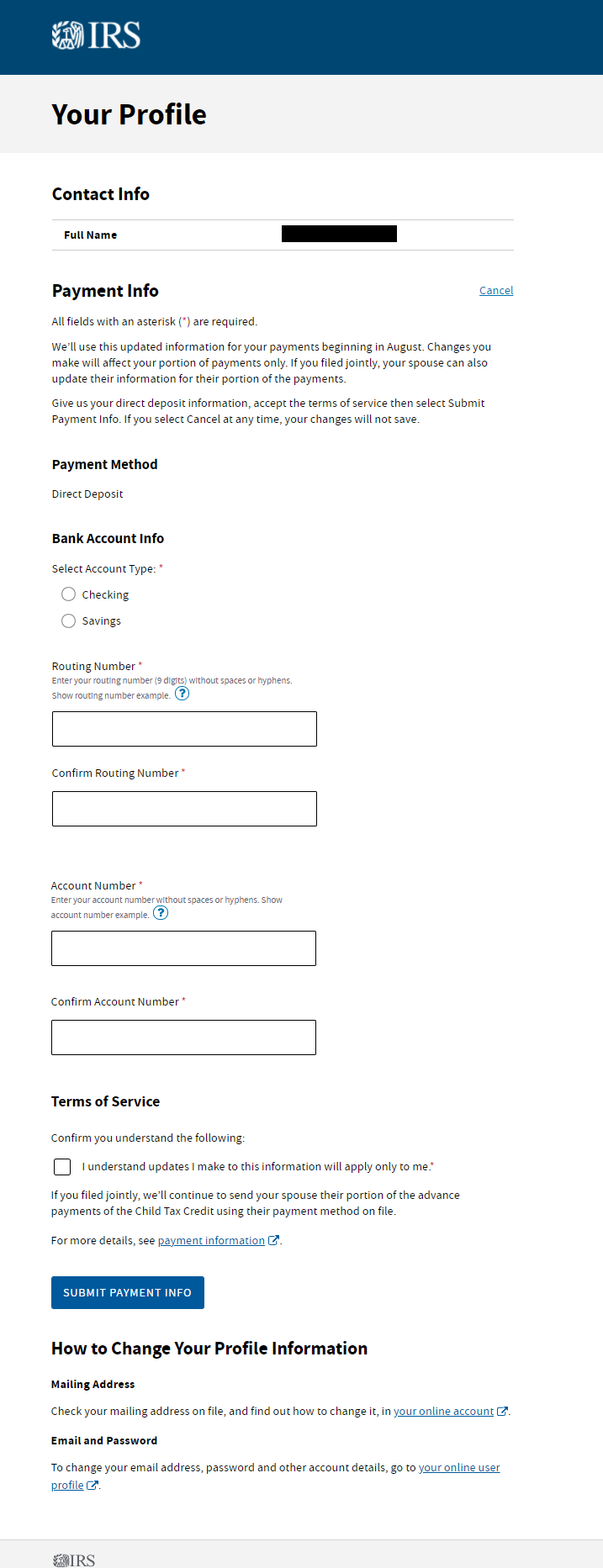

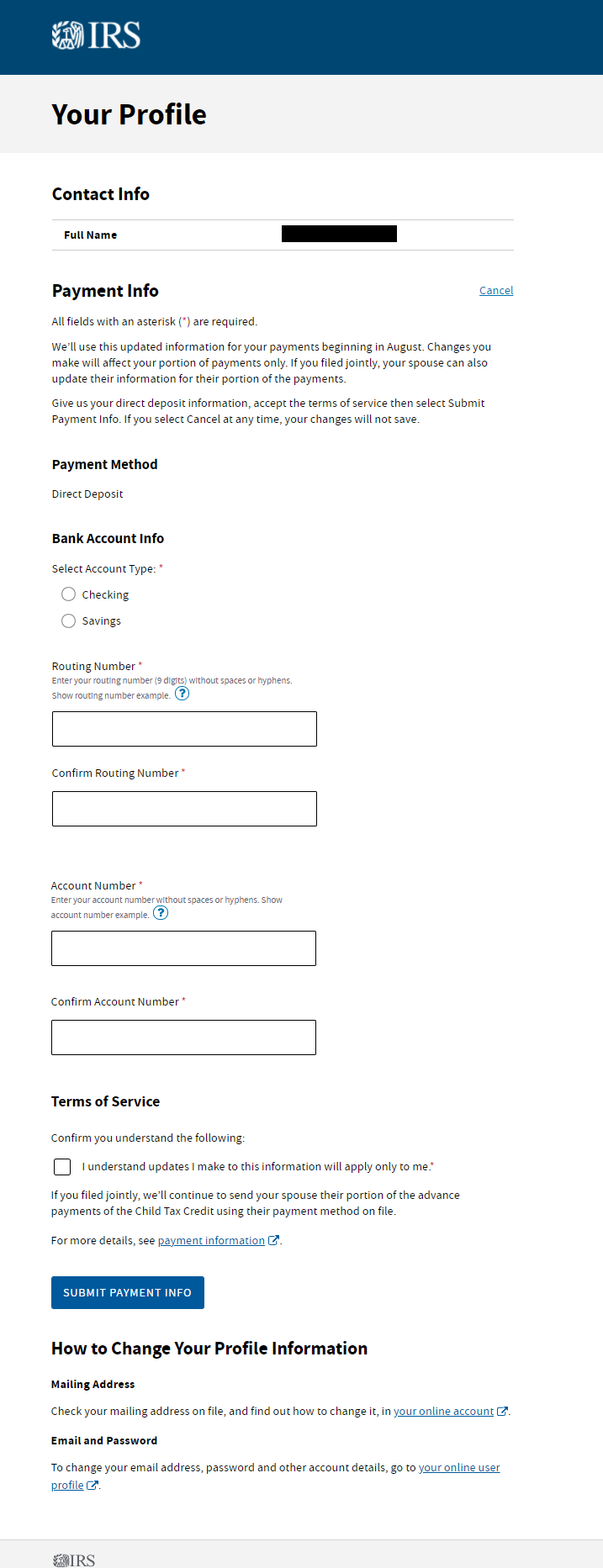

Irs Child Tax Credit Portal IRS Stimulus Update Child Tax Credits

https://www.irs.gov/credits-deductions/tax-year...

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022 tax filing season

https://www.irs.gov/credits-deductions/advance...

You can claim the full amount of the 2021 Child Tax Credit if you re eligible even if you don t normally file a tax return To claim the full Child Tax Credit file a 2021 tax return

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022 tax filing season

You can claim the full amount of the 2021 Child Tax Credit if you re eligible even if you don t normally file a tax return To claim the full Child Tax Credit file a 2021 tax return

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Irs Child Tax Credit 2021 Be Such A Good Blook Photogallery

Earned Income Credit 2022 Calculator INCOMEBAU

Irs Child Tax Credit Problems Gorgeously Chatroom Picture Show

Irs Child Tax Credit Portal IRS Stimulus Update Child Tax Credits

Irs Child Tax Credit 2021 Qualifications Trending US

IRS Child Tax Credit 2021 Letters And Payment Schedule YouTube

IRS Child Tax Credit 2021 Letters And Payment Schedule YouTube

Child Tax Credit 2021 Chart Publication 596 2020 Earned Income Credit