In this digital age, where screens rule our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. Be it for educational use for creative projects, simply to add a personal touch to your area, Irs Child Tax Credit Amount 2022 are now a useful resource. The following article is a dive into the world of "Irs Child Tax Credit Amount 2022," exploring what they are, how you can find them, and ways they can help you improve many aspects of your daily life.

Get Latest Irs Child Tax Credit Amount 2022 Below

Irs Child Tax Credit Amount 2022

Irs Child Tax Credit Amount 2022 -

Enacted in 1997 the credit currently provides up to 2 000 per child to about 40 million families every year The American Rescue Plan made historic expansions to the Child Tax Credit CTC

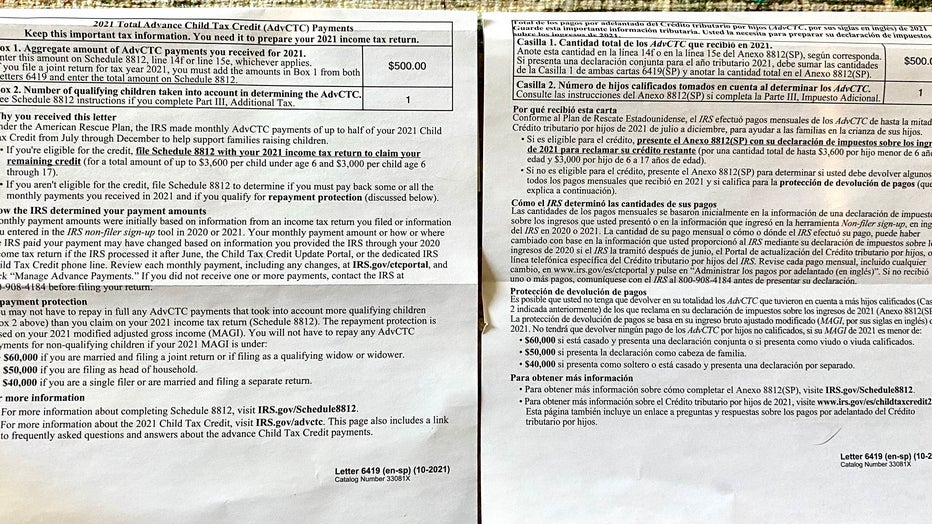

The IRS determined your advance Child Tax Credit payment amounts by estimating the amount of the Child Tax Credit that you may properly claim on your 2021 tax return filed during the 2022 tax filing season

Printables for free include a vast array of printable materials available online at no cost. They are available in a variety of forms, like worksheets templates, coloring pages, and many more. The appealingness of Irs Child Tax Credit Amount 2022 lies in their versatility and accessibility.

More of Irs Child Tax Credit Amount 2022

Child Tax Credit Payment Schedule 2022 Child Tax Credit Payment

Child Tax Credit Payment Schedule 2022 Child Tax Credit Payment

The American Rescue Plan increased the amount of the Child Tax Credit from 2 000 to 3 600 for qualifying children under age 6 and 3 000 for other qualifying children under age 18 The credit was made fully refundable

What is the Child Tax Credit for 2022 and how much is it The child tax credit is an important credit for families Here s why By Andrew Keshner Published April 17 2023 11 00 a m

The Irs Child Tax Credit Amount 2022 have gained huge popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

Individualization This allows you to modify designs to suit your personal needs, whether it's designing invitations or arranging your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes them an essential instrument for parents and teachers.

-

Easy to use: Access to the vast array of design and templates, which saves time as well as effort.

Where to Find more Irs Child Tax Credit Amount 2022

Child Tax Credit 2022 Brackets Latest News Update

Child Tax Credit 2022 Brackets Latest News Update

In detail the latest child tax credit scheme allows each family to claim up to 3 600 for every child below the age of 6 and up to 3 000 for every child below the age of 18 However these tax credits begin to phase out at certain income levels depending on your filing status

The 2022 child tax credit calculator is created for fast estimating the CTC you can avail in the tax year 2022 when the CTC rules are not same as the tax year 2021 when the enhanced child tax credits were allowed due to passing of American Rescue Plan ARP

We've now piqued your curiosity about Irs Child Tax Credit Amount 2022 Let's take a look at where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection of Irs Child Tax Credit Amount 2022 for various applications.

- Explore categories like interior decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets with flashcards and other teaching tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad spectrum of interests, all the way from DIY projects to party planning.

Maximizing Irs Child Tax Credit Amount 2022

Here are some unique ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to build your knowledge at home (or in the learning environment).

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Irs Child Tax Credit Amount 2022 are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and passions. Their availability and versatility make them a fantastic addition to both professional and personal life. Explore the vast array of printables for free today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really free?

- Yes they are! You can download and print these tools for free.

-

Are there any free printables to make commercial products?

- It depends on the specific conditions of use. Always verify the guidelines provided by the creator before using any printables on commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables may come with restrictions regarding usage. Be sure to check the terms of service and conditions provided by the creator.

-

How can I print Irs Child Tax Credit Amount 2022?

- You can print them at home with either a printer at home or in the local print shop for more high-quality prints.

-

What program do I require to open printables at no cost?

- Many printables are offered in the format PDF. This can be opened with free software, such as Adobe Reader.

2022 Child Tax Credit Refundable Amount Latest News Update

Child Tax Credit 2022 Income Limit Phase Out TAX

Check more sample of Irs Child Tax Credit Amount 2022 below

Irs Child Tax Credit Problems Gorgeously Chatroom Picture Show

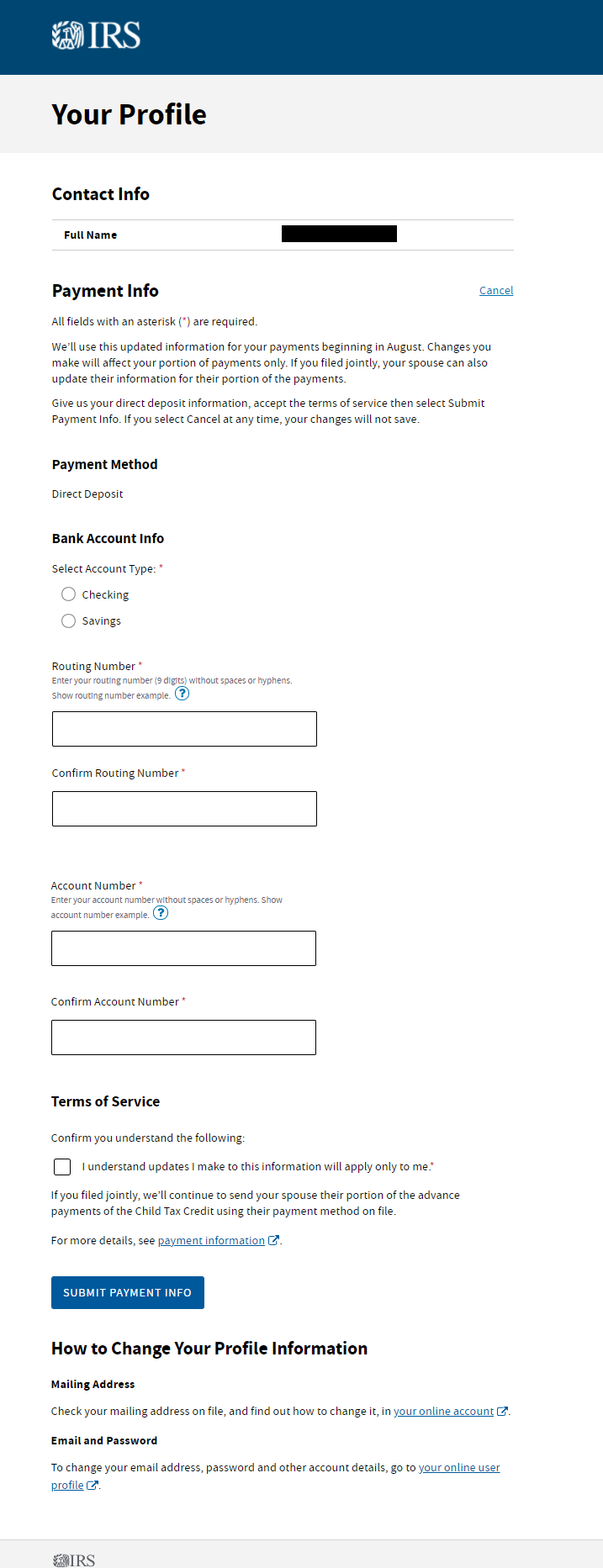

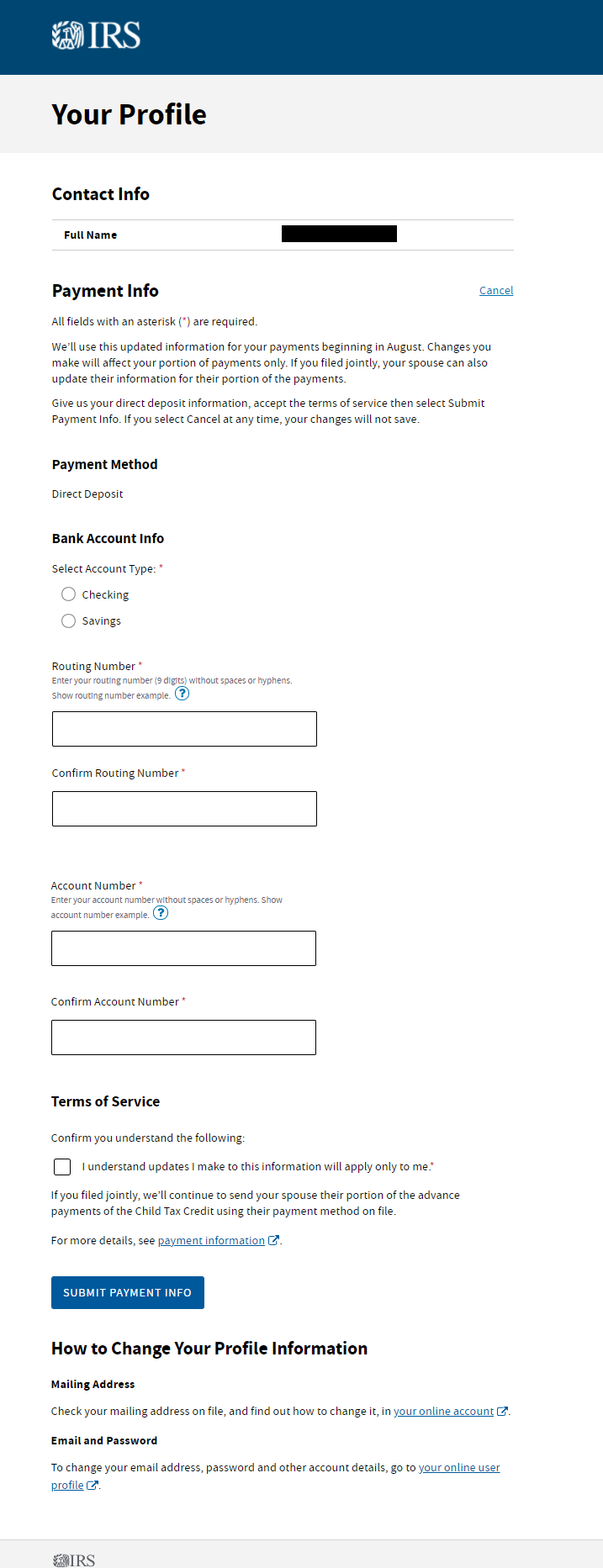

Irs Child Tax Credit Portal IRS Stimulus Update Child Tax Credits

Irs Child Tax Credit 2021 Be Such A Good Blook Photogallery

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

Don t Throw Away This Document Why IRS Letter 6419 Is Critical To

Tax Filing 2022 Eitc Latest News Update

https://www.irs.gov › credits-deductions

The IRS determined your advance Child Tax Credit payment amounts by estimating the amount of the Child Tax Credit that you may properly claim on your 2021 tax return filed during the 2022 tax filing season

https://theweek.com › finance

For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child 3 600

The IRS determined your advance Child Tax Credit payment amounts by estimating the amount of the Child Tax Credit that you may properly claim on your 2021 tax return filed during the 2022 tax filing season

For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child 3 600

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

Irs Child Tax Credit Portal IRS Stimulus Update Child Tax Credits

Don t Throw Away This Document Why IRS Letter 6419 Is Critical To

Tax Filing 2022 Eitc Latest News Update

Earned Income Credit 2021 Worksheet

Aca Percentage Of Income 2022 INCOMUNTA

Aca Percentage Of Income 2022 INCOMUNTA

Irs Child Tax Credit 2020 First IRS Child Tax Credit Portal Now Open