In this age of technology, where screens rule our lives, the charm of tangible printed items hasn't gone away. In the case of educational materials as well as creative projects or simply to add the personal touch to your home, printables for free can be an excellent resource. In this article, we'll take a dive deep into the realm of "Irs Deduction Categories," exploring their purpose, where to locate them, and how they can improve various aspects of your life.

Get Latest Irs Deduction Categories Below

Irs Deduction Categories

Irs Deduction Categories -

Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a dollar for dollar reduction to your tax bill

1 Startup and organizational costs Our first small business tax deduction comes with a caveat it s not actually a tax deduction Business startup costs are seen as a capital expense

Irs Deduction Categories include a broad range of downloadable, printable material that is available online at no cost. They are available in numerous forms, including worksheets, templates, coloring pages, and many more. The value of Irs Deduction Categories is in their versatility and accessibility.

More of Irs Deduction Categories

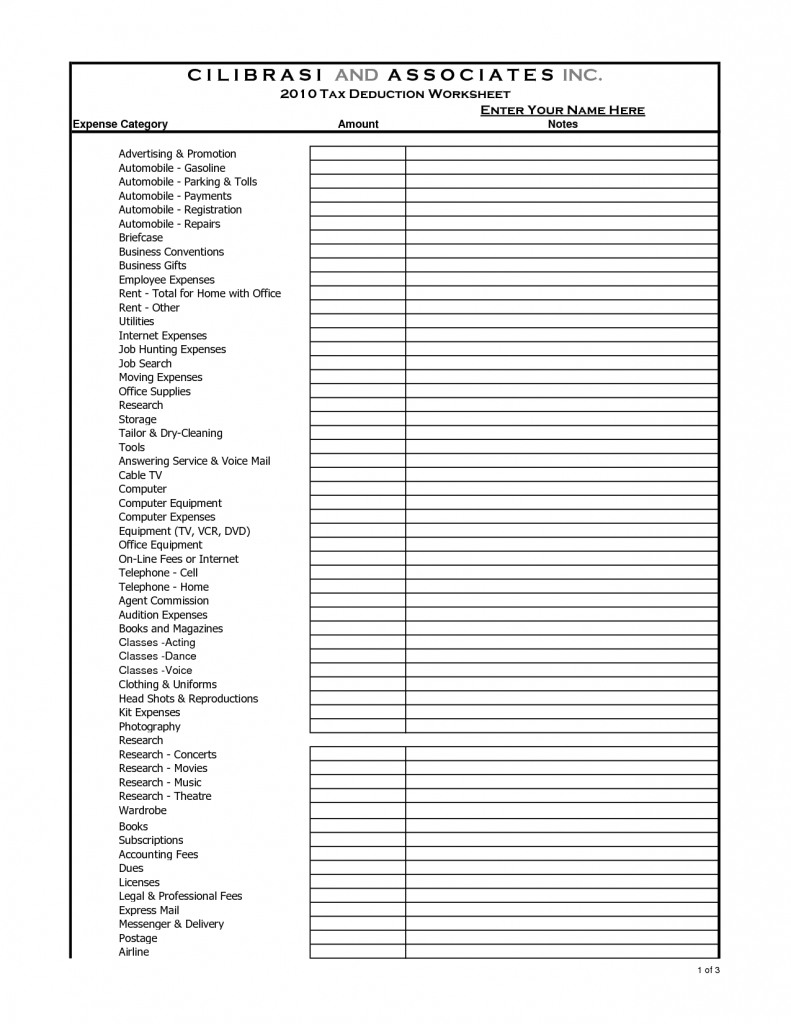

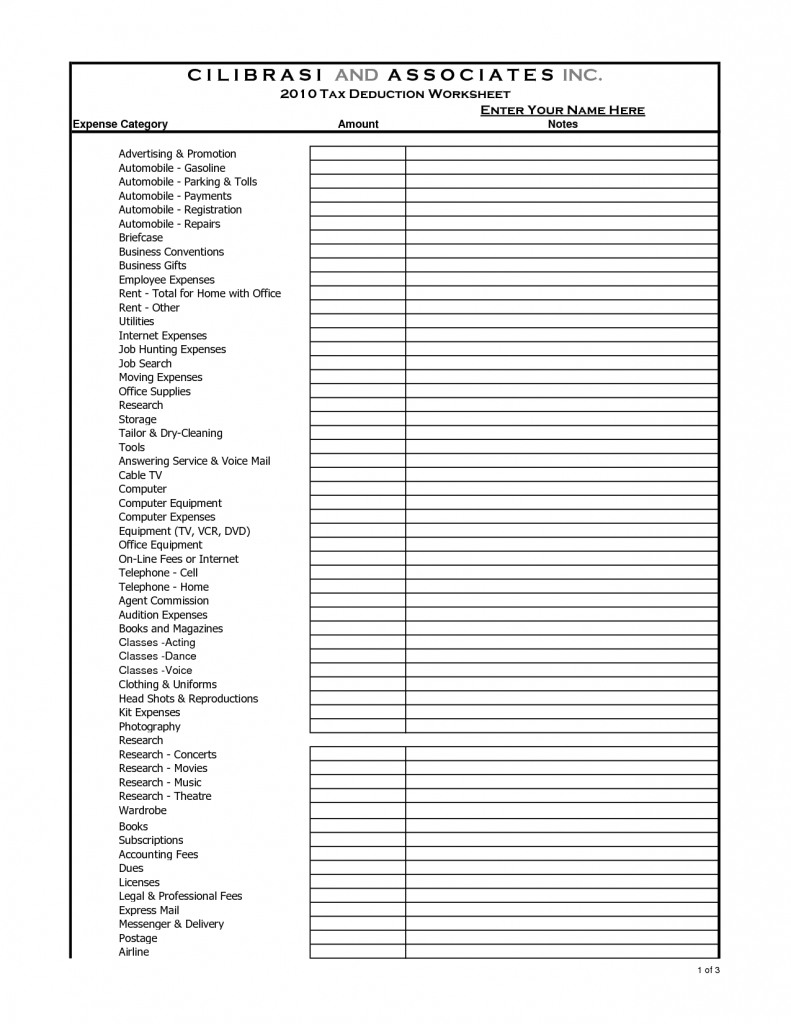

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

Below is a mapping to the major resources for each topic For a full list go to the Publication 535 for 2022 PDF Also note that Worksheet 6A that was in chapter 6 is now new 2023

For example the IRS has a list of the major expense categories that are deductible for small businesses specifically Much of this information was previously consolidated in

Irs Deduction Categories have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize printing templates to your own specific requirements whether it's making invitations to organize your schedule or even decorating your house.

-

Educational value: Printables for education that are free can be used by students of all ages, which makes them a vital tool for teachers and parents.

-

Affordability: Quick access to a myriad of designs as well as templates will save you time and effort.

Where to Find more Irs Deduction Categories

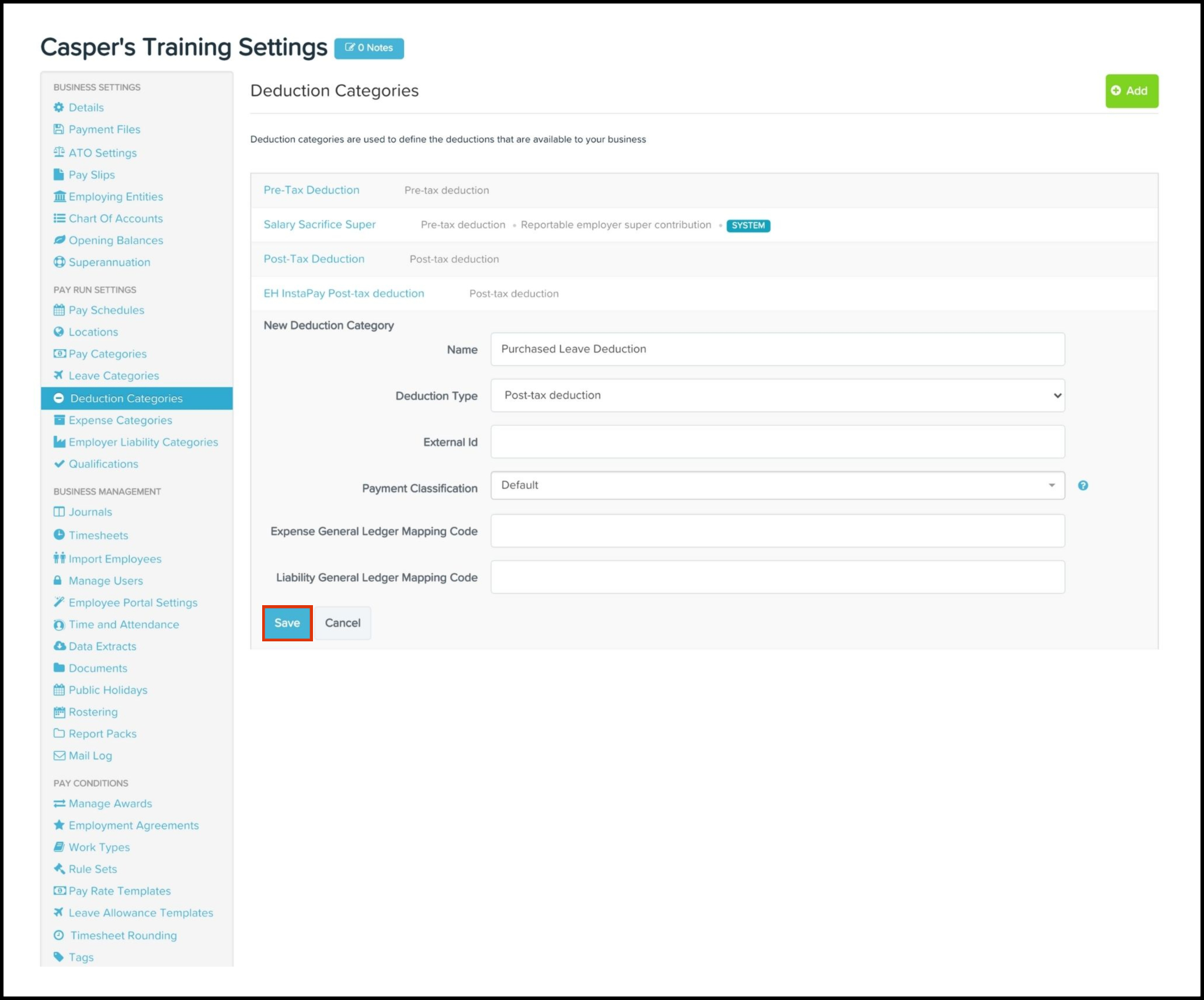

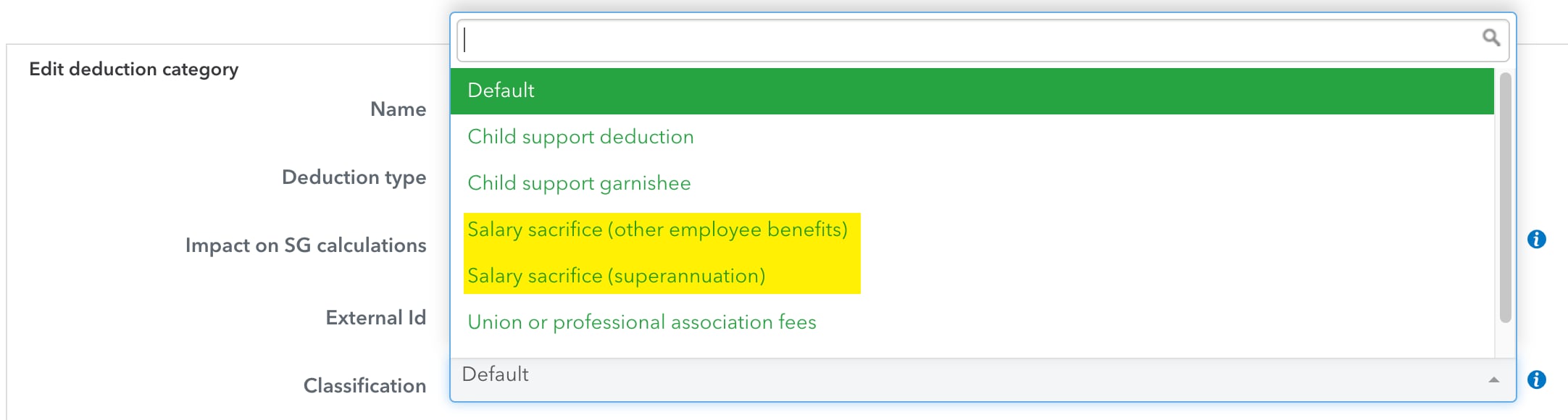

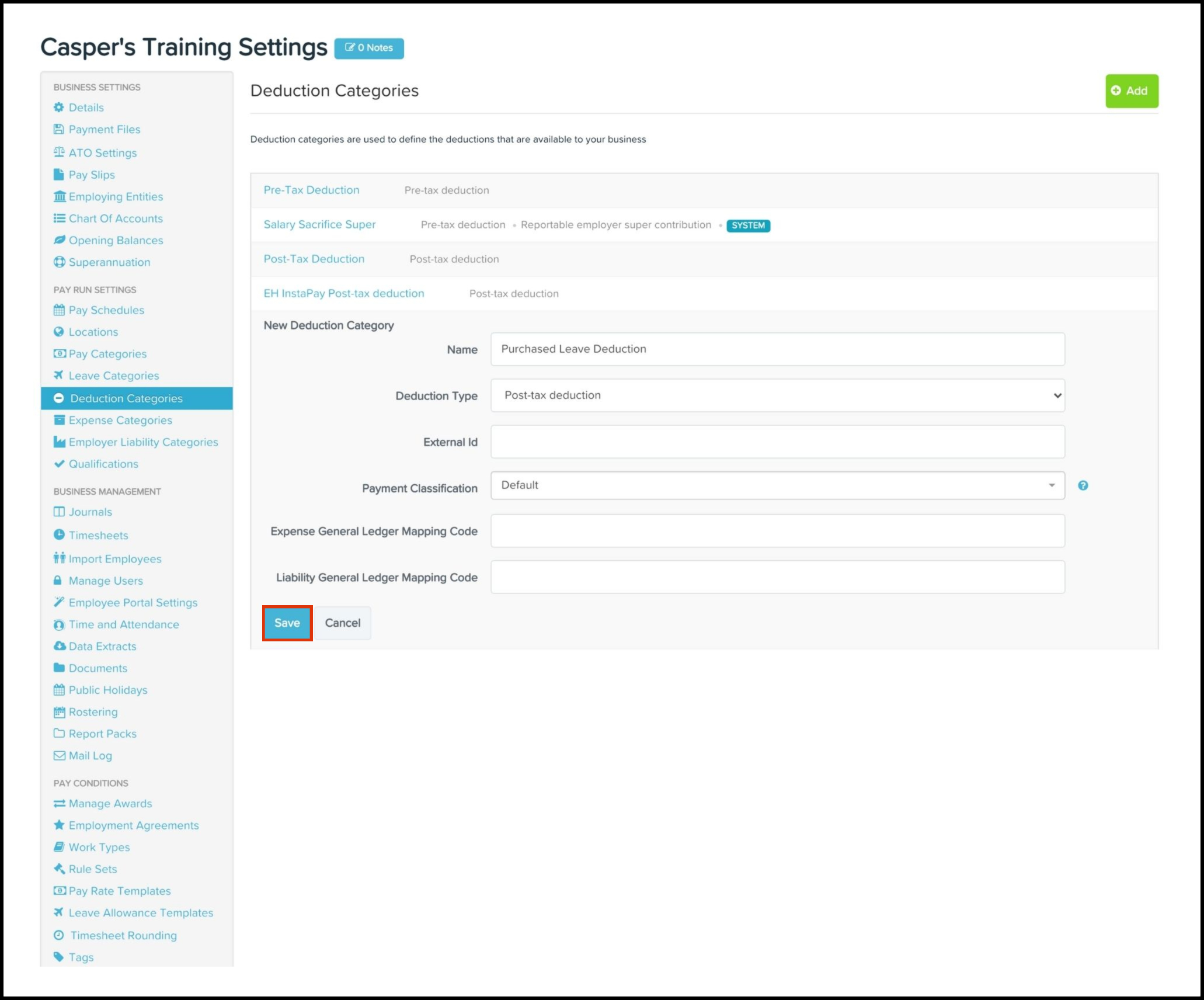

Update Deduction Categories For STP Phase 2

Update Deduction Categories For STP Phase 2

Home office Deduct a percentage of property taxes insurance utilities mortgage interest Or 5 per square foot standardized deduction Note You can t deduct unrelated

22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill

If we've already piqued your interest in Irs Deduction Categories Let's see where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection with Irs Deduction Categories for all reasons.

- Explore categories such as decoration for your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets, flashcards, and learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a broad array of topics, ranging starting from DIY projects to planning a party.

Maximizing Irs Deduction Categories

Here are some innovative ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars with to-do lists, planners, and meal planners.

Conclusion

Irs Deduction Categories are an abundance of creative and practical resources that meet a variety of needs and interest. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the endless world of Irs Deduction Categories and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes you can! You can download and print these materials for free.

-

Are there any free printables for commercial purposes?

- It is contingent on the specific usage guidelines. Be sure to read the rules of the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may contain restrictions on their use. Make sure you read the terms and conditions offered by the creator.

-

How do I print Irs Deduction Categories?

- You can print them at home using printing equipment or visit a local print shop to purchase the highest quality prints.

-

What software do I need to run printables for free?

- A majority of printed materials are in PDF format. These can be opened using free software like Adobe Reader.

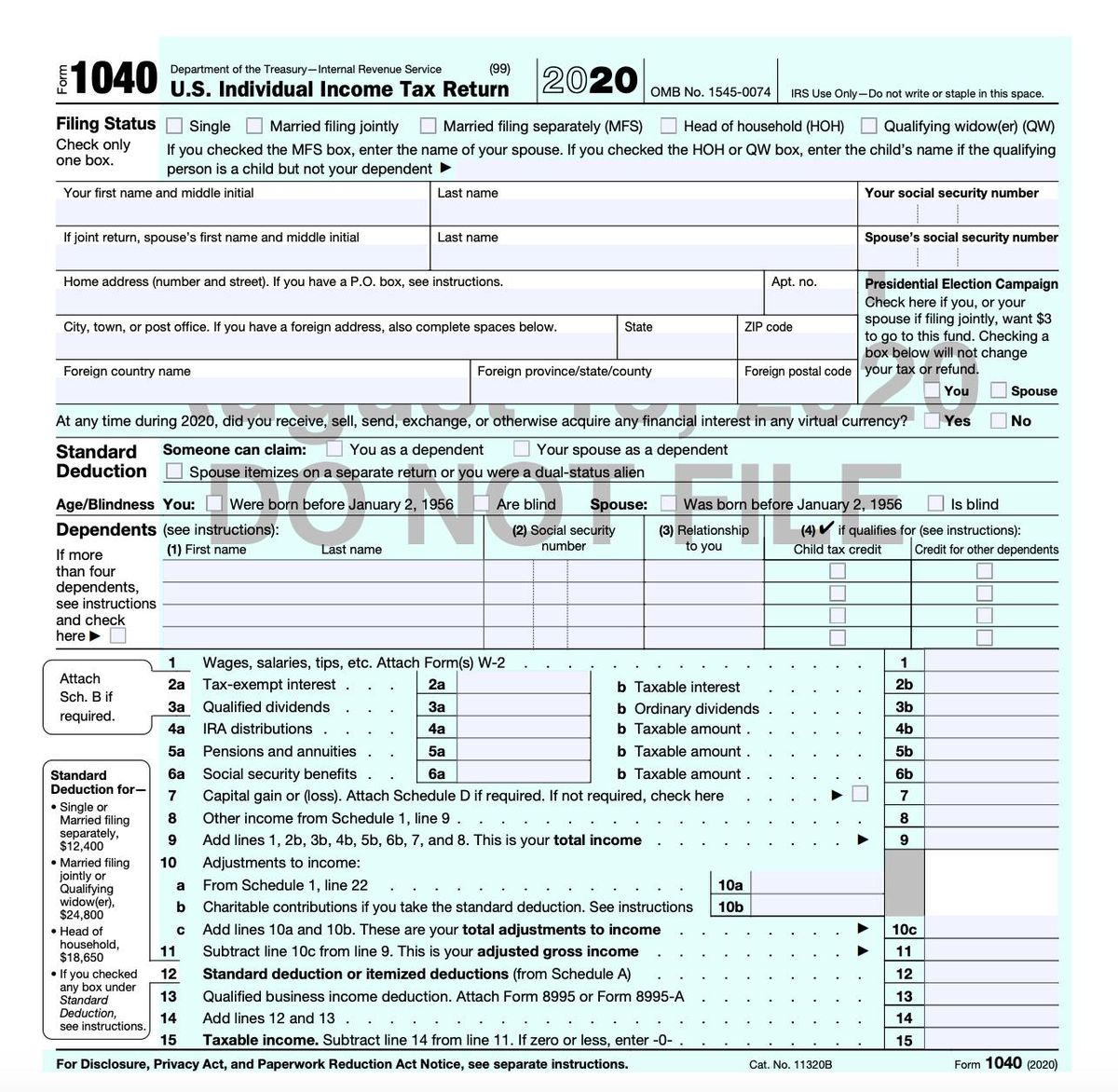

2023 Irs 1040 Form Printable Printable Forms Free Online

PDF The Conflation Of Two Problems In Kant s Deduction Of Categories

Check more sample of Irs Deduction Categories below

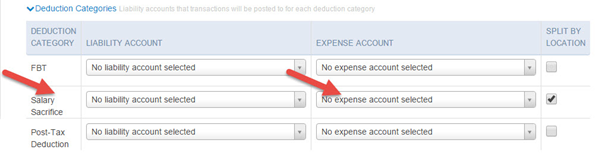

Mapping Deduction Categories For Your General Ledger Roubler

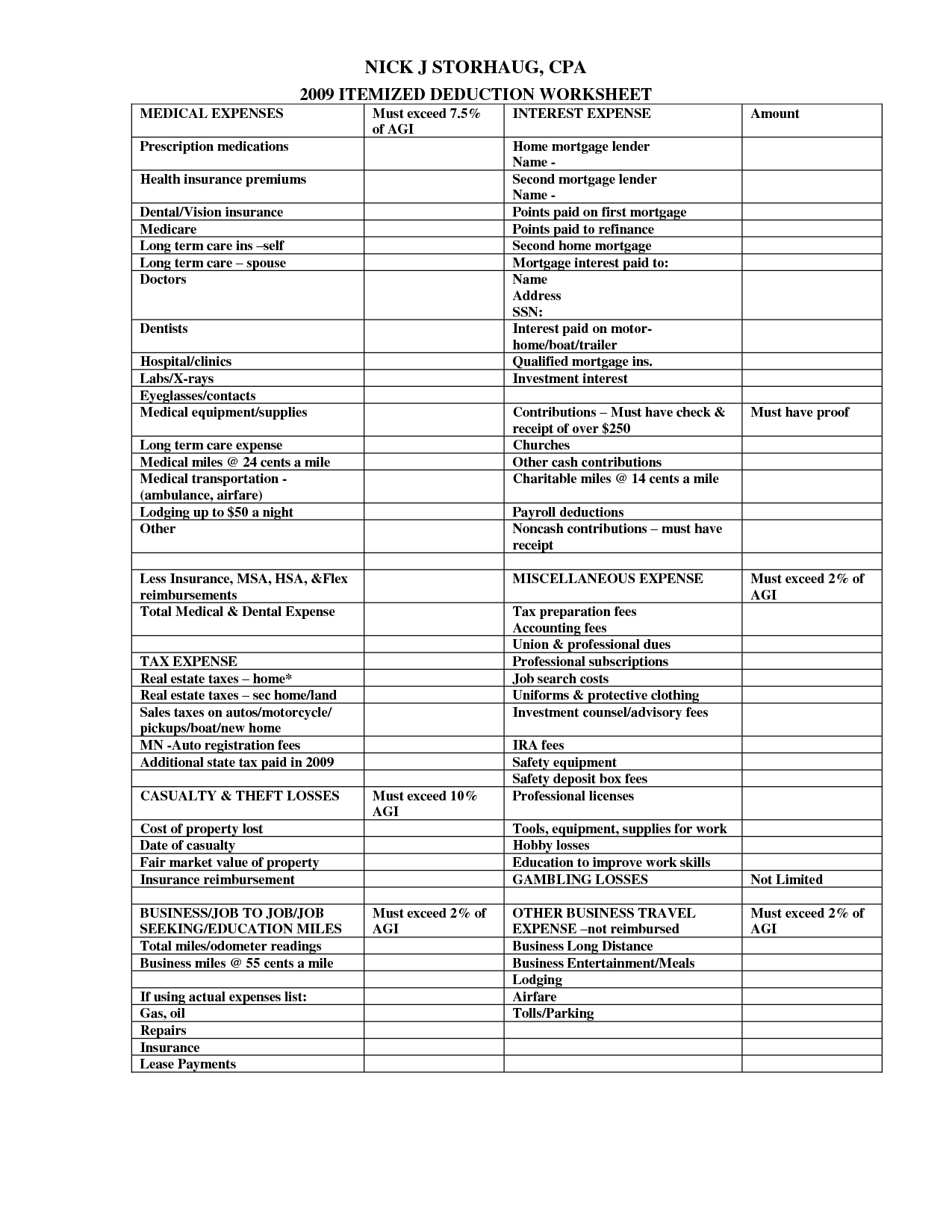

Itemized Deduction Worksheet Template Free

Are You Unsure What Expenses Are Deductible For You Business This

Printable Itemized Deductions Worksheet

How To CALCULATE Numbers For IRS Taxes Pen And Paper Spreadsheets

Small Business Tax Deductions Worksheet

https://www.nerdwallet.com/article/sma…

1 Startup and organizational costs Our first small business tax deduction comes with a caveat it s not actually a tax deduction Business startup costs are seen as a capital expense

https://money.usnews.com/money/personal-finance/...

Each year the IRS releases the updated standard deduction amounts which vary by tax filing status Itemized deductions are qualified expenses you can

1 Startup and organizational costs Our first small business tax deduction comes with a caveat it s not actually a tax deduction Business startup costs are seen as a capital expense

Each year the IRS releases the updated standard deduction amounts which vary by tax filing status Itemized deductions are qualified expenses you can

Printable Itemized Deductions Worksheet

Itemized Deduction Worksheet Template Free

How To CALCULATE Numbers For IRS Taxes Pen And Paper Spreadsheets

Small Business Tax Deductions Worksheet

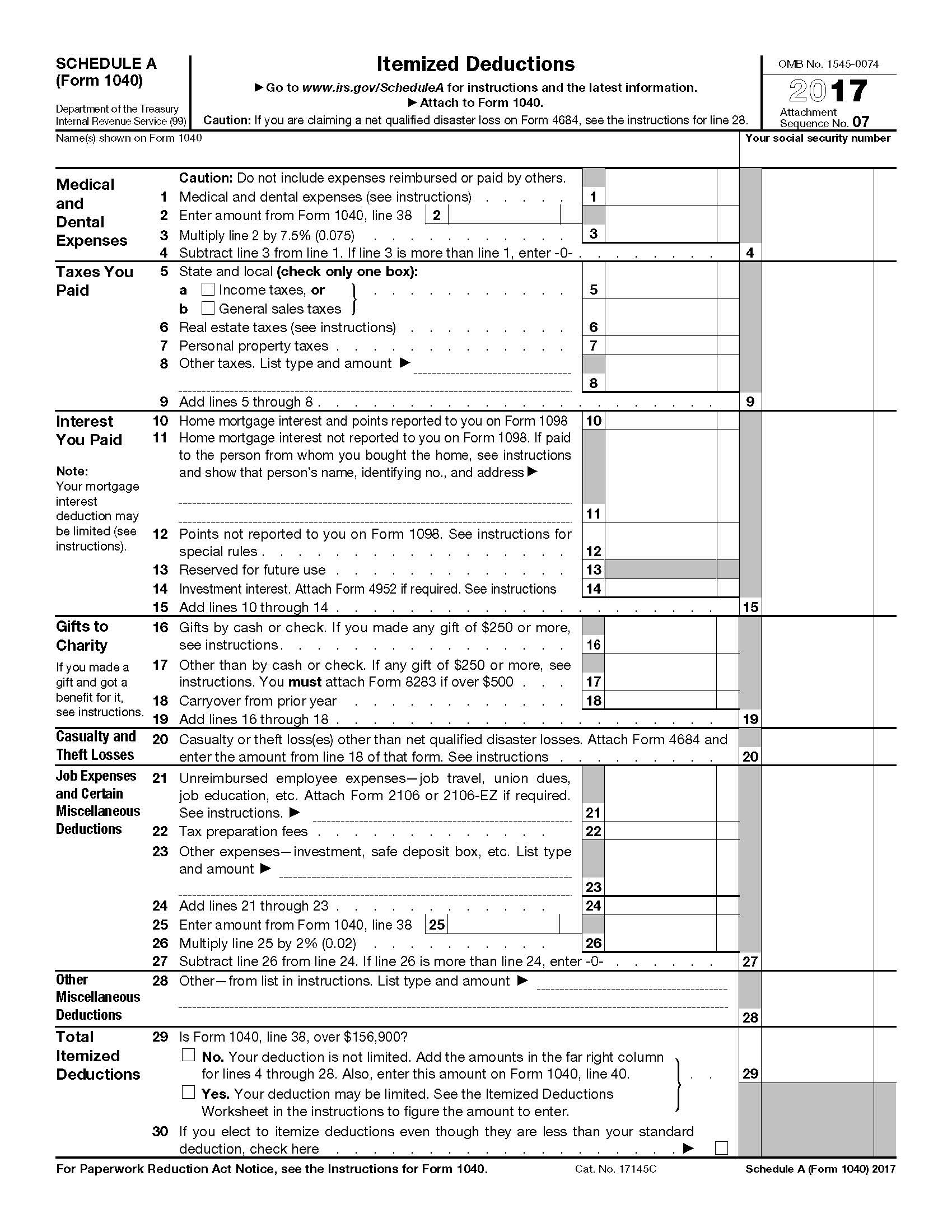

2017 Irs Tax Forms 1040 Schedule A Itemized Deductions 2021 Tax Forms

Avoiding The Outrageous Tax Deductions That Could Get You In Trouble

Avoiding The Outrageous Tax Deductions That Could Get You In Trouble

Deduction Categories