In the digital age, when screens dominate our lives however, the attraction of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add a personal touch to your area, Irs Definition Of Tax Deductions are now a vital resource. We'll dive through the vast world of "Irs Definition Of Tax Deductions," exploring what they are, where to get them, as well as what they can do to improve different aspects of your daily life.

Get Latest Irs Definition Of Tax Deductions Below

Irs Definition Of Tax Deductions

Irs Definition Of Tax Deductions -

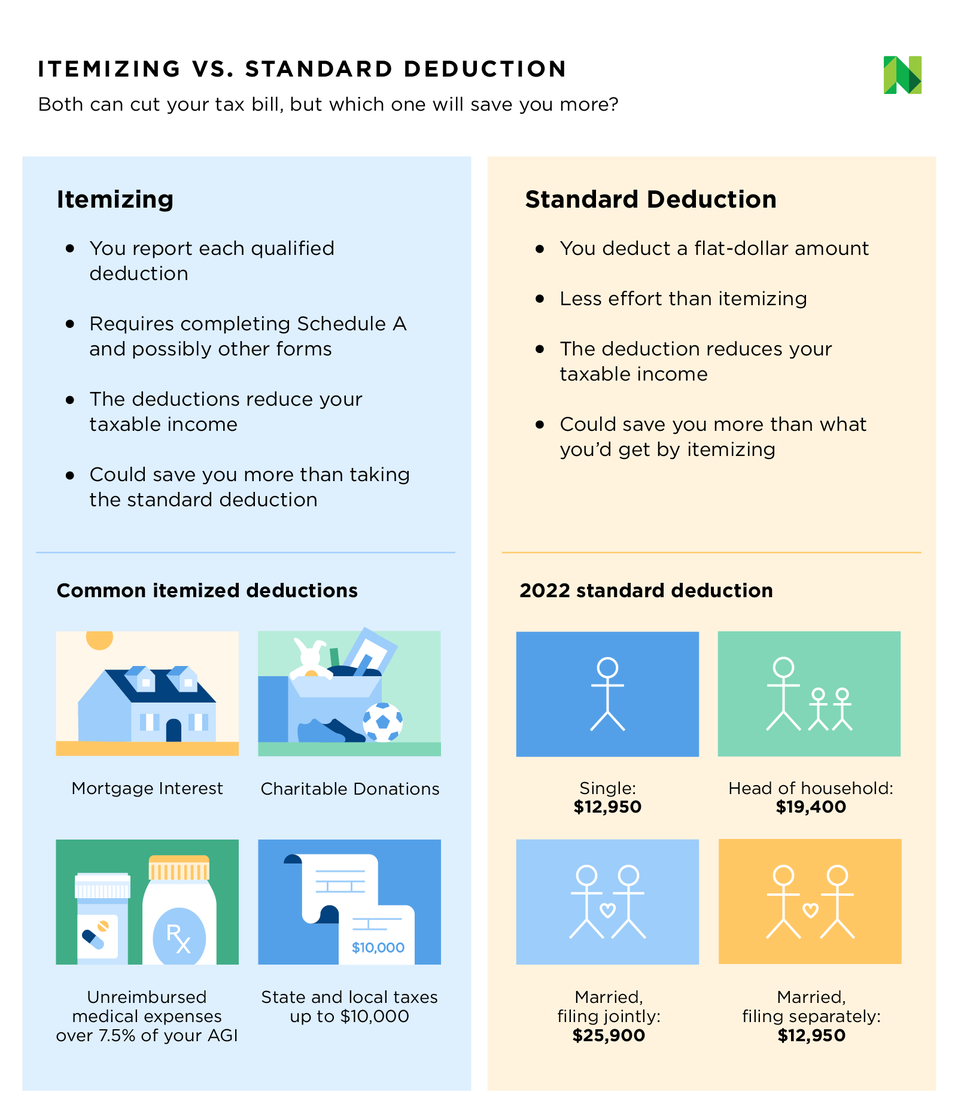

OVERVIEW The federal tax law allows you to deduct several different personal expenses from your taxable income each year This can really pay off during tax season because the reduction to taxable income reduces

A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now

Irs Definition Of Tax Deductions offer a wide assortment of printable, downloadable materials available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and more. One of the advantages of Irs Definition Of Tax Deductions is in their variety and accessibility.

More of Irs Definition Of Tax Deductions

How To Meet The IRS Definition Of A Dependent Sapling

How To Meet The IRS Definition Of A Dependent Sapling

A tax deductible is an expense that an individual taxpayer or a business can subtract from adjusted gross income AGI The deductible expense reduces taxable income and therefore reduces the

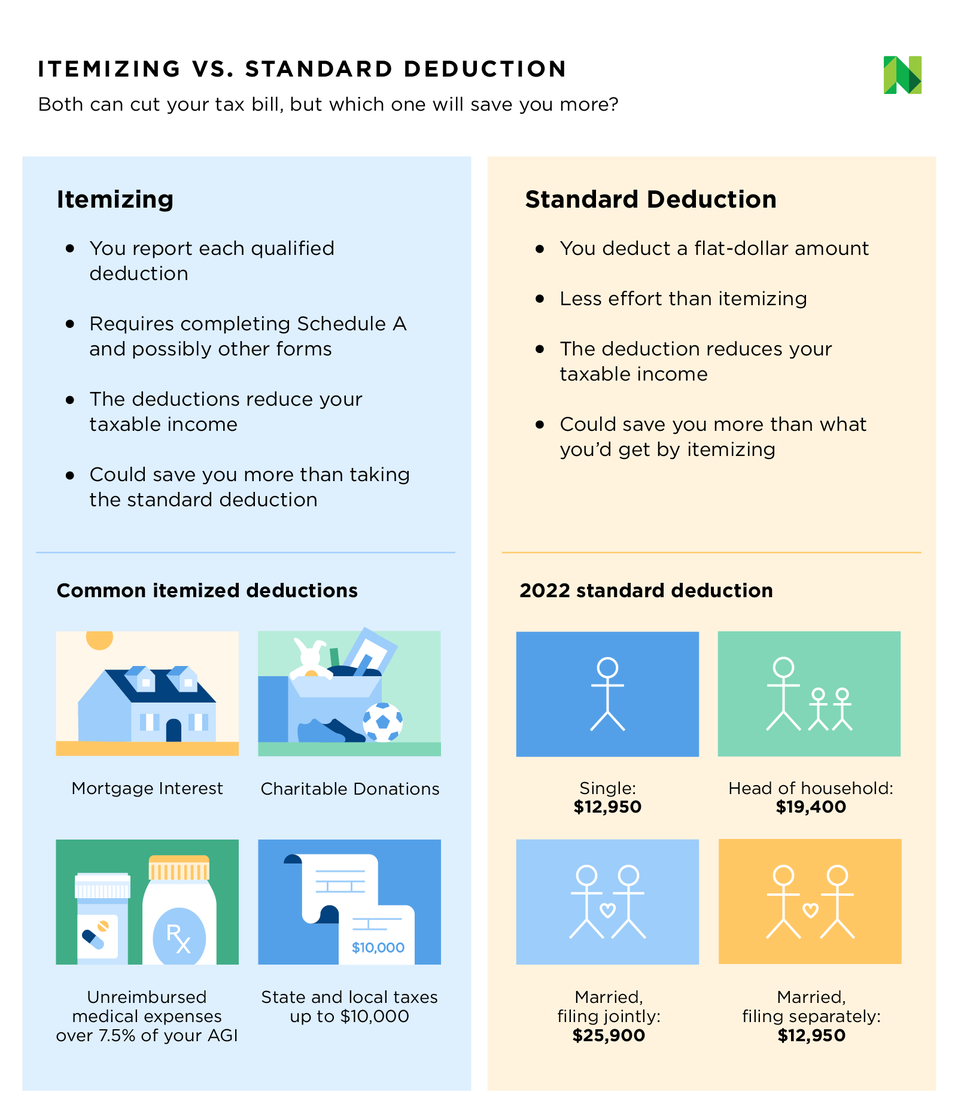

Itemized deductions are subtractions from a taxpayer s Adjusted Gross Income AGI that reduce the amount of income that is taxed Most taxpayers have a choice of taking a standard

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Individualization They can make the templates to meet your individual needs in designing invitations to organize your schedule or decorating your home.

-

Educational Worth: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes these printables a powerful instrument for parents and teachers.

-

The convenience of Access to various designs and templates can save you time and energy.

Where to Find more Irs Definition Of Tax Deductions

What Is A Plan Administrator IRS Definition Of A Plan Administrator

What Is A Plan Administrator IRS Definition Of A Plan Administrator

A tax deduction is a provision that reduces taxable income A standard deduction is a single deduction at a fixed amount Itemized deductions are popular among higher income taxpayers who often have significant deductible

What are tax deductions Tax deductions are essentially items or costs the IRS allows to reduce your taxable income on your tax return Put simply tax deductions lower the amount of money you must pay taxes on A

In the event that we've stirred your curiosity about Irs Definition Of Tax Deductions and other printables, let's discover where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with Irs Definition Of Tax Deductions for all motives.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free or flashcards as well as learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- These blogs cover a wide array of topics, ranging that includes DIY projects to planning a party.

Maximizing Irs Definition Of Tax Deductions

Here are some new ways for you to get the best use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use free printable worksheets for teaching at-home or in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

Irs Definition Of Tax Deductions are an abundance of useful and creative resources that cater to various needs and interests. Their accessibility and versatility make these printables a useful addition to your professional and personal life. Explore the vast collection that is Irs Definition Of Tax Deductions today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes, they are! You can download and print these items for free.

-

Can I use the free printables in commercial projects?

- It's determined by the specific terms of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns with Irs Definition Of Tax Deductions?

- Some printables may have restrictions in use. Be sure to check the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home with any printer or head to the local print shops for better quality prints.

-

What program must I use to open printables free of charge?

- Most printables come as PDF files, which is open with no cost software like Adobe Reader.

IRS Publication 525 Definition

/GettyImages-56043781-1a2cdb581d4d4f10801a93e0da9f2283.jpg)

123 ZF FAQ ENTITY TRUST What Is A Receivership IRS Definition Of A

Check more sample of Irs Definition Of Tax Deductions below

What Is The Difference Between A Tax Credit And Tax Deduction

Itemized Deductions Definition Who Should Itemize NerdWallet 2023

Tax And Types Of Tax Definitions And Examples Educational Hub YouTube

Claiming A Child On Taxes JustAnswer Blog

What Is A Health Reimbursement Account And Who Can Own One

List Of Tax Deductions Here s What You Can Deduct

https://www.irs.gov/newsroom/deductions-for...

A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now

https://www.irs.gov/credits

The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or qualifying surviving spouse 20 800 for head of household Find the standard deduction if

A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now

The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or qualifying surviving spouse 20 800 for head of household Find the standard deduction if

Claiming A Child On Taxes JustAnswer Blog

Itemized Deductions Definition Who Should Itemize NerdWallet 2023

What Is A Health Reimbursement Account And Who Can Own One

List Of Tax Deductions Here s What You Can Deduct

8 Tax Itemized Deduction Worksheet Worksheeto

Claim Medical Expenses On Your Taxes Health For CA

Claim Medical Expenses On Your Taxes Health For CA

What Is Small Company Definition Criteria Tax Deductions