In the age of digital, when screens dominate our lives yet the appeal of tangible printed material hasn't diminished. Be it for educational use and creative work, or simply adding an individual touch to your space, Irs Energy Star Tax Credit 2022 can be an excellent source. This article will take a dive into the world of "Irs Energy Star Tax Credit 2022," exploring their purpose, where to find them, and ways they can help you improve many aspects of your life.

Get Latest Irs Energy Star Tax Credit 2022 Below

Irs Energy Star Tax Credit 2022

Irs Energy Star Tax Credit 2022 -

The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings more

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs

Irs Energy Star Tax Credit 2022 encompass a wide variety of printable, downloadable documents that can be downloaded online at no cost. These printables come in different styles, from worksheets to coloring pages, templates and many more. The benefit of Irs Energy Star Tax Credit 2022 lies in their versatility as well as accessibility.

More of Irs Energy Star Tax Credit 2022

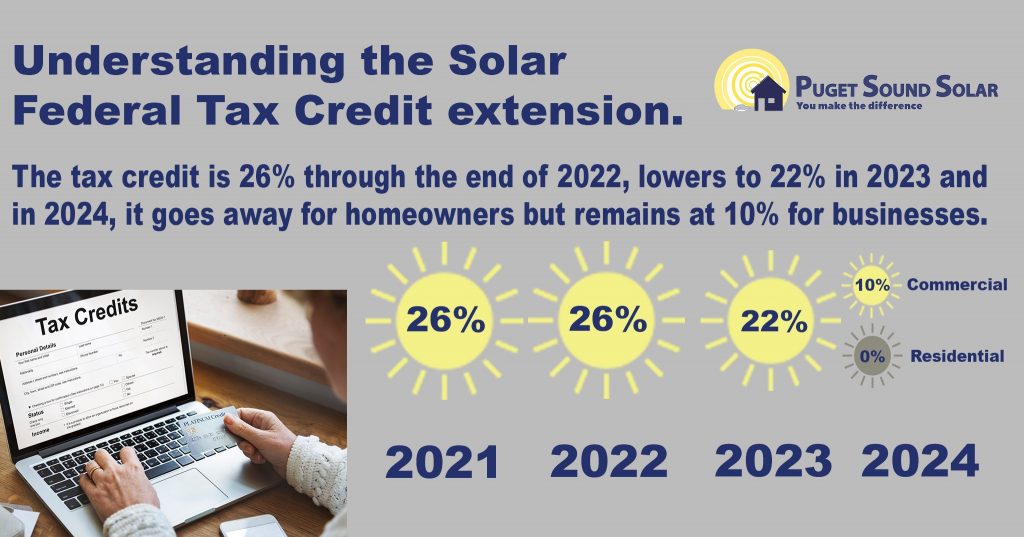

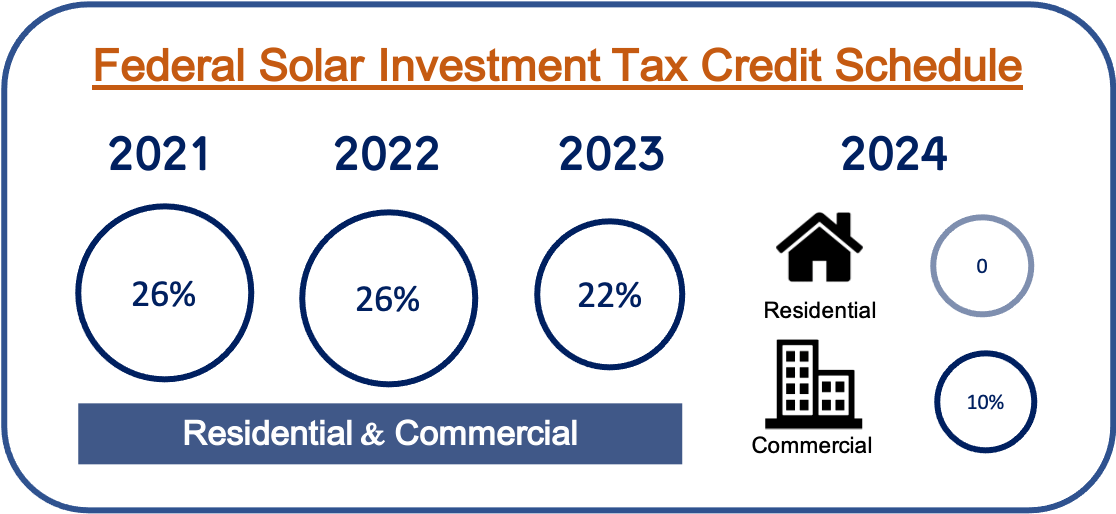

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 Form

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may

The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star

Irs Energy Star Tax Credit 2022 have gained a lot of popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Flexible: It is possible to tailor printables to your specific needs in designing invitations to organize your schedule or decorating your home.

-

Educational Benefits: Printing educational materials for no cost provide for students of all ages, which makes the perfect device for teachers and parents.

-

Simple: The instant accessibility to a plethora of designs and templates can save you time and energy.

Where to Find more Irs Energy Star Tax Credit 2022

Irs Energy Tax Credit 2022

Irs Energy Tax Credit 2022

Residential Energy Credits Department of the Treasury Internal Revenue Service Attach to Form 1040 1040 SR or 1040 NR Credit carryforward from 2022 Enter the amount if any from

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by

We hope we've stimulated your interest in Irs Energy Star Tax Credit 2022 Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Irs Energy Star Tax Credit 2022 to suit a variety of applications.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- These blogs cover a wide spectrum of interests, everything from DIY projects to planning a party.

Maximizing Irs Energy Star Tax Credit 2022

Here are some innovative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Irs Energy Star Tax Credit 2022 are a treasure trove filled with creative and practical information catering to different needs and desires. Their access and versatility makes them an invaluable addition to both professional and personal lives. Explore the wide world of Irs Energy Star Tax Credit 2022 right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free templates for commercial use?

- It's based on the usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations on usage. Always read the terms and conditions set forth by the author.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a local print shop for superior prints.

-

What program do I require to open printables at no cost?

- A majority of printed materials are with PDF formats, which can be opened with free software like Adobe Reader.

Virtual Career Fair Hosted By EPA s Office Of Water My Green

Section 45L Credit Extended Energy Saving Requirement Hamilton CPA

Check more sample of Irs Energy Star Tax Credit 2022 below

Five Star Tax Resolution IRS Tax Problems Experienced Tax Attorneys

Standing Seam Metal Roofing And Panel Metal Construction News

Get Ready For The Energy Star Tax Holiday Bandera Electric Cooperative

.jpg.aspx?width=1400&height=696)

Form 5695 Instructions 2023 Printable Forms Free Online

ENERGY STAR Sales Tax Holiday Pedernales Electric Cooperative Inc

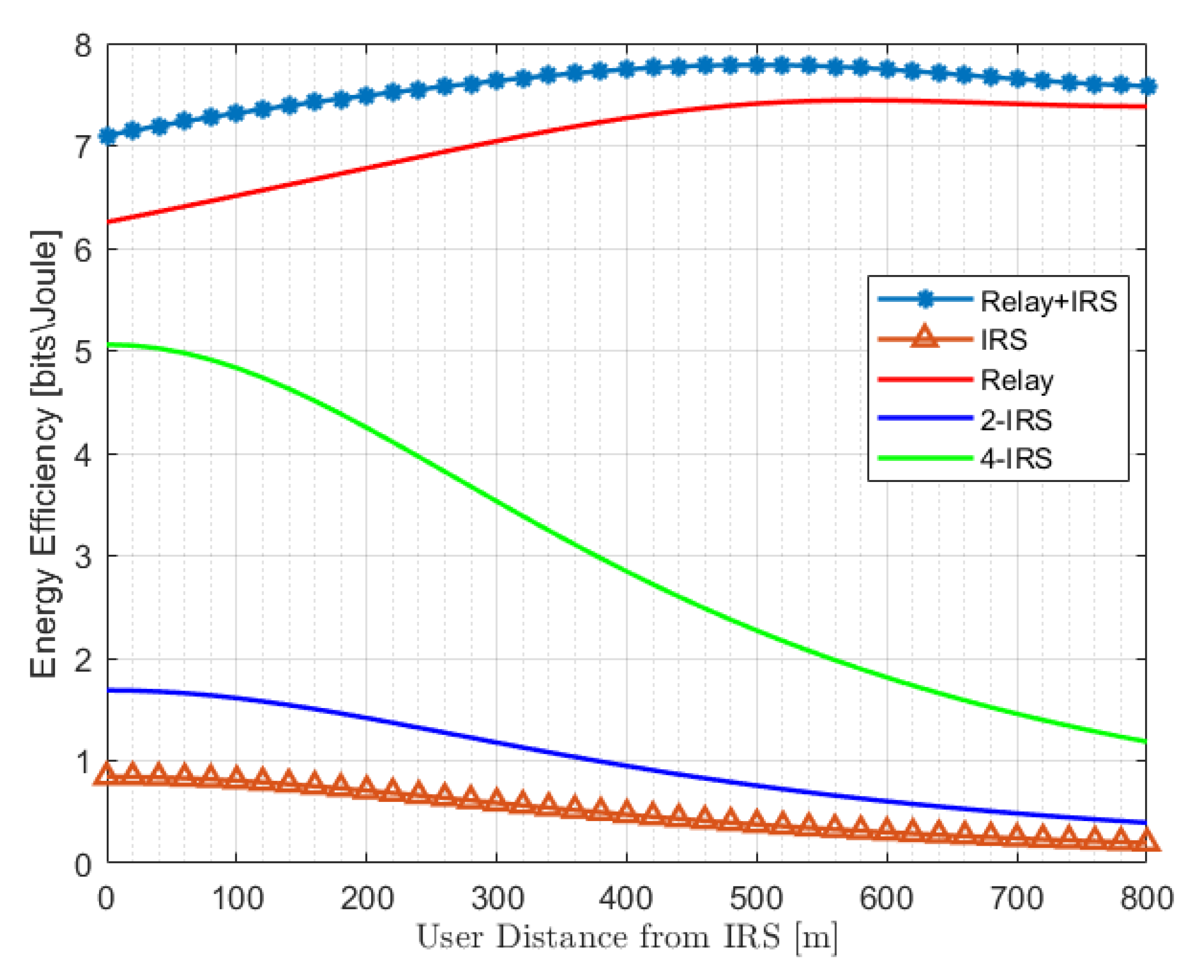

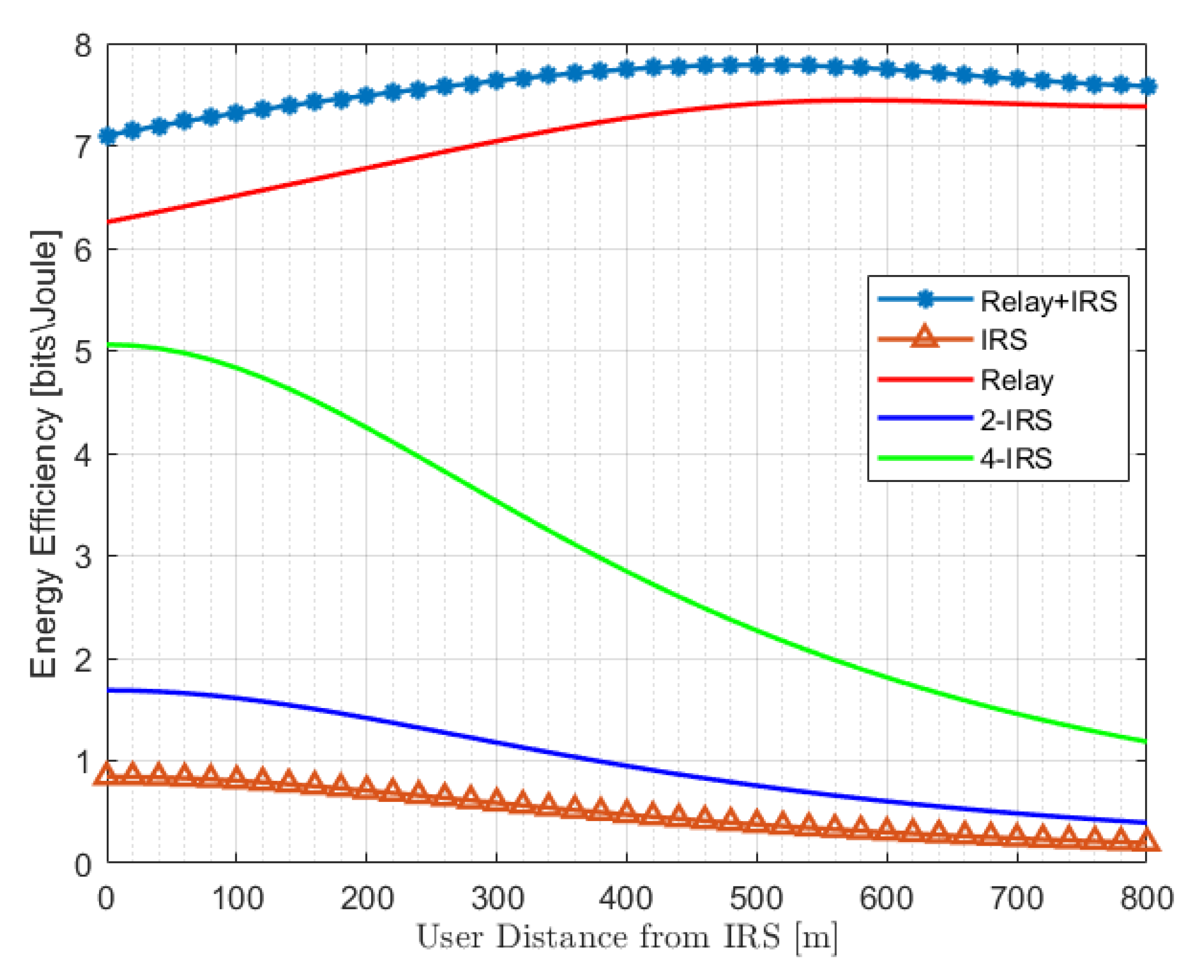

Electronics Free Full Text Energy Efficient Hybrid Relay IRS Aided

https://www.energystar.gov/about/fede…

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs

https://www.irs.gov/credits-and-deductions-under...

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for

Form 5695 Instructions 2023 Printable Forms Free Online

Standing Seam Metal Roofing And Panel Metal Construction News

ENERGY STAR Sales Tax Holiday Pedernales Electric Cooperative Inc

Electronics Free Full Text Energy Efficient Hybrid Relay IRS Aided

Free Water Heater Assistance Program For Low Income GrantsGeeks

Preparing For The Future With All Electric VRF Technology Engineered

Preparing For The Future With All Electric VRF Technology Engineered

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions