In the digital age, with screens dominating our lives but the value of tangible printed material hasn't diminished. Whatever the reason, whether for education as well as creative projects or simply to add the personal touch to your home, printables for free have become an invaluable source. This article will take a dive deep into the realm of "Irs Energy Tax Credit 2023," exploring their purpose, where they are available, and how they can enrich various aspects of your life.

Get Latest Irs Energy Tax Credit 2023 Below

Irs Energy Tax Credit 2023

Irs Energy Tax Credit 2023 -

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

Printables for free include a vast array of printable materials that are accessible online for free cost. They are available in a variety of designs, including worksheets templates, coloring pages, and more. The value of Irs Energy Tax Credit 2023 is their flexibility and accessibility.

More of Irs Energy Tax Credit 2023

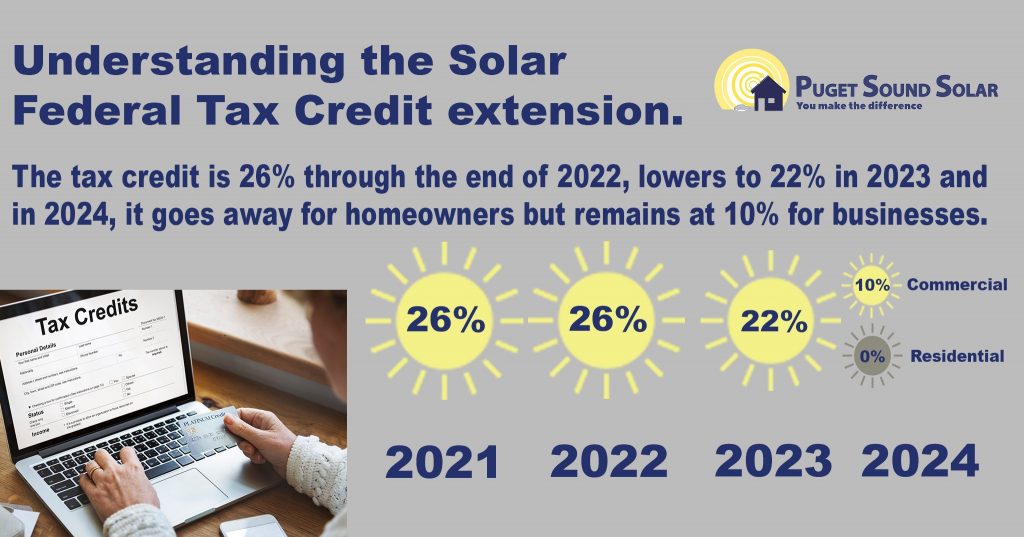

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 Form

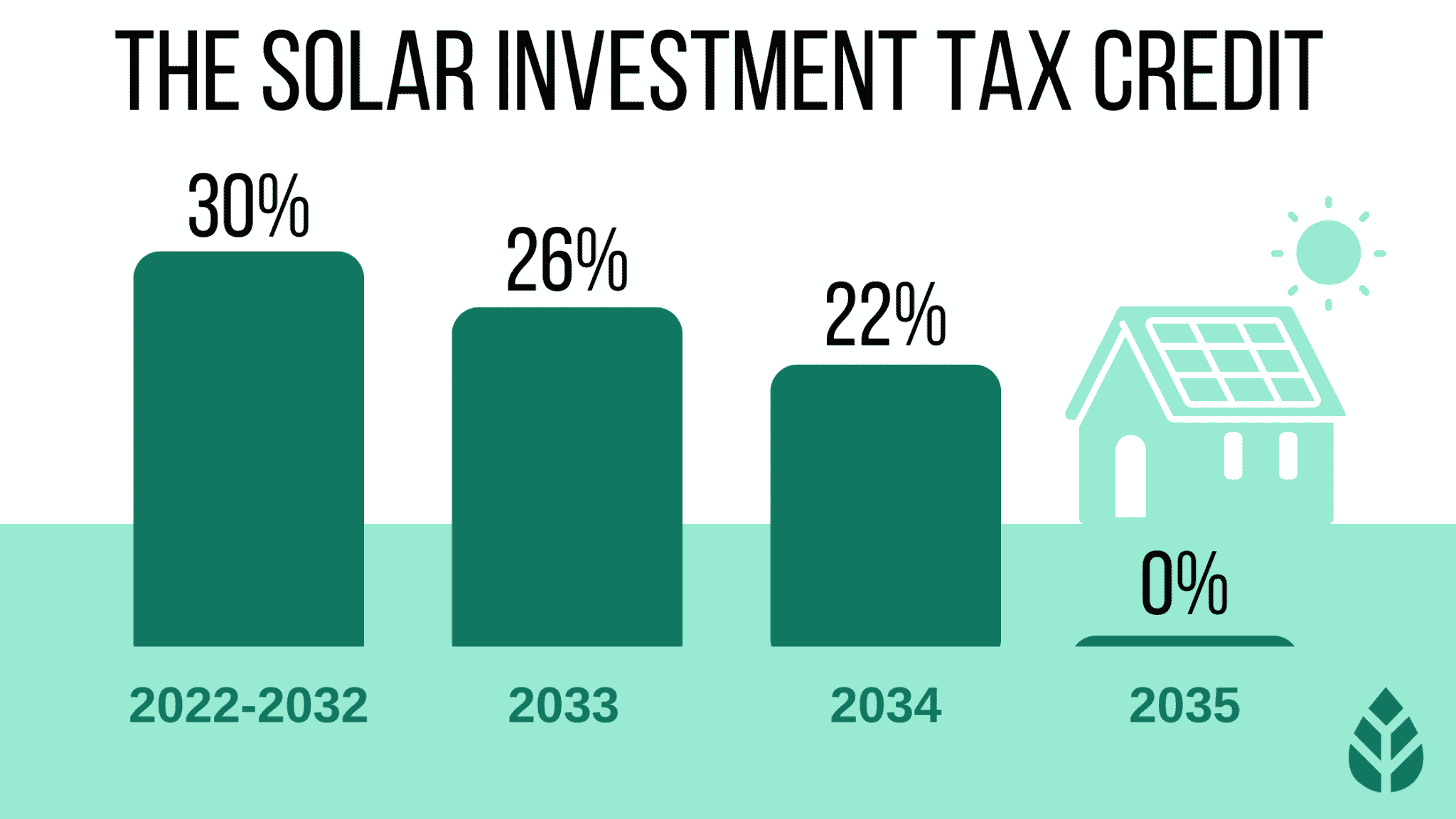

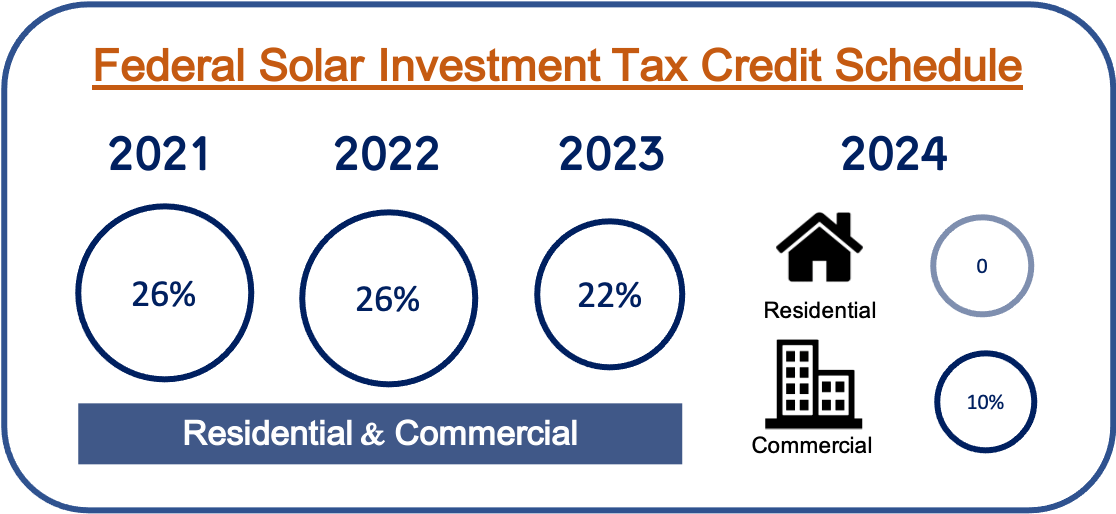

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

Flexible: Your HTML0 customization options allow you to customize printables to fit your particular needs in designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational value: Educational printables that can be downloaded for free provide for students from all ages, making them an essential instrument for parents and teachers.

-

Easy to use: Instant access to a myriad of designs as well as templates saves time and effort.

Where to Find more Irs Energy Tax Credit 2023

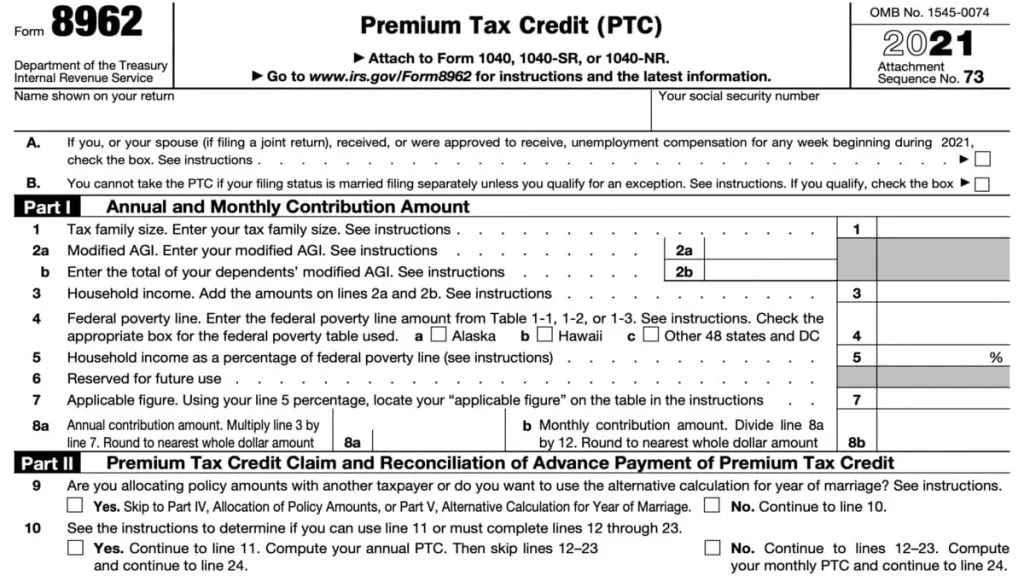

8962 Form 2023 2024 Premium Tax Credit IRS Forms TaxUni

8962 Form 2023 2024 Premium Tax Credit IRS Forms TaxUni

For tax year 2023 if you have more than 200 Forms 3468 or 200 Forms 8835 you can submit a single Form 3468 or Form 8835 with the aggregated credit amounts

The residential energy property credit which expired at the end of December 2014 was extended for two years through December 2016 by the Protecting

We hope we've stimulated your interest in Irs Energy Tax Credit 2023 we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of reasons.

- Explore categories like the home, decor, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets along with flashcards, as well as other learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- These blogs cover a broad range of topics, including DIY projects to party planning.

Maximizing Irs Energy Tax Credit 2023

Here are some unique ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars along with lists of tasks, and meal planners.

Conclusion

Irs Energy Tax Credit 2023 are a treasure trove of practical and imaginative resources that satisfy a wide range of requirements and interest. Their accessibility and flexibility make them a wonderful addition to both professional and personal lives. Explore the world of Irs Energy Tax Credit 2023 and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these materials for free.

-

Can I make use of free printing templates for commercial purposes?

- It's all dependent on the conditions of use. Make sure you read the guidelines for the creator prior to using the printables in commercial projects.

-

Are there any copyright issues when you download Irs Energy Tax Credit 2023?

- Some printables may come with restrictions regarding their use. Always read the terms and regulations provided by the designer.

-

How do I print printables for free?

- Print them at home with the printer, or go to an area print shop for superior prints.

-

What program do I require to open printables for free?

- The majority are printed with PDF formats, which is open with no cost software such as Adobe Reader.

2023 Residential Clean Energy Credit Guide ReVision Energy

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

Check more sample of Irs Energy Tax Credit 2023 below

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Tax Credit 2023 2023

Irs Energy Tax Credit 2022

IRS Clarifies Clean Energy Tax Credit Direct Pay Transferability

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

https://www.irs.gov/instructions/i5695

Residential Clean Energy Credit Part I If you made energy saving improvements to more than one home that you used as a residence during 2023 enter the total of those costs

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

Residential Clean Energy Credit Part I If you made energy saving improvements to more than one home that you used as a residence during 2023 enter the total of those costs

IRS Clarifies Clean Energy Tax Credit Direct Pay Transferability

Tax Credit 2023 2023

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Tax Credit 2023 2023

2023 Residential Clean Energy Credit Guide ReVision Energy

2023 Residential Clean Energy Credit Guide ReVision Energy

Section 45L Credit Extended Energy Saving Requirement Hamilton CPA