In the age of digital, when screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. In the case of educational materials or creative projects, or simply adding an element of personalization to your space, Irs Geothermal Tax Credit 2022 are now a vital resource. This article will take a dive into the world "Irs Geothermal Tax Credit 2022," exploring their purpose, where to get them, as well as how they can enhance various aspects of your lives.

Get Latest Irs Geothermal Tax Credit 2022 Below

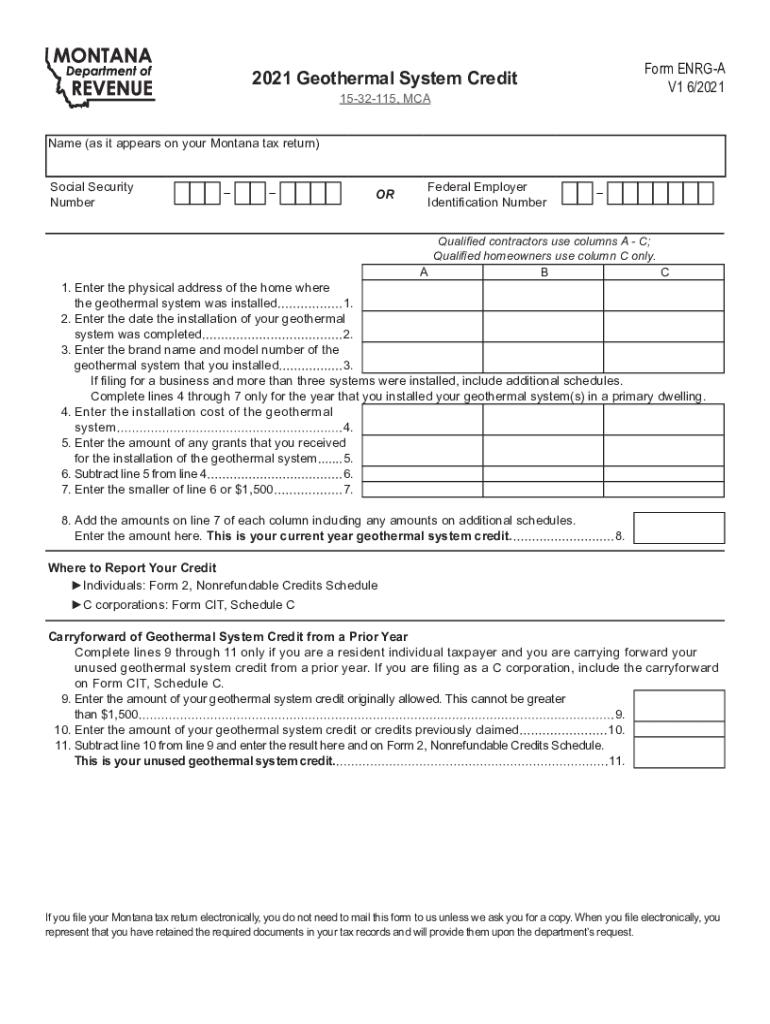

Irs Geothermal Tax Credit 2022

Irs Geothermal Tax Credit 2022 -

There is a 26 Federal Tax Credit available for residential geothermal heat pumps and a 10 tax credit for commercial geothermal heat pumps that meet the ENERGY STAR requirements

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date

Irs Geothermal Tax Credit 2022 offer a wide array of printable material that is available online at no cost. They are available in numerous types, like worksheets, templates, coloring pages, and much more. The attraction of printables that are free lies in their versatility as well as accessibility.

More of Irs Geothermal Tax Credit 2022

Geothermal Tax Credits Are Back

Geothermal Tax Credits Are Back

Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems Tax Credit 30 for systems placed in service by 12 31 2019

The Residential Clean Energy Property Credit is a 30 percent tax credit for certain qualified expenditures made by a taxpayer for residential energy efficient property eligible under the Inflation Reduction Act of 2022 s investment in clean energy solutions

Irs Geothermal Tax Credit 2022 have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

customization: There is the possibility of tailoring designs to suit your personal needs whether it's making invitations to organize your schedule or decorating your home.

-

Educational Use: Free educational printables offer a wide range of educational content for learners from all ages, making them an invaluable aid for parents as well as educators.

-

It's easy: Access to a variety of designs and templates saves time and effort.

Where to Find more Irs Geothermal Tax Credit 2022

Wadidaw Geothermal Tax Credit 2023 Ideas 2023 HWU

Wadidaw Geothermal Tax Credit 2023 Ideas 2023 HWU

In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations placed in service on January 1 2022 or later

Residential Tax Credits for Geothermal Heat Pumps Homeowners are eligible for a 30 tax credit under the Inflation Reduction Act IRA Residential Energy Efficient Property Credit Section 25D for ENERGY STAR rated GHPs that are in service by Jan 1 2033 The tax credits expire at the end of 2034

Now that we've piqued your curiosity about Irs Geothermal Tax Credit 2022 and other printables, let's discover where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Irs Geothermal Tax Credit 2022 for different uses.

- Explore categories such as decorating your home, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free with flashcards and other teaching materials.

- The perfect resource for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a wide range of interests, from DIY projects to party planning.

Maximizing Irs Geothermal Tax Credit 2022

Here are some creative ways create the maximum value use of Irs Geothermal Tax Credit 2022:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Irs Geothermal Tax Credit 2022 are a treasure trove of fun and practical tools for a variety of needs and interest. Their accessibility and flexibility make them an essential part of any professional or personal life. Explore the vast array of Irs Geothermal Tax Credit 2022 right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Geothermal Tax Credit 2022 really are they free?

- Yes, they are! You can print and download the resources for free.

-

Can I use free printables for commercial uses?

- It's contingent upon the specific rules of usage. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with Irs Geothermal Tax Credit 2022?

- Certain printables could be restricted in their usage. Be sure to read these terms and conditions as set out by the author.

-

How do I print Irs Geothermal Tax Credit 2022?

- Print them at home using an printer, or go to an in-store print shop to get more high-quality prints.

-

What software will I need to access printables at no cost?

- Many printables are offered with PDF formats, which can be opened with free software, such as Adobe Reader.

What You Need To Know About Energy Efficient Property Credits

New York Homeowners Could Qualify For Geothermal Tax Credit

Check more sample of Irs Geothermal Tax Credit 2022 below

The Geothermal Tax Credit Is Back

Tax Credit For Heat Pumps HEARATYU

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Help Extend The Geothermal 30 Tax Credit Through 2024 ECS

For 346PRODUCTION Www directingactors

Congress Extends Tax Benefits For Geothermal Heat Pumps Colorado

https://www.irs.gov › newsroom › energy-incentives-for...

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date

https://www.irs.gov

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as it becomes available

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities We ll post guidance for taxpayers on all credits and deductions from the Inflation Reduction Act as it becomes available

Help Extend The Geothermal 30 Tax Credit Through 2024 ECS

Tax Credit For Heat Pumps HEARATYU

For 346PRODUCTION Www directingactors

Congress Extends Tax Benefits For Geothermal Heat Pumps Colorado

Learning To Cope Without The Geothermal Tax Credit 2017 03 01

Form 5695 Instructions 2023 Printable Forms Free Online

Form 5695 Instructions 2023 Printable Forms Free Online

Fillable Online Understand The Geothermal Tax Credit Form Fill Out