In this day and age where screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. Be it for educational use and creative work, or simply to add personal touches to your space, Irs Incentive Program are now an essential resource. Here, we'll dive through the vast world of "Irs Incentive Program," exploring the benefits of them, where to get them, as well as how they can enrich various aspects of your lives.

Get Latest Irs Incentive Program Below

Irs Incentive Program

Irs Incentive Program -

We ll see what they come back with on the FJO

If you make home improvements for energy efficiency you may qualify for an annual tax credit up to 3 200

The Irs Incentive Program are a huge range of printable, free documents that can be downloaded online at no cost. These materials come in a variety of types, such as worksheets coloring pages, templates and many more. The appealingness of Irs Incentive Program is in their versatility and accessibility.

More of Irs Incentive Program

Problems Remain At Plug in Incentive Page At IRS Autoblog

Problems Remain At Plug in Incentive Page At IRS Autoblog

The deal is set to include direct payments of up to 600 to eligible adults plus 600 per child dependent This means that under the new relief package a family of four will potentially receive 2 400 depending on if they

The IRS Office of Chief Counsel issued memorandum number 202323006 on May 9 2023 and proposed regulation amendments on July 12 2023 regarding certain wellness plans which are promoted as saving

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Value: Downloads of educational content for free are designed to appeal to students of all ages. This makes the perfect resource for educators and parents.

-

An easy way to access HTML0: instant access numerous designs and templates reduces time and effort.

Where to Find more Irs Incentive Program

IRS Offers Mission Critical Employees Incentive Pay To Return To

IRS Offers Mission Critical Employees Incentive Pay To Return To

The Opportunity Zone incentive is an economic development tool that supports economic growth Invest in Opportunity Zones and defer tax on eligible gains

The IRS would benefit the wellness industry by further clarifying when wellness services count as medical expenses that could be reimbursed by an employer without being subject to employment taxes The IRS had that

In the event that we've stirred your interest in printables for free, let's explore where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of motives.

- Explore categories like furniture, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast array of topics, ranging everything from DIY projects to party planning.

Maximizing Irs Incentive Program

Here are some innovative ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings and birthdays.

4. Organization

- Be organized by using printable calendars or to-do lists. meal planners.

Conclusion

Irs Incentive Program are an abundance of practical and imaginative resources designed to meet a range of needs and interest. Their access and versatility makes these printables a useful addition to both professional and personal lives. Explore the plethora of Irs Incentive Program now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can download and print these materials for free.

-

Can I utilize free printables for commercial uses?

- It's all dependent on the terms of use. Always check the creator's guidelines before using any printables on commercial projects.

-

Are there any copyright violations with Irs Incentive Program?

- Certain printables could be restricted on usage. You should read the terms and conditions set forth by the author.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit the local print shops for premium prints.

-

What program do I need to open Irs Incentive Program?

- A majority of printed materials are in the PDF format, and is open with no cost software like Adobe Reader.

IRS Offers Tax Refund Incentive Money Credit Millionaires Get

Recent GAO Report Provides Insight On Opportunity Zones Incentive

Check more sample of Irs Incentive Program below

What To Know About The IRS Fresh Start Program Tax Resolution Services

IRS Stimulus Tracker IRS Get My Payment 2022 SKREC News

![]()

TAX TIME An IRS Incentive To Save For Retirement CNBNews

Recent GAO Report Provides Insight On Opportunity Zones Incentive

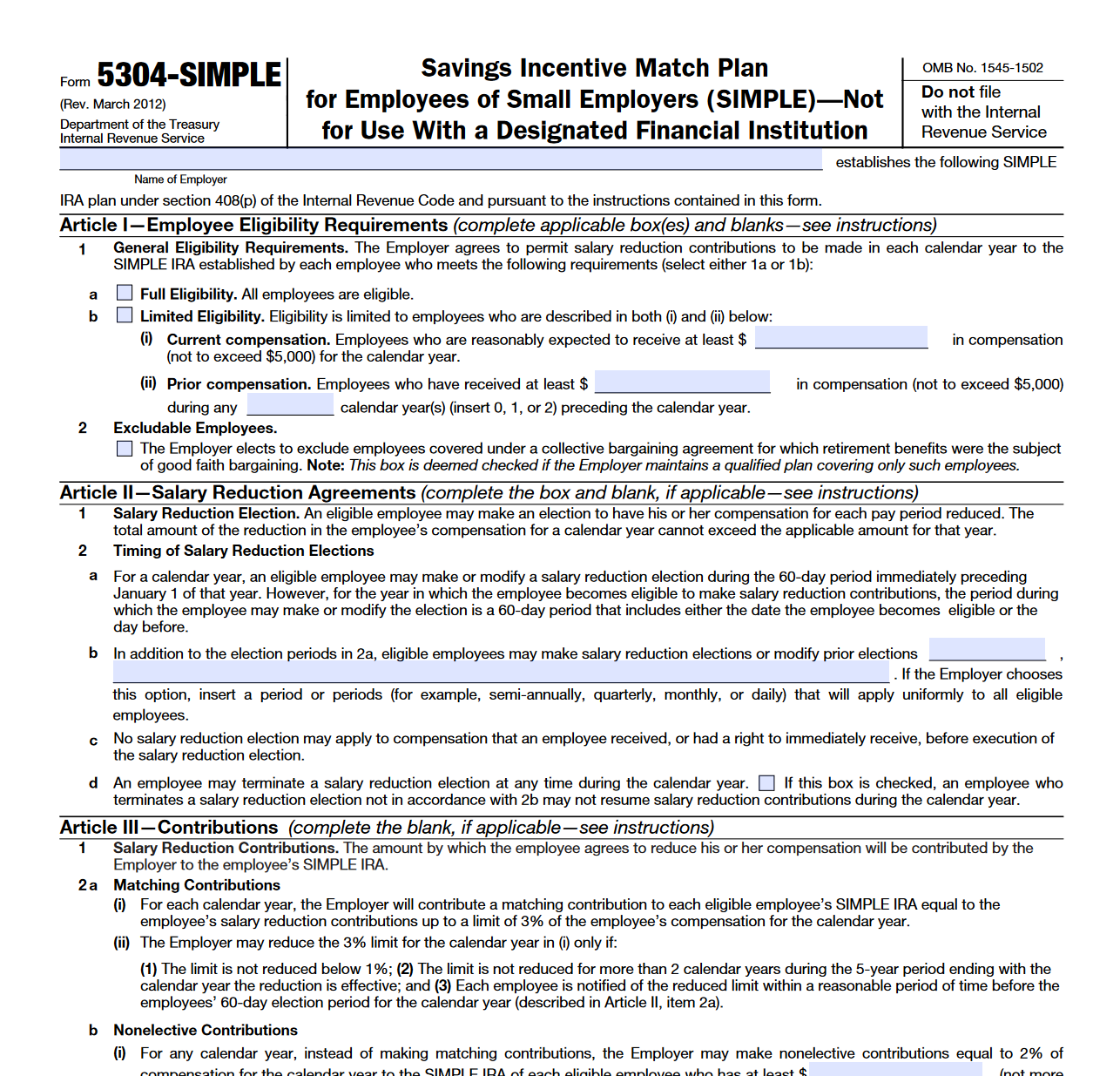

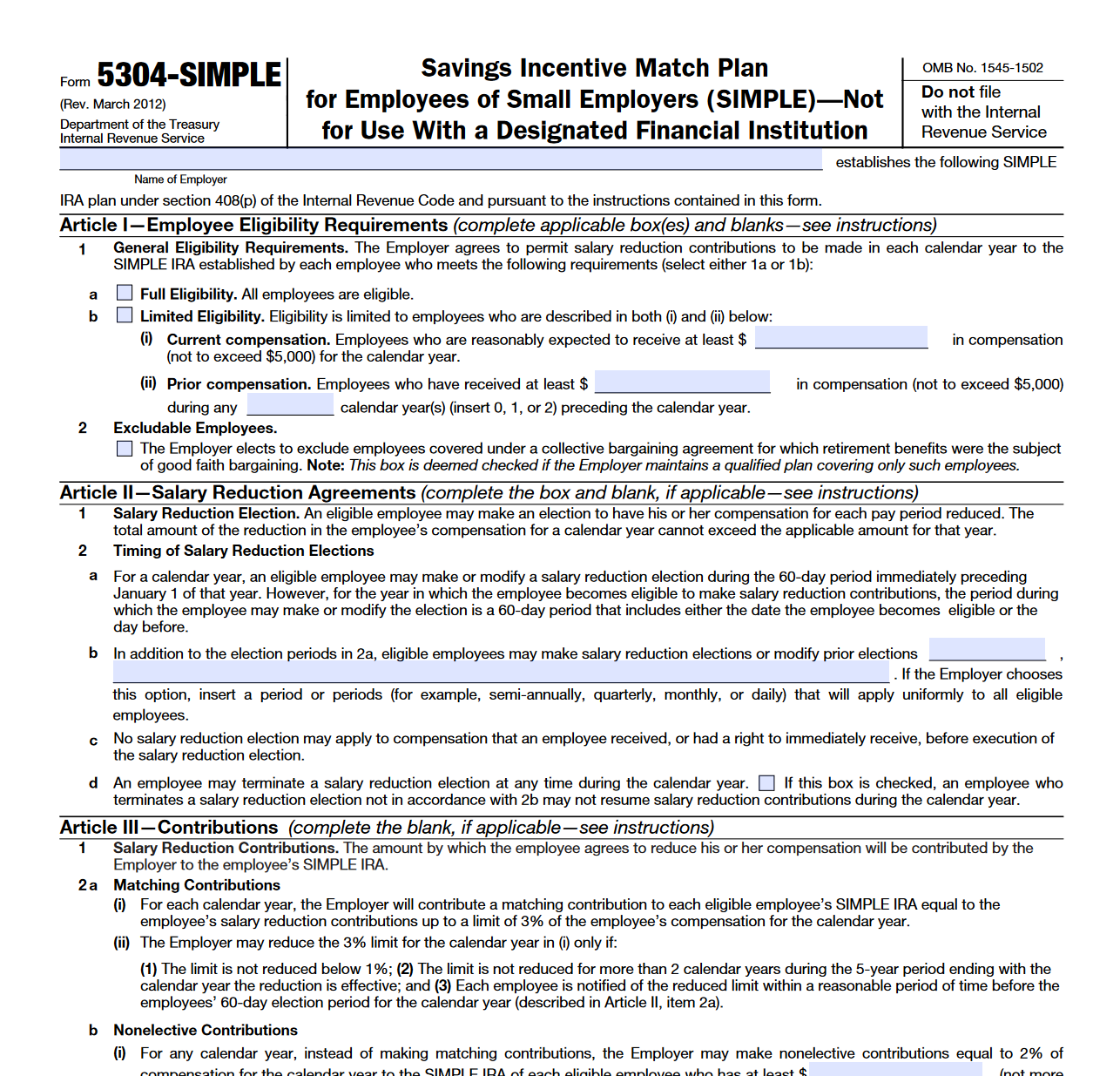

IRS Form 5304 SIMPLE Savings Incentive Match Plan For Employees Of

An IRS Incentive To Save For Retirement The Jersey Tomato Press

https://www.irs.gov/credits-deductions/energy...

If you make home improvements for energy efficiency you may qualify for an annual tax credit up to 3 200

https://home.treasury.gov/policy-issues/…

The American Rescue Plan Act of 2021 American Rescue Plan enacted in early March 2021 provided Economic Impact Payments of up to 1 400 for eligible individuals or 2 800 for married couples filing jointly plus 1 400 for each

If you make home improvements for energy efficiency you may qualify for an annual tax credit up to 3 200

The American Rescue Plan Act of 2021 American Rescue Plan enacted in early March 2021 provided Economic Impact Payments of up to 1 400 for eligible individuals or 2 800 for married couples filing jointly plus 1 400 for each

Recent GAO Report Provides Insight On Opportunity Zones Incentive

IRS Stimulus Tracker IRS Get My Payment 2022 SKREC News

IRS Form 5304 SIMPLE Savings Incentive Match Plan For Employees Of

An IRS Incentive To Save For Retirement The Jersey Tomato Press

Huge Incentive For A New Website Hester Designs

Incentive Program Template Google Docs Word Apple Pages Template

Incentive Program Template Google Docs Word Apple Pages Template

Is The IRS Fresh Start Program Legit Tax Law Advocates