In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed items hasn't gone away. Whether it's for educational purposes and creative work, or simply to add the personal touch to your area, Irs Induction Stove Tax Credit have become a valuable source. Through this post, we'll take a dive into the world "Irs Induction Stove Tax Credit," exploring what they are, where to find them and the ways that they can benefit different aspects of your life.

Get Latest Irs Induction Stove Tax Credit Below

Irs Induction Stove Tax Credit

Irs Induction Stove Tax Credit -

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

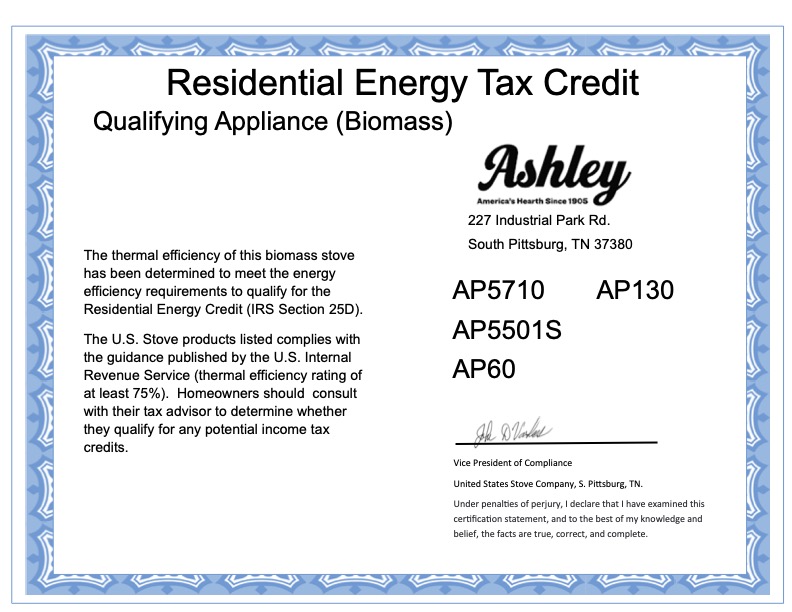

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Printables for free cover a broad assortment of printable, downloadable material that is available online at no cost. These materials come in a variety of styles, from worksheets to templates, coloring pages and more. One of the advantages of Irs Induction Stove Tax Credit lies in their versatility and accessibility.

More of Irs Induction Stove Tax Credit

All The Details On The Pellet And Wood Stove Tax Credit Energy Center

All The Details On The Pellet And Wood Stove Tax Credit Energy Center

The Internal Revenue Service IRS has recently issued Notice 2024 30 bringing significant modifications to the Energy Community Tax Credit Bonus amounts under the Inflation Reduction Act of 2022 This development brings significant opportunities for taxpayers to claim increased credit amounts or rates if they meet certain

8 000 for an HVAC heat pump 840 for an electric including induction cooktop stove range oven or heat pump clothes dryer 1 600 for air sealing insulation and ventilation 2 500 for electric wiring

Irs Induction Stove Tax Credit have garnered immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: We can customize printables to your specific needs such as designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value: The free educational worksheets offer a wide range of educational content for learners from all ages, making them a valuable tool for parents and educators.

-

Accessibility: Access to many designs and templates reduces time and effort.

Where to Find more Irs Induction Stove Tax Credit

What Is The Biomass Stove Tax Credit Mountain Hearth Patio

What Is The Biomass Stove Tax Credit Mountain Hearth Patio

The Inflation Reduction Act includes significant funding for states and tribes to offer rebates to households that install new electric appliances including super efficient heat pumps water heaters clothes dryers stoves and ovens and for households that make repairs and improvements that increase energy efficiency

By Rocky Mengle last updated 22 March 2024 If you are planning a few home improvements that will boost the energy efficiency of your house you may save some money on your projects under the

Now that we've ignited your curiosity about Irs Induction Stove Tax Credit Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Irs Induction Stove Tax Credit for different reasons.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets including flashcards, learning materials.

- Ideal for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing Irs Induction Stove Tax Credit

Here are some new ways for you to get the best use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home (or in the learning environment).

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Irs Induction Stove Tax Credit are an abundance of practical and innovative resources that can meet the needs of a variety of people and interests. Their availability and versatility make them a wonderful addition to each day life. Explore the many options of Irs Induction Stove Tax Credit today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Induction Stove Tax Credit really are they free?

- Yes they are! You can print and download these tools for free.

-

Can I use the free templates for commercial use?

- It depends on the specific terms of use. Always read the guidelines of the creator before using any printables on commercial projects.

-

Are there any copyright issues with Irs Induction Stove Tax Credit?

- Some printables may contain restrictions on use. You should read the terms of service and conditions provided by the author.

-

How can I print Irs Induction Stove Tax Credit?

- You can print them at home using a printer or visit an in-store print shop to get superior prints.

-

What software will I need to access printables that are free?

- The majority of printables are in PDF format. These can be opened using free software, such as Adobe Reader.

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

Wood Burning Stove Tax Credit

![]()

Check more sample of Irs Induction Stove Tax Credit below

Tax Credit For Wood Stove 2021 Revised Info On Federal Credit What

Learn More About The New Wood Pellet Stove Tax Credit Energy Center

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

Green Mountain 80 HearthStone Stoves

Feens Financing Promotions And Sales

Get A 300 Tax Credit For Qualifying Wood Stoves Milford CT The Cozy

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Green Mountain 80 HearthStone Stoves

Learn More About The New Wood Pellet Stove Tax Credit Energy Center

Feens Financing Promotions And Sales

Get A 300 Tax Credit For Qualifying Wood Stoves Milford CT The Cozy

Government Extends Biomass Stove Tax Credit Royal Oak MI

Heated Up How To Claim The 300 Stove Tax Credit

Heated Up How To Claim The 300 Stove Tax Credit

Heated Up Consumers Can Now Rely On Almost All Stove Tax Credit