In a world when screens dominate our lives yet the appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons, creative projects, or just adding a personal touch to your home, printables for free can be an excellent source. In this article, we'll take a dive in the world of "Irs Phone Number Tax Refund Status," exploring the different types of printables, where to find them and how they can improve various aspects of your daily life.

Get Latest Irs Phone Number Tax Refund Status Below

Irs Phone Number Tax Refund Status

Irs Phone Number Tax Refund Status -

You can contact the IRS to check on the status of your refund If you call wait times to speak with a representative can be long But you can avoid the wait by using the automated phone system Follow the message prompts when you call Find out when to expect your federal tax refund

Phone help Where s My Refund has the latest information on your return If you don t have internet call the automated refund hotline at 800 829 1954 for a current year refund or 866 464 2050 for an amended return For prior year refunds check Where s My Refund We can t give you the refund status over the phone

Irs Phone Number Tax Refund Status provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. They are available in a variety of formats, such as worksheets, templates, coloring pages, and more. The appealingness of Irs Phone Number Tax Refund Status lies in their versatility and accessibility.

More of Irs Phone Number Tax Refund Status

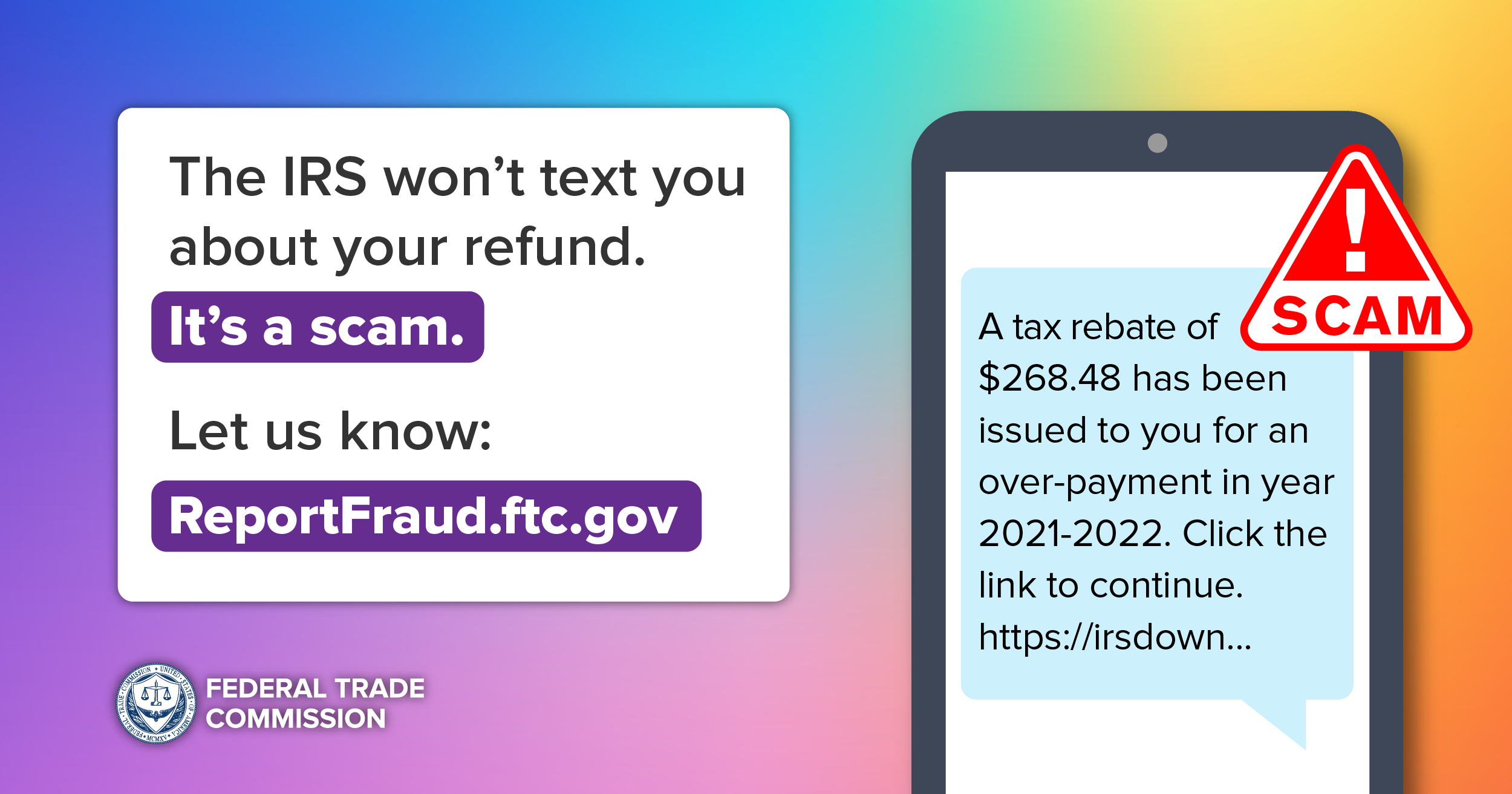

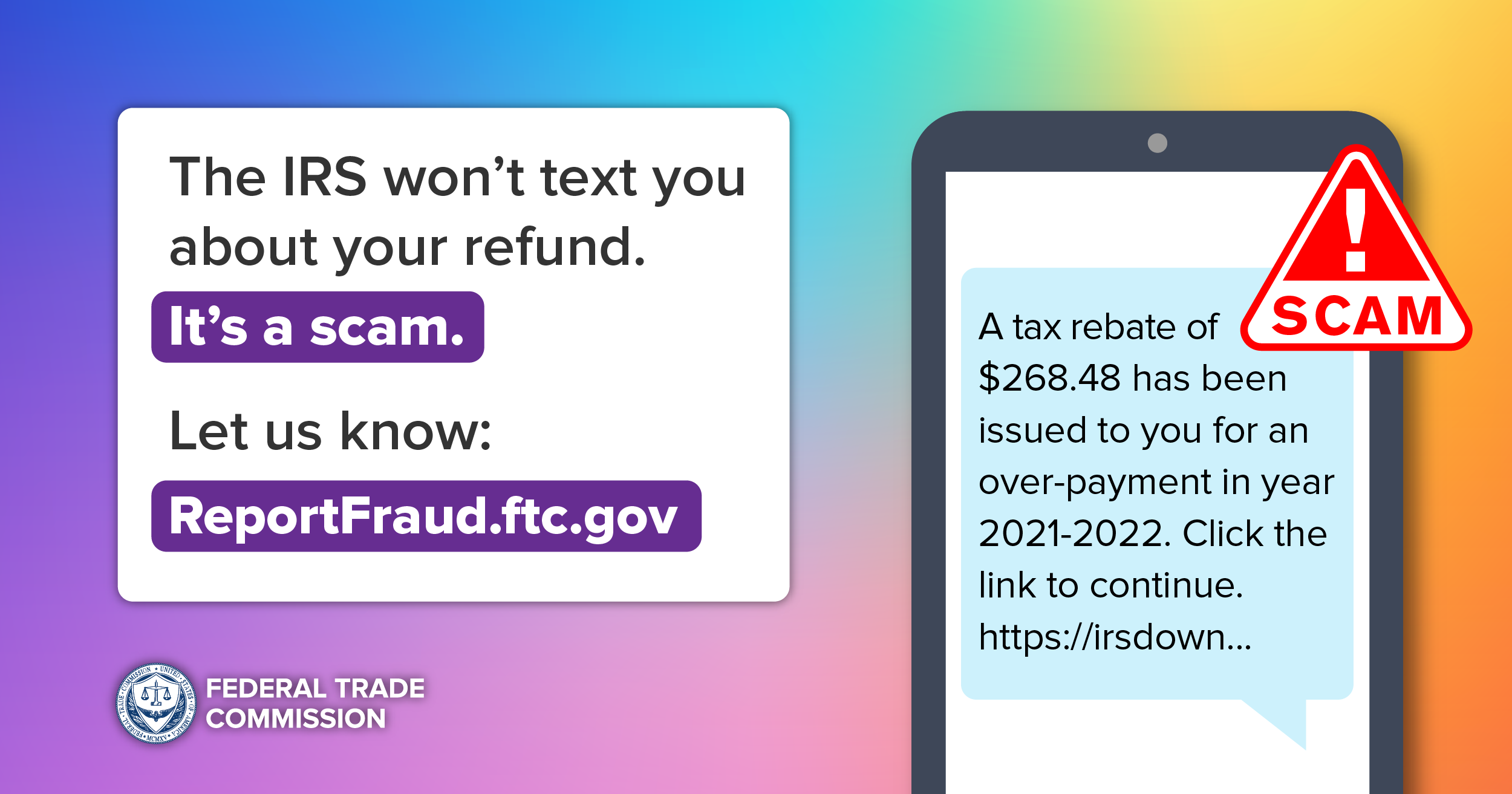

No That s Not The IRS Texting About A Tax Refund Or Rebate It s A

No That s Not The IRS Texting About A Tax Refund Or Rebate It s A

Call the IRS at 800 829 1040 TTY TDD 800 829 4059 You can however check the status of your amended tax return with Where s My Amended Return on IRS gov It should generally be available three weeks after you mail the amended tax return to the IRS When checking on your refund have this information available

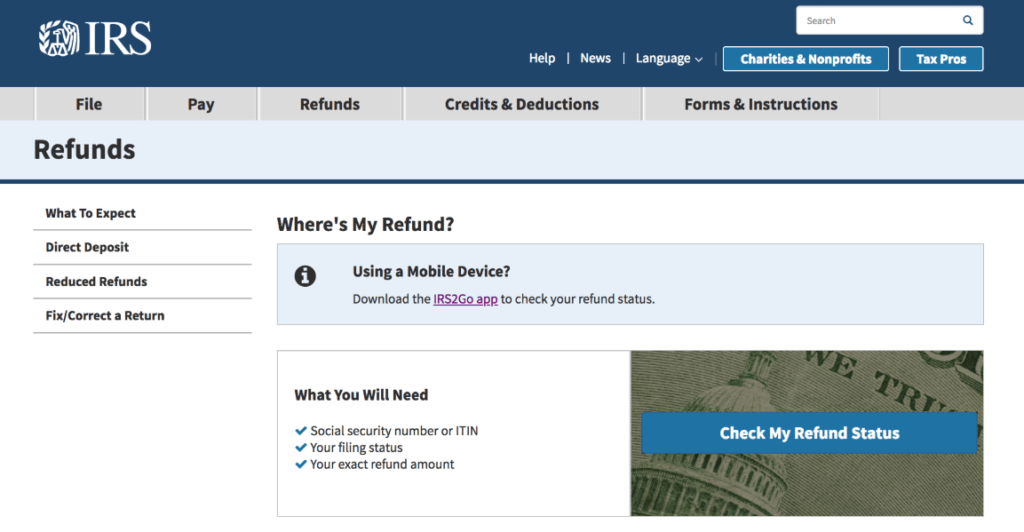

Refund Status Get Refund Status Please enter your Social Security Number Tax Year your Filing Status and the Refund Amount as shown on your tax return All fields marked with an asterisk are required Social Security Number Enter the SSN or ITIN shown on your tax return Example 123 45 6789 Show SSN Tax Year

Printables that are free have gained enormous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Customization: They can make printables to fit your particular needs such as designing invitations planning your schedule or even decorating your home.

-

Educational Benefits: Free educational printables offer a wide range of educational content for learners of all ages. This makes them a great aid for parents as well as educators.

-

Convenience: Access to many designs and templates, which saves time as well as effort.

Where to Find more Irs Phone Number Tax Refund Status

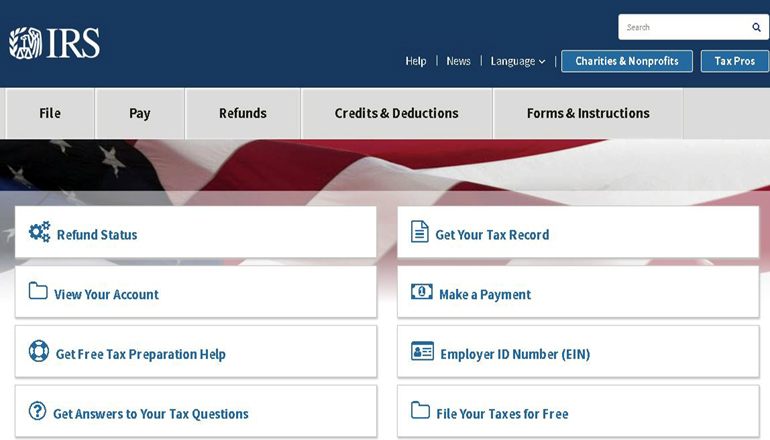

IRS Phone Numbers Where s My Refund Tax News Information

IRS Phone Numbers Where s My Refund Tax News Information

You can also try the automated refund hotline at 800 829 1954 for a current year refund or 866 464 2050 for an amended return That said the fastest and easiest way to get the status of

If you still aren t sure what happened with your refund contact an IRS representative at IRS Tax Help Line for Individuals 800 829 1040 TTY TDD 800 829 4059

Now that we've piqued your interest in printables for free we'll explore the places you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Irs Phone Number Tax Refund Status for a variety purposes.

- Explore categories such as decorations for the home, education and organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free or flashcards as well as learning materials.

- Ideal for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- The blogs are a vast spectrum of interests, ranging from DIY projects to party planning.

Maximizing Irs Phone Number Tax Refund Status

Here are some ideas create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home (or in the learning environment).

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars as well as to-do lists and meal planners.

Conclusion

Irs Phone Number Tax Refund Status are an abundance filled with creative and practical information that cater to various needs and interests. Their availability and versatility make them a valuable addition to any professional or personal life. Explore the vast world of Irs Phone Number Tax Refund Status now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Phone Number Tax Refund Status really free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I utilize free printables for commercial use?

- It's based on the rules of usage. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Certain printables may be subject to restrictions regarding their use. Be sure to review the terms and regulations provided by the author.

-

How do I print Irs Phone Number Tax Refund Status?

- You can print them at home with an printer, or go to a print shop in your area for better quality prints.

-

What software do I need to open printables at no cost?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software such as Adobe Reader.

All The Latest Phone Number Of IRS On One Page

How Do I Check The Status Of My Federal Tax Refund Where s My Refund

Check more sample of Irs Phone Number Tax Refund Status below

What To Do If Your Tax Refund Is Wrong

Talk To A Live Person At The IRS Where s My Refund Tax News

Irs Gov Refund Status Phone Number TAX

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

IRS Phone Numbers Where s My Refund Tax News Information

Where Is My 2011 State And Federal Refund Using Online Tool

https://www.irs.gov › refunds

Phone help Where s My Refund has the latest information on your return If you don t have internet call the automated refund hotline at 800 829 1954 for a current year refund or 866 464 2050 for an amended return For prior year refunds check Where s My Refund We can t give you the refund status over the phone

https://www.irs.gov › faqs › irs-procedures › refund-inquiries

If you lost your refund check you should initiate a refund trace Use Where s My Refund call us at 800 829 1954 and use the automated system or speak with an agent by calling 800 829 1040 see telephone assistance for hours of operation However if you filed a married filing jointly return you can t initiate a trace using the automated

Phone help Where s My Refund has the latest information on your return If you don t have internet call the automated refund hotline at 800 829 1954 for a current year refund or 866 464 2050 for an amended return For prior year refunds check Where s My Refund We can t give you the refund status over the phone

If you lost your refund check you should initiate a refund trace Use Where s My Refund call us at 800 829 1954 and use the automated system or speak with an agent by calling 800 829 1040 see telephone assistance for hours of operation However if you filed a married filing jointly return you can t initiate a trace using the automated

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

Talk To A Live Person At The IRS Where s My Refund Tax News

IRS Phone Numbers Where s My Refund Tax News Information

Where Is My 2011 State And Federal Refund Using Online Tool

IRS Customer Service Phone Number 1 800 829 1040

Get Your Tax Number Tax Refund

Get Your Tax Number Tax Refund

Check On Your Refund And Find Out Why The IRS Might Not Send It