In this day and age where screens have become the dominant feature of our lives it's no wonder that the appeal of tangible, printed materials hasn't diminished. Whatever the reason, whether for education as well as creative projects or just adding an individual touch to the home, printables for free have become an invaluable resource. In this article, we'll dive in the world of "Irs Renewable Energy Tax Credit 2022," exploring what they are, how they can be found, and how they can enhance various aspects of your daily life.

Get Latest Irs Renewable Energy Tax Credit 2022 Below

Irs Renewable Energy Tax Credit 2022

Irs Renewable Energy Tax Credit 2022 -

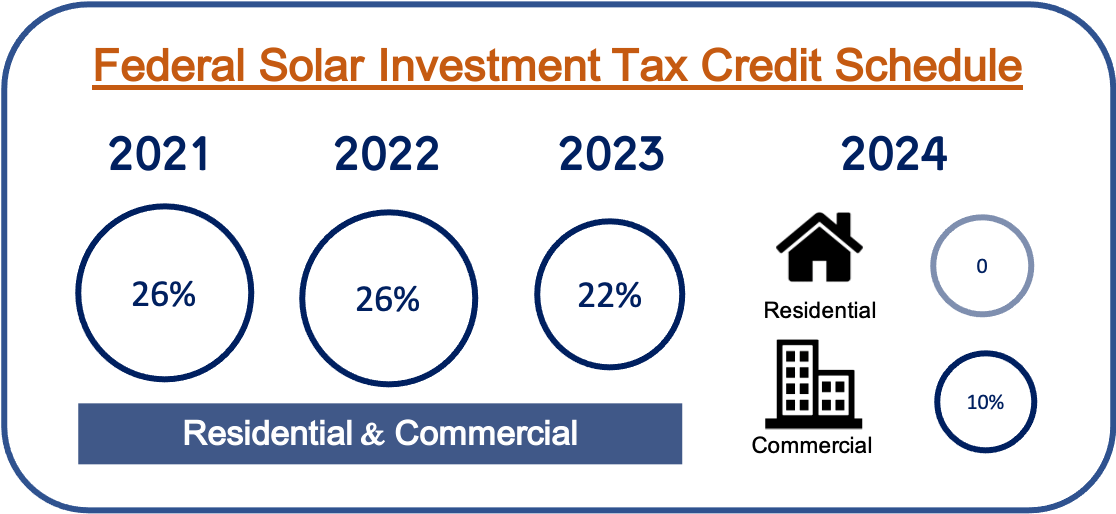

Renewable Energy Tax Credits Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

Irs Renewable Energy Tax Credit 2022 encompass a wide assortment of printable content that can be downloaded from the internet at no cost. These resources come in various formats, such as worksheets, templates, coloring pages and more. The beauty of Irs Renewable Energy Tax Credit 2022 lies in their versatility as well as accessibility.

More of Irs Renewable Energy Tax Credit 2022

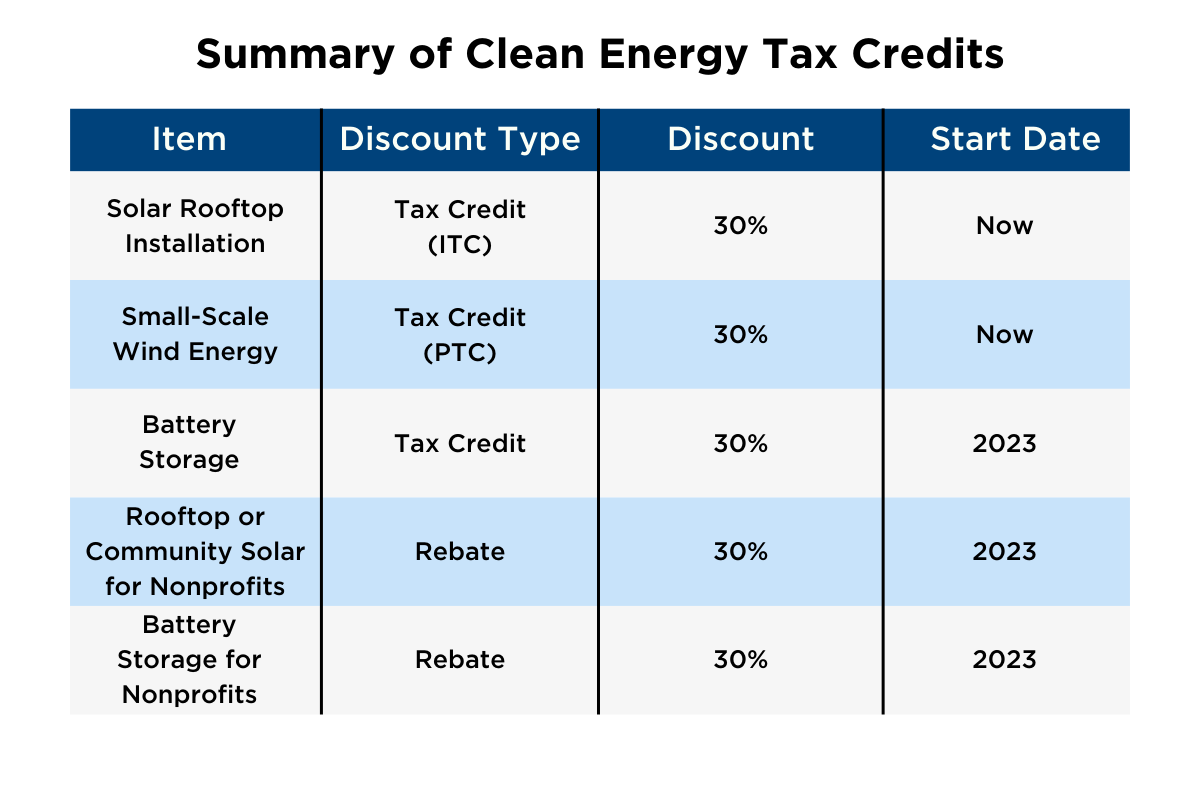

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

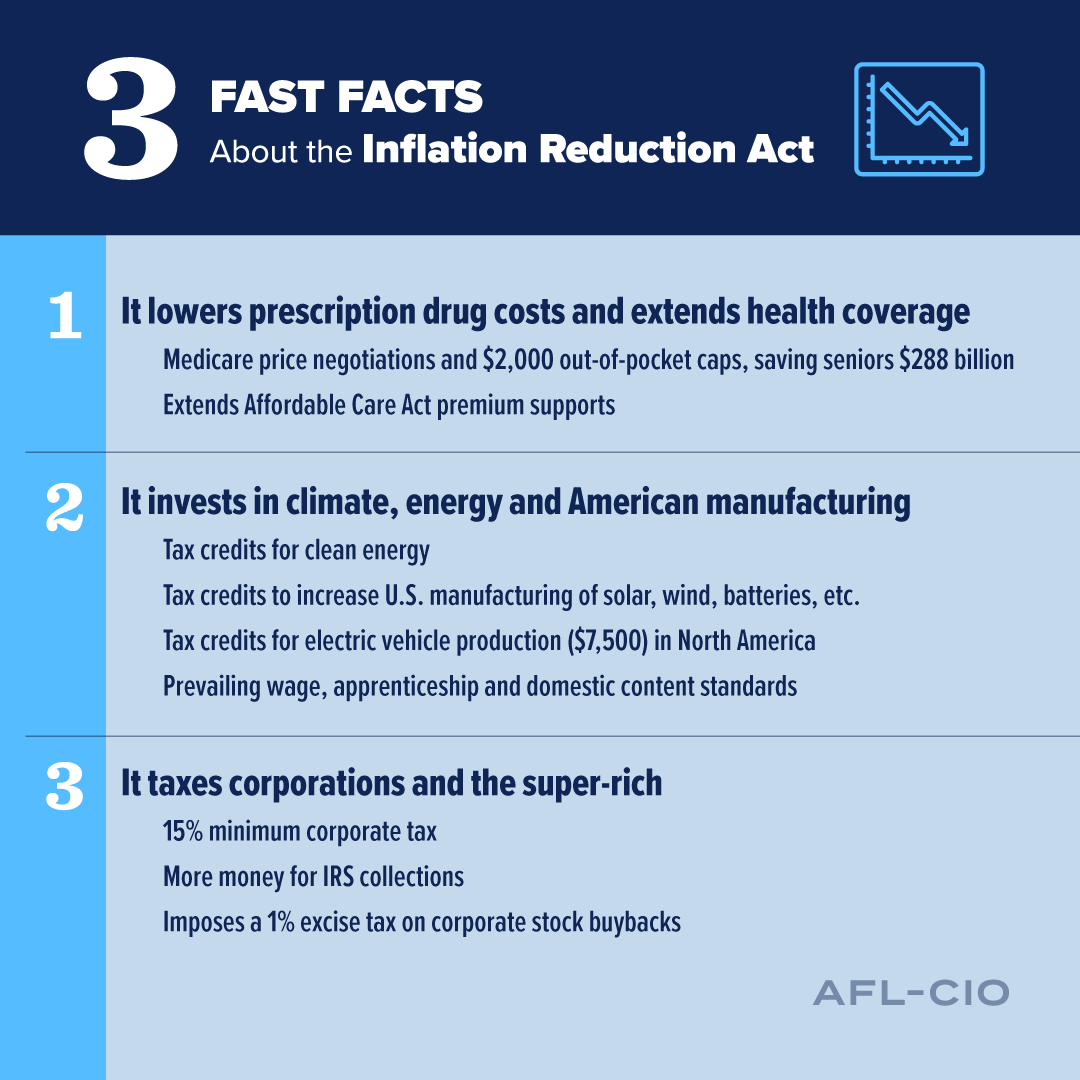

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

Printables for free have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements for invitations, whether that's creating them and schedules, or even decorating your home.

-

Educational Worth: Downloads of educational content for free can be used by students from all ages, making them a vital tool for parents and educators.

-

An easy way to access HTML0: Instant access to a myriad of designs as well as templates reduces time and effort.

Where to Find more Irs Renewable Energy Tax Credit 2022

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 Form

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are

A nonrefundable tax credit allows taxpayers to lower their tax liability to zero but not below zero Page Last Reviewed or Updated 30 Jan 2024 Updated questions and

After we've peaked your curiosity about Irs Renewable Energy Tax Credit 2022 Let's take a look at where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Irs Renewable Energy Tax Credit 2022 for a variety needs.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning tools.

- Ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing Irs Renewable Energy Tax Credit 2022

Here are some ways to make the most use of Irs Renewable Energy Tax Credit 2022:

1. Home Decor

- Print and frame beautiful artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to aid in learning at your home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Irs Renewable Energy Tax Credit 2022 are a treasure trove of creative and practical resources for a variety of needs and preferences. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the many options of Irs Renewable Energy Tax Credit 2022 to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Renewable Energy Tax Credit 2022 truly cost-free?

- Yes they are! You can download and print these files for free.

-

Can I use free printouts for commercial usage?

- It's all dependent on the conditions of use. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright concerns when using Irs Renewable Energy Tax Credit 2022?

- Some printables could have limitations concerning their use. Make sure you read these terms and conditions as set out by the creator.

-

How can I print Irs Renewable Energy Tax Credit 2022?

- Print them at home using printing equipment or visit a print shop in your area for high-quality prints.

-

What program do I require to open printables free of charge?

- The majority are printed in PDF format, which can be opened with free software such as Adobe Reader.

Renewable Energy Tax Credit Budget And Electricity Production Issues

Utah State Solar Tax Credit Lanette Huber

Check more sample of Irs Renewable Energy Tax Credit 2022 below

How To Claim Your Renewable Energy Credits Suntec Wind And Solar

Wage Mandates Complicate IRS Renewable Energy Tax Credit Program

The Inflation Reduction Act Is A Victory For Working People AFL CIO

Rebates Tax Incentives Residential Renewable Energy Tax Credit

The Residential Renewable Energy Tax Credit Is A Little known

Renewable Reboot The Inflation Reduction Act Of 2022 Released As

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s

Rebates Tax Incentives Residential Renewable Energy Tax Credit

Wage Mandates Complicate IRS Renewable Energy Tax Credit Program

The Residential Renewable Energy Tax Credit Is A Little known

Renewable Reboot The Inflation Reduction Act Of 2022 Released As

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable