In the age of digital, where screens dominate our lives it's no wonder that the appeal of tangible printed materials hasn't faded away. It doesn't matter if it's for educational reasons in creative or artistic projects, or simply adding some personal flair to your space, Irs Renewable Energy Tax Credit 2023 can be an excellent source. The following article is a dive deep into the realm of "Irs Renewable Energy Tax Credit 2023," exploring the different types of printables, where to find them, and how they can enrich various aspects of your lives.

Get Latest Irs Renewable Energy Tax Credit 2023 Below

Irs Renewable Energy Tax Credit 2023

Irs Renewable Energy Tax Credit 2023 -

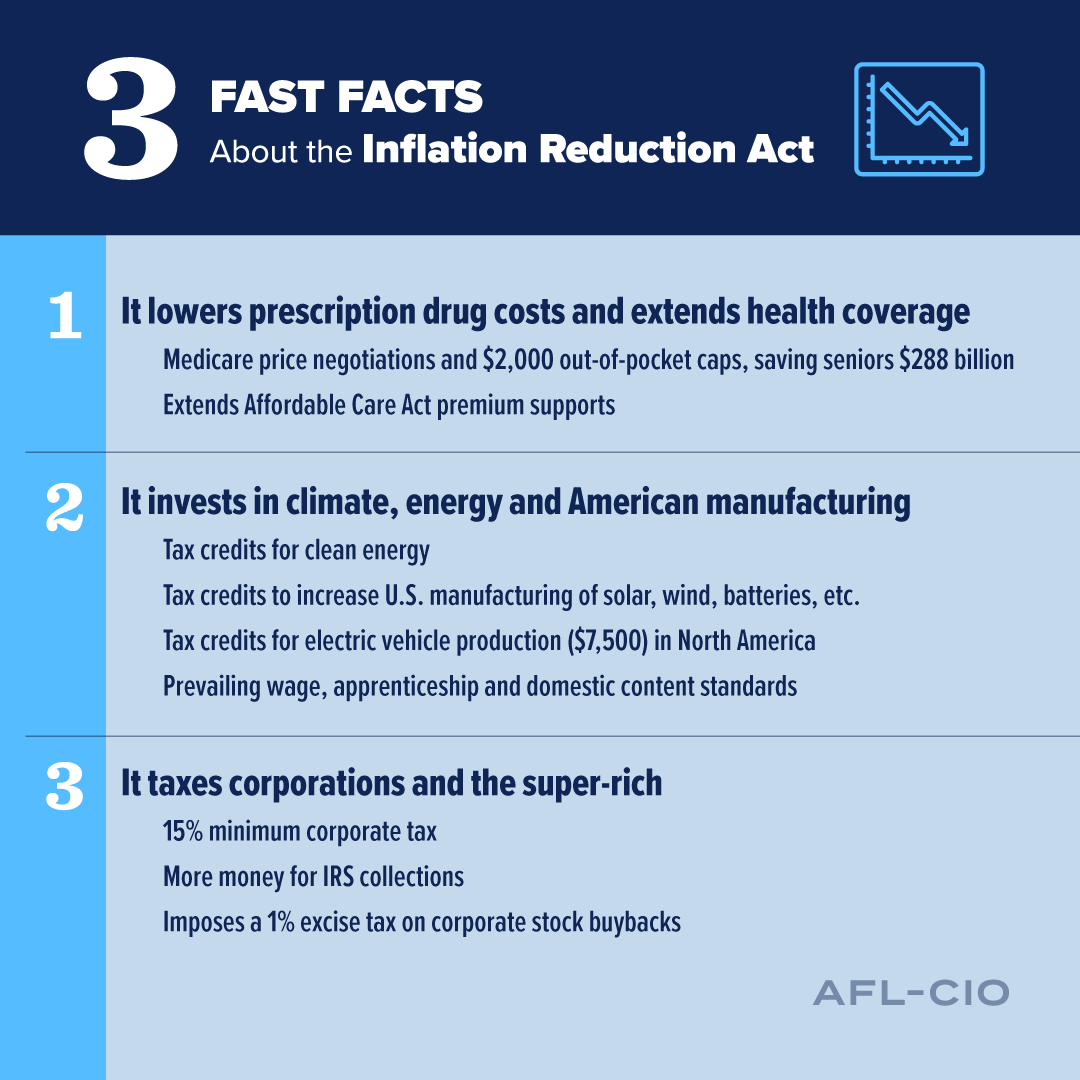

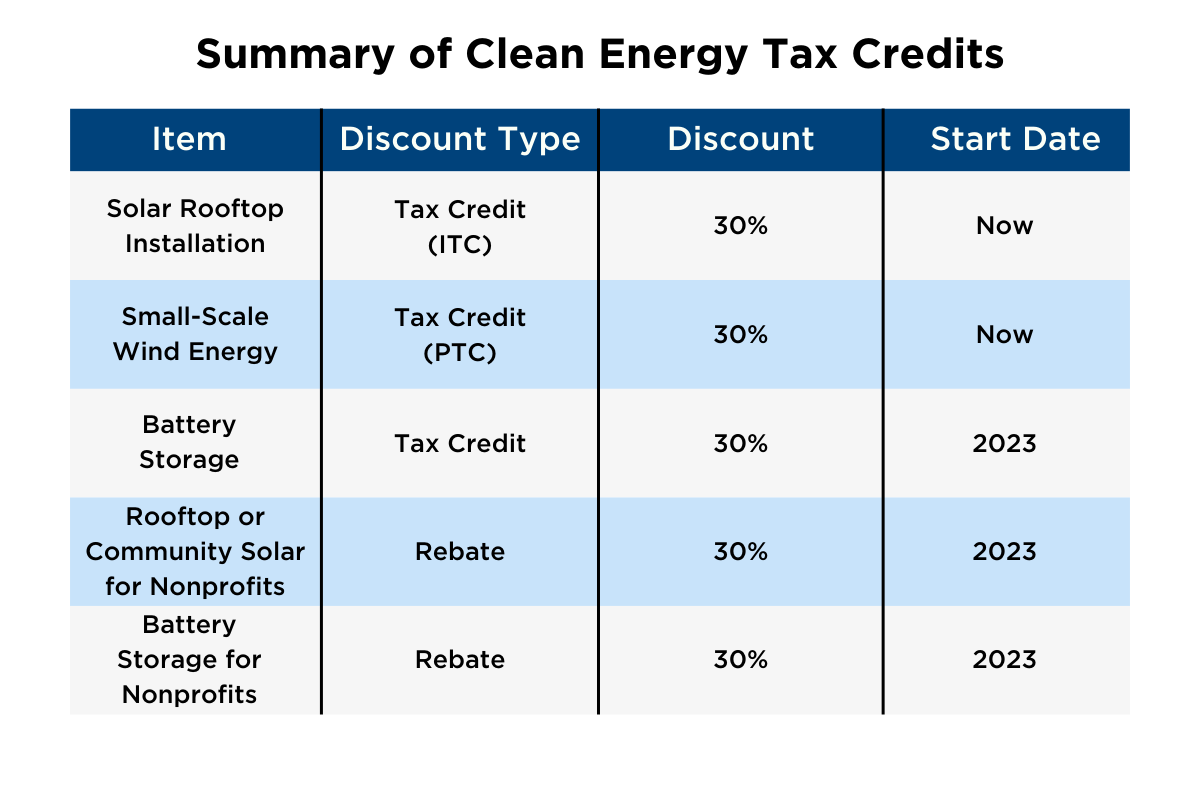

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are made As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

The Irs Renewable Energy Tax Credit 2023 are a huge assortment of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and more. The attraction of printables that are free is their flexibility and accessibility.

More of Irs Renewable Energy Tax Credit 2023

Renewable Energy Tax Credit Budget And Electricity Production Issues

Renewable Energy Tax Credit Budget And Electricity Production Issues

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage and other renewable energy projects that meet prevailing wage standards and employ a sufficient proportion of qualified apprentices from registered

Printables that are free have gained enormous popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies or costly software.

-

Personalization This allows you to modify the design to meet your needs in designing invitations for your guests, organizing your schedule or decorating your home.

-

Educational value: Free educational printables provide for students from all ages, making these printables a powerful aid for parents as well as educators.

-

It's easy: immediate access numerous designs and templates reduces time and effort.

Where to Find more Irs Renewable Energy Tax Credit 2023

Utah State Solar Tax Credit Lanette Huber

Utah State Solar Tax Credit Lanette Huber

The US Internal Revenue Service IRS and US Department of the Treasury Treasury released proposed regulations on November 17 2023 addressing the investment tax credit ITC for renewable energy and energy storage facilities expanding upon and clarifying prior guidance on applying the ITC following the enactment of the Inflation

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts

We hope we've stimulated your curiosity about Irs Renewable Energy Tax Credit 2023 Let's find out where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection in Irs Renewable Energy Tax Credit 2023 for different applications.

- Explore categories such as home decor, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching tools.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for free.

- These blogs cover a wide spectrum of interests, starting from DIY projects to party planning.

Maximizing Irs Renewable Energy Tax Credit 2023

Here are some innovative ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print worksheets that are free to build your knowledge at home and in class.

3. Event Planning

- Design invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Irs Renewable Energy Tax Credit 2023 are a treasure trove with useful and creative ideas designed to meet a range of needs and pursuits. Their availability and versatility make them an invaluable addition to the professional and personal lives of both. Explore the world of Irs Renewable Energy Tax Credit 2023 today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can print and download these documents for free.

-

Do I have the right to use free printables in commercial projects?

- It's all dependent on the terms of use. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables could have limitations in their usage. Always read the conditions and terms of use provided by the designer.

-

How do I print Irs Renewable Energy Tax Credit 2023?

- You can print them at home with the printer, or go to a local print shop for high-quality prints.

-

What program will I need to access printables at no cost?

- The majority are printed with PDF formats, which is open with no cost software, such as Adobe Reader.

How To Claim Your Renewable Energy Credits Suntec Wind And Solar

2023 Residential Clean Energy Credit Guide ReVision Energy

Check more sample of Irs Renewable Energy Tax Credit 2023 below

Wage Mandates Complicate IRS Renewable Energy Tax Credit Program

The Inflation Reduction Act Is A Victory For Working People AFL CIO

Rebates Tax Incentives Residential Renewable Energy Tax Credit

The Residential Renewable Energy Tax Credit Is A Little known

Renewable Reboot The Inflation Reduction Act Of 2022 Released As

A Little known Government Program Called The Residential Renewable

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

The Residential Renewable Energy Tax Credit Is A Little known

The Inflation Reduction Act Is A Victory For Working People AFL CIO

Renewable Reboot The Inflation Reduction Act Of 2022 Released As

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

A Little known Government Program Called The Residential Renewable

The Residential Renewable Energy Tax Credit Is A Little known