In this day and age when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects hasn't waned. Whether it's for educational purposes in creative or artistic projects, or simply adding some personal flair to your area, Irs Solar Credit Carryforward are now a useful source. Through this post, we'll take a dive through the vast world of "Irs Solar Credit Carryforward," exploring the benefits of them, where to get them, as well as how they can be used to enhance different aspects of your lives.

Get Latest Irs Solar Credit Carryforward Below

Irs Solar Credit Carryforward

Irs Solar Credit Carryforward -

For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your

Q4 May a taxpayer carry forward unused credits to another tax year added December 22 2022 A4 The rules vary by credit Under the Energy Efficient Home

The Irs Solar Credit Carryforward are a huge variety of printable, downloadable resources available online for download at no cost. These materials come in a variety of types, such as worksheets templates, coloring pages, and many more. The great thing about Irs Solar Credit Carryforward is their flexibility and accessibility.

More of Irs Solar Credit Carryforward

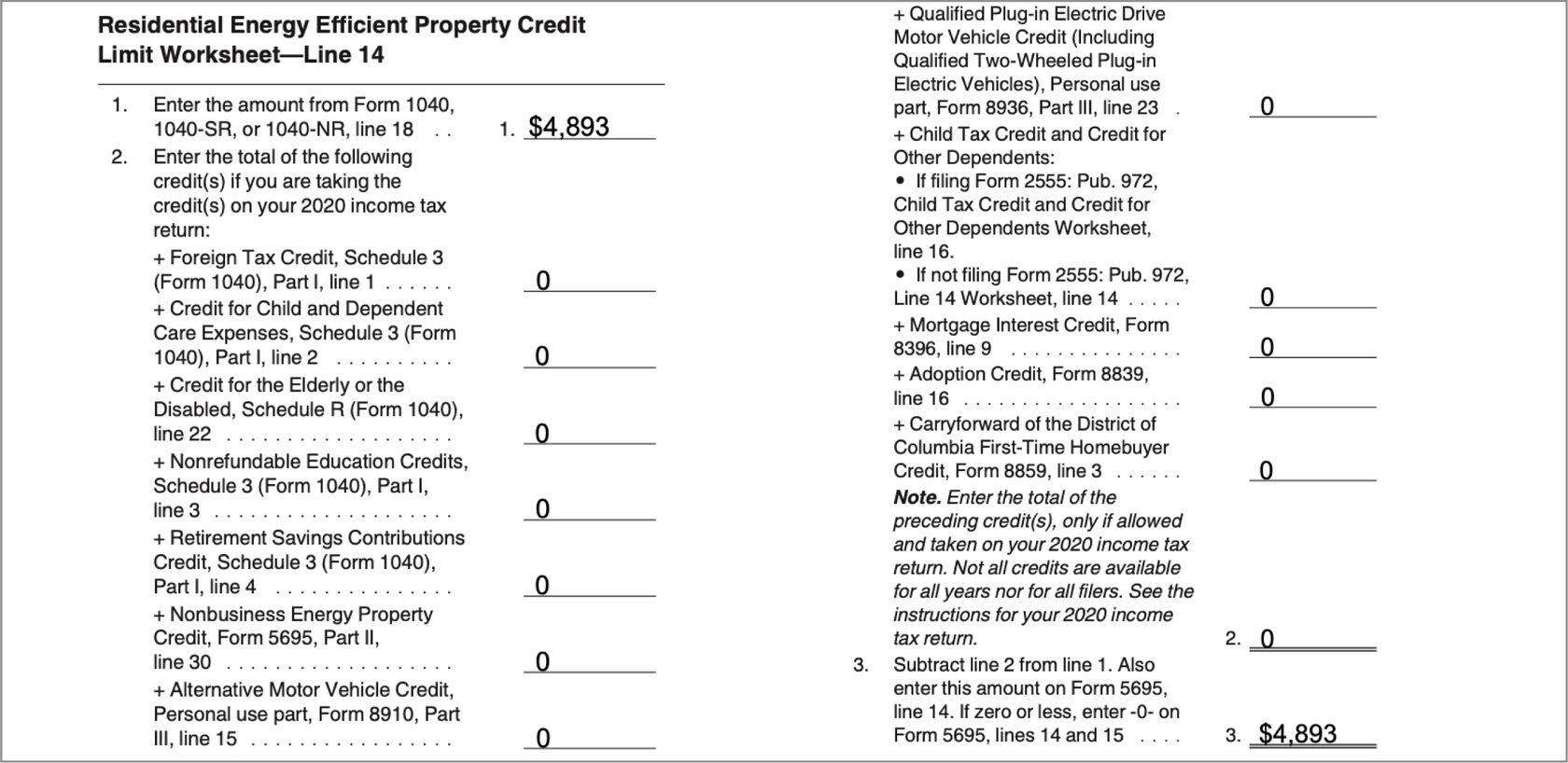

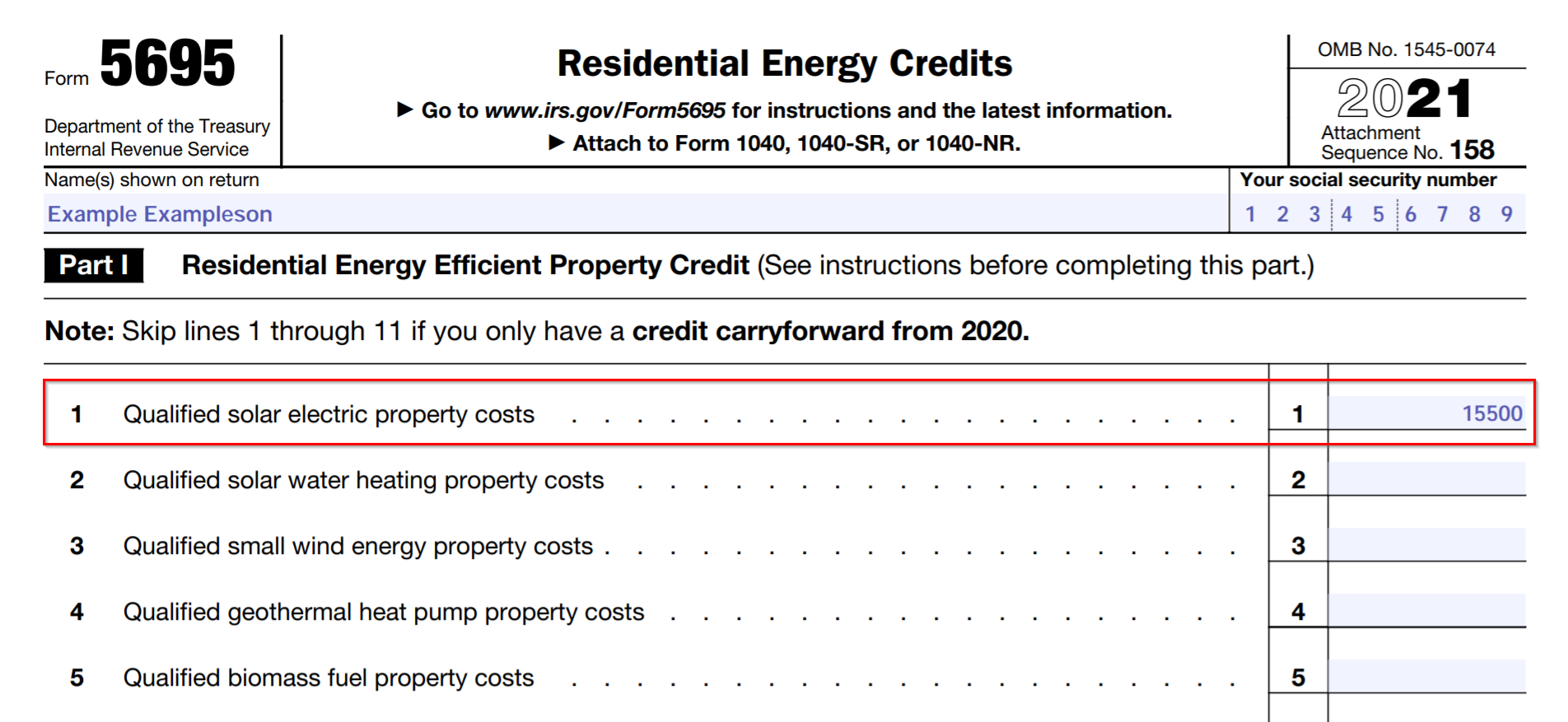

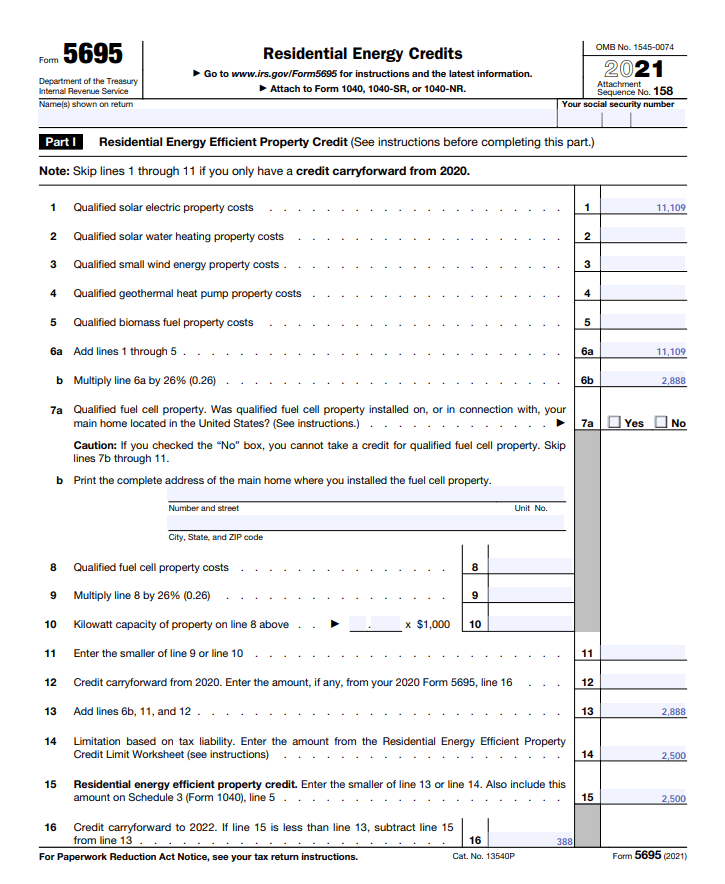

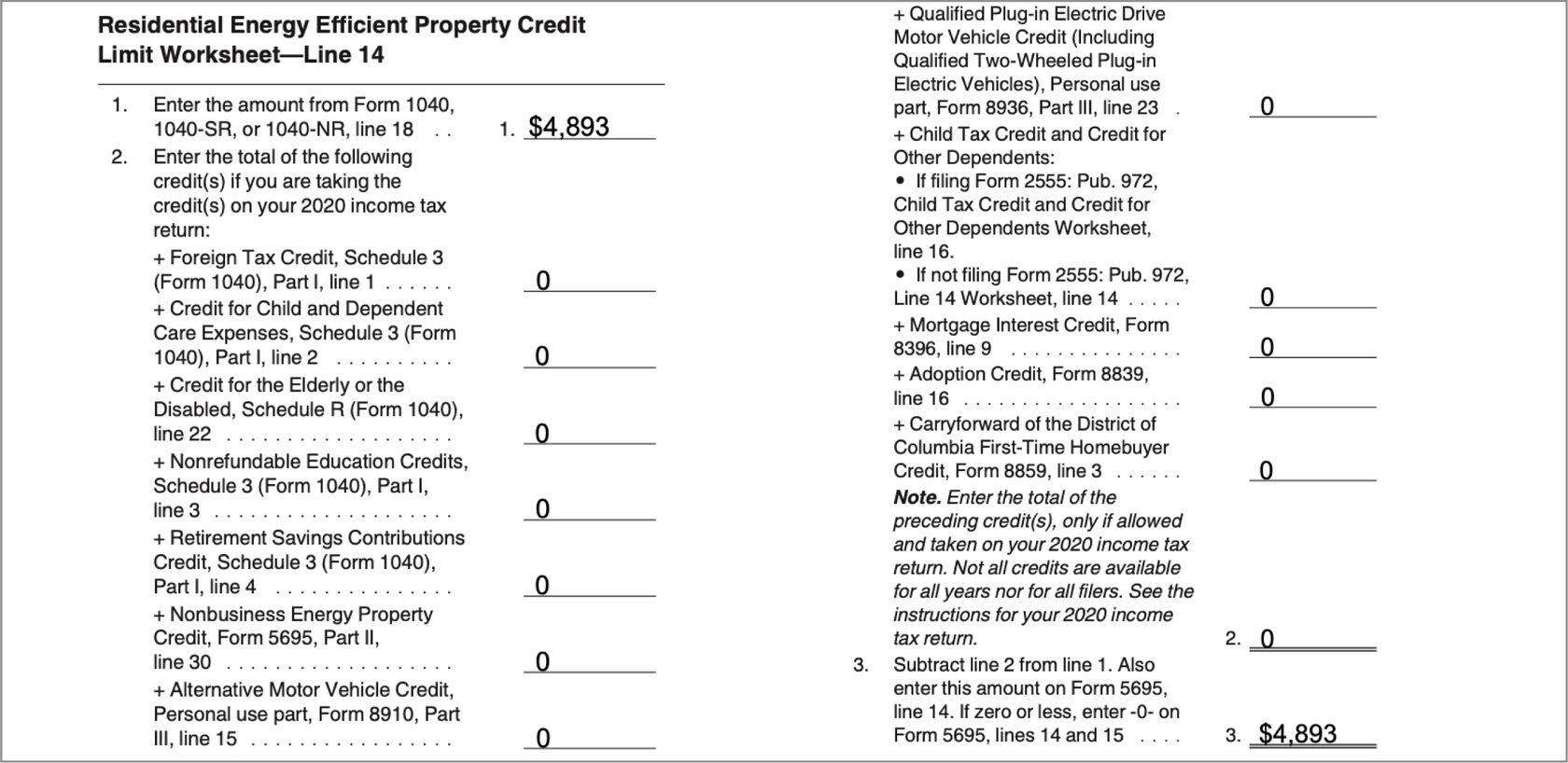

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

The federal solar tax credit is a nonrefundable credit available from 2022 to 2034 with any unused credit carried forward to future tax years

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: They can make designs to suit your personal needs whether you're designing invitations or arranging your schedule or even decorating your house.

-

Educational value: These Irs Solar Credit Carryforward can be used by students of all ages, which makes them an essential device for teachers and parents.

-

It's easy: instant access the vast array of design and templates can save you time and energy.

Where to Find more Irs Solar Credit Carryforward

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is

When you purchase not lease new solar powered equipment that generates electricity or heats water or purchase solar power storage equipment you generally can claim the Residential Clean Energy Credit to lower your tax bill

If we've already piqued your interest in Irs Solar Credit Carryforward Let's look into where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Irs Solar Credit Carryforward suitable for many motives.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and educational websites often provide worksheets that can be printed for free Flashcards, worksheets, and other educational materials.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates at no cost.

- These blogs cover a broad selection of subjects, starting from DIY projects to party planning.

Maximizing Irs Solar Credit Carryforward

Here are some ways of making the most of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Irs Solar Credit Carryforward are a treasure trove with useful and creative ideas designed to meet a range of needs and desires. Their access and versatility makes they a beneficial addition to the professional and personal lives of both. Explore the vast world of printables for free today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Solar Credit Carryforward truly available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use free printouts for commercial usage?

- It's based on the usage guidelines. Be sure to read the rules of the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues with Irs Solar Credit Carryforward?

- Some printables may come with restrictions concerning their use. You should read the terms and condition of use as provided by the designer.

-

How do I print printables for free?

- You can print them at home with the printer, or go to a print shop in your area for premium prints.

-

What program do I need in order to open Irs Solar Credit Carryforward?

- A majority of printed materials are in the PDF format, and is open with no cost software like Adobe Reader.

IRS 26 Tax Credit Safe Harbor For New Solar Energy Systems Project MN

Solar Tax Credit Calculator ChayaAndreja

Check more sample of Irs Solar Credit Carryforward below

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Adoption Credit Carryforward Worksheet Free Download Gmbar co

Capital Loss Carryover Worksheet Example Educational Worksheets Tax

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

What Is Investment Credit And Example Leia Aqui What Is The Meaning

How Does The Federal Solar Tax Credit Work In 2023

![]()

https://www.irs.gov › credits-deductions › frequently...

Q4 May a taxpayer carry forward unused credits to another tax year added December 22 2022 A4 The rules vary by credit Under the Energy Efficient Home

https://www.energy.gov › sites › default › files

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming

Q4 May a taxpayer carry forward unused credits to another tax year added December 22 2022 A4 The rules vary by credit Under the Energy Efficient Home

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Adoption Credit Carryforward Worksheet Free Download Gmbar co

What Is Investment Credit And Example Leia Aqui What Is The Meaning

How Does The Federal Solar Tax Credit Work In 2023

Federal Solar Tax Credits For Businesses Department Of Energy

Solar Tax Credit And Your Boat Updated Blog

Solar Tax Credit And Your Boat Updated Blog

How To File The Federal Solar Tax Credit A Step By Step Guide Solar