In a world when screens dominate our lives and the appeal of physical printed materials hasn't faded away. Whether it's for educational purposes such as creative projects or simply to add the personal touch to your area, Irs Solar Energy Tax Credit 2023 are now an essential resource. We'll take a dive through the vast world of "Irs Solar Energy Tax Credit 2023," exploring the benefits of them, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest Irs Solar Energy Tax Credit 2023 Below

Irs Solar Energy Tax Credit 2023

Irs Solar Energy Tax Credit 2023 -

Tax Tip 2023 68 May 16 2023 Homeowners who make improvements like replacing old doors and windows installing solar panels or upgrading a hot water heater may qualify for home energy tax credits

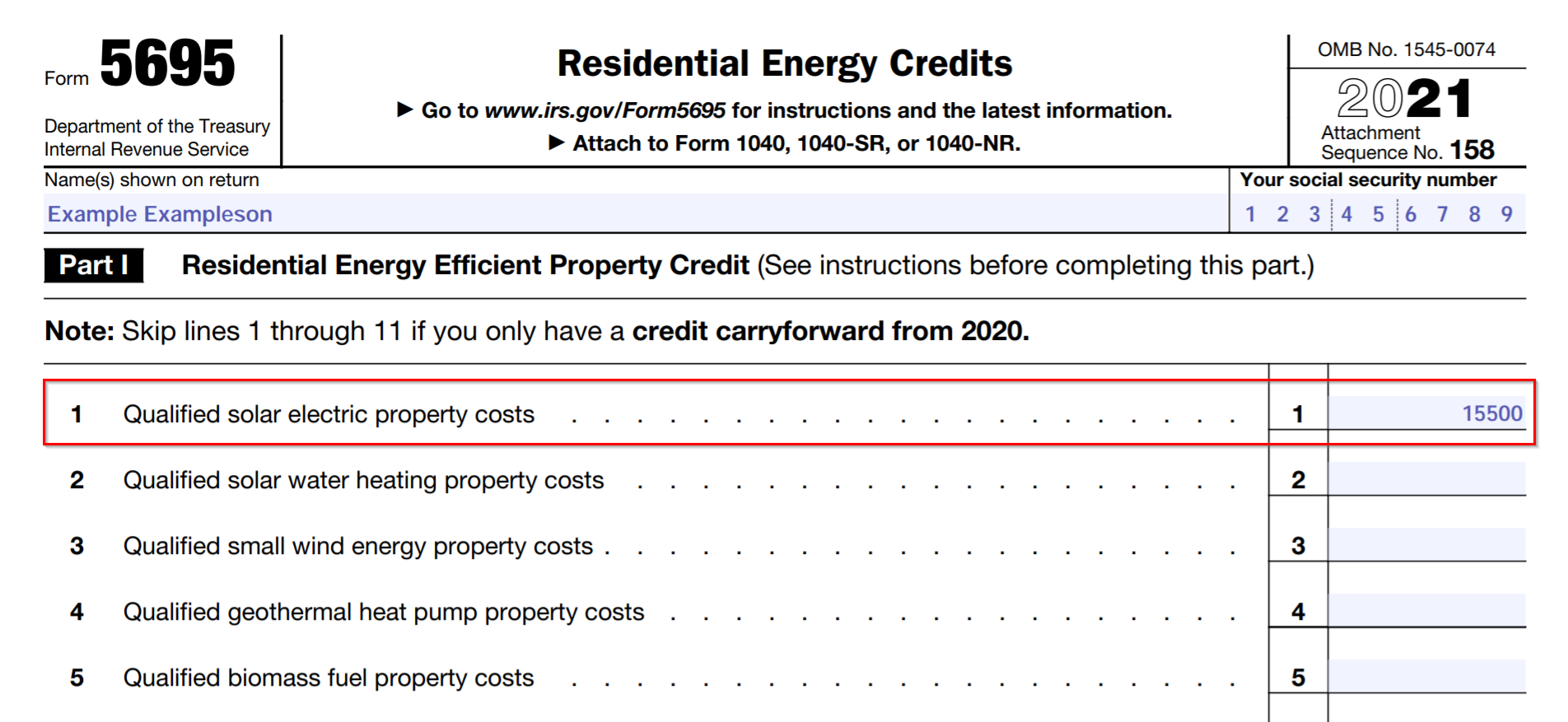

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

Irs Solar Energy Tax Credit 2023 offer a wide collection of printable items that are available online at no cost. They come in many designs, including worksheets templates, coloring pages and more. One of the advantages of Irs Solar Energy Tax Credit 2023 is their flexibility and accessibility.

More of Irs Solar Energy Tax Credit 2023

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

Form 5695 2023 Page 2 Part II Energy Efficient Home Improvement Credit Section A Qualified Energy Efficiency Improvements 17 a Are the qualified energy efficiency improvements installed in or on your main home located in the

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Irs Solar Energy Tax Credit 2023 have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Individualization Your HTML0 customization options allow you to customize designs to suit your personal needs when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Educational Benefits: Education-related printables at no charge cater to learners of all ages, making them a useful device for teachers and parents.

-

Simple: immediate access the vast array of design and templates cuts down on time and efforts.

Where to Find more Irs Solar Energy Tax Credit 2023

Irs Solar Tax Credit 2022 Form

Irs Solar Tax Credit 2022 Form

Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Now that we've piqued your interest in Irs Solar Energy Tax Credit 2023 and other printables, let's discover where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Irs Solar Energy Tax Credit 2023 designed for a variety applications.

- Explore categories such as interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning tools.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing Irs Solar Energy Tax Credit 2023

Here are some inventive ways how you could make the most of Irs Solar Energy Tax Credit 2023:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet to enhance your learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Irs Solar Energy Tax Credit 2023 are an abundance filled with creative and practical information that can meet the needs of a variety of people and interests. Their accessibility and flexibility make them a wonderful addition to the professional and personal lives of both. Explore the vast array of Irs Solar Energy Tax Credit 2023 to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download the resources for free.

-

Can I download free printables in commercial projects?

- It depends on the specific usage guidelines. Always read the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables may contain restrictions on their use. Make sure you read the terms and conditions set forth by the designer.

-

How can I print Irs Solar Energy Tax Credit 2023?

- You can print them at home with any printer or head to a local print shop to purchase high-quality prints.

-

What program must I use to open printables for free?

- The majority are printed as PDF files, which can be opened using free programs like Adobe Reader.

How The Inflation Reduction Act Is Extending Solar Energy Tax Incentives

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Check more sample of Irs Solar Energy Tax Credit 2023 below

Solar Energy Tax Credit Andrews Tax Accounting

Solar Tax Credits Solar Tribune

Solar Energy Tax Credit Explained Basit Siddiqi CPA

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

2023 Residential Clean Energy Credit Guide ReVision Energy

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irs.gov/instructions/i5695

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Solar Tax Credits Solar Tribune

2023 Residential Clean Energy Credit Guide ReVision Energy

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Clean Energy Credit Overview In Inflation Reduction Act

30 Solar Energy Tax Credit Ask A CPA YouTube

30 Solar Energy Tax Credit Ask A CPA YouTube

New Mexico s Solar Energy Tax Credit Passes Legislature