Today, when screens dominate our lives yet the appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons and creative work, or just adding an individual touch to your home, printables for free have become a valuable source. Here, we'll dive into the world of "Irs Tax Credit For Hybrid Cars 2021," exploring what they are, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Irs Tax Credit For Hybrid Cars 2021 Below

Irs Tax Credit For Hybrid Cars 2021

Irs Tax Credit For Hybrid Cars 2021 -

Qualifying clean energy vehicle buyers are eligible for a tax credit of up to 7 500 Internal Revenue Service Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

Irs Tax Credit For Hybrid Cars 2021 include a broad assortment of printable content that can be downloaded from the internet at no cost. They are available in numerous formats, such as worksheets, templates, coloring pages, and more. The appealingness of Irs Tax Credit For Hybrid Cars 2021 is their versatility and accessibility.

More of Irs Tax Credit For Hybrid Cars 2021

Toyota Has Run Out Of EV Tax Credits Page 3 Toyota BZ Forum

Toyota Has Run Out Of EV Tax Credits Page 3 Toyota BZ Forum

You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

Irs Tax Credit For Hybrid Cars 2021 have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Customization: Your HTML0 customization options allow you to customize printing templates to your own specific requirements in designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational value: Printables for education that are free offer a wide range of educational content for learners of all ages, which makes them a great device for teachers and parents.

-

It's easy: Instant access to many designs and templates helps save time and effort.

Where to Find more Irs Tax Credit For Hybrid Cars 2021

Toyota Is Running Out Of EV Tax Credits De Yuan

Toyota Is Running Out Of EV Tax Credits De Yuan

Which models are eligible The credit applies to fully electric cars along with plug in hybrid EVs PHEVs which differ from normal hybrids in that they have bigger batteries that you

Namely the credit is worth up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for an electric vehicle with a battery capacity of at least 5 kilowatt hours kWh plus 417 for each kWh of capacity over 5 kWh up to 7 500 in combined value

After we've peaked your curiosity about Irs Tax Credit For Hybrid Cars 2021 Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Irs Tax Credit For Hybrid Cars 2021 for a variety uses.

- Explore categories such as design, home decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Ideal for teachers, parents and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a broad range of topics, ranging from DIY projects to party planning.

Maximizing Irs Tax Credit For Hybrid Cars 2021

Here are some new ways that you can make use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print free worksheets to help reinforce your learning at home as well as in the class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Irs Tax Credit For Hybrid Cars 2021 are a treasure trove with useful and creative ideas for a variety of needs and interest. Their availability and versatility make them a great addition to every aspect of your life, both professional and personal. Explore the vast array of Irs Tax Credit For Hybrid Cars 2021 and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really absolutely free?

- Yes, they are! You can download and print these documents for free.

-

Can I use free printouts for commercial usage?

- It's based on specific terms of use. Always check the creator's guidelines before using printables for commercial projects.

-

Are there any copyright problems with Irs Tax Credit For Hybrid Cars 2021?

- Some printables may come with restrictions concerning their use. Be sure to check the terms and conditions set forth by the author.

-

How do I print printables for free?

- You can print them at home using your printer or visit a local print shop for better quality prints.

-

What program will I need to access printables that are free?

- Many printables are offered in the format PDF. This can be opened with free software like Adobe Reader.

Employee Retention Tax Credit Practice Compliance Solutions

Government Tax Rebates For Hybrid Cars 2023 Carrebate

Check more sample of Irs Tax Credit For Hybrid Cars 2021 below

What Does The EV Tax Credit Overhaul Mean For Car Shoppers News

2009 Honda Insight Hybrid Tax Credit

Can I Get A Tax Credit For Buying A Used Hybrid Car Juiced Frenzy

Hyundai Hybrid Cars 2021 Concept And Review Auto Concept

EV Federal IRS Tax Credit Survival Is Good News For Consumers In

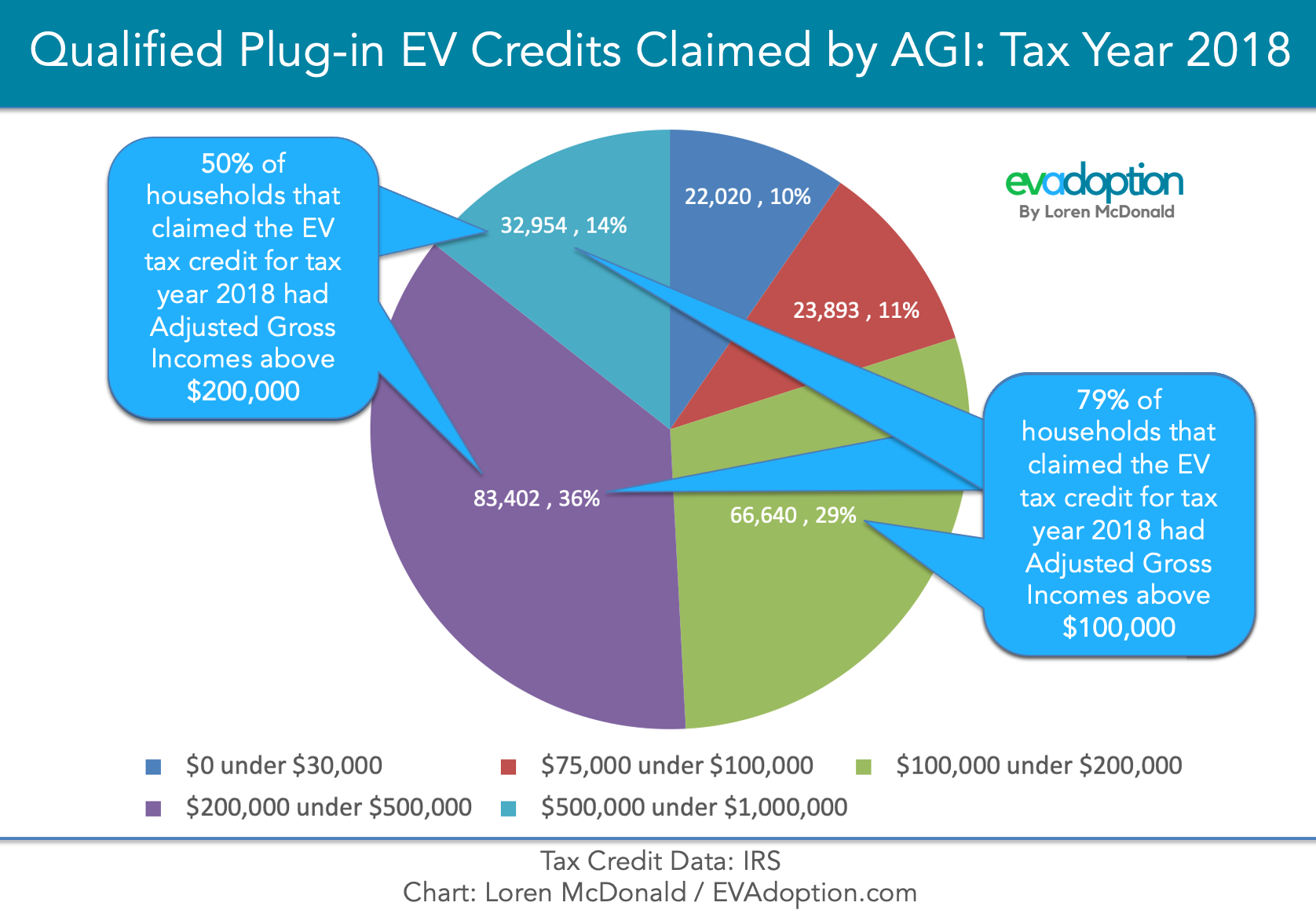

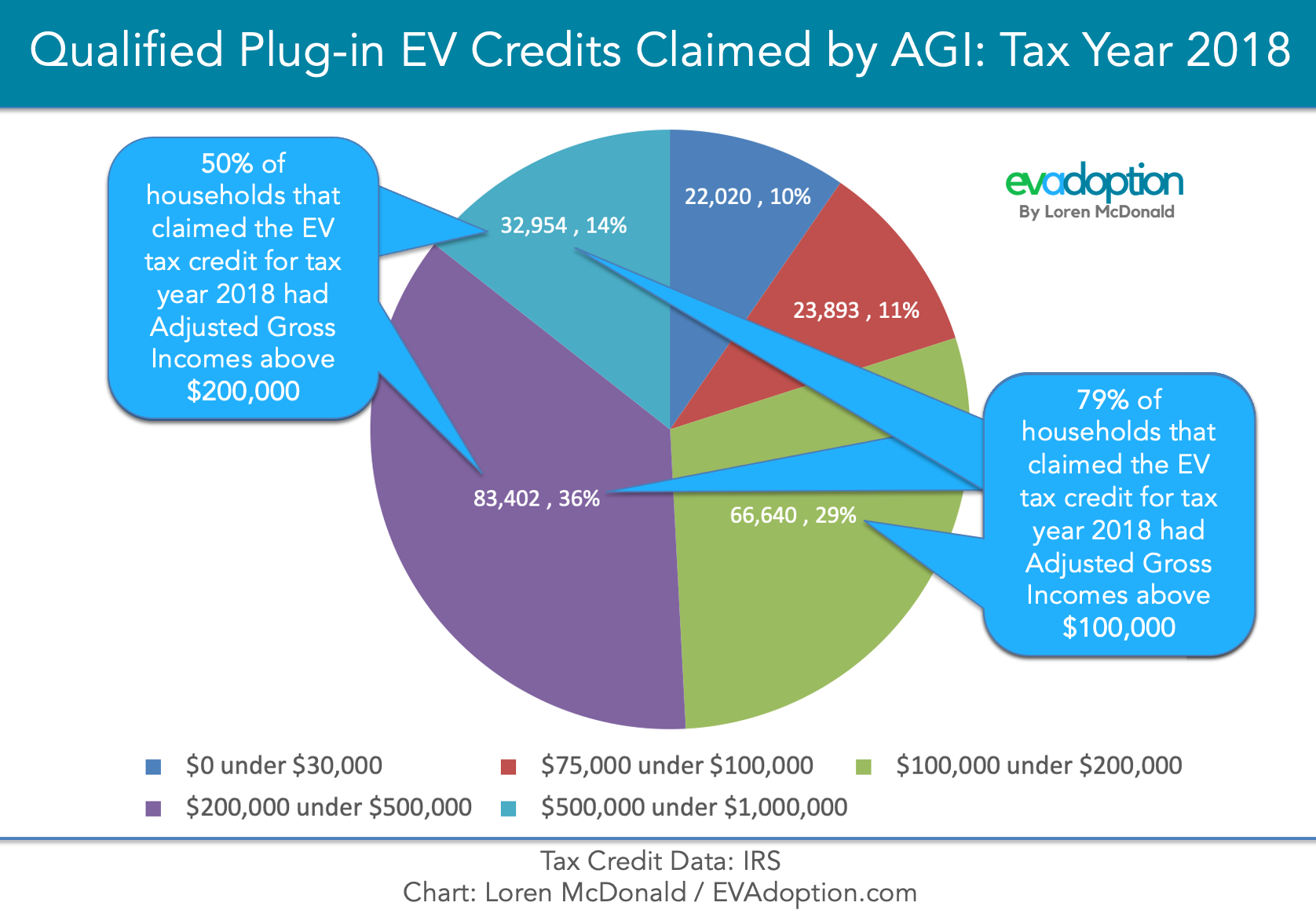

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

https://www.irs.gov/credits-deductions/credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

https://www.irs.gov/clean-vehicle-tax-credits

Page Last Reviewed or Updated 22 Apr 2024 Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of capacity over 5 kWh The maximum

Page Last Reviewed or Updated 22 Apr 2024 Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

Hyundai Hybrid Cars 2021 Concept And Review Auto Concept

2009 Honda Insight Hybrid Tax Credit

EV Federal IRS Tax Credit Survival Is Good News For Consumers In

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

Maximize Your Tax Savings With The 2022 Hybrid Car Tax Credit

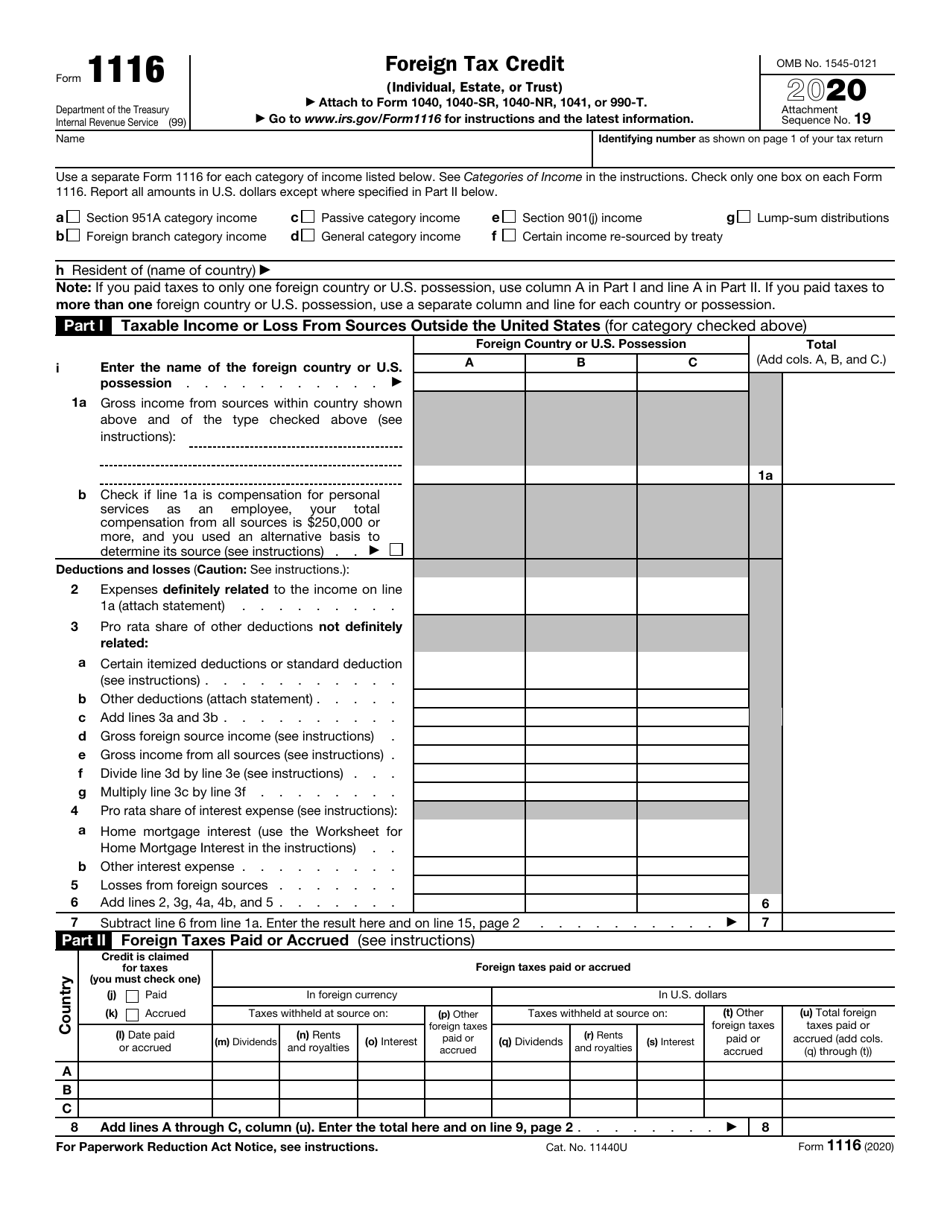

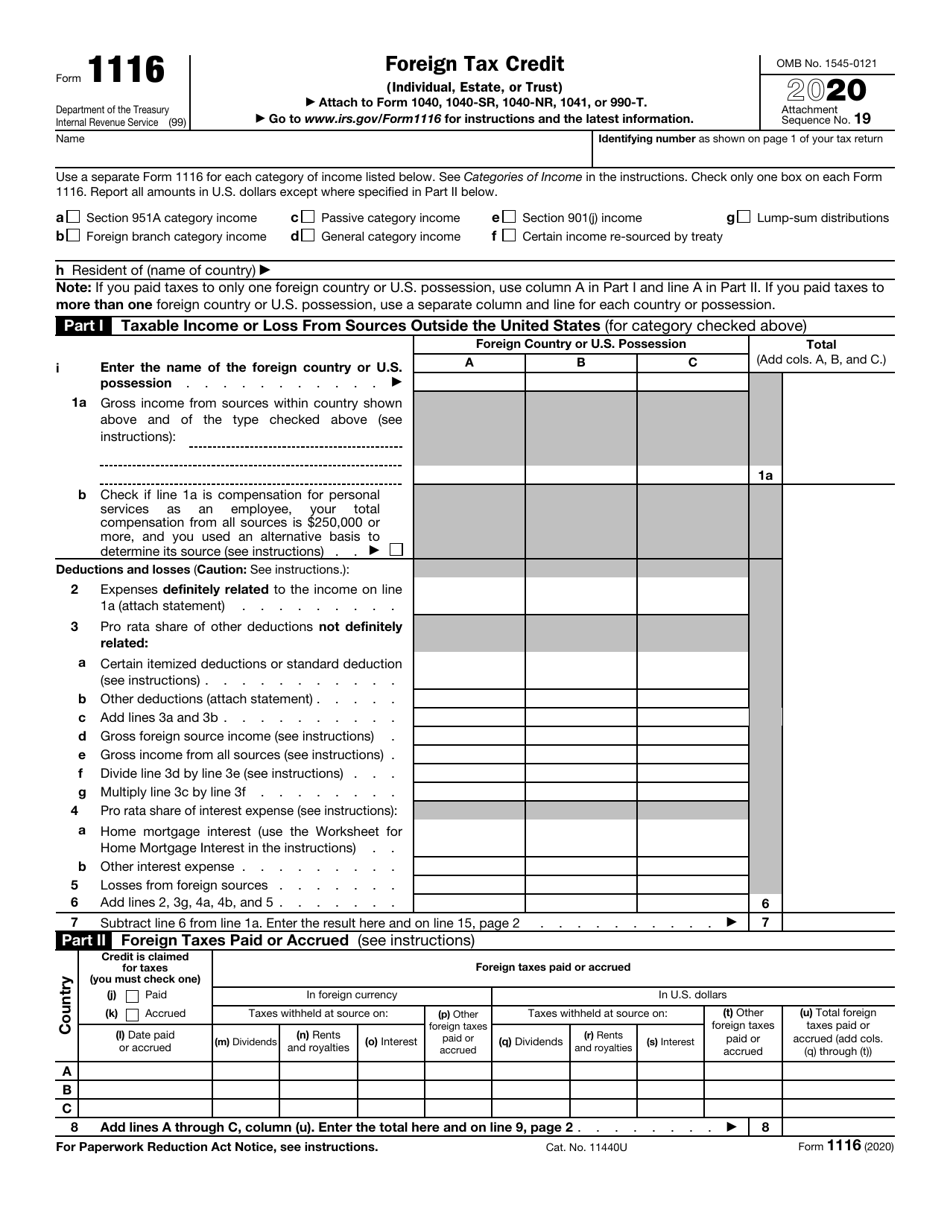

Irs Form 1116 Printable Printable Forms Free Online

Irs Form 1116 Printable Printable Forms Free Online

Rebates For Hybrid Cars California 2023 Carrebate