In this age of technology, where screens have become the dominant feature of our lives and the appeal of physical printed objects isn't diminished. It doesn't matter if it's for educational reasons or creative projects, or just adding personal touches to your area, Irs Tax Credit For New Ac Unit are now an essential source. We'll dive into the sphere of "Irs Tax Credit For New Ac Unit," exploring what they are, how to find them and ways they can help you improve many aspects of your daily life.

Get Latest Irs Tax Credit For New Ac Unit Below

Irs Tax Credit For New Ac Unit

Irs Tax Credit For New Ac Unit -

Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an addition to or renovation of an existing home and not for a newly constructed home

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Irs Tax Credit For New Ac Unit offer a wide array of printable materials available online at no cost. These printables come in different kinds, including worksheets templates, coloring pages, and much more. The great thing about Irs Tax Credit For New Ac Unit lies in their versatility and accessibility.

More of Irs Tax Credit For New Ac Unit

US Hyundai Ioniq 5 Sales Decreased To The Lowest Level Since January

US Hyundai Ioniq 5 Sales Decreased To The Lowest Level Since January

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

Irs Tax Credit For New Ac Unit have risen to immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Modifications: This allows you to modify the templates to meet your individual needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Education Value These Irs Tax Credit For New Ac Unit are designed to appeal to students of all ages. This makes them a great tool for parents and teachers.

-

It's easy: Access to a variety of designs and templates is time-saving and saves effort.

Where to Find more Irs Tax Credit For New Ac Unit

How To Claim The 3 600 Child Tax Credit For A Baby Born In 2021 YouTube

How To Claim The 3 600 Child Tax Credit For A Baby Born In 2021 YouTube

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

Use these steps for claiming an energy efficient home improvement tax credit for residential energy property Step 1 Check eligibility Make sure the property on or in connection which you are installing the residential energy property is eligible

If we've already piqued your interest in Irs Tax Credit For New Ac Unit we'll explore the places you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of Irs Tax Credit For New Ac Unit suitable for many objectives.

- Explore categories such as design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents and students looking for extra sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- The blogs covered cover a wide spectrum of interests, including DIY projects to party planning.

Maximizing Irs Tax Credit For New Ac Unit

Here are some ideas how you could make the most of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Irs Tax Credit For New Ac Unit are an abundance with useful and creative ideas catering to different needs and preferences. Their availability and versatility make them a wonderful addition to the professional and personal lives of both. Explore the vast collection of Irs Tax Credit For New Ac Unit now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Irs Tax Credit For New Ac Unit truly available for download?

- Yes they are! You can download and print these resources at no cost.

-

Can I download free printouts for commercial usage?

- It's dependent on the particular usage guidelines. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Certain printables could be restricted in use. You should read these terms and conditions as set out by the designer.

-

How can I print printables for free?

- Print them at home with any printer or head to a local print shop for top quality prints.

-

What program do I require to view printables at no cost?

- The majority of printables are in the format of PDF, which can be opened using free software such as Adobe Reader.

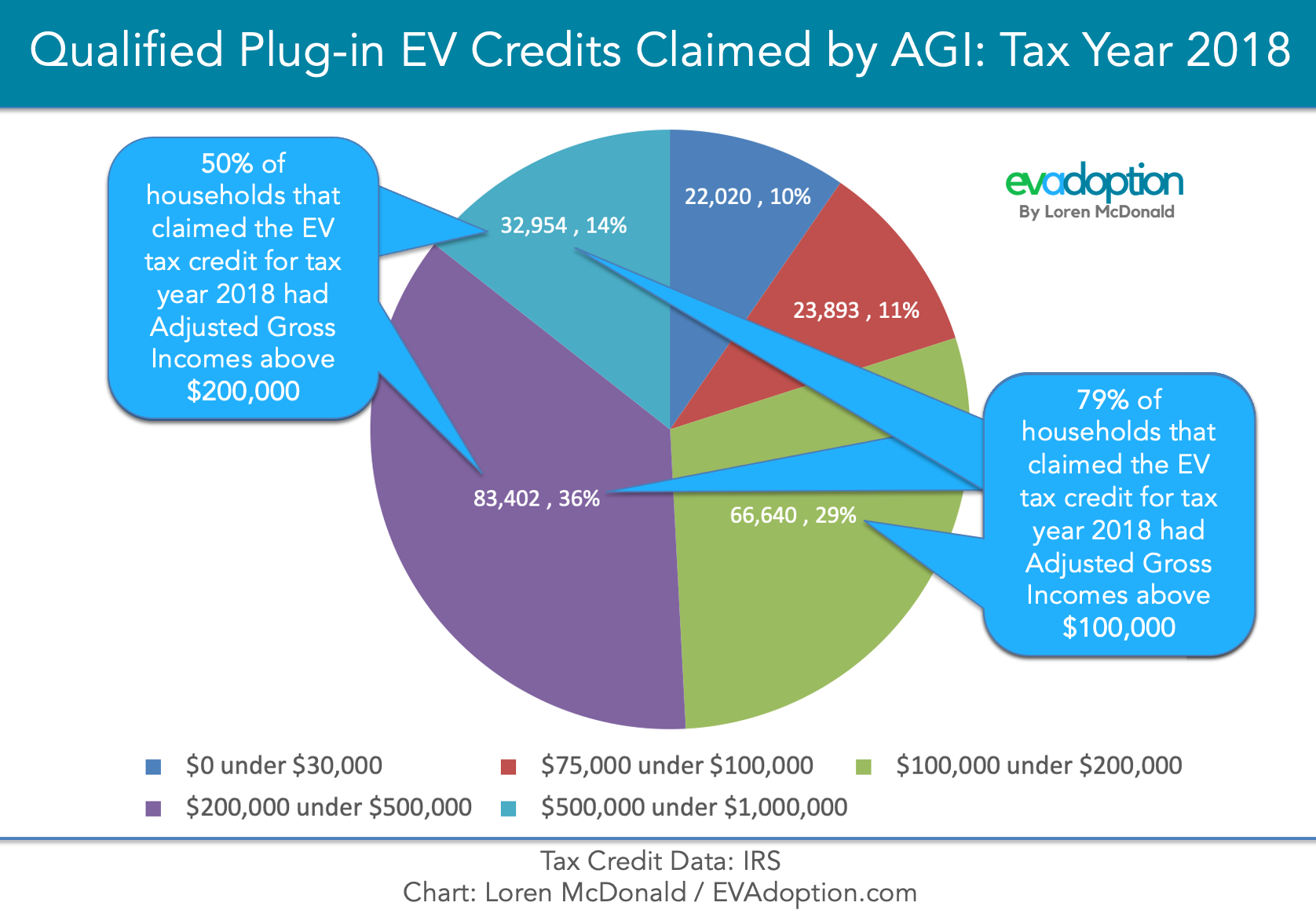

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

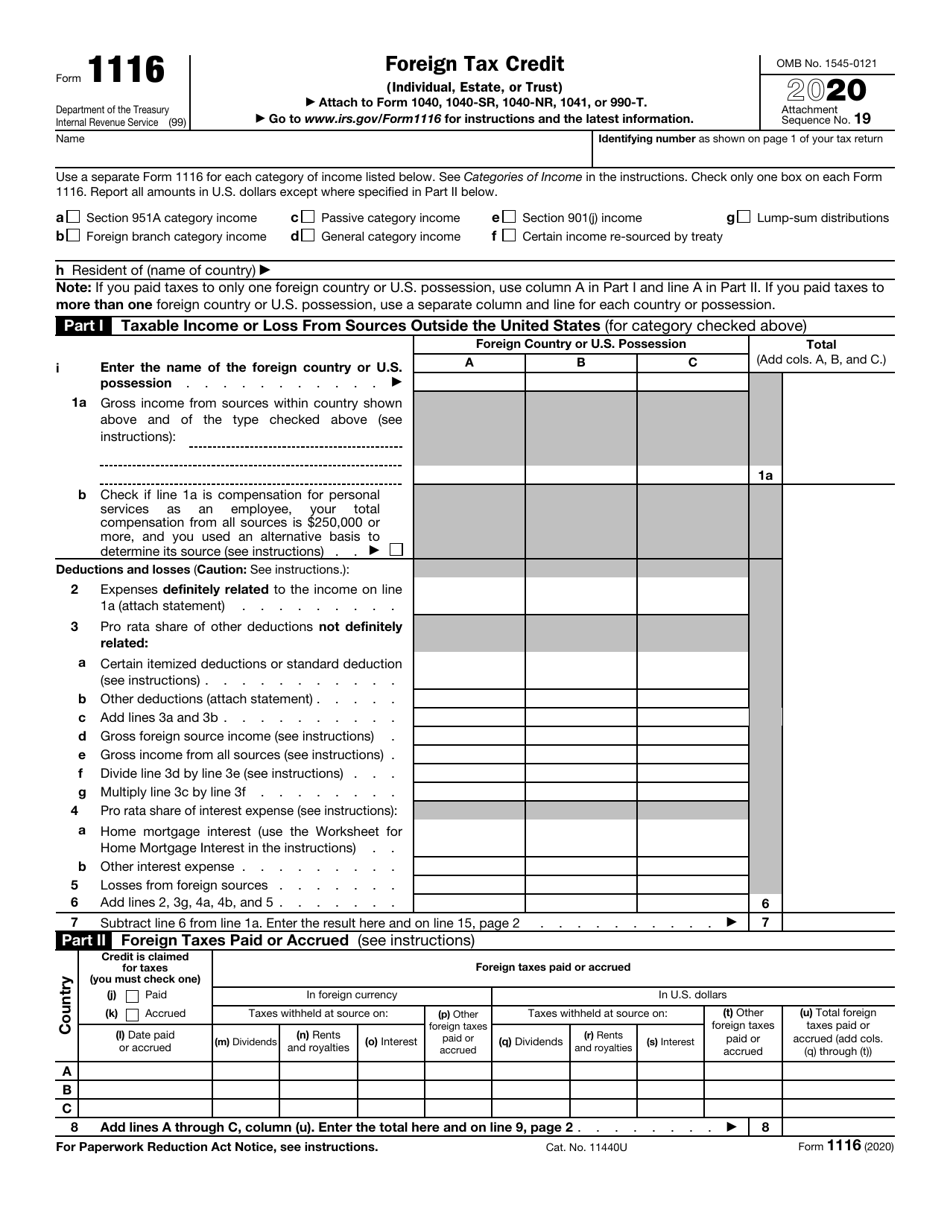

Irs Form 1116 Printable Printable Forms Free Online

Check more sample of Irs Tax Credit For New Ac Unit below

Sunset Pickens County SC House For Sale Property ID 416952636

What SEER Rating For New AC Unit In Nashville TN Frog

Split Ac Installation Services In Gorakhpur DR Cool Air ID

Best Financing For Hvac Contractors

125 The Season Drive Sunset SC Sunset Cabin Homes For Sale

Bakersfield Police Activities League Receives 8K For New AC Unit

https://www.energystar.gov/about/federal-tax...

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

https://www.irs.gov/newsroom/irs-home-improvements...

WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Best Financing For Hvac Contractors

What SEER Rating For New AC Unit In Nashville TN Frog

125 The Season Drive Sunset SC Sunset Cabin Homes For Sale

Bakersfield Police Activities League Receives 8K For New AC Unit

FAQ Energy Tax Credit For New Windows 2023 Inflation Reduction Act

Puget Sound Solar LLC

Puget Sound Solar LLC

125 The Season Drive Sunset SC Sunset Cabin Homes For Sale