In the age of digital, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible, printed materials hasn't diminished. In the case of educational materials such as creative projects or just adding an element of personalization to your space, Irs Tax Credit High Efficiency Furnace are now a useful resource. For this piece, we'll take a dive in the world of "Irs Tax Credit High Efficiency Furnace," exploring what they are, how they are, and how they can enrich various aspects of your life.

Get Latest Irs Tax Credit High Efficiency Furnace Below

Irs Tax Credit High Efficiency Furnace

Irs Tax Credit High Efficiency Furnace -

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

Printables for free cover a broad range of downloadable, printable materials online, at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and more. One of the advantages of Irs Tax Credit High Efficiency Furnace is in their versatility and accessibility.

More of Irs Tax Credit High Efficiency Furnace

Employee Retention Tax Credit Practice Compliance Solutions

Employee Retention Tax Credit Practice Compliance Solutions

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by

Energy Efficient Home Improvement income tax credits are available for central air conditioning systems boilers furnaces air source heat pumps and biomass stoves that

Printables for free have gained immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: This allows you to modify designs to suit your personal needs, whether it's designing invitations and schedules, or even decorating your house.

-

Educational Benefits: Free educational printables provide for students of all ages, which makes them a useful source for educators and parents.

-

Easy to use: Access to various designs and templates will save you time and effort.

Where to Find more Irs Tax Credit High Efficiency Furnace

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

Art And Cosmetic Industries Are Benefiting From IRS Tax Credit Pros

The amended Energy Efficient Home Improvement Credit which begins in 2023 and extends through 2032 increases the tax credits as high as 600 for qualified air

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s

We hope we've stimulated your curiosity about Irs Tax Credit High Efficiency Furnace and other printables, let's discover where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection and Irs Tax Credit High Efficiency Furnace for a variety objectives.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates for no cost.

- These blogs cover a broad selection of subjects, that range from DIY projects to party planning.

Maximizing Irs Tax Credit High Efficiency Furnace

Here are some ideas for you to get the best of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home also in the classes.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Irs Tax Credit High Efficiency Furnace are a treasure trove of fun and practical tools that cater to various needs and passions. Their accessibility and flexibility make them a wonderful addition to any professional or personal life. Explore the plethora of Irs Tax Credit High Efficiency Furnace right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes you can! You can print and download the resources for free.

-

Do I have the right to use free printables to make commercial products?

- It's dependent on the particular rules of usage. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables might have limitations on use. Make sure to read the conditions and terms of use provided by the designer.

-

How can I print Irs Tax Credit High Efficiency Furnace?

- Print them at home using either a printer at home or in a print shop in your area for top quality prints.

-

What software do I need in order to open printables for free?

- Many printables are offered in PDF format. These can be opened using free software like Adobe Reader.

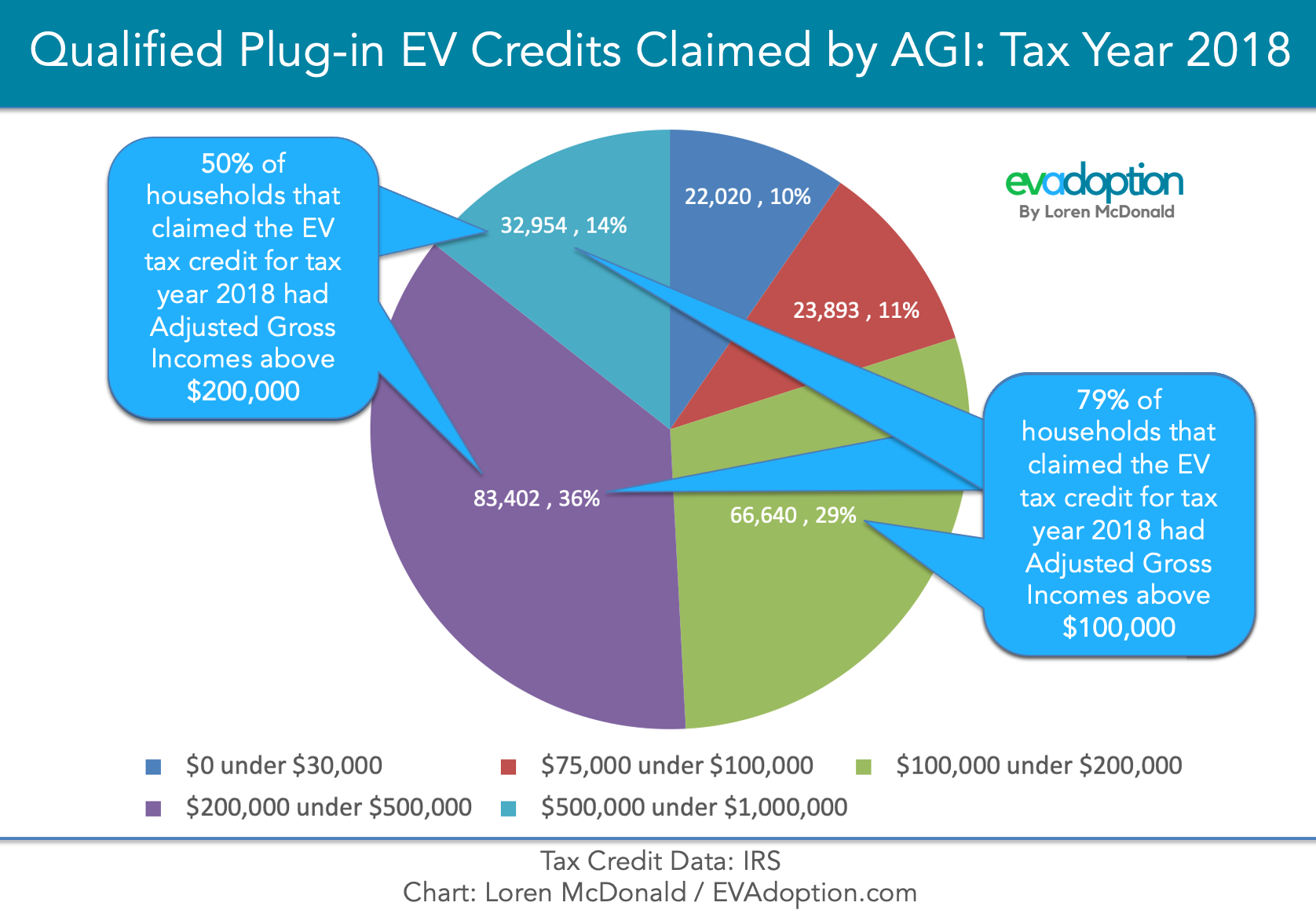

EV Federal IRS Tax Credit Survival Is Good News For Consumers In

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption

Check more sample of Irs Tax Credit High Efficiency Furnace below

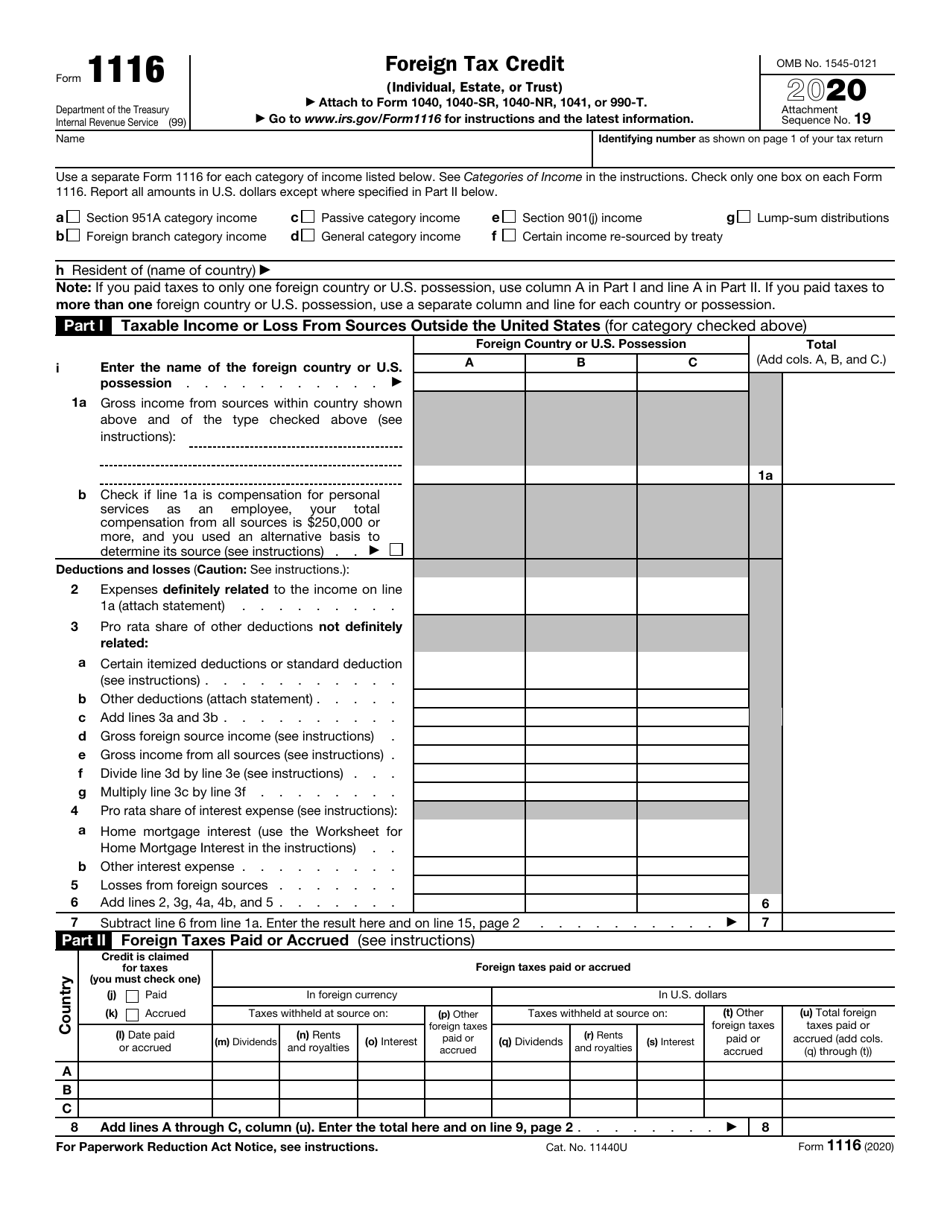

Irs Form 1116 Printable Printable Forms Free Online

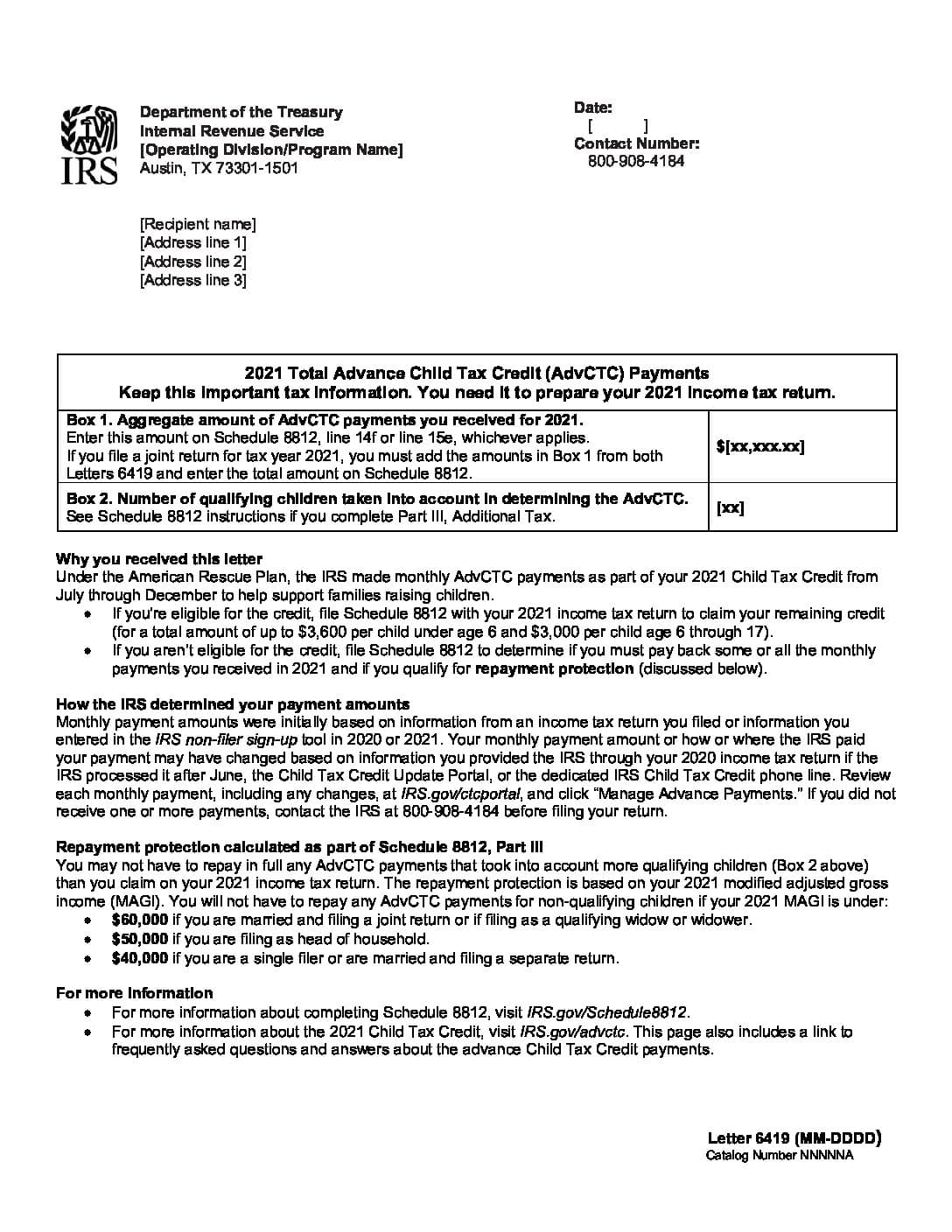

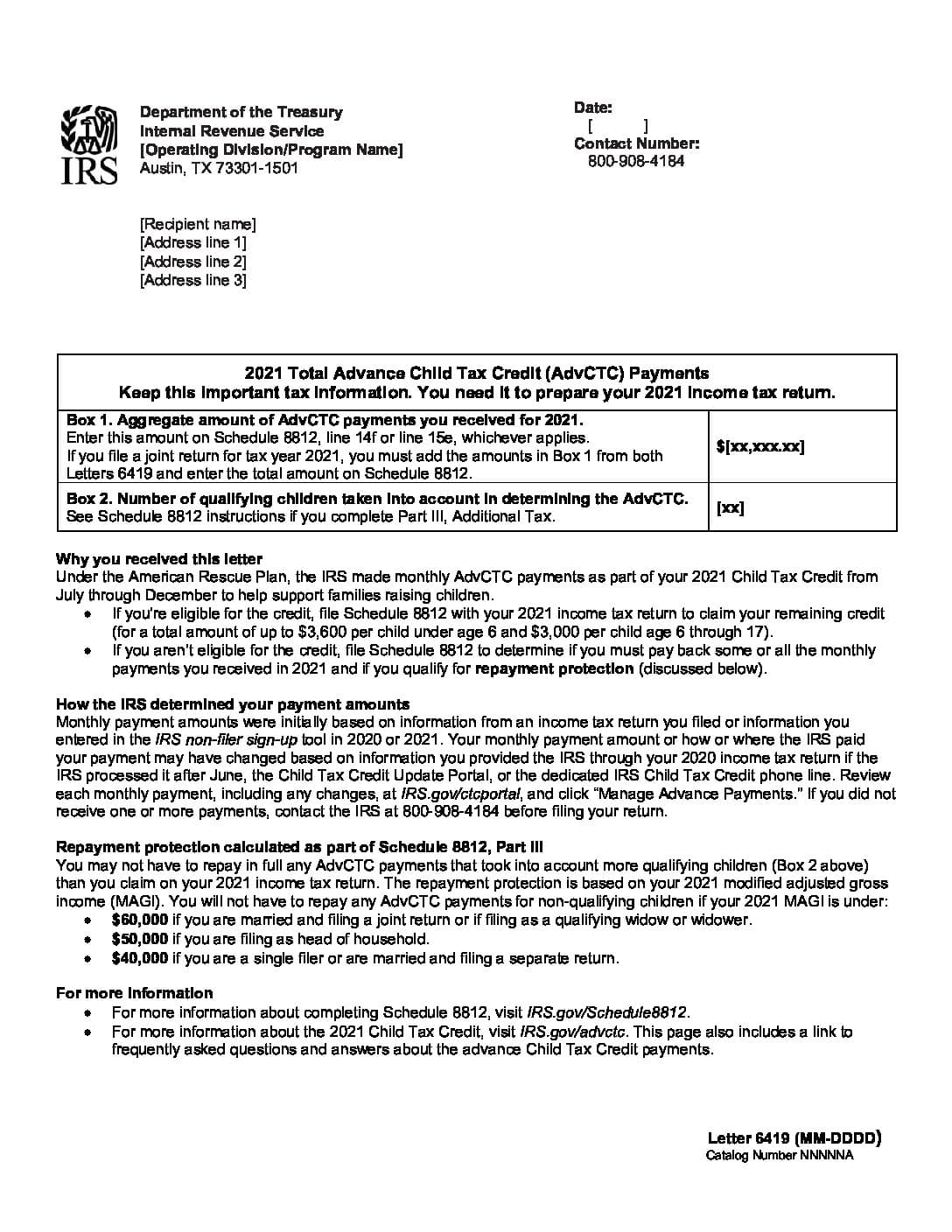

IRS To Send Letter 6419 Regarding Advance CTC Payments Lanigan Ryan

High efficiency Furnace Venting Problems HomesMSP Real Estate

Employee Retention Credit IRS Tax Credit

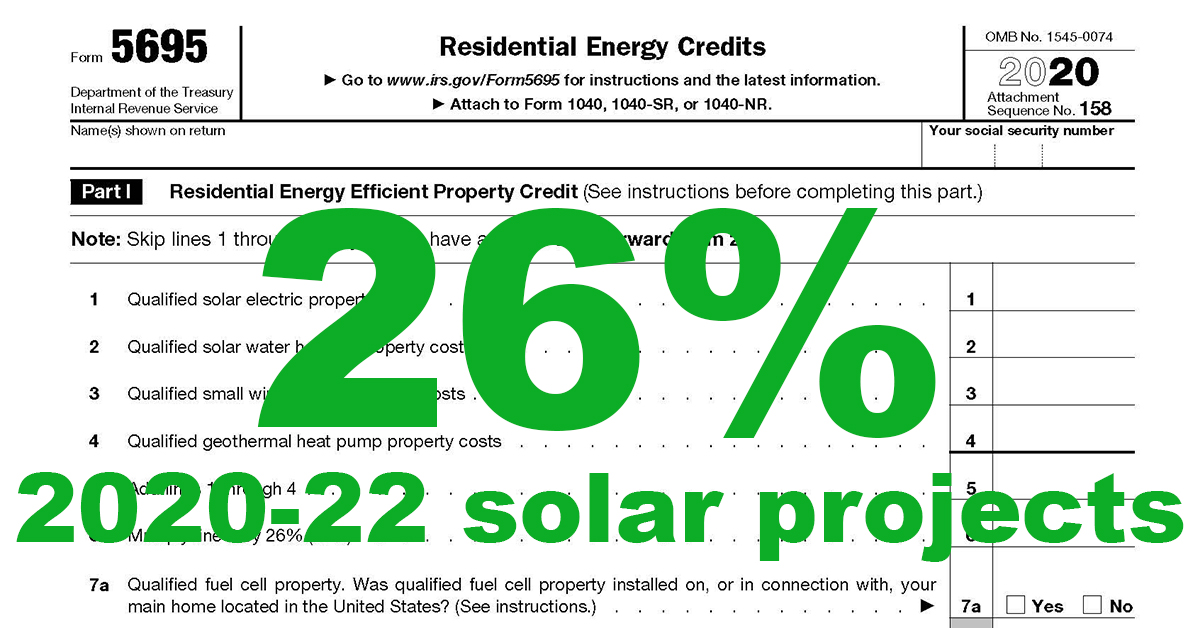

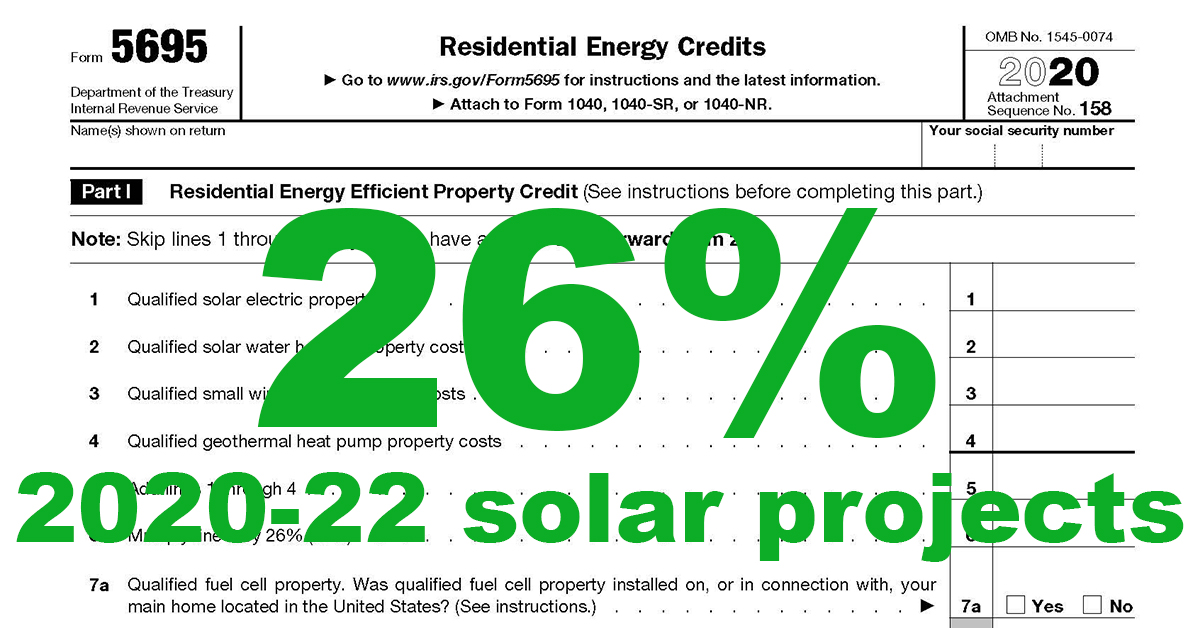

Puget Sound Solar LLC

The California Furnace Tax Credit An FAQ For Homeowners Bell Brothers

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

https://www.irs.gov/credits-deductions/frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is

Employee Retention Credit IRS Tax Credit

IRS To Send Letter 6419 Regarding Advance CTC Payments Lanigan Ryan

Puget Sound Solar LLC

The California Furnace Tax Credit An FAQ For Homeowners Bell Brothers

Condensation In A High Efficiency Furnace Inspection Gallery

Implementing A Community based Approach To Indoor Residual Spraying To

Implementing A Community based Approach To Indoor Residual Spraying To

Outdoor Wood Furnace Crown Royal Stoves