In this age of electronic devices, in which screens are the norm but the value of tangible printed material hasn't diminished. If it's to aid in education in creative or artistic projects, or simply adding an extra personal touch to your area, Irs Tax Credit On Solar Panels are now a vital source. This article will dive to the depths of "Irs Tax Credit On Solar Panels," exploring what they are, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Irs Tax Credit On Solar Panels Below

Irs Tax Credit On Solar Panels

Irs Tax Credit On Solar Panels -

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

Irs Tax Credit On Solar Panels include a broad array of printable documents that can be downloaded online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and many more. The attraction of printables that are free is their flexibility and accessibility.

More of Irs Tax Credit On Solar Panels

Federal Tax Credit On Solar Installation Resnick Roofing

Federal Tax Credit On Solar Installation Resnick Roofing

What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Need to jump ahead

Irs Tax Credit On Solar Panels have garnered immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Customization: The Customization feature lets you tailor the templates to meet your individual needs whether it's making invitations making your schedule, or even decorating your house.

-

Educational Value: These Irs Tax Credit On Solar Panels cater to learners of all ages, making them a useful tool for parents and teachers.

-

An easy way to access HTML0: The instant accessibility to various designs and templates cuts down on time and efforts.

Where to Find more Irs Tax Credit On Solar Panels

Why To Have Solar Panels In Yulee Cinque Restaurant

Why To Have Solar Panels In Yulee Cinque Restaurant

Adding solar panels to your home can save you money not only on your utility bills but also at tax time That s because installing solar panels is one of the energy related upgrades

To claim the solar tax credit you ll need all the receipts from your solar installation as well as IRS form 1040 and form 5695 and instructions for both of those forms We ve included an example below of how to fill out the tax forms and some frequently asked questions about the process of claiming the 30 tax credit

We've now piqued your curiosity about Irs Tax Credit On Solar Panels we'll explore the places the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Irs Tax Credit On Solar Panels designed for a variety uses.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets with flashcards and other teaching tools.

- It is ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their creative designs with templates and designs for free.

- The blogs are a vast range of topics, that includes DIY projects to planning a party.

Maximizing Irs Tax Credit On Solar Panels

Here are some new ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free for teaching at-home, or even in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Irs Tax Credit On Solar Panels are an abundance of practical and innovative resources that meet a variety of needs and interest. Their accessibility and versatility make them an essential part of each day life. Explore the plethora of Irs Tax Credit On Solar Panels now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes you can! You can print and download these tools for free.

-

Can I utilize free printables for commercial uses?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with printables that are free?

- Some printables may contain restrictions in use. You should read the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home with any printer or head to a print shop in your area for top quality prints.

-

What program do I require to view printables that are free?

- Most PDF-based printables are available in the format of PDF, which is open with no cost programs like Adobe Reader.

LA Solar Group

Employee Retention Tax Credit Practice Compliance Solutions

Check more sample of Irs Tax Credit On Solar Panels below

Solar Tax Credit Jumps To 30 Until 2032 Beantown Home Improvements

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Zena Royster

Claiming The Solar Tax Credit Using IRS Form 5695 Solar Energy Solutions

https://www. irs.gov /credits-deductions/home-energy-tax-credits

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

https://www. energy.gov /eere/solar/homeowners-guide...

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

Zena Royster

Claiming The Solar Tax Credit Using IRS Form 5695 Solar Energy Solutions

Colorado Government Solar Tax Credit Big History Blogger Photography

Is Now The Time To Give Your House An Eco makeover New Tax Rules Could

Is Now The Time To Give Your House An Eco makeover New Tax Rules Could

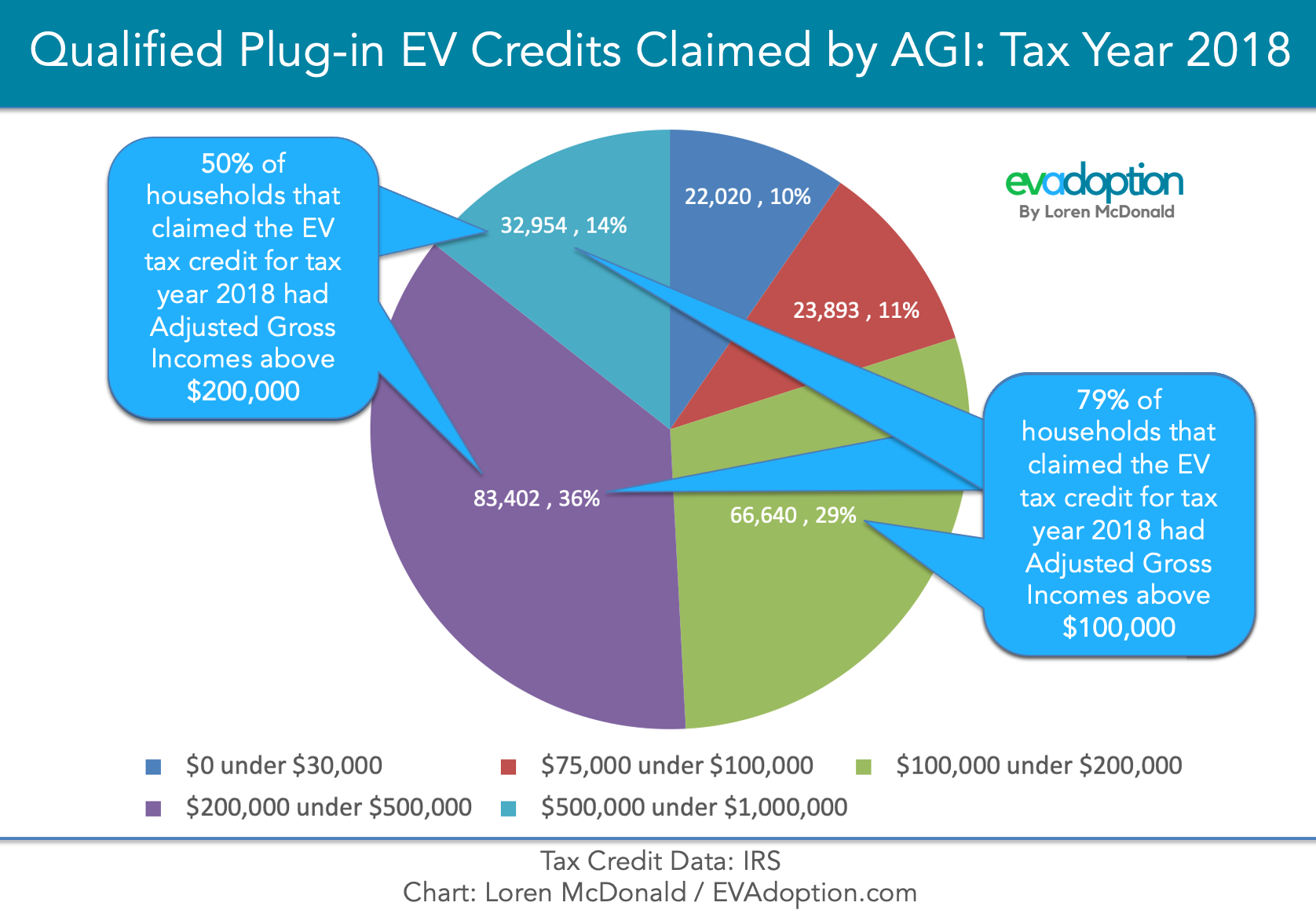

IRS Tax credit by Household AGI 2018 updated FINAL2 EVAdoption