In this age of technology, when screens dominate our lives, the charm of tangible printed objects hasn't waned. For educational purposes such as creative projects or just adding an individual touch to your space, Is 80ccf Part Of 80c are now a useful source. Here, we'll take a dive in the world of "Is 80ccf Part Of 80c," exploring what they are, how you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Is 80ccf Part Of 80c Below

Is 80ccf Part Of 80c

Is 80ccf Part Of 80c -

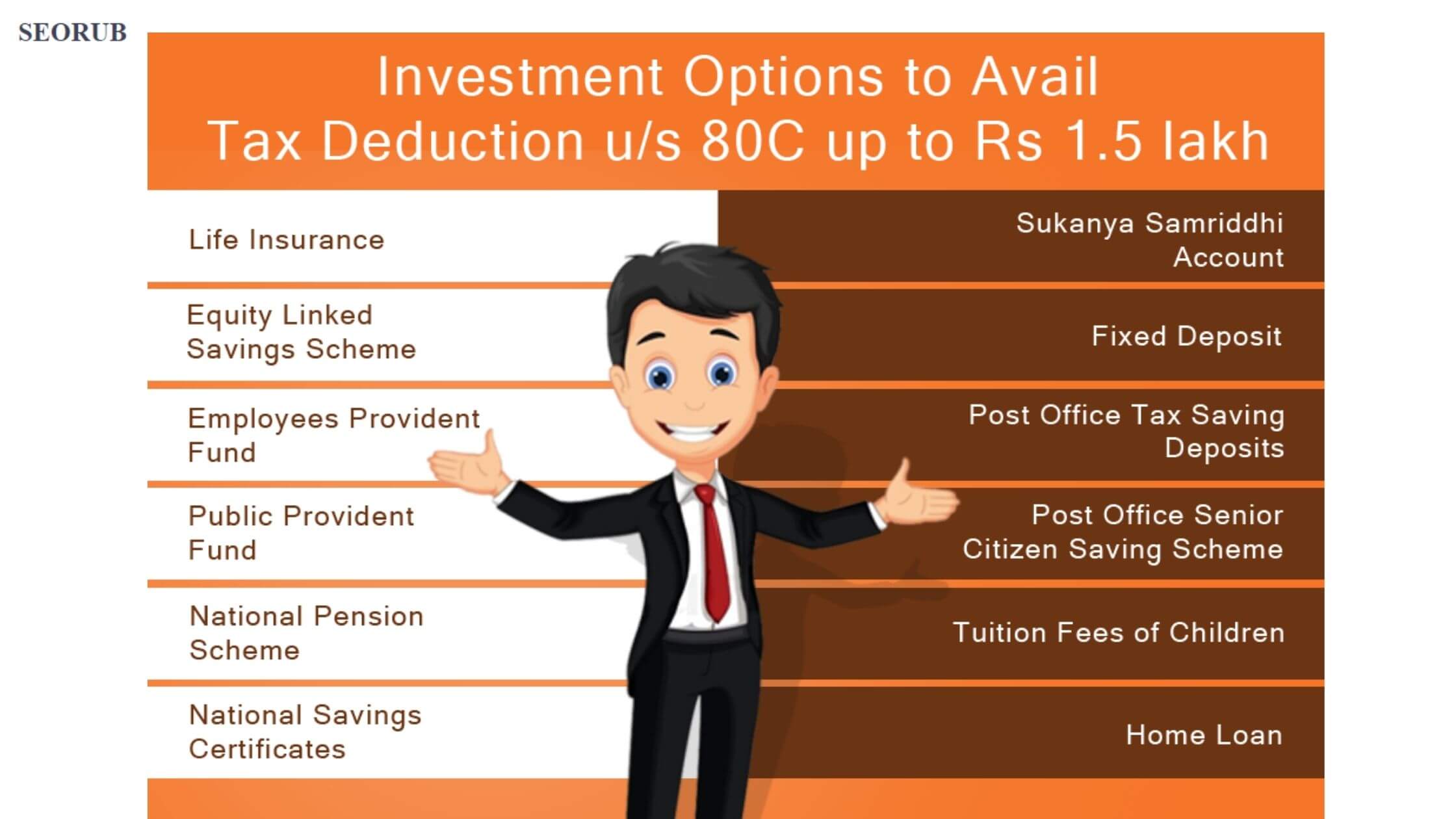

Section 80CCF has been introduced to allow individuals to enjoy additional tax deductions over and above those mentioned under 80C Eligible individuals can claim a maximum

Section 80CCF is a subsection under section 80C It provides a deduction with respect to the amount invested by a taxpayer in specific infrastructure bonds as approved by

Printables for free cover a broad array of printable materials online, at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages and much more. The value of Is 80ccf Part Of 80c is in their variety and accessibility.

More of Is 80ccf Part Of 80c

Deductions Under Sections 80C 80CCC 80CCD 80CCF 80CCG Times Of India

Deductions Under Sections 80C 80CCC 80CCD 80CCF 80CCG Times Of India

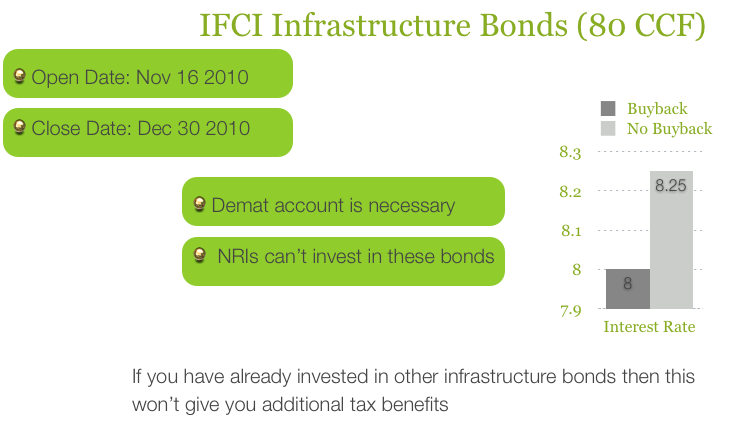

Section 80CCF of the Act The deduction under Section 80CCF was available to the individuals or HUFs for the limited window i e for financial year 2010 11 and 2011 12 for the subscriptions made to

UpVotes Deductions under various Sections of the Income Tax Act help in lowering the overall tax burden of an individual One such section is the 80CCF It s a provision of the ITA that is a win win for both

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Modifications: There is the possibility of tailoring printables to your specific needs whether you're designing invitations planning your schedule or even decorating your home.

-

Educational value: Free educational printables can be used by students from all ages, making these printables a powerful tool for teachers and parents.

-

An easy way to access HTML0: instant access numerous designs and templates is time-saving and saves effort.

Where to Find more Is 80ccf Part Of 80c

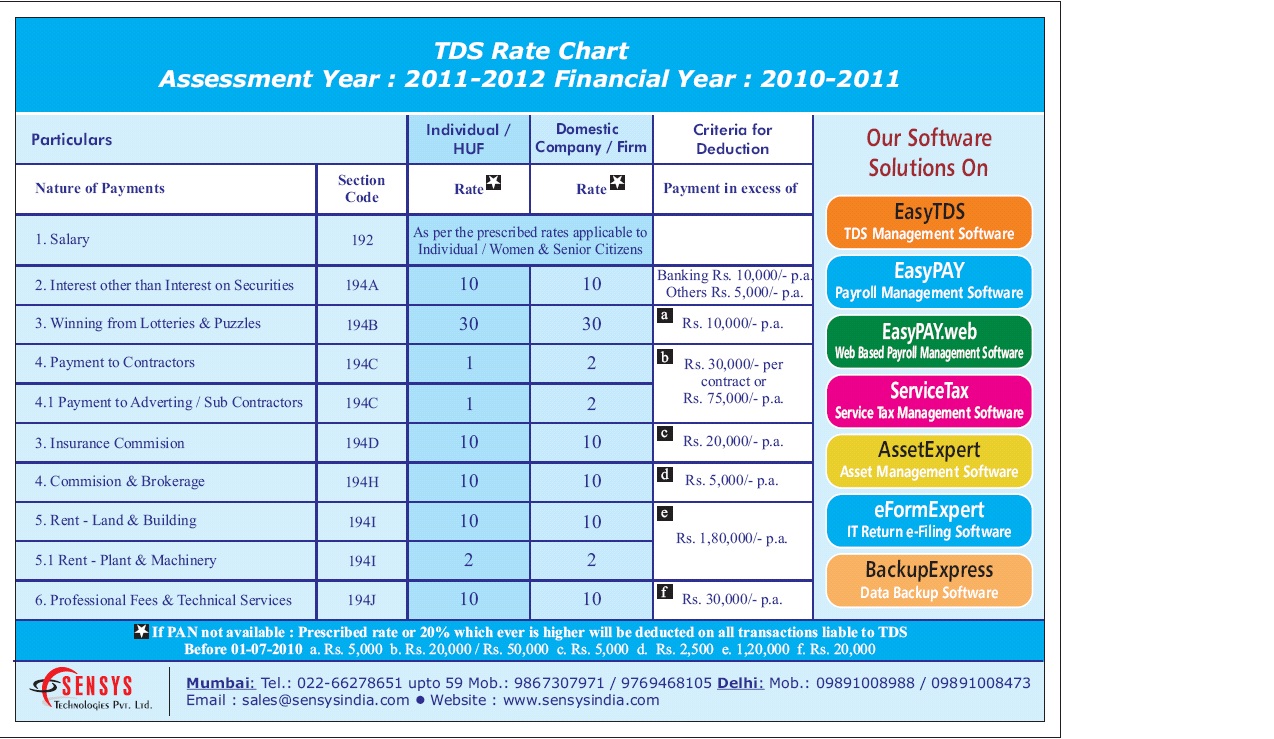

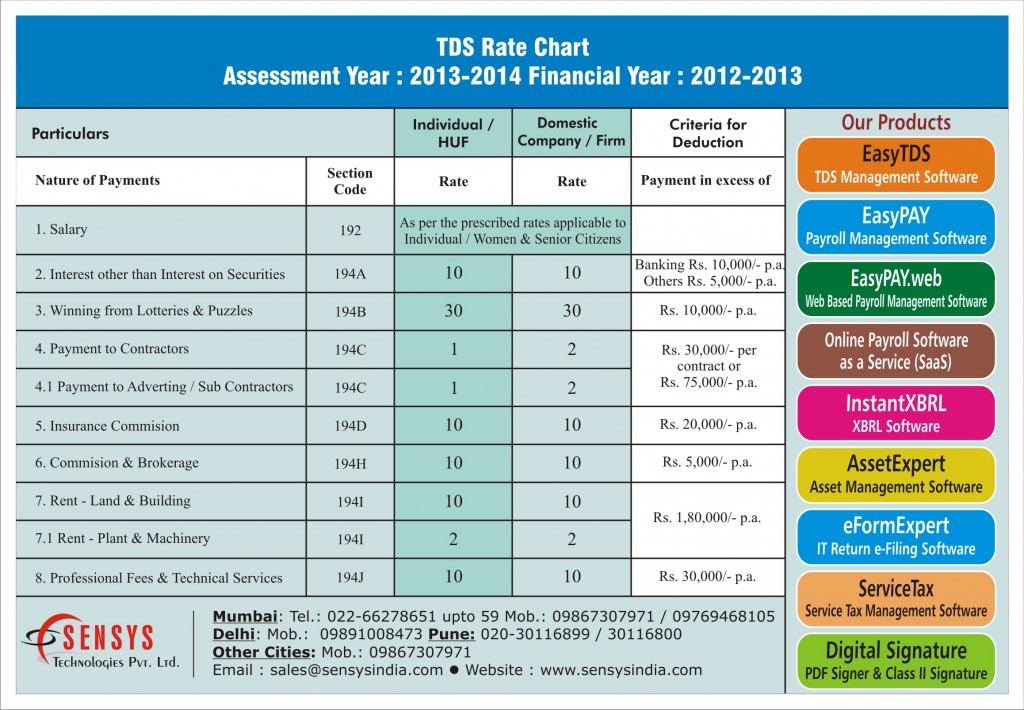

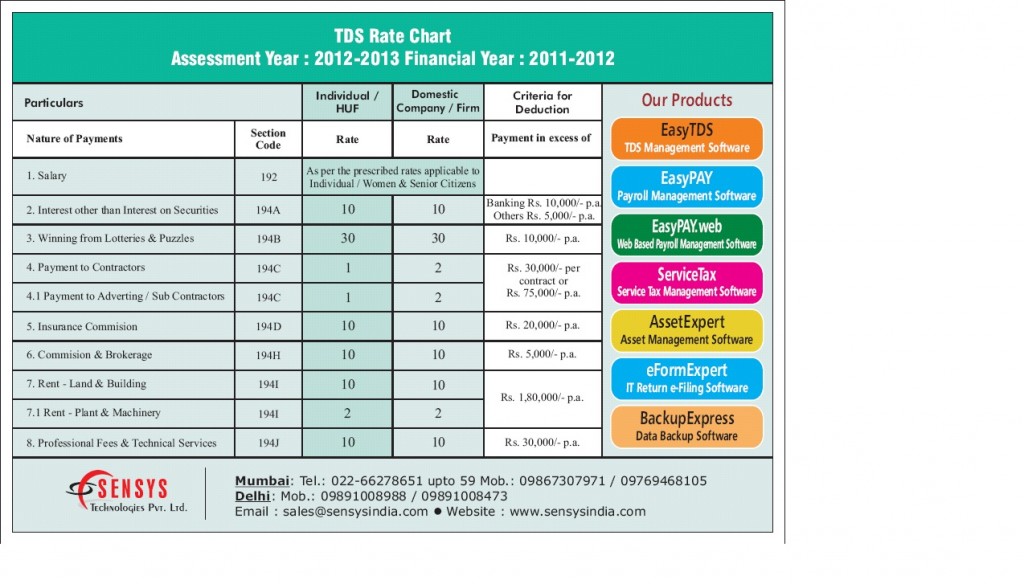

TDS Rate Chart AY 2011 2012 Sensys Blog

TDS Rate Chart AY 2011 2012 Sensys Blog

What is Section 80CCF of the Income Tax Act This scheme provides tax benefits to investors It lists certain tax benefits and provides additional deductions that investors can enjoy This results in a win win

Section 80CCF of the IT Act contains provisions for certain tax deductions in a bid to attract investors and utilise funds efficiently The current maximum deduction an individual is

We've now piqued your curiosity about Is 80ccf Part Of 80c Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Is 80ccf Part Of 80c suitable for many objectives.

- Explore categories like decorations for the home, education and crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs are a vast array of topics, ranging ranging from DIY projects to party planning.

Maximizing Is 80ccf Part Of 80c

Here are some unique ways create the maximum value use of Is 80ccf Part Of 80c:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars or to-do lists. meal planners.

Conclusion

Is 80ccf Part Of 80c are a treasure trove with useful and creative ideas designed to meet a range of needs and needs and. Their accessibility and flexibility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the many options of Is 80ccf Part Of 80c today and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes they are! You can print and download the resources for free.

-

Are there any free printables for commercial uses?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues in Is 80ccf Part Of 80c?

- Some printables could have limitations regarding their use. You should read the terms and regulations provided by the designer.

-

How can I print printables for free?

- Print them at home using a printer or visit any local print store for the highest quality prints.

-

What software do I require to open printables for free?

- A majority of printed materials are in the format of PDF, which can be opened using free software such as Adobe Reader.

IFCI Infrastructure Bonds Tax Saving Bonds Under Section 80 CCF OneMint

Is EPF A Part Of 80C Quora

Check more sample of Is 80ccf Part Of 80c below

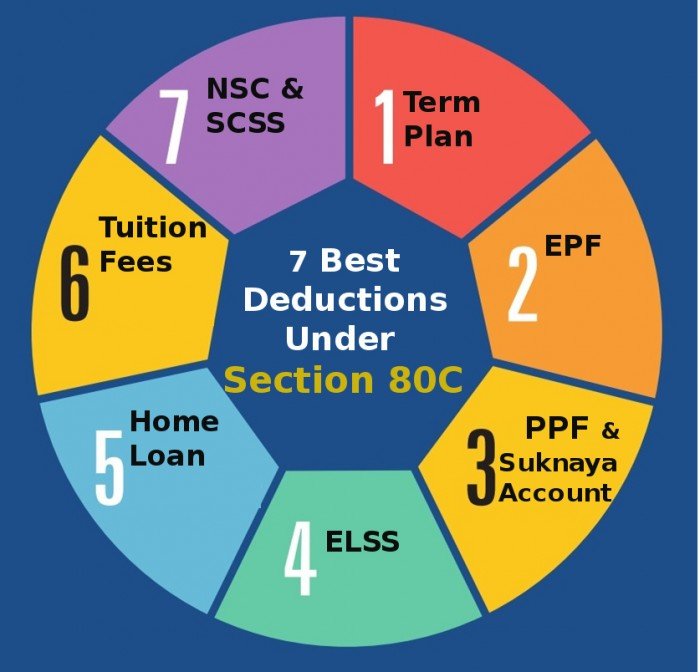

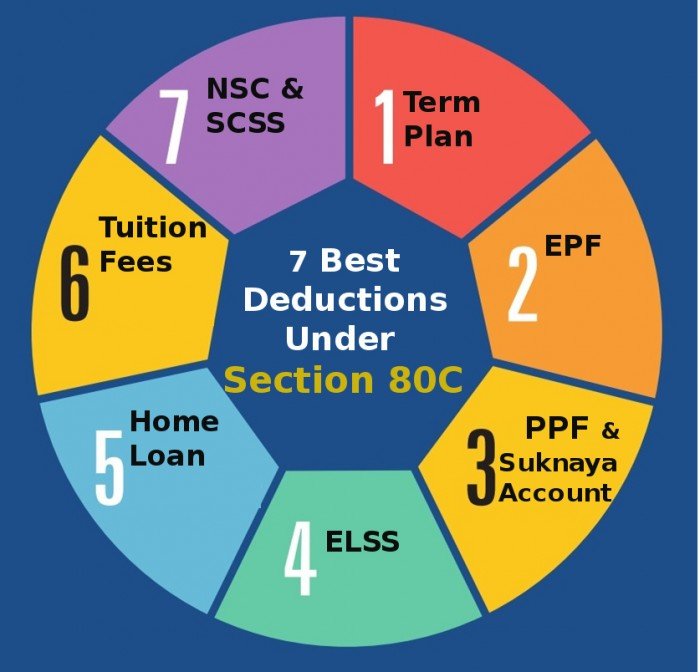

Deduction Under Section 80C A Complete List BasuNivesh

Section 80 CCD 80CCD 1 80CCD IB 80CCD 2 80CCE 80CCF

Is EPF Employer Contribution Taxable In The Revised New Tax Regime

Section 80CCF Infrastructure Bonds FAQ OneMint

Why Is 80C The Best Tax Saving Instrument

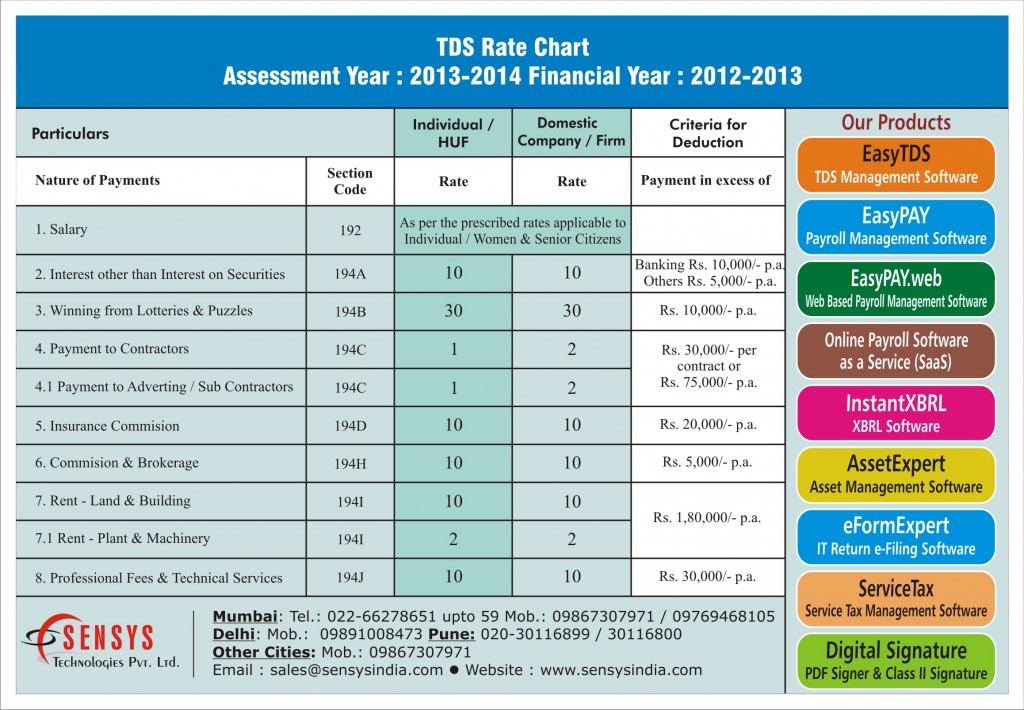

TDS Rate Chart AY 2013 2014 Sensys Blog

https://www.coverfox.com/personal-finance/tax/section-80ccf

Section 80CCF is a subsection under section 80C It provides a deduction with respect to the amount invested by a taxpayer in specific infrastructure bonds as approved by

https://cleartax.in/s/80c-80-deductions

Maximum deduction limit under 80C 80CCC 80CCD 1 80CCE is Rs 1 5 Lakhs with an additional Rs 50 000 under 80CCD 1B Deductions are available for

Section 80CCF is a subsection under section 80C It provides a deduction with respect to the amount invested by a taxpayer in specific infrastructure bonds as approved by

Maximum deduction limit under 80C 80CCC 80CCD 1 80CCE is Rs 1 5 Lakhs with an additional Rs 50 000 under 80CCD 1B Deductions are available for

Section 80CCF Infrastructure Bonds FAQ OneMint

Section 80 CCD 80CCD 1 80CCD IB 80CCD 2 80CCE 80CCF

Why Is 80C The Best Tax Saving Instrument

TDS Rate Chart AY 2013 2014 Sensys Blog

TDS Rate Chart 2012 2013 Sensys Blog

Budget 2022 Expectations Six Measures That Can Help Home Buyers

Budget 2022 Expectations Six Measures That Can Help Home Buyers

What Is ELSS Funds And How To Invest CreditHita