Today, where screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. Whatever the reason, whether for education as well as creative projects or simply adding an element of personalization to your space, Is 87a Applicable For Senior Citizens are now a vital resource. For this piece, we'll take a dive into the world of "Is 87a Applicable For Senior Citizens," exploring what they are, how to find them and the ways that they can benefit different aspects of your life.

Get Latest Is 87a Applicable For Senior Citizens Below

Is 87a Applicable For Senior Citizens

Is 87a Applicable For Senior Citizens -

Verkko 3 jouluk 2020 nbsp 0183 32 Senior citizens above the age of 60 years and below 80 years are also eligible for rebate u s 87A Only Resident individual taxpayers can take benefit of section 87A Non resident individual taxpayers are not eligible for rebate u s 87A Partnership firms LLP HUF Companies etc are not eligible under section 87A

Verkko 2 toukok 2023 nbsp 0183 32 Super senior citizens above 80 years of age are not eligible to claim rebates under Section 87A The amount of rebate will be lower than the limit specified under Section 87A or total income tax payable before cess Section 87A rebate is available under the old and the new tax regime

The Is 87a Applicable For Senior Citizens are a huge selection of printable and downloadable content that can be downloaded from the internet at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and much more. The value of Is 87a Applicable For Senior Citizens is in their versatility and accessibility.

More of Is 87a Applicable For Senior Citizens

Stevens Model 87A 22 LR Cal Tube Fed Semi Auto Rifle W 24 Bbl

Stevens Model 87A 22 LR Cal Tube Fed Semi Auto Rifle W 24 Bbl

Verkko 3 marrask 2023 nbsp 0183 32 Senior citizens between the ages of 60 and 80 They are eligible for the rebate if their total income does not exceed the specified limit Super senior citizens above the age of 80 The tax rebate is available to them if their total income falls within the prescribed limit

Verkko 2 helmik 2023 nbsp 0183 32 Senior citizens and super senior citizens can also claim rebate under this section Rebate under 87A is available under both the tax regimes i e old as well as new Note Rebate u s 87A can not be availed against income from long term capital gains on equity shares or equity oriented mutual funds Section 112A

Is 87a Applicable For Senior Citizens have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or expensive software.

-

The ability to customize: We can customize print-ready templates to your specific requirements when it comes to designing invitations, organizing your schedule, or decorating your home.

-

Educational value: Printing educational materials for no cost offer a wide range of educational content for learners of all ages, making them an essential instrument for parents and teachers.

-

Convenience: immediate access a myriad of designs as well as templates reduces time and effort.

Where to Find more Is 87a Applicable For Senior Citizens

Explained Long term Capital Gains From Shares And Rebate Under Section

Explained Long term Capital Gains From Shares And Rebate Under Section

Verkko 22 toukok 2023 nbsp 0183 32 Alaik 228 isen oikeudet Lapsella on oikeus osallistua asioidensa hoitoa koskevaan p 228 228 t 246 ksentekoon kehitystasonsa mukaisesti Toimintatavat ovat erilaisia sosiaali ja terveydenhuollossa Alaik 228 inen voi k 228 ytt 228 228 itse OmaKantaa jos h 228 nell 228 on s 228 hk 246 iset tunnistautumisv 228 lineet kuten verkkopankkitunnukset tai mobiilivarmenne

Verkko 25 tammik 2022 nbsp 0183 32 Super senior citizens i e individuals over 80 years of age are not eligible to claim rebate under Section 87A The rebate amount of Rs 12 500 is the maximum amount that one can claim under Section 87A If your annual income attracts a tax lower than the maximum rebate amount the rebate will also be the same

After we've peaked your interest in Is 87a Applicable For Senior Citizens, let's explore where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of needs.

- Explore categories such as furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a broad spectrum of interests, including DIY projects to party planning.

Maximizing Is 87a Applicable For Senior Citizens

Here are some fresh ways that you can make use use of Is 87a Applicable For Senior Citizens:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home as well as in the class.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Is 87a Applicable For Senior Citizens are an abundance of useful and creative resources for a variety of needs and passions. Their accessibility and versatility make them a wonderful addition to both personal and professional life. Explore the plethora of Is 87a Applicable For Senior Citizens and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is 87a Applicable For Senior Citizens truly absolutely free?

- Yes, they are! You can print and download these files for free.

-

Can I use the free templates for commercial use?

- It depends on the specific usage guidelines. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with Is 87a Applicable For Senior Citizens?

- Some printables could have limitations on use. Be sure to check the terms of service and conditions provided by the designer.

-

How can I print Is 87a Applicable For Senior Citizens?

- Print them at home with your printer or visit any local print store for better quality prints.

-

What software do I require to open printables for free?

- The majority of printables are as PDF files, which can be opened with free software, such as Adobe Reader.

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

Stevens Model 87A 22 LR Cal Tube Fed Semi Auto Rifle W 24 Bbl

Check more sample of Is 87a Applicable For Senior Citizens below

STEVENS MODEL 87A CALIBER 22 LR

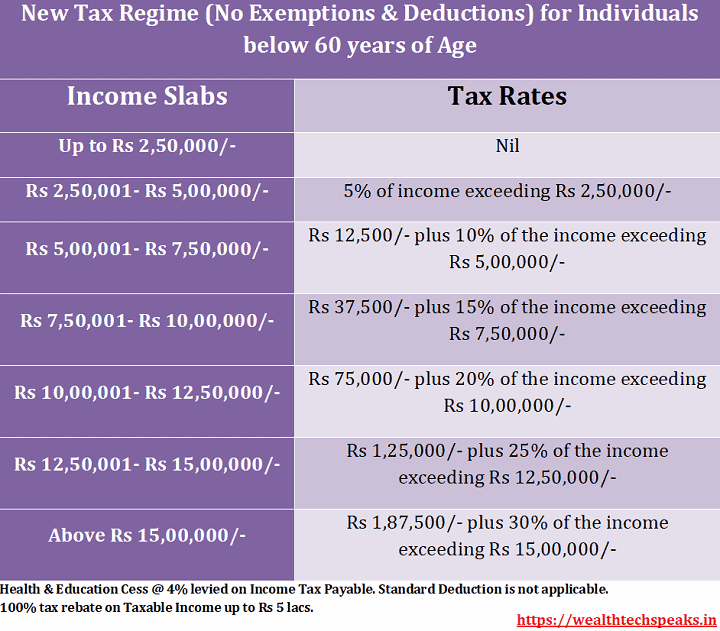

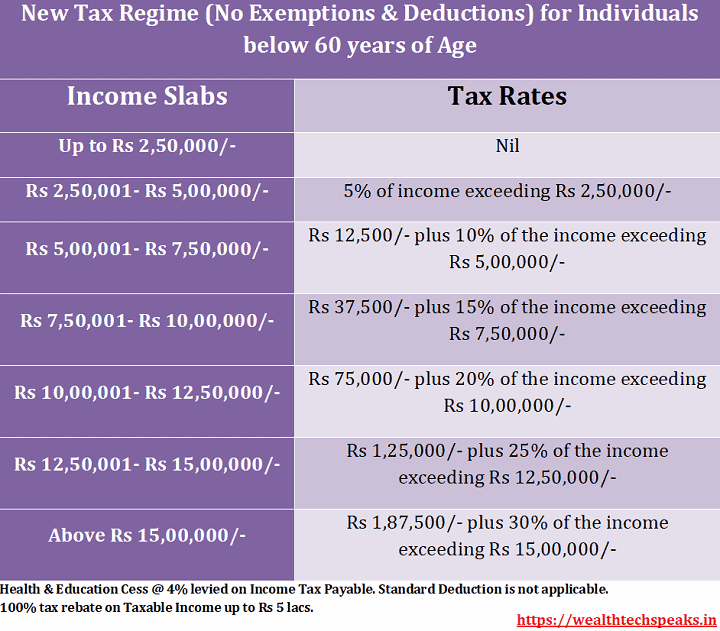

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Tax Planning V Financial Services

Are Vietnam Visa Exemptions Applicable To Belgium Passports 2023 Ways

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

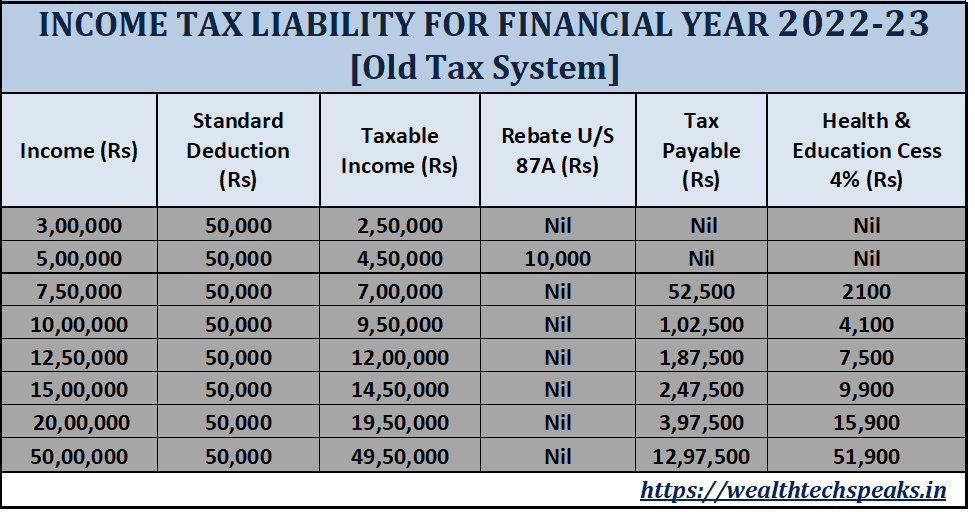

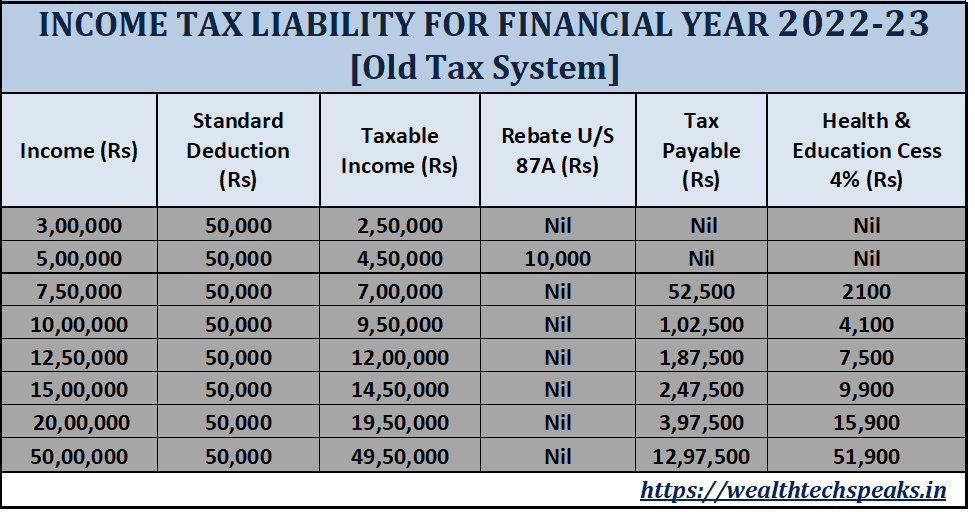

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

https://cleartax.in/s/income-tax-rebate-us-87a

Verkko 2 toukok 2023 nbsp 0183 32 Super senior citizens above 80 years of age are not eligible to claim rebates under Section 87A The amount of rebate will be lower than the limit specified under Section 87A or total income tax payable before cess Section 87A rebate is available under the old and the new tax regime

https://www.maxlifeinsurance.com/blog/tax-savings/section-87a-rebate

Verkko Under section 87A are senior citizens eligible to get tax rebate Yes Senior citizens aged 60 years and up to 80 years as well as super senior citizens olders than 80 years are eligible for a tax rebate under section 87A

Verkko 2 toukok 2023 nbsp 0183 32 Super senior citizens above 80 years of age are not eligible to claim rebates under Section 87A The amount of rebate will be lower than the limit specified under Section 87A or total income tax payable before cess Section 87A rebate is available under the old and the new tax regime

Verkko Under section 87A are senior citizens eligible to get tax rebate Yes Senior citizens aged 60 years and up to 80 years as well as super senior citizens olders than 80 years are eligible for a tax rebate under section 87A

Are Vietnam Visa Exemptions Applicable To Belgium Passports 2023 Ways

Income Tax Slabs Rates Financial Year 2022 23 WealthTech Speaks

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Income Tax Calculation Financial Year 2022 23 WealthTech Speaks

Stevens Model 87A 22 LR Cal Tube Fed Semi Auto Rifle W 24 Bbl

STEVENS MODEL 87A CALIBER 22 LR

STEVENS MODEL 87A CALIBER 22 LR

STEVENS MODEL 87A CALIBER 22 LR