In the digital age, where screens dominate our lives but the value of tangible printed items hasn't gone away. Be it for educational use such as creative projects or simply to add an individual touch to the space, Is Arrears Of Salary Taxable are a great source. In this article, we'll dive to the depths of "Is Arrears Of Salary Taxable," exploring what they are, where to find them, and what they can do to improve different aspects of your daily life.

Get Latest Is Arrears Of Salary Taxable Below

Is Arrears Of Salary Taxable

Is Arrears Of Salary Taxable -

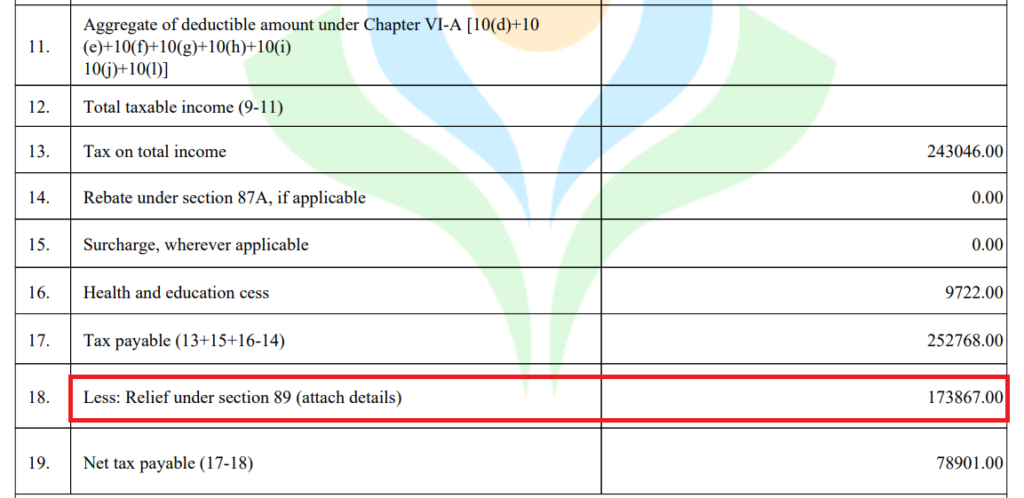

Relief under section 89 1 Taxability in case of Arrear of Salary Updated on 07 May 2024 02 20 PM An employee may receive a component of his salary in the form of arrear or advance salary during employment These advances or arrears can affect your taxes and are reflected in the year of the receipt

Taxable salary Add Arrears of salary 8 25 000 1 50 000 8 75 000 1 25 000 9 00 000 1 75 000 Taxable salary 9 75 000 10 00 000 10 75 000 Tax on the above Add Cess at applicable rate 1 20 000 3 600 1 12 500 3 375 1 35 000 5 400 Tax payable 1 23 600 1 15 875 1 40 400

Is Arrears Of Salary Taxable provide a diverse variety of printable, downloadable content that can be downloaded from the internet at no cost. These resources come in various kinds, including worksheets coloring pages, templates and many more. One of the advantages of Is Arrears Of Salary Taxable lies in their versatility and accessibility.

More of Is Arrears Of Salary Taxable

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

Arrears Of Salary Taxability Relief Under Section 89 1 Learn By

Relief under section 89 1 for arrears of salary Assisted Team 1 year ago Updated Did you receive any advance salary or arrears of salary If yes you might be worried about the tax implications of the same Do I have to pay taxes on the total amount What about the tax calculations of the previous year and so on

Can you claim income tax relief for arrears Yes If the assessee has received a portion of his salary in arrears or in advance or received a family pension in arrears the Income Tax Act allows you to claim tax relief under section 89 1

Is Arrears Of Salary Taxable have gained a lot of popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

The ability to customize: This allows you to modify printing templates to your own specific requirements, whether it's designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: The free educational worksheets provide for students of all ages. This makes them a great device for teachers and parents.

-

Convenience: immediate access a variety of designs and templates reduces time and effort.

Where to Find more Is Arrears Of Salary Taxable

If There Is A Salary Revision Do We Need To Deduct PF From The Arrears

If There Is A Salary Revision Do We Need To Deduct PF From The Arrears

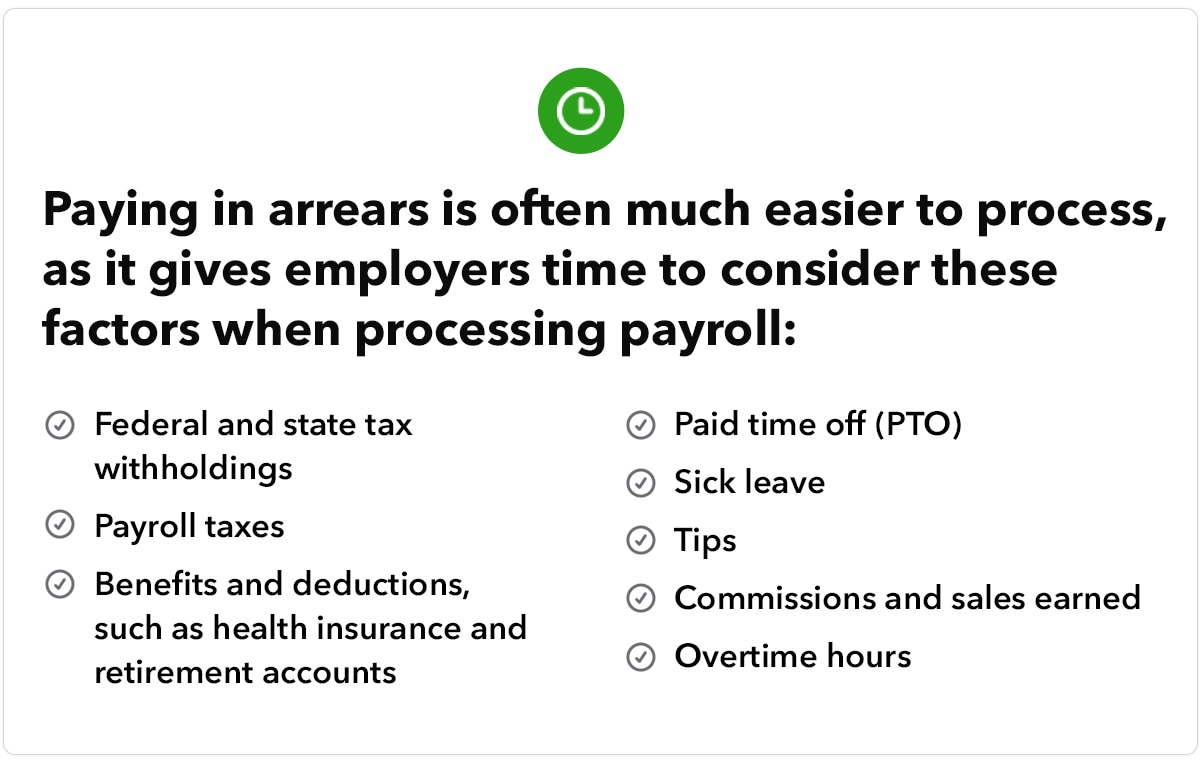

Salary is usually taxable when it is due or when it is received but in case of arrears they are usually announced from a back date which is why they cannot be taxed when due 3 Submit Form 10E before filing your ITR When it comes to choosing the assessment year for arrears you must choose the assessment year in which arrears have been

Arrears of salary is treated as salary income in the ITR They are taxable in the year of receipt However the taxpayer may be worried about paying taxes at a higher rate because of a higher tax bracket in the year of receipt or due to a change in the applicable slab rate

We've now piqued your curiosity about Is Arrears Of Salary Taxable and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of applications.

- Explore categories like home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Perfect for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- These blogs cover a wide range of interests, from DIY projects to planning a party.

Maximizing Is Arrears Of Salary Taxable

Here are some ideas for you to get the best of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Is Arrears Of Salary Taxable are a treasure trove of practical and imaginative resources which cater to a wide range of needs and interests. Their availability and versatility make them a fantastic addition to your professional and personal life. Explore the vast collection of Is Arrears Of Salary Taxable and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can print and download the resources for free.

-

Do I have the right to use free printables for commercial uses?

- It's based on the conditions of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns with Is Arrears Of Salary Taxable?

- Some printables may have restrictions regarding their use. Be sure to check the conditions and terms of use provided by the creator.

-

How can I print Is Arrears Of Salary Taxable?

- You can print them at home using printing equipment or visit a print shop in your area for higher quality prints.

-

What software is required to open printables at no cost?

- Most printables come in PDF format. These can be opened using free software such as Adobe Reader.

Income Tax Salary Allowances PF Arrears Leave Encashment And

Income Tax FAQ On Salary Income Are Arrears Of Salary Taxable SA POST

Check more sample of Is Arrears Of Salary Taxable below

Relief Under Section 89 1 On Arrears Of Salary FY 2020 21 Excel

Income Tax Returns Filing Taxable Or Not PF And Gratuity To Salary

What Is The Meaning Of The Word ARREARS YouTube

Income Tax Return Filing Are Arrears Of Salary Taxable How To Claim

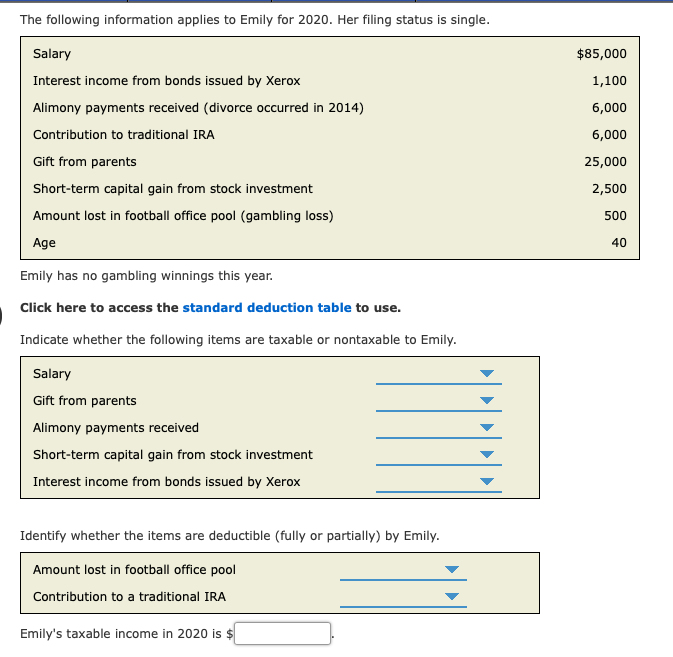

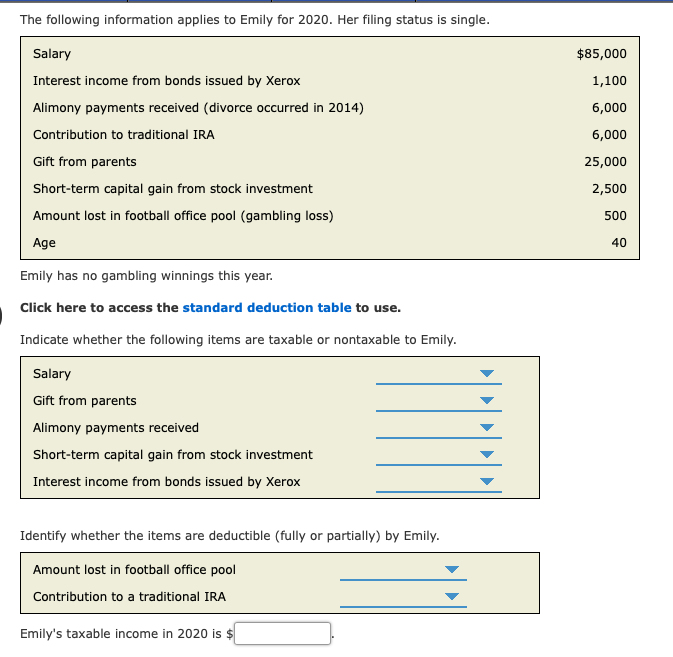

Solved The Following Information Applies To Emily For 2020 Chegg

Tax Exemption From Salary Arrears Filing Form 10E In The New Tax

https://taxguru.in/income-tax/arrears-salary...

Taxable salary Add Arrears of salary 8 25 000 1 50 000 8 75 000 1 25 000 9 00 000 1 75 000 Taxable salary 9 75 000 10 00 000 10 75 000 Tax on the above Add Cess at applicable rate 1 20 000 3 600 1 12 500 3 375 1 35 000 5 400 Tax payable 1 23 600 1 15 875 1 40 400

https://cleartax.in/s/get-help-with-salary-arrears

2 Salary is normally taxable when it is due or when it is received but arrears are usually announced from a back date so they cannot be taxed when they are due 3 Before filing your ITR submit Form 10E When determining the assessment year for arrears you must select the year in which the arrears were received

Taxable salary Add Arrears of salary 8 25 000 1 50 000 8 75 000 1 25 000 9 00 000 1 75 000 Taxable salary 9 75 000 10 00 000 10 75 000 Tax on the above Add Cess at applicable rate 1 20 000 3 600 1 12 500 3 375 1 35 000 5 400 Tax payable 1 23 600 1 15 875 1 40 400

2 Salary is normally taxable when it is due or when it is received but arrears are usually announced from a back date so they cannot be taxed when they are due 3 Before filing your ITR submit Form 10E When determining the assessment year for arrears you must select the year in which the arrears were received

Income Tax Return Filing Are Arrears Of Salary Taxable How To Claim

Income Tax Returns Filing Taxable Or Not PF And Gratuity To Salary

Solved The Following Information Applies To Emily For 2020 Chegg

Tax Exemption From Salary Arrears Filing Form 10E In The New Tax

Calls In Arrears Example Of Calls In Arrear Meaning Of Calls In

Arrears Billing And Payments What Does It Mean QuickBooks

Arrears Billing And Payments What Does It Mean QuickBooks

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput