In this digital age, when screens dominate our lives The appeal of tangible printed objects hasn't waned. Whether it's for educational purposes in creative or artistic projects, or simply adding the personal touch to your space, Is Fuel Tax Deductible For Truck Drivers have proven to be a valuable source. For this piece, we'll take a dive in the world of "Is Fuel Tax Deductible For Truck Drivers," exploring what they are, how they are, and how they can enrich various aspects of your lives.

Get Latest Is Fuel Tax Deductible For Truck Drivers Below

Is Fuel Tax Deductible For Truck Drivers

Is Fuel Tax Deductible For Truck Drivers -

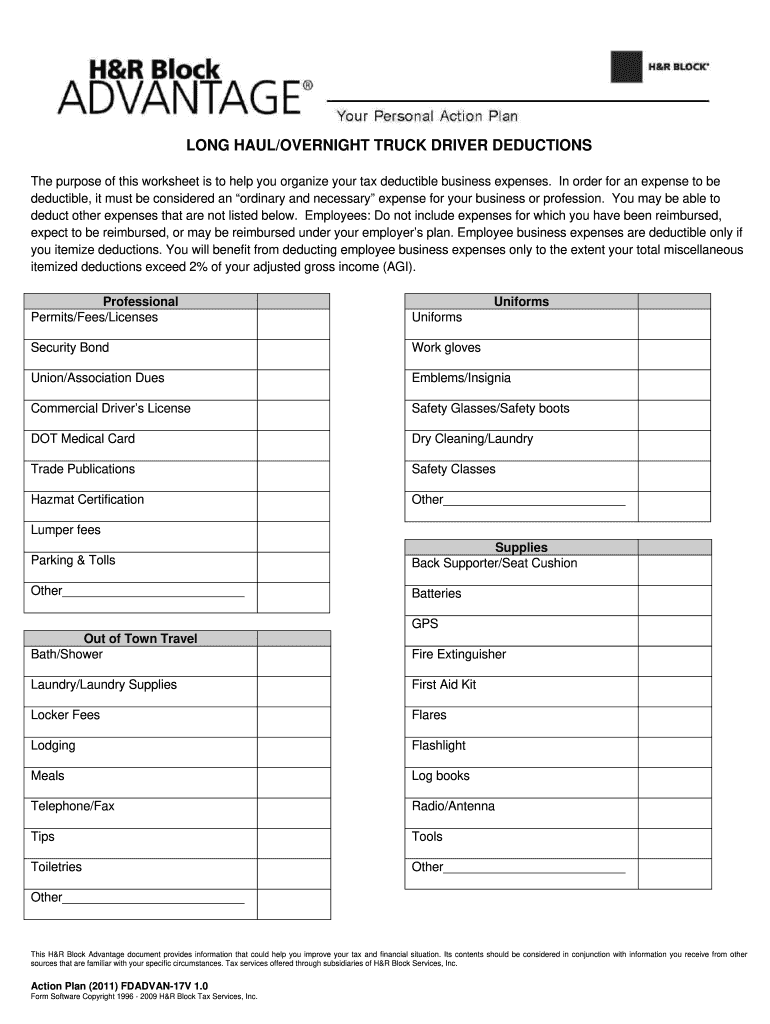

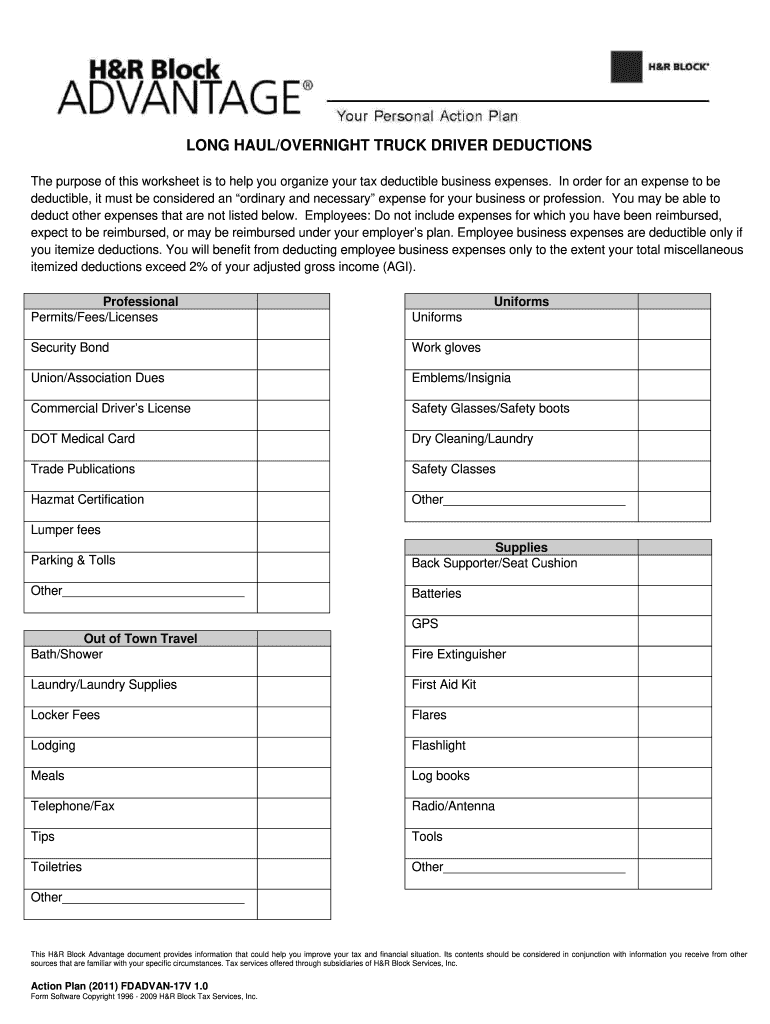

Fuel Cost One of the most substantial expenses for truck drivers is fuel Deducting these costs reflects the intrinsic role that fuel plays in a truck driver s ability to perform their job Licensing Fees Truck drivers must maintain a valid commercial driver s license CDL and may be required to hold additional certifications Deducting

Can I claim gas on your taxes for driving to work No the costs for fuel that you incur on your commute between your home and workplace are not tax deductible However fuel costs that truckers incur while driving their business vehicle for work purposes are tax deductible How do truck drivers pay less taxes

The Is Fuel Tax Deductible For Truck Drivers are a huge assortment of printable, downloadable resources available online for download at no cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and more. The beauty of Is Fuel Tax Deductible For Truck Drivers is in their variety and accessibility.

More of Is Fuel Tax Deductible For Truck Drivers

QLD Cosmetic Surgery Model Calls For Tax Deductions Herald Sun

QLD Cosmetic Surgery Model Calls For Tax Deductions Herald Sun

Fuel Tax and Licensing Fees Truckers can deduct any fees licenses and use taxes that are required to do their job This includes Business permits Commercial driver s license Heavy Highway Vehicle Use Tax Required Insurance Premiums

Though even without this bill passed into law truck drivers can earn huge tax deductibles For example a truck driver can deduct up to 80 of their meal costs as well as up to 100 of vehicle repair costs Can truckers write off fuel Yes Owner Operators can deduct the cost of fuel but only for when the truck was in service

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: They can make print-ready templates to your specific requirements in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Benefits: Downloads of educational content for free provide for students of all ages. This makes them a useful aid for parents as well as educators.

-

Affordability: instant access an array of designs and templates saves time and effort.

Where to Find more Is Fuel Tax Deductible For Truck Drivers

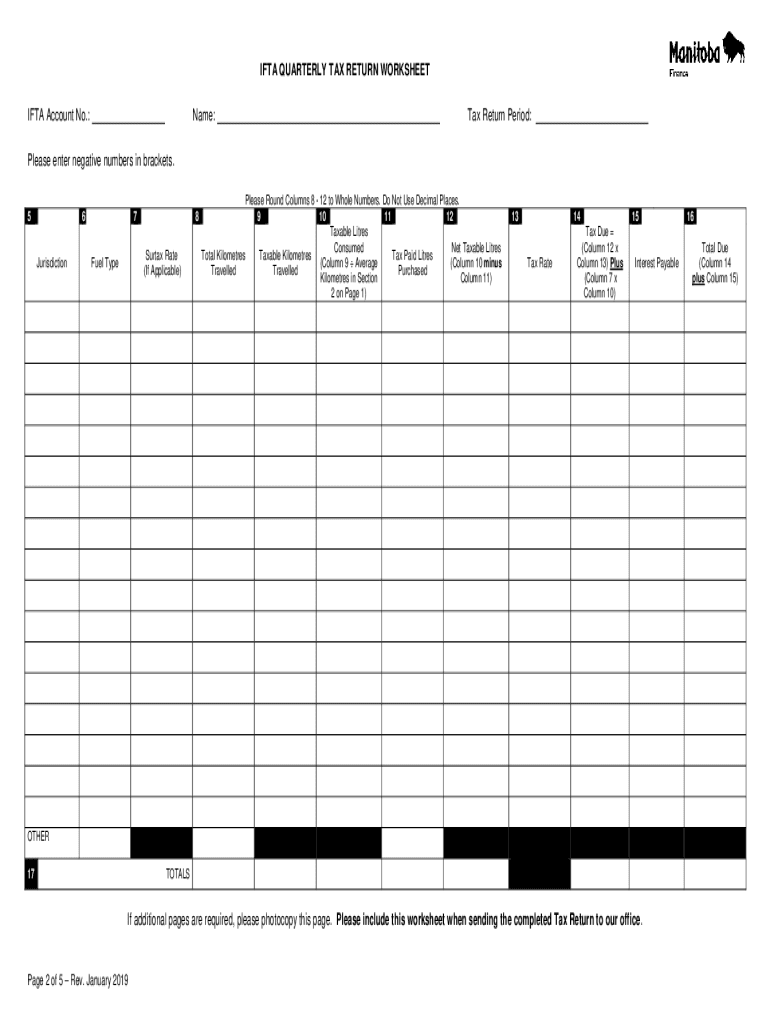

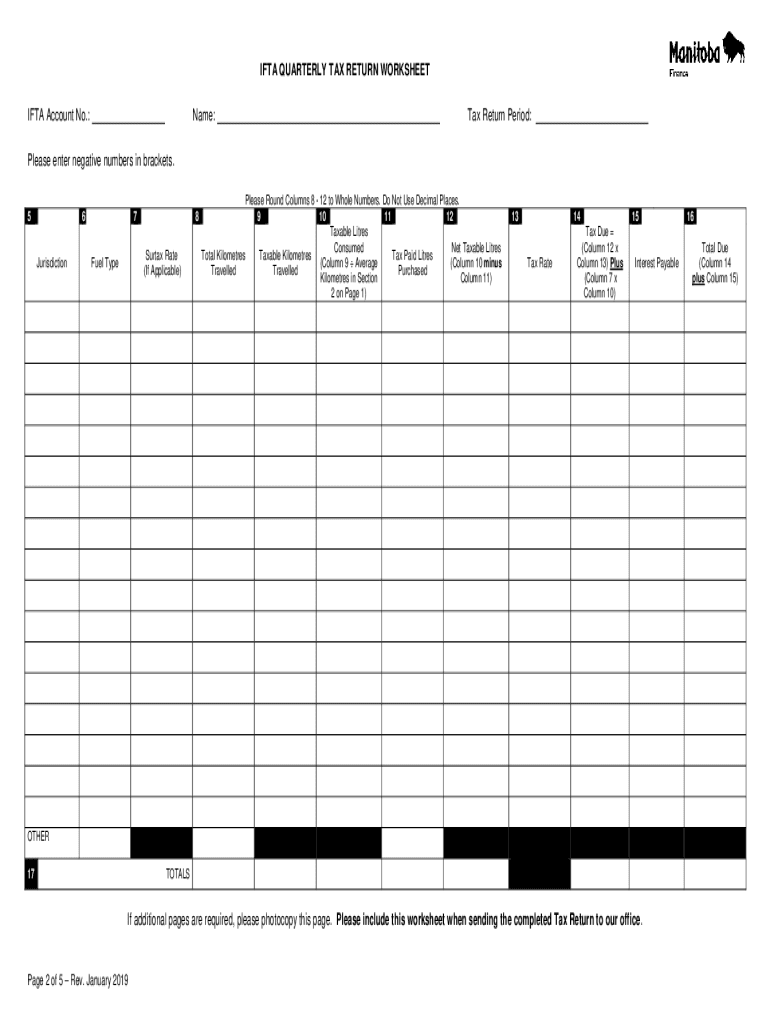

Is IFTA Tax Deductible Leia Aqui Is Fuel Tax Deductible For Truck

Is IFTA Tax Deductible Leia Aqui Is Fuel Tax Deductible For Truck

Review information on filing Form 2290 Heavy Highway Vehicle Use Tax Return and other tax tips trends and statistics related to the trucking industry

For any trucking business fuel is one of the largest overall costs You may deduct the cost of fuel plus additional travel expenses including truck repair and maintenance If you have to travel to a different site to pick up a vehicle or

Now that we've ignited your interest in Is Fuel Tax Deductible For Truck Drivers Let's look into where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Is Fuel Tax Deductible For Truck Drivers designed for a variety motives.

- Explore categories like furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets including flashcards, learning tools.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- The blogs covered cover a wide variety of topics, all the way from DIY projects to party planning.

Maximizing Is Fuel Tax Deductible For Truck Drivers

Here are some ideas of making the most use of Is Fuel Tax Deductible For Truck Drivers:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home also in the classes.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is Fuel Tax Deductible For Truck Drivers are a treasure trove of innovative and useful resources catering to different needs and pursuits. Their accessibility and versatility make these printables a useful addition to both professional and personal lives. Explore the world of Is Fuel Tax Deductible For Truck Drivers and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can download and print these resources at no cost.

-

Are there any free printables to make commercial products?

- It's based on specific rules of usage. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright violations with Is Fuel Tax Deductible For Truck Drivers?

- Some printables may contain restrictions on usage. Be sure to check the terms and conditions offered by the creator.

-

How do I print Is Fuel Tax Deductible For Truck Drivers?

- Print them at home with your printer or visit an in-store print shop to get top quality prints.

-

What software will I need to access printables that are free?

- The majority of PDF documents are provided as PDF files, which can be opened with free software, such as Adobe Reader.

Are Training Costs Tax Deductible For The Self Employed

Brilliant Tax Write Off Template Stores Inventory Excel Format

Check more sample of Is Fuel Tax Deductible For Truck Drivers below

Court Determines What Truck Driving Expenses Are Deductible

Is IFTA Tax Deductible Leia Aqui Is Fuel Tax Deductible For Truck

Template Driver License

Tax Deductions For Truck Drivers LoveToKnow

Tax Deductible Vs Non Deductible For Churches ChurchTrac Blog

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets

https://www.freshbooks.com/hub/taxes/truck-driver-tax-deductions

Can I claim gas on your taxes for driving to work No the costs for fuel that you incur on your commute between your home and workplace are not tax deductible However fuel costs that truckers incur while driving their business vehicle for work purposes are tax deductible How do truck drivers pay less taxes

https://wmaccountingllc.com/a-comprehensive-guide...

Key Tax Deductions Explained Daily Expenses Per Diem and Fuel Costs Truck drivers can use per diem deductions for nights spent away from home covering meals and incidental costs Additionally fuel and maintenance costs are deductible

Can I claim gas on your taxes for driving to work No the costs for fuel that you incur on your commute between your home and workplace are not tax deductible However fuel costs that truckers incur while driving their business vehicle for work purposes are tax deductible How do truck drivers pay less taxes

Key Tax Deductions Explained Daily Expenses Per Diem and Fuel Costs Truck drivers can use per diem deductions for nights spent away from home covering meals and incidental costs Additionally fuel and maintenance costs are deductible

Tax Deductions For Truck Drivers LoveToKnow

Is IFTA Tax Deductible Leia Aqui Is Fuel Tax Deductible For Truck

Tax Deductible Vs Non Deductible For Churches ChurchTrac Blog

Truck Expenses Worksheet Spreadsheet Template Printable Worksheets

Tax Deductions For Truck Drivers East Insurance Group LLC

40 Itemized Deduction Worksheet 2015 Worksheet Master

40 Itemized Deduction Worksheet 2015 Worksheet Master

What Is The Best Deductible For Car Insurance Compare Insurance Auto