In this age of electronic devices, where screens dominate our lives and the appeal of physical printed objects hasn't waned. In the case of educational materials as well as creative projects or simply to add an individual touch to the space, Is Hra Exempted From Income Tax have become an invaluable resource. Here, we'll take a dive deeper into "Is Hra Exempted From Income Tax," exploring what they are, where to find them and how they can enhance various aspects of your daily life.

Get Latest Is Hra Exempted From Income Tax Below

Is Hra Exempted From Income Tax

Is Hra Exempted From Income Tax -

No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act Can HRA exemption be claimed if living parents A taxpayer can go for a rental agreement with anyone except their spouse and claim HRA

HRA is a part of your salary income and therefore it is initially considered as your taxable income However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption

The Is Hra Exempted From Income Tax are a huge assortment of printable, downloadable material that is available online at no cost. These resources come in various forms, including worksheets, coloring pages, templates and more. The beauty of Is Hra Exempted From Income Tax lies in their versatility and accessibility.

More of Is Hra Exempted From Income Tax

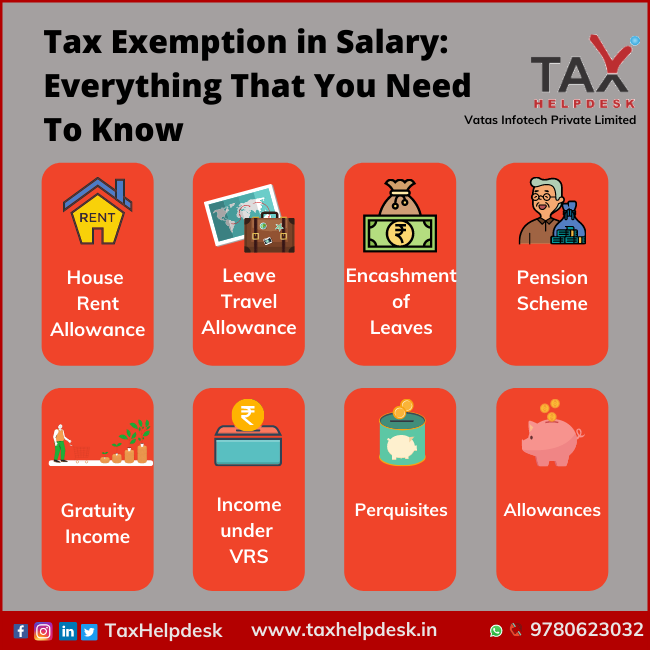

Tax Exemption In Salary Everything That You Need To Know

Tax Exemption In Salary Everything That You Need To Know

What you must remember while claiming tax exemption of HRA or while filing income tax returns ThinkStock Photos You must ask for receipt for the rent paid every month irrespective of the channel used for making payments In April 2017 an income tax tribunal ruling on rent receipts grabbed many eyeballs

House rent allowance is eligible for HRA deduction under Section 10 13A of the Income Tax Act if an individual meets the following criteria The person claiming HRA deduction is a salaried or a self employed individual The person must be living in a rented house HRA tax calculations cannot be made for living in your own house

The Is Hra Exempted From Income Tax have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Modifications: We can customize printed materials to meet your requirements whether it's making invitations making your schedule, or even decorating your home.

-

Educational Value: These Is Hra Exempted From Income Tax cater to learners of all ages, which makes them a useful aid for parents as well as educators.

-

Easy to use: The instant accessibility to a variety of designs and templates reduces time and effort.

Where to Find more Is Hra Exempted From Income Tax

How To Show HRA Not Accounted By The Employer In ITR

How To Show HRA Not Accounted By The Employer In ITR

Therefore you will get Rs 1 32 lakh exemption from income tax You can claim HRA exemptions by submitting your monthly rent receipts However keep in mind that it is mandatory to report the PAN card details of your property owner if you pay more than Rs 1 lakh annually How does the new tax regime impact HRA

Yes you may HRA has no bearing towards your home loan interest deduction Both can be claimed Try out our free HRA calculator to determine your HRA exemption This calculator shows you on what part of your HRA you have to pay taxes i e how much of your HRA is taxable and how much is exempt from tax Ask for your landlord s PAN

Since we've got your interest in printables for free, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of Is Hra Exempted From Income Tax designed for a variety motives.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- These blogs cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Is Hra Exempted From Income Tax

Here are some ways how you could make the most of Is Hra Exempted From Income Tax:

1. Home Decor

- Print and frame stunning art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Print out free worksheets and activities to help reinforce your learning at home also in the classes.

3. Event Planning

- Designs invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Is Hra Exempted From Income Tax are a treasure trove of innovative and useful resources that cater to various needs and preferences. Their accessibility and flexibility make them a valuable addition to both professional and personal lives. Explore the world of Is Hra Exempted From Income Tax now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually free?

- Yes you can! You can print and download these documents for free.

-

Can I make use of free templates for commercial use?

- It's contingent upon the specific terms of use. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with Is Hra Exempted From Income Tax?

- Certain printables might have limitations in use. Make sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- You can print them at home with a printer or visit any local print store for better quality prints.

-

What software do I need to run Is Hra Exempted From Income Tax?

- The majority of PDF documents are provided as PDF files, which can be opened using free software like Adobe Reader.

This Is The Portion Of Your Salary Exempted Deductible From Tax

Income That Is Non taxable Is Called As Exempt Income Section 10 Of

Check more sample of Is Hra Exempted From Income Tax below

Exemption Income Tax Income Tax Deduction Agriculture Income Non

HRA Exemption Calculation From Income Tax Tdstaxindia

HRA Calculator To Determine House Rent Allowance Scripbox

2023

All You Need To Know On Exempted Income In Income Tax Ebizfiling

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

https://cleartax.in/s/hra-house-rent-allowance

HRA is a part of your salary income and therefore it is initially considered as your taxable income However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption

https://tax2win.in/guide/hra-house-rent-allowance

The best part Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A

HRA is a part of your salary income and therefore it is initially considered as your taxable income However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption

The best part Salaried individuals who live in a rented house can claim tax exemption on HRA under Section 10 13A of the Income Tax Act HRA is subject to full or partial tax deductions An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A

2023

HRA Exemption Calculation From Income Tax Tdstaxindia

All You Need To Know On Exempted Income In Income Tax Ebizfiling

How To Claim HRA While Filing Your Income Tax Return ITR SAG Infotech

House Rent Allowance HRA Exemption Section 10 13A Income Tax CA Club

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

What Is HRA ExcelDataPro