Today, with screens dominating our lives The appeal of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons project ideas, artistic or simply to add an extra personal touch to your area, Is Interest On Housing Loan Exempt From Tax In New Regime are now an essential resource. This article will take a dive deeper into "Is Interest On Housing Loan Exempt From Tax In New Regime," exploring what they are, where to find them and how they can enrich various aspects of your daily life.

Get Latest Is Interest On Housing Loan Exempt From Tax In New Regime Below

Is Interest On Housing Loan Exempt From Tax In New Regime

Is Interest On Housing Loan Exempt From Tax In New Regime -

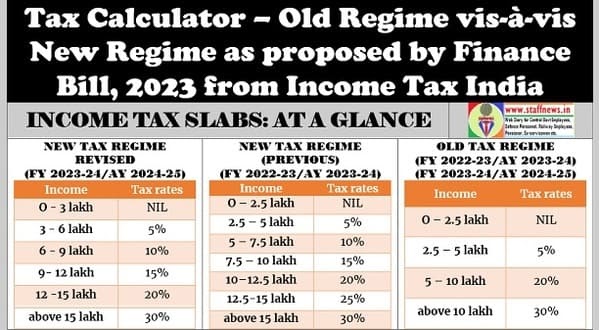

A major chunk of deductions and exemptions are removed under the New Tax Regime The important tax breaks that will no longer be available under the New Tax Regime include Chapter VI A deductions like 80C 80D 80DD 80U 80TTA TTB 80E HRA LTA and interest on Housing Loan There are a few deductions that can still be

Interest on housing loans Under the new tax regime the deduction for interest paid on housing loans is not allowed on self occupied or vacant properties under Section 24 b of the ITA

Printables for free include a vast range of downloadable, printable items that are available online at no cost. The resources are offered in a variety kinds, including worksheets coloring pages, templates and many more. The great thing about Is Interest On Housing Loan Exempt From Tax In New Regime is in their variety and accessibility.

More of Is Interest On Housing Loan Exempt From Tax In New Regime

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

It is important to note that the deduction for interest paid on housing loans taken for a self occupied property is not available under the new tax regime

Interest paid on housing loan taken for a rented out property can be claimed as deduction under section 24 b even in the new proposed tax regime Budget 2020 has proposed a new tax regime with lower tax slab rates along with removal of almost all deductions exemptions

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization We can customize printed materials to meet your requirements, whether it's designing invitations planning your schedule or even decorating your home.

-

Educational Value: Downloads of educational content for free cater to learners from all ages, making them a vital aid for parents as well as educators.

-

Affordability: Fast access many designs and templates, which saves time as well as effort.

Where to Find more Is Interest On Housing Loan Exempt From Tax In New Regime

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

In the case of a self occupied property you cannot claim a deduction on interest for a housing loan under the new tax regime The deduction of Rs 2 lakh allowed in the existing system is not available in the new tax regime

You can exercise your choice after making a comparison of the tax benefits under both the regimes Similar to the existing regime under the new regime you can claim deductions on municipal tax standard deduction of 30

After we've peaked your interest in Is Interest On Housing Loan Exempt From Tax In New Regime Let's take a look at where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in Is Interest On Housing Loan Exempt From Tax In New Regime for different reasons.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free or flashcards as well as learning tools.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs are a vast range of topics, including DIY projects to party planning.

Maximizing Is Interest On Housing Loan Exempt From Tax In New Regime

Here are some ideas how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to enhance learning at home and in class.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars as well as to-do lists and meal planners.

Conclusion

Is Interest On Housing Loan Exempt From Tax In New Regime are an abundance filled with creative and practical information that can meet the needs of a variety of people and hobbies. Their access and versatility makes these printables a useful addition to both professional and personal life. Explore the many options of Is Interest On Housing Loan Exempt From Tax In New Regime right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes you can! You can print and download these free resources for no cost.

-

Are there any free templates for commercial use?

- It's contingent upon the specific rules of usage. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Certain printables may be subject to restrictions concerning their use. Be sure to read the conditions and terms of use provided by the creator.

-

How can I print Is Interest On Housing Loan Exempt From Tax In New Regime?

- You can print them at home with printing equipment or visit any local print store for more high-quality prints.

-

What software must I use to open printables that are free?

- A majority of printed materials are as PDF files, which can be opened with free software like Adobe Reader.

Tax Calculator Old Regime Vis vis New Regime As Proposed By Finance

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

Check more sample of Is Interest On Housing Loan Exempt From Tax In New Regime below

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

All about interest on housing loan Priya Shelar Flickr

All About Deduction Of Housing Loan Interest U s 24 b Of The Income

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

https://news.cleartax.in/new-tax-regime-a-quick-take-on-exemptions/9969

Interest on housing loans Under the new tax regime the deduction for interest paid on housing loans is not allowed on self occupied or vacant properties under Section 24 b of the ITA

https://thetaxtalk.com/2021/04/new-tax-regime-deduction-towards

In case of a self occupied property taxpayers cannot claim a deduction on interest for a housing loan under the new tax regime The deduction of Rs 2 lakh allowable under the existing system is not available in the new tax regime Taxpayers cannot set off the loss of Rs 2 lakh from house property from the salary income

Interest on housing loans Under the new tax regime the deduction for interest paid on housing loans is not allowed on self occupied or vacant properties under Section 24 b of the ITA

In case of a self occupied property taxpayers cannot claim a deduction on interest for a housing loan under the new tax regime The deduction of Rs 2 lakh allowable under the existing system is not available in the new tax regime Taxpayers cannot set off the loss of Rs 2 lakh from house property from the salary income

DEDUCTIONS U S 24 Out Of Net Annual Value NAV Of House Property Income

All about interest on housing loan Priya Shelar Flickr

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

How To Calculate Interest On Housing Loan For Income Tax Haiper

Section 80EE And 80EEA Interest On Housing Loan Deduction

Section 80EE And 80EEA Interest On Housing Loan Deduction

New Builds To Be Exempt From Tax Rule Change For 20 Years Interest