In the digital age, in which screens are the norm but the value of tangible printed items hasn't gone away. In the case of educational materials or creative projects, or just adding an extra personal touch to your space, Is Medical Reimbursement Taxable For Central Government Employees can be an excellent resource. For this piece, we'll dive deep into the realm of "Is Medical Reimbursement Taxable For Central Government Employees," exploring what they are, how they are, and the ways that they can benefit different aspects of your daily life.

Get Latest Is Medical Reimbursement Taxable For Central Government Employees Below

Is Medical Reimbursement Taxable For Central Government Employees

Is Medical Reimbursement Taxable For Central Government Employees -

Employer run government run or Central Government approved hospitals have no upper limit on expense reimbursements In contrast to the medical allowance medical reimbursement is separate and distinct

There are primarily three ways of funding your medical expenses 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer does not provide any medical benefit 2 Medical reimbursement provided by employer in case of salaried people only

Printables for free cover a broad range of printable, free materials online, at no cost. These resources come in various styles, from worksheets to coloring pages, templates and much more. The beauty of Is Medical Reimbursement Taxable For Central Government Employees is their flexibility and accessibility.

More of Is Medical Reimbursement Taxable For Central Government Employees

Is Employee Mileage Reimbursement Taxable

Is Employee Mileage Reimbursement Taxable

When both husband and wife are Govt Servants both can claim reimbursement of medical expenses for their respective parents Q Both the husband and wife are employees of a Central Government Organization and claiming the

Revision of Rates for reimbursement of Medical Expenses Incurred in Emergency Conditions under CSMA Rules OM S 14025 14 2012 MS 1 06 MB

Printables for free have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Customization: The Customization feature lets you tailor the design to meet your needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your home.

-

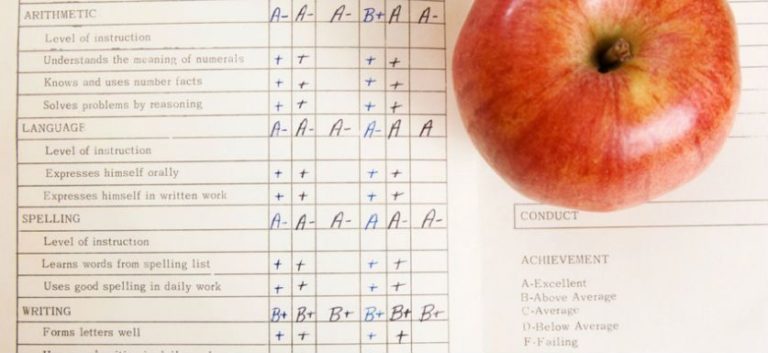

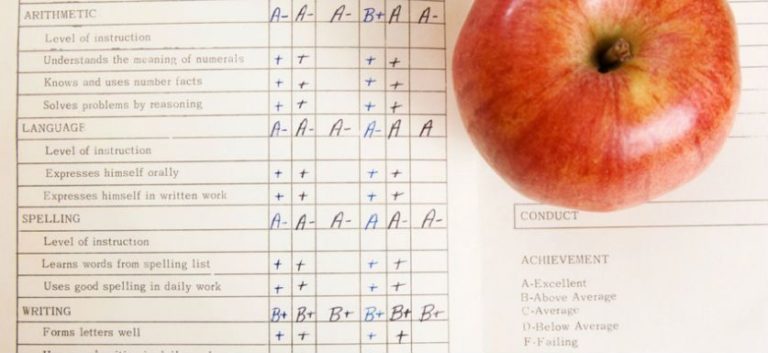

Educational Value Downloads of educational content for free are designed to appeal to students from all ages, making the perfect device for teachers and parents.

-

An easy way to access HTML0: Fast access the vast array of design and templates cuts down on time and efforts.

Where to Find more Is Medical Reimbursement Taxable For Central Government Employees

Is Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

CGHS is the model Health care facility provider for Central Government employees Pensioners and is unique of its kind due to the large volume of beneficiary base and open ended generous approach of providing health care

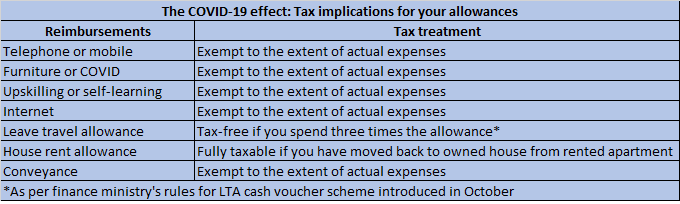

Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and generally is subject to federal income tax withholding Social Security and Medicare taxes

Now that we've piqued your interest in Is Medical Reimbursement Taxable For Central Government Employees, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection with Is Medical Reimbursement Taxable For Central Government Employees for all objectives.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free including flashcards, learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad spectrum of interests, that range from DIY projects to party planning.

Maximizing Is Medical Reimbursement Taxable For Central Government Employees

Here are some inventive ways that you can make use of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print free worksheets to enhance your learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Is Medical Reimbursement Taxable For Central Government Employees are a treasure trove of innovative and useful resources that meet a variety of needs and pursuits. Their availability and versatility make them a wonderful addition to your professional and personal life. Explore the world of Is Medical Reimbursement Taxable For Central Government Employees to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free are they free?

- Yes, they are! You can print and download these resources at no cost.

-

Do I have the right to use free printables in commercial projects?

- It is contingent on the specific usage guidelines. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may contain restrictions on use. You should read the terms of service and conditions provided by the author.

-

How do I print Is Medical Reimbursement Taxable For Central Government Employees?

- You can print them at home using an printer, or go to an in-store print shop to get superior prints.

-

What software do I need to run printables for free?

- The majority are printed as PDF files, which can be opened using free software, such as Adobe Reader.

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Check more sample of Is Medical Reimbursement Taxable For Central Government Employees below

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Medical Reimbursement Claim Form For Central Government Employees

Is Tuition Reimbursement Taxable A Guide ClearDegree

Is Travel Reimbursement Taxable Exploring The Tax Implications The

What Is Educational Assistance Is Education Reimbursement Taxable

https://taxguru.in/income-tax/taxability-medical...

There are primarily three ways of funding your medical expenses 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer does not provide any medical benefit 2 Medical reimbursement provided by employer in case of salaried people only

https://cleartax.in/s/central-government-health-scheme

The CGHS provides medical care to Central Government employees and pensioners It covers various systems of medicine and offers benefits like OPD treatments specialist consultations indoor treatments and reimbursement for treatment expenses

There are primarily three ways of funding your medical expenses 1 To pay medical expenses out of your own source It happens in case of non insured self employed persons or for non insured salaried people where employer does not provide any medical benefit 2 Medical reimbursement provided by employer in case of salaried people only

The CGHS provides medical care to Central Government employees and pensioners It covers various systems of medicine and offers benefits like OPD treatments specialist consultations indoor treatments and reimbursement for treatment expenses

Is Tuition Reimbursement Taxable A Guide ClearDegree

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Is Travel Reimbursement Taxable Exploring The Tax Implications The

What Is Educational Assistance Is Education Reimbursement Taxable

Reimbursement Of Medical Expenses A Brief Detail Your Guide To

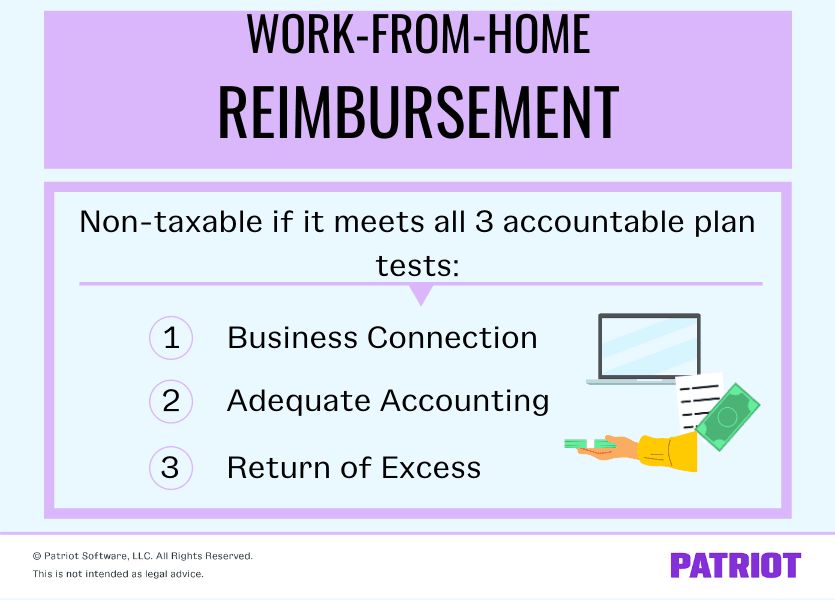

Work from home Reimbursement Definition Taxes Policy

Work from home Reimbursement Definition Taxes Policy

Travelling Allowance Subject To Epf AnabelletaroOchoa