In the age of digital, where screens rule our lives but the value of tangible printed material hasn't diminished. No matter whether it's for educational uses for creative projects, just adding personal touches to your area, Is Medical Reimbursement Taxable In India have become a valuable source. For this piece, we'll dive in the world of "Is Medical Reimbursement Taxable In India," exploring what they are, how to locate them, and how they can improve various aspects of your lives.

Get Latest Is Medical Reimbursement Taxable In India Below

Is Medical Reimbursement Taxable In India

Is Medical Reimbursement Taxable In India -

Medical Allowance is fully taxable and employee is not required to furnish any bills to employer to get the medical allowance 1B Medical Reimbursement It means the

3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical

Is Medical Reimbursement Taxable In India cover a large array of printable material that is available online at no cost. These resources come in many forms, including worksheets, templates, coloring pages and more. The appealingness of Is Medical Reimbursement Taxable In India lies in their versatility and accessibility.

More of Is Medical Reimbursement Taxable In India

Is Crowdfunding Taxable In India No Know The TAX BENEFITS

Is Crowdfunding Taxable In India No Know The TAX BENEFITS

Unlike allowance medical reimbursements are exempt from tax to a certain extent Currently reimbursements up to Rs 15 000 each year is exempt from taxation To claim

Yes in India Medical Reimbursements are exempted from Income Tax but only up to Rs 15000 in a year However if the amount exceeds the exemption limit then

The Is Medical Reimbursement Taxable In India have gained huge popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or expensive software.

-

Flexible: This allows you to modify the design to meet your needs be it designing invitations and schedules, or decorating your home.

-

Educational Worth: These Is Medical Reimbursement Taxable In India are designed to appeal to students from all ages, making them a great instrument for parents and teachers.

-

Accessibility: Fast access a myriad of designs as well as templates reduces time and effort.

Where to Find more Is Medical Reimbursement Taxable In India

Is Employee Mileage Reimbursement Taxable

Is Employee Mileage Reimbursement Taxable

As per section 17 2 of the income tax act reimbursement against medical expenses of Rs 15 000 in a year is exempt from tax Who is Eligible to Claim Medical

This report seeks to address some typical issues relating to taxability of reimbursements in light of the prevalent tax legislation and the courts rulings in India 2 Meaning of

We hope we've stimulated your interest in printables for free Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection with Is Medical Reimbursement Taxable In India for all purposes.

- Explore categories like home decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free or flashcards as well as learning tools.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- The blogs are a vast array of topics, ranging that range from DIY projects to planning a party.

Maximizing Is Medical Reimbursement Taxable In India

Here are some unique ways how you could make the most of Is Medical Reimbursement Taxable In India:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Is Medical Reimbursement Taxable In India are an abundance with useful and creative ideas that satisfy a wide range of requirements and interests. Their accessibility and versatility make them an invaluable addition to both professional and personal life. Explore the world of Is Medical Reimbursement Taxable In India today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes they are! You can print and download the resources for free.

-

Can I use the free printables for commercial use?

- It is contingent on the specific terms of use. Always consult the author's guidelines before using printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables could have limitations regarding their use. You should read the terms and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using either a printer at home or in a local print shop to purchase more high-quality prints.

-

What software is required to open printables that are free?

- Many printables are offered in the format of PDF, which can be opened using free software, such as Adobe Reader.

Is Mileage Reimbursement Taxable

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Check more sample of Is Medical Reimbursement Taxable In India below

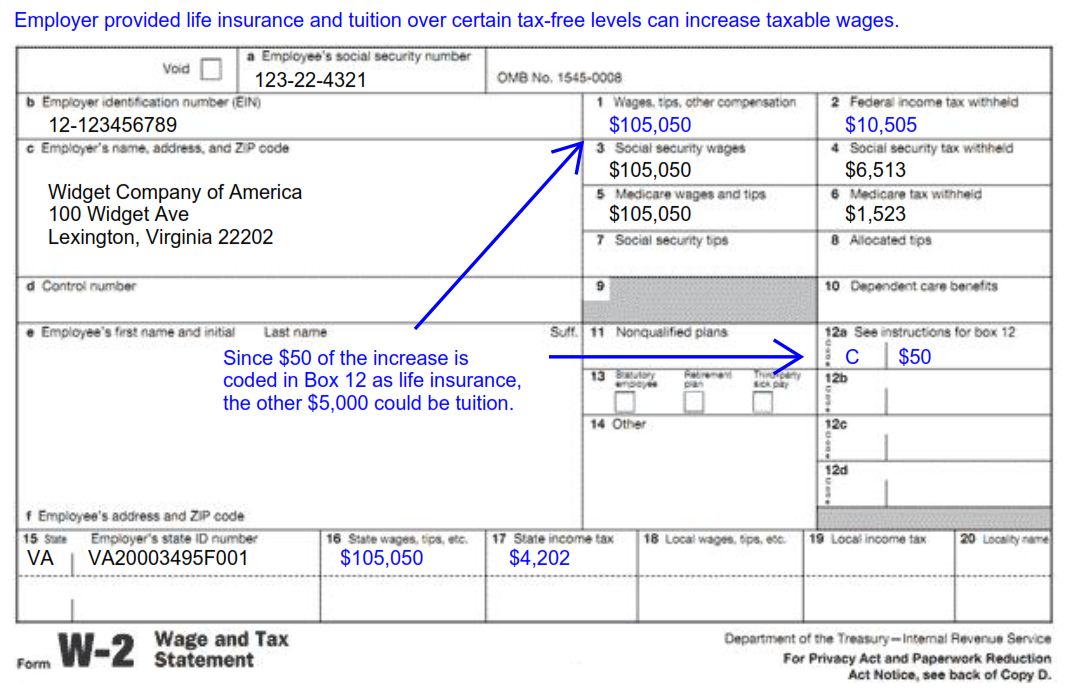

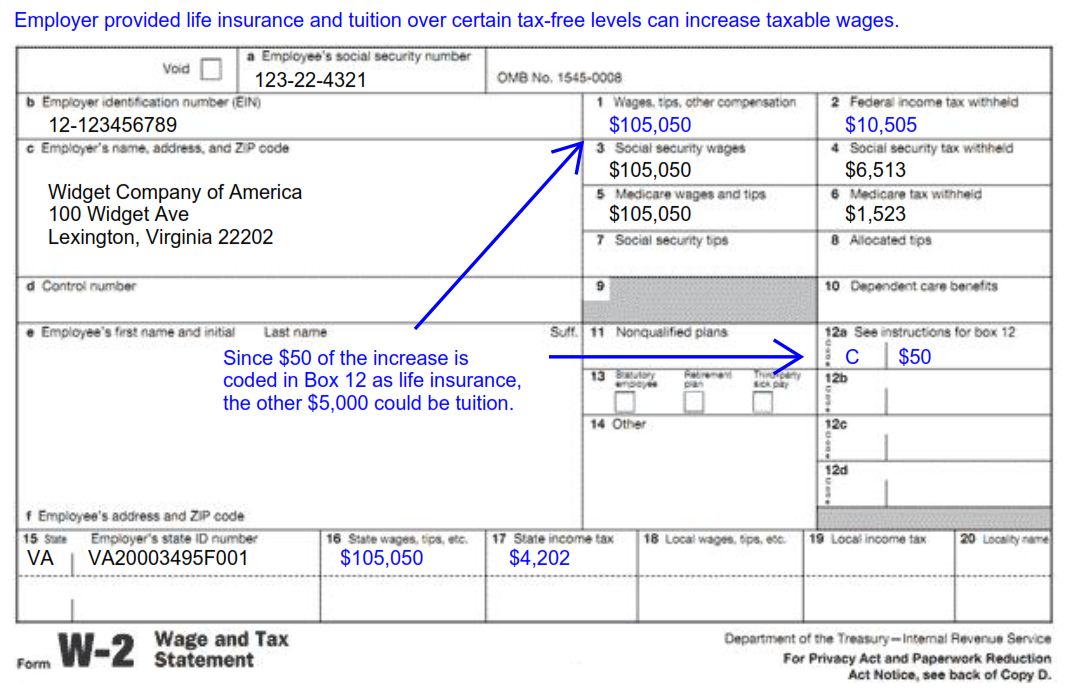

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Salary Reimbursement Of Seconded Employees Not Taxable In The Hands Of

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

What Is Healthcare Reimbursement Insurance Noon

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

What Is Pre Tax Commuter Benefit

https://taxguru.in/income-tax/taxability-medica…

3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical

https://www.financialexpress.com/money/are-medical...

While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable

3 Income Tax treatment in case of medical insurance reimbursement under mediclaim policy for both salaried as well as non salaried people Money received through a claim under a medical

While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable

What Is Healthcare Reimbursement Insurance Noon

Salary Reimbursement Of Seconded Employees Not Taxable In The Hands Of

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

What Is Pre Tax Commuter Benefit

Is Tuition Reimbursement Taxable A Guide ClearDegree

GST Reimbursement Of Toll Charge Liable To Include In The Value Of

GST Reimbursement Of Toll Charge Liable To Include In The Value Of

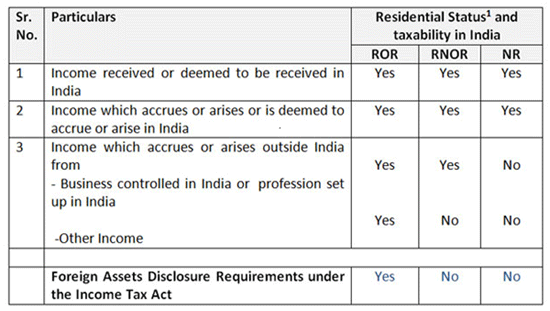

Income Tax Deductions To NRI In India India Financial Cons