In this age of technology, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. Whatever the reason, whether for education for creative projects, just adding an element of personalization to your space, Is Medical Reimbursement Taxable In New Tax Regime are now an essential resource. With this guide, you'll dive through the vast world of "Is Medical Reimbursement Taxable In New Tax Regime," exploring their purpose, where you can find them, and ways they can help you improve many aspects of your life.

Get Latest Is Medical Reimbursement Taxable In New Tax Regime Below

Is Medical Reimbursement Taxable In New Tax Regime

Is Medical Reimbursement Taxable In New Tax Regime -

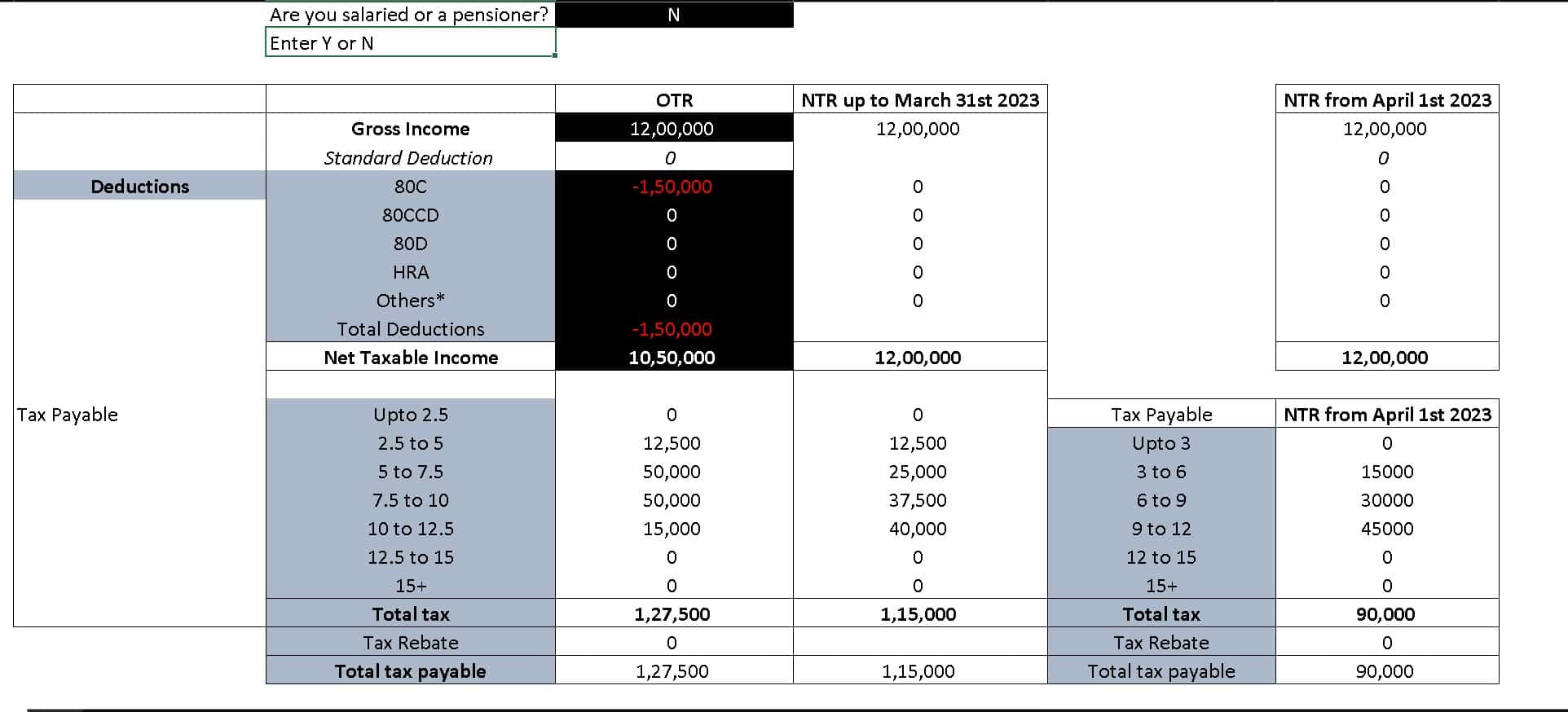

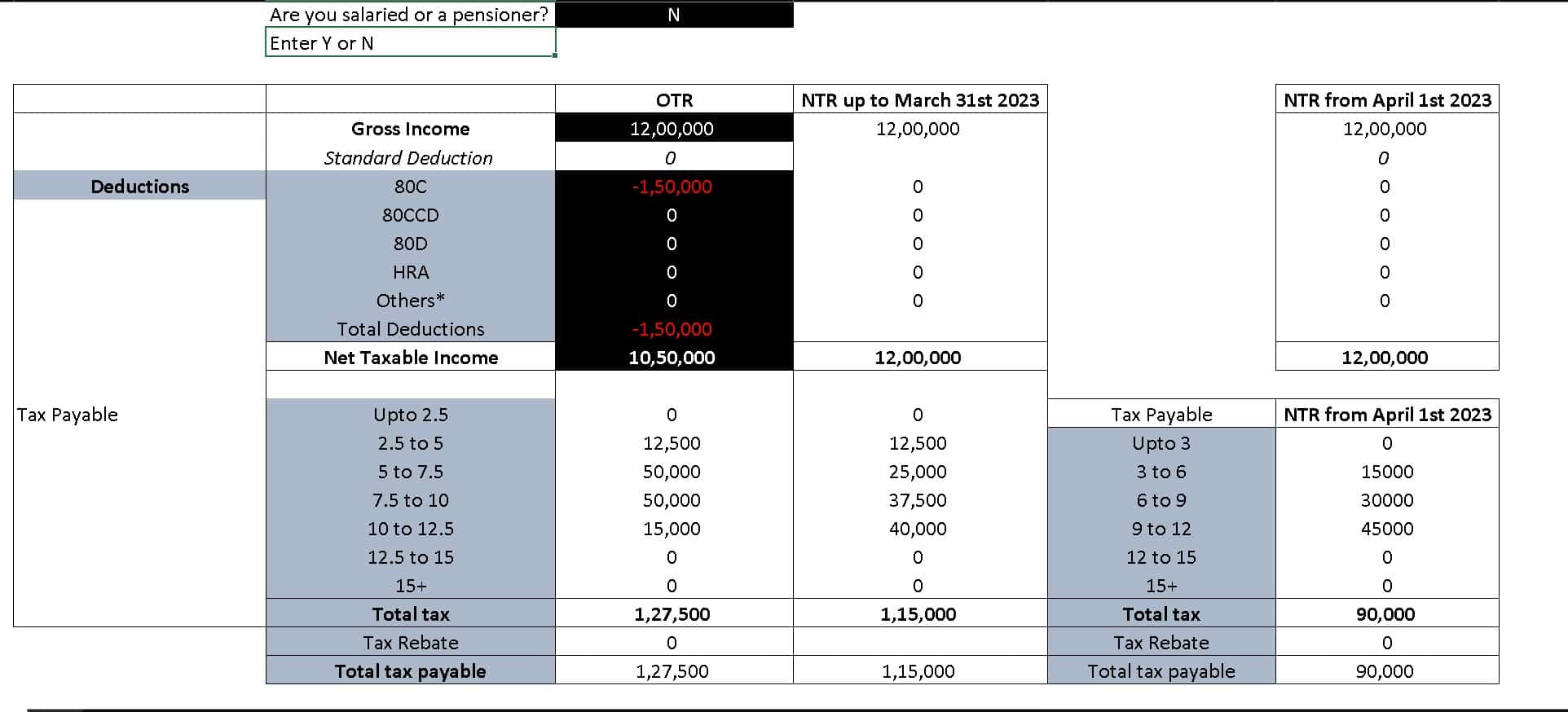

Following are the changes made in the new tax regime for FY2023 24 and onwards a Income tax slabs reduced from six to five b Basic exemption limit hiked to

Section 80D This deduction is available for premium paid on medical insurance policy An individual can claim maximum deduction of Rs 25 000 for insurance

Is Medical Reimbursement Taxable In New Tax Regime provide a diverse assortment of printable documents that can be downloaded online at no cost. These resources come in many designs, including worksheets coloring pages, templates and many more. The value of Is Medical Reimbursement Taxable In New Tax Regime is their flexibility and accessibility.

More of Is Medical Reimbursement Taxable In New Tax Regime

Is Employee Mileage Reimbursement Taxable

Is Employee Mileage Reimbursement Taxable

This means that the new regime is applicable as of 1 January 2022 Time for a more extensive update Conditions The new expat regime can be divided into two systems the Special Tax Regime

Old Tax Regime New tax Regime until 31st March 2023 New Tax Regime From 1st April 2023 Income level for rebate eligibility 5 lakhs 5 lakhs 7 lakhs Standard Deduction 50 000 50 000 Effective Tax

Is Medical Reimbursement Taxable In New Tax Regime have gained a lot of appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Customization: It is possible to tailor printables to fit your particular needs such as designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Impact: These Is Medical Reimbursement Taxable In New Tax Regime offer a wide range of educational content for learners of all ages. This makes them a valuable source for educators and parents.

-

An easy way to access HTML0: Fast access a variety of designs and templates is time-saving and saves effort.

Where to Find more Is Medical Reimbursement Taxable In New Tax Regime

Is Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

HRA is available only to salaried individuals who are planning to opt for old tax regime Watch Business Today s Visual Story to know more about tax exemptions and deductions under the new tax tegime

What are the income tax slab and tax rates under the revised new tax regime As per Budget 2023 the income tax slabs under the new income tax regime

In the event that we've stirred your interest in Is Medical Reimbursement Taxable In New Tax Regime, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Is Medical Reimbursement Taxable In New Tax Regime suitable for many reasons.

- Explore categories such as furniture, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning materials.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- The blogs covered cover a wide selection of subjects, starting from DIY projects to planning a party.

Maximizing Is Medical Reimbursement Taxable In New Tax Regime

Here are some inventive ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to aid in learning at your home for the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is Medical Reimbursement Taxable In New Tax Regime are a treasure trove filled with creative and practical information that cater to various needs and needs and. Their accessibility and flexibility make them a great addition to both professional and personal life. Explore the many options of Is Medical Reimbursement Taxable In New Tax Regime now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really available for download?

- Yes you can! You can print and download these items for free.

-

Can I use the free printables for commercial use?

- It's all dependent on the conditions of use. Make sure you read the guidelines for the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables could have limitations regarding usage. Be sure to check the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home using printing equipment or visit an area print shop for more high-quality prints.

-

What program is required to open printables that are free?

- Most PDF-based printables are available in PDF format, which is open with no cost programs like Adobe Reader.

Difference Between Old Vs New Tax Regime Which Is Better Vrogue

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Check more sample of Is Medical Reimbursement Taxable In New Tax Regime below

Changes In New Tax Regime All You Need To Know

Is Labor Only Taxable In New Jersey Best Reviews

Is EPF Employer Contribution Taxable In The Revised New Tax Regime

Additional Benefit In New Tax Regime For Those With Net Taxable Income

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

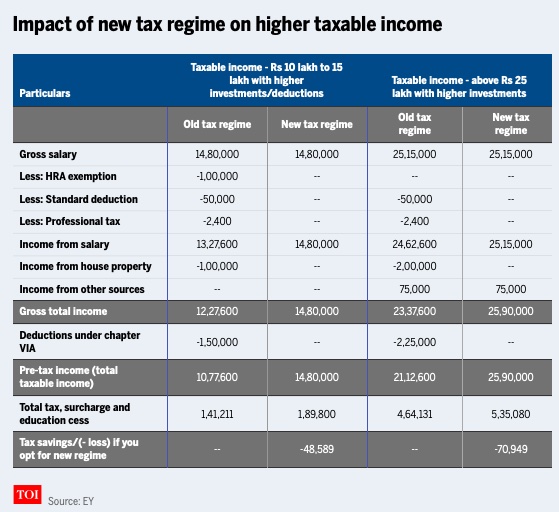

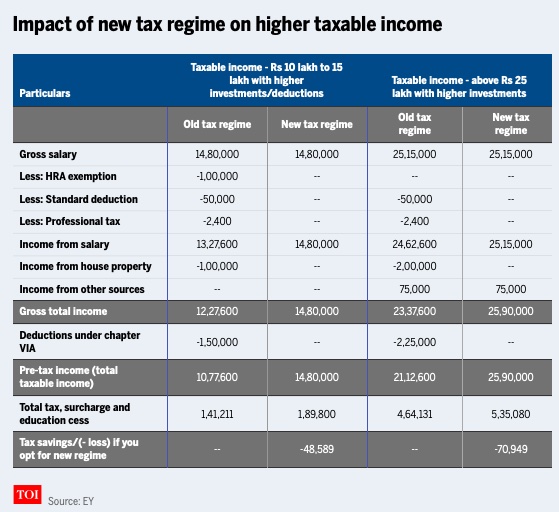

File Impact Of New Tax Regime On Higher Taxable Income As In 2020 21

https://m.economictimes.com/wealth/tax/new-tax...

Section 80D This deduction is available for premium paid on medical insurance policy An individual can claim maximum deduction of Rs 25 000 for insurance

https://www.basunivesh.com/new-tax-regim…

During the Budget 2020 Finance Minister introduced the new tax regime However an option has been given to pay tax at lower

Section 80D This deduction is available for premium paid on medical insurance policy An individual can claim maximum deduction of Rs 25 000 for insurance

During the Budget 2020 Finance Minister introduced the new tax regime However an option has been given to pay tax at lower

Additional Benefit In New Tax Regime For Those With Net Taxable Income

Is Labor Only Taxable In New Jersey Best Reviews

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

File Impact Of New Tax Regime On Higher Taxable Income As In 2020 21

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

What Is Pre Tax Commuter Benefit

What Is Pre Tax Commuter Benefit

Is Repair Labor Taxable In New Jersey Best Reviews