Today, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed items hasn't gone away. No matter whether it's for educational uses such as creative projects or simply to add the personal touch to your space, Is Medical Reimbursement Taxable In Singapore are now a useful resource. The following article is a take a dive into the world "Is Medical Reimbursement Taxable In Singapore," exploring what they are, where they can be found, and how they can enhance various aspects of your daily life.

Get Latest Is Medical Reimbursement Taxable In Singapore Below

Is Medical Reimbursement Taxable In Singapore

Is Medical Reimbursement Taxable In Singapore -

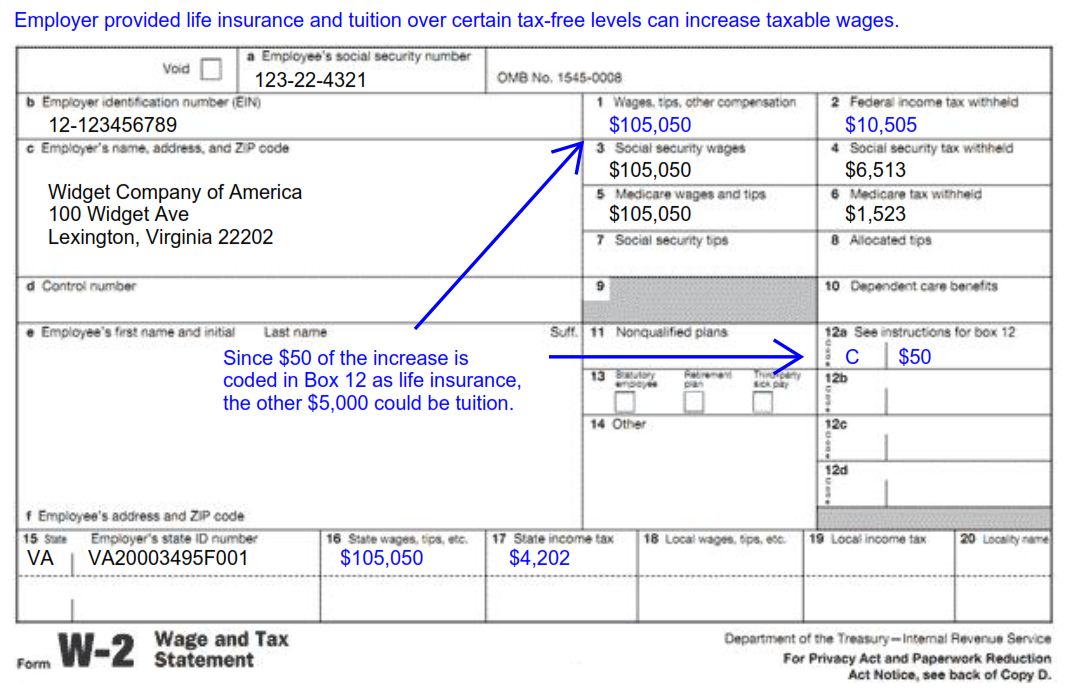

Scheme PMBS or the Transferable Medical Insurance Scheme TMIS can enjoy a higher tax deduction for medical expenses of up to 2 of their employees remuneration

Medical Expenses If the medical expenses including rider premiums do not exceed 1 of the total remuneration of the employees for the relevant basis period the full amount of

Printables for free cover a broad range of downloadable, printable materials online, at no cost. They are available in numerous designs, including worksheets templates, coloring pages and much more. The appeal of printables for free is in their versatility and accessibility.

More of Is Medical Reimbursement Taxable In Singapore

Is Employee Mileage Reimbursement Taxable

Is Employee Mileage Reimbursement Taxable

If medical costs were paid by your employee using cash MediSave or MediShield you must reimburse payment in the following order Reimburse the cash

You will need to submit relevant documents such as the finalised medical bill Healthcare payments and claims statement and or MediSave transaction statement to your

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: You can tailor printables to fit your particular needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Printables for education that are free offer a wide range of educational content for learners of all ages, making the perfect tool for teachers and parents.

-

An easy way to access HTML0: You have instant access the vast array of design and templates can save you time and energy.

Where to Find more Is Medical Reimbursement Taxable In Singapore

Is Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

Payments made to employees for working beyond official working hours on ad hoc basis are not taxable if the overtime meal allowance reimbursement policy is available to all

Besides medical leave wages and medical expenses for up to one year or up to 45 000 employees are also entitled to lump sum compensation for permanent

We've now piqued your interest in Is Medical Reimbursement Taxable In Singapore, let's explore where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Is Medical Reimbursement Taxable In Singapore for all motives.

- Explore categories like decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums frequently offer worksheets with printables that are free, flashcards, and learning materials.

- Perfect for teachers, parents as well as students who require additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad range of interests, that includes DIY projects to party planning.

Maximizing Is Medical Reimbursement Taxable In Singapore

Here are some innovative ways how you could make the most use of Is Medical Reimbursement Taxable In Singapore:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets from the internet to enhance learning at home for the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Is Medical Reimbursement Taxable In Singapore are an abundance of practical and imaginative resources that meet a variety of needs and passions. Their accessibility and versatility make them a valuable addition to any professional or personal life. Explore the vast array of Is Medical Reimbursement Taxable In Singapore and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes, they are! You can print and download these items for free.

-

Can I utilize free printouts for commercial usage?

- It depends on the specific terms of use. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright issues when you download Is Medical Reimbursement Taxable In Singapore?

- Some printables could have limitations regarding usage. Make sure to read these terms and conditions as set out by the designer.

-

How can I print Is Medical Reimbursement Taxable In Singapore?

- You can print them at home using any printer or head to any local print store for better quality prints.

-

What program is required to open printables at no cost?

- Most printables come in PDF format. These can be opened with free software, such as Adobe Reader.

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Is Health Insurance Reimbursement Taxable

Check more sample of Is Medical Reimbursement Taxable In Singapore below

What Is Healthcare Reimbursement Insurance Noon

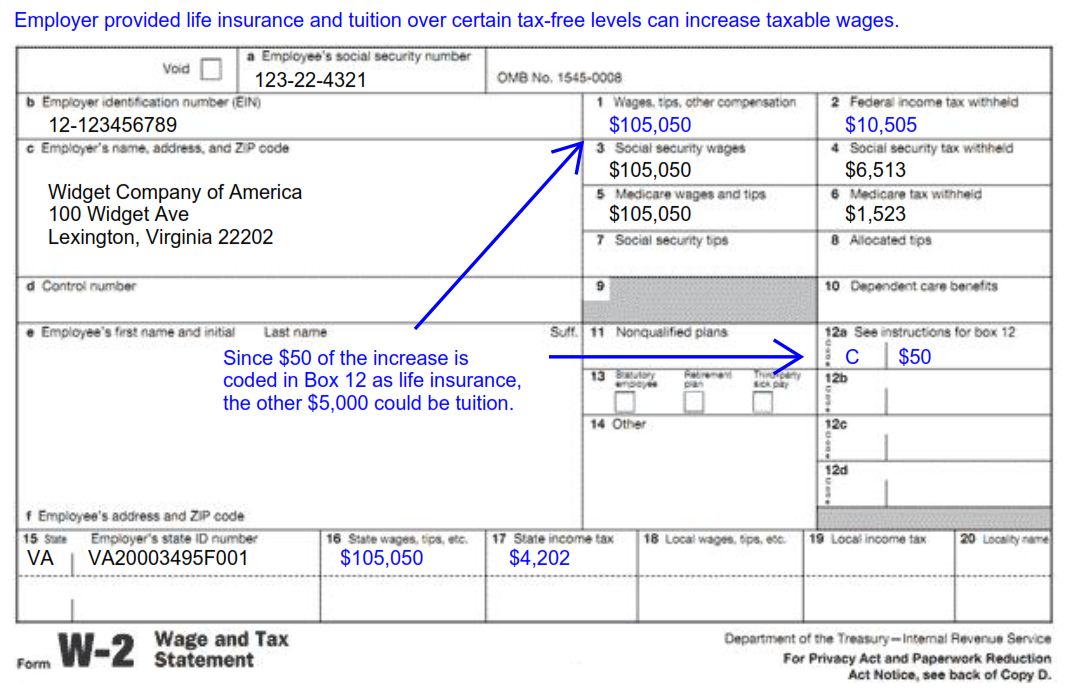

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Is Dividend Income Taxable In Singapore Sprout Asia

What Is Pre Tax Commuter Benefit

https://www.iras.gov.sg/taxes/corporate-income-tax/...

Medical Expenses If the medical expenses including rider premiums do not exceed 1 of the total remuneration of the employees for the relevant basis period the full amount of

https://singaporelegaladvice.com/law-ar…

However employers are legally required to reimburse medical expenses under certain circumstances Transport expenses

Medical Expenses If the medical expenses including rider premiums do not exceed 1 of the total remuneration of the employees for the relevant basis period the full amount of

However employers are legally required to reimburse medical expenses under certain circumstances Transport expenses

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Is Dividend Income Taxable In Singapore Sprout Asia

What Is Pre Tax Commuter Benefit

Is Tuition Reimbursement Taxable A Guide ClearDegree

GST Reimbursement Of Toll Charge Liable To Include In The Value Of

GST Reimbursement Of Toll Charge Liable To Include In The Value Of

Is Travel Reimbursement Taxable Exploring The Tax Implications The