In the digital age, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons and creative work, or just adding the personal touch to your space, Is Medical Reimbursement Taxable Income are now a vital resource. Through this post, we'll dive into the world of "Is Medical Reimbursement Taxable Income," exploring the different types of printables, where to find them, and how they can be used to enhance different aspects of your lives.

Get Latest Is Medical Reimbursement Taxable Income Below

Is Medical Reimbursement Taxable Income

Is Medical Reimbursement Taxable Income -

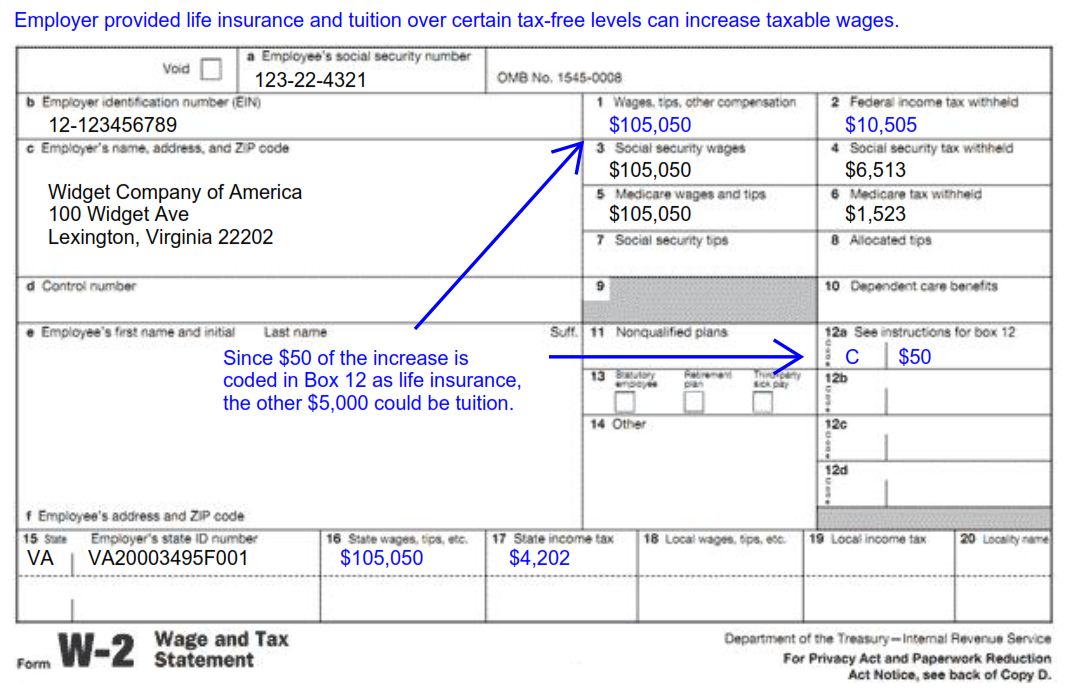

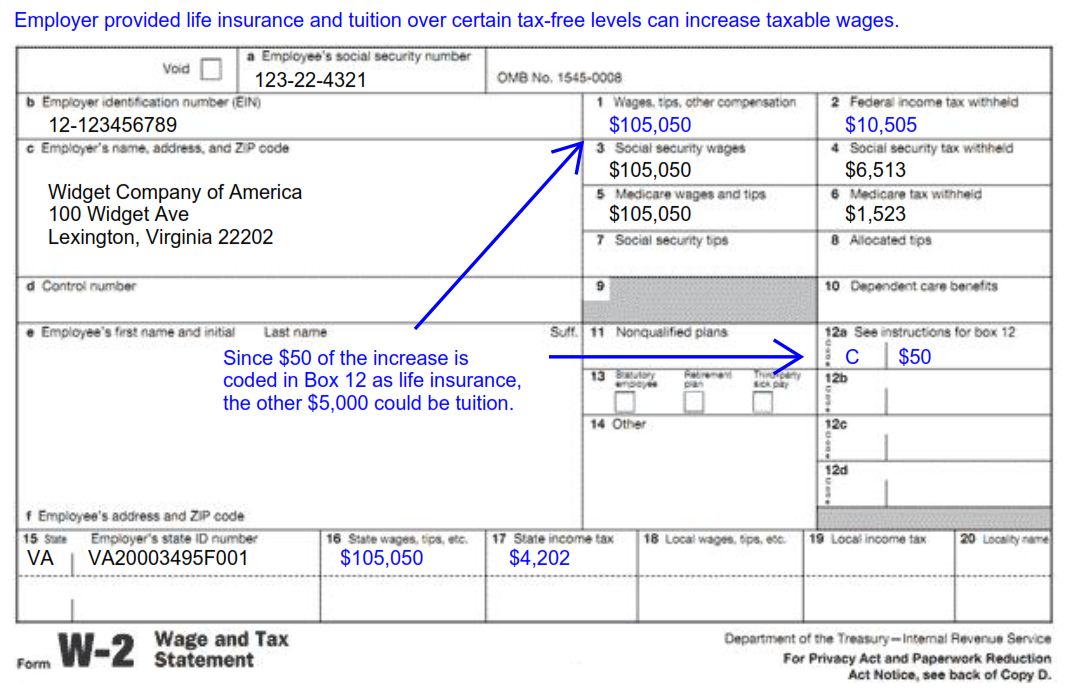

Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and generally is subject to federal income tax withholding Social Security and Medicare taxes For

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in most cases aren t included in your income

Is Medical Reimbursement Taxable Income cover a large range of downloadable, printable items that are available online at no cost. They are available in a variety of types, such as worksheets templates, coloring pages and much more. The benefit of Is Medical Reimbursement Taxable Income is in their versatility and accessibility.

More of Is Medical Reimbursement Taxable Income

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Is Relocation Reimbursement Taxable How To Assess Tax Liability For

Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans

Is the medical allowance taxable Medical Allowance is entirely taxable However Medical reimbursement up to INR 15 000 is not taxable up to FY 2017 18 However from FY 2018 19 onwards medical reimbursement has been discontinued

Is Medical Reimbursement Taxable Income have garnered immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization They can make printables to your specific needs, whether it's designing invitations and schedules, or even decorating your house.

-

Educational Value Free educational printables offer a wide range of educational content for learners of all ages, making these printables a powerful resource for educators and parents.

-

It's easy: Fast access the vast array of design and templates reduces time and effort.

Where to Find more Is Medical Reimbursement Taxable Income

Is Tuition Reimbursement Taxable A Guide ClearDegree

Is Tuition Reimbursement Taxable A Guide ClearDegree

Health insurance reimbursement can be tax free for your business and your employees Explore the tax differences between HRAs and healthcare stipends

The monthly taxable amount paid by an employer as part of a worker s taxable salary is known as the Medical Allowance Medical reimbursement requires the submission of proper medical bills to receive compensation

We've now piqued your interest in Is Medical Reimbursement Taxable Income we'll explore the places you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection of Is Medical Reimbursement Taxable Income for various needs.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free, flashcards, and learning materials.

- Ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates, which are free.

- The blogs are a vast spectrum of interests, everything from DIY projects to planning a party.

Maximizing Is Medical Reimbursement Taxable Income

Here are some fresh ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Is Medical Reimbursement Taxable Income are a treasure trove of useful and creative resources catering to different needs and pursuits. Their accessibility and versatility make they a beneficial addition to both professional and personal lives. Explore the endless world of Is Medical Reimbursement Taxable Income and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Medical Reimbursement Taxable Income really free?

- Yes they are! You can print and download these documents for free.

-

Can I utilize free printables for commercial purposes?

- It's based on the terms of use. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download printables that are free?

- Some printables may have restrictions in use. Be sure to check the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home using printing equipment or visit an area print shop for higher quality prints.

-

What software do I require to open printables free of charge?

- The majority of printed documents are as PDF files, which can be opened with free software, such as Adobe Reader.

Is Employee Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

Check more sample of Is Medical Reimbursement Taxable Income below

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Is Health Insurance Reimbursement Taxable Income Bedgut

Payment Or Reimbursement Of Medical Expenses By The Employer Is It

What Is Healthcare Reimbursement Insurance Noon

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

https://www.irs.gov/publications/p525

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in most cases aren t included in your income

https://taxguru.in/income-tax/taxability-medical...

In case of self financed medical expenses i e from own source there is no income to the person who has incurred expenses Hence the question of chargeability of tax does not arise Now the question arises Whether such expenses can be treated as allowable expenditure under Income Tax

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in most cases aren t included in your income

In case of self financed medical expenses i e from own source there is no income to the person who has incurred expenses Hence the question of chargeability of tax does not arise Now the question arises Whether such expenses can be treated as allowable expenditure under Income Tax

Payment Or Reimbursement Of Medical Expenses By The Employer Is It

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

What Is Healthcare Reimbursement Insurance Noon

Is Travel Reimbursement Taxable Exploring The Tax Implications Of

Is Travel Reimbursement Taxable Exploring The Tax Implications The

What Is Pre Tax Commuter Benefit

What Is Pre Tax Commuter Benefit

Reimbursement Of Medical Expenses A Brief Detail Your Guide To