Today, with screens dominating our lives but the value of tangible printed materials hasn't faded away. For educational purposes and creative work, or just adding a personal touch to your area, Is Medicare Part B Premium Reimbursement Taxable are now an essential resource. This article will take a dive through the vast world of "Is Medicare Part B Premium Reimbursement Taxable," exploring what they are, how to find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Is Medicare Part B Premium Reimbursement Taxable Below

Is Medicare Part B Premium Reimbursement Taxable

Is Medicare Part B Premium Reimbursement Taxable -

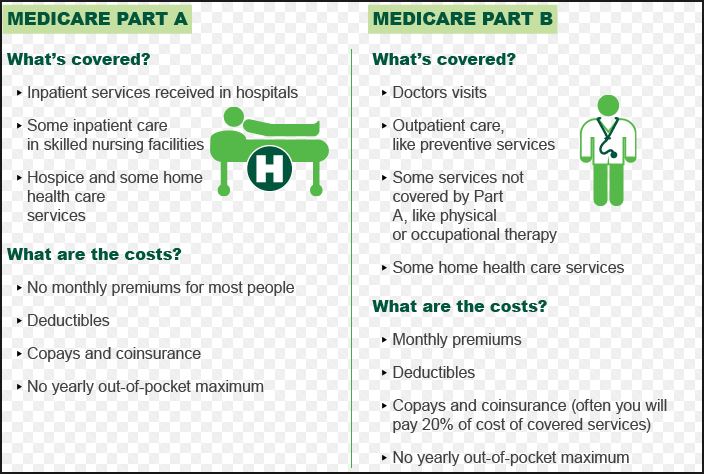

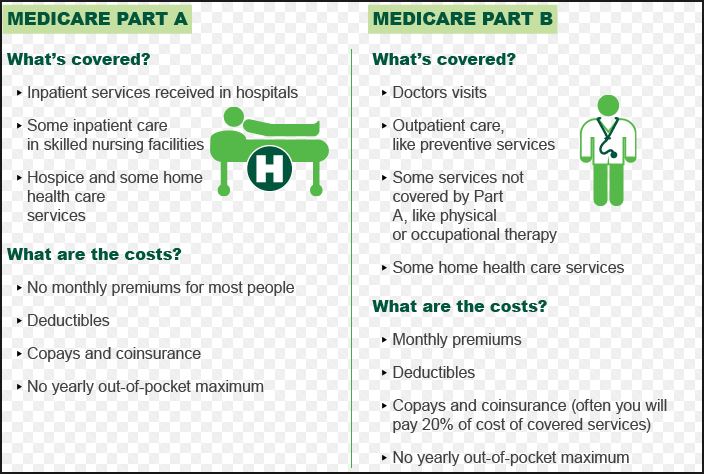

Verkko 28 syysk 2023 nbsp 0183 32 Yes your monthly Medicare Part B premiums are tax deductible However you can only benefit from the medical expense deduction by following specific rules You ll need to file your taxes in a certain way itemizing your deductions instead of choosing the standard deduction

Verkko 31 maalisk 2022 nbsp 0183 32 Probably nothing needed Medicare part B and D premiums are carried to your medical expenses for itemized deduction If you take the standard deduction then you are not gaining a deduction so no need to include the reimbursement

Printables for free cover a broad assortment of printable, downloadable content that can be downloaded from the internet at no cost. These resources come in many types, like worksheets, coloring pages, templates and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of Is Medicare Part B Premium Reimbursement Taxable

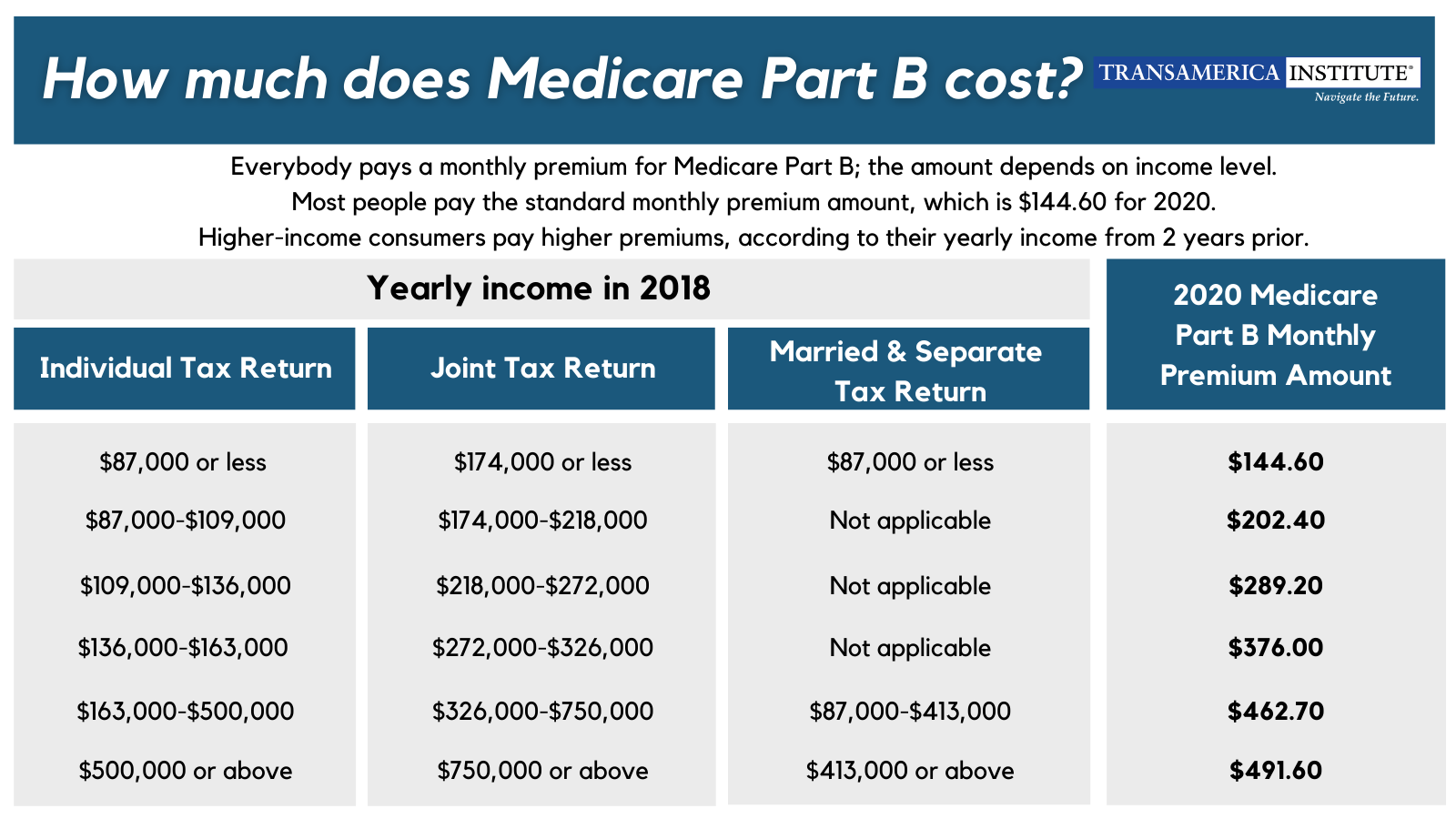

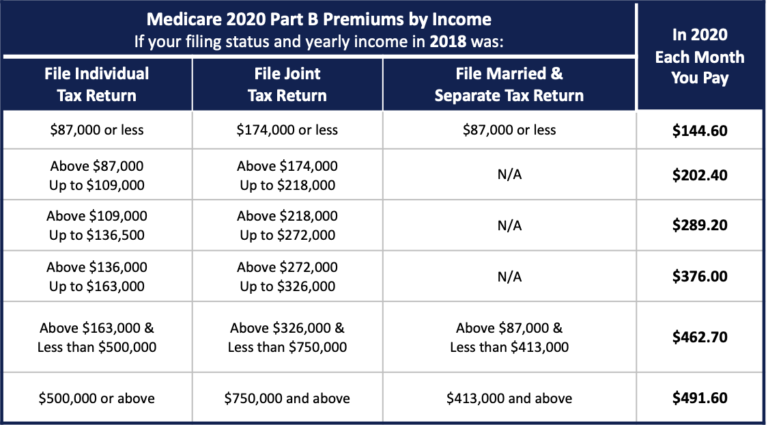

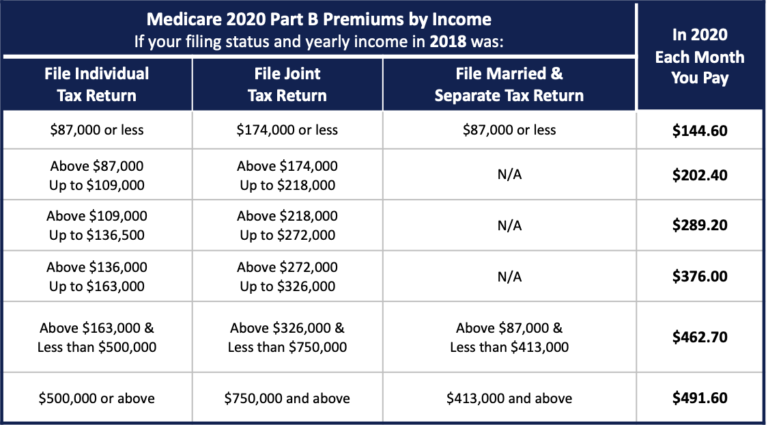

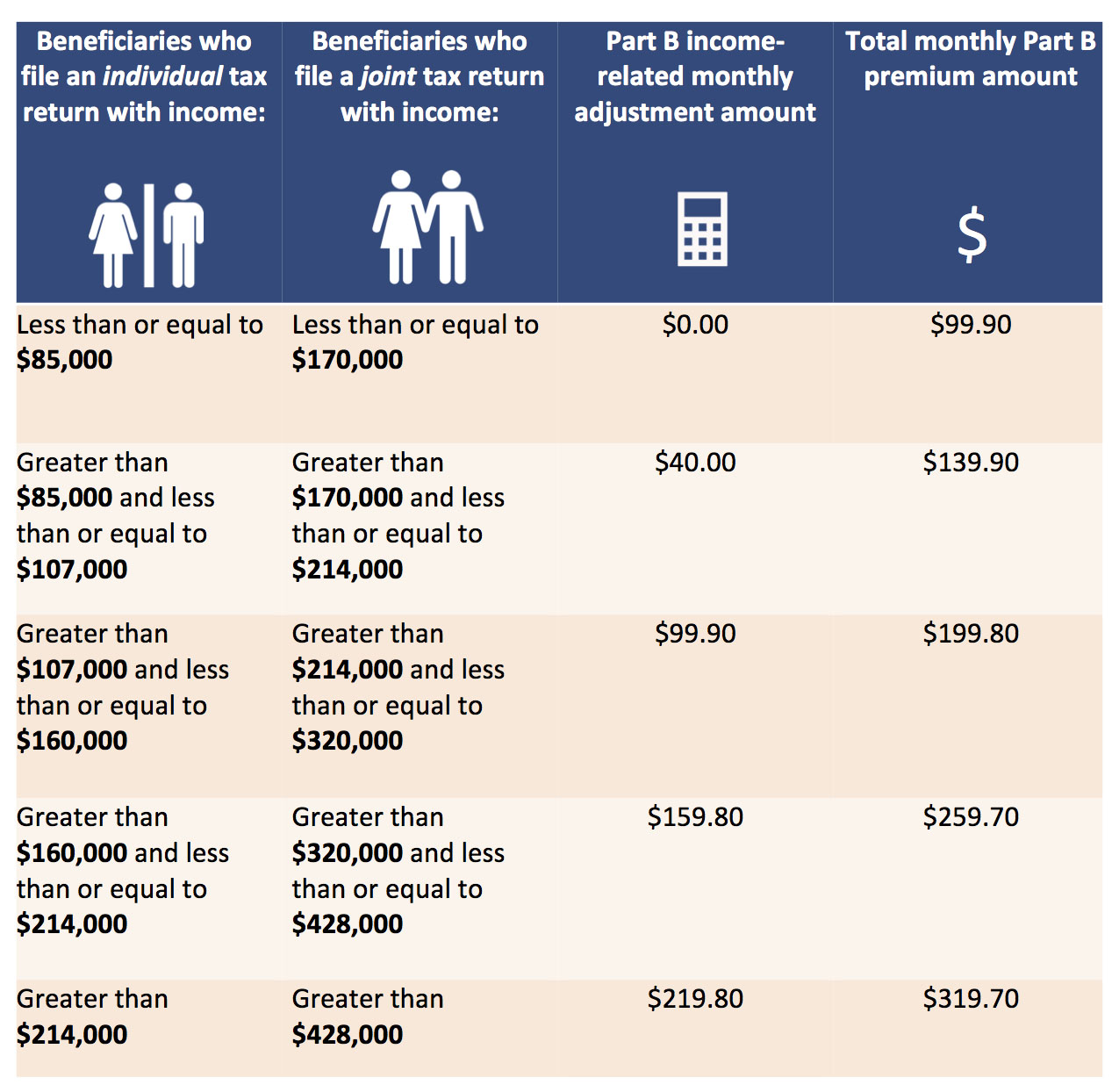

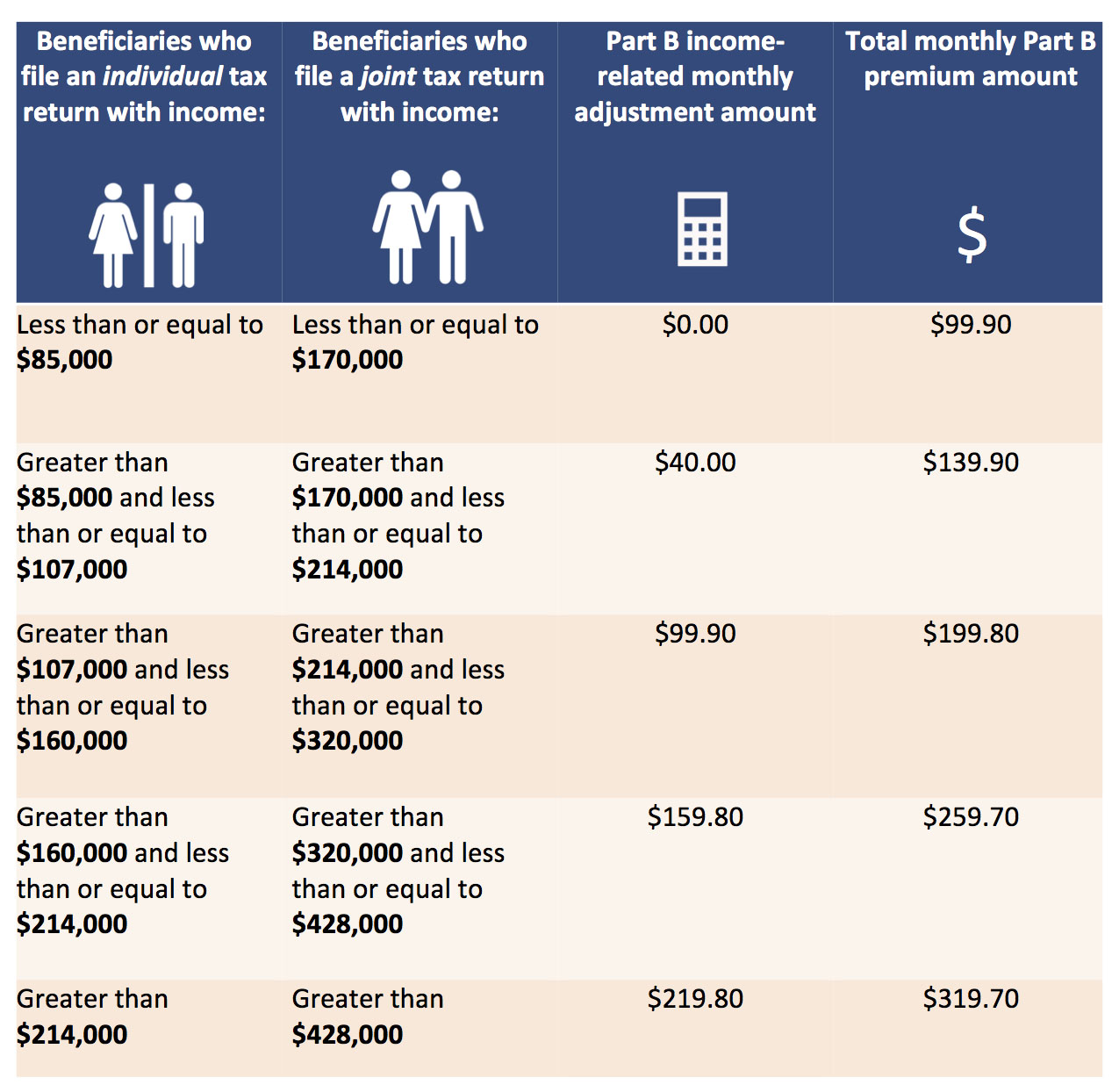

What Is Medicare Part B Going To Cost

What Is Medicare Part B Going To Cost

Verkko 7 hein 228 k 2020 nbsp 0183 32 Part B premiums are tax deductible as long as you meet the income rules Part C premiums You can deduct Part C premiums if you meet the income rules Part D premiums As with parts B

Verkko 28 kes 228 k 2023 nbsp 0183 32 Are Medicare reimbursements taxable Medicare Part B reimbursements aren t taxable So you won t incorporate those premium costs into the Medicare premiums portion of your taxes The HRA pays the premiums Is Medicare reimbursement considered income No Since the reimbursement is for the money

Is Medicare Part B Premium Reimbursement Taxable have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Flexible: We can customize designs to suit your personal needs when it comes to designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners of all ages, making the perfect instrument for parents and teachers.

-

Accessibility: The instant accessibility to many designs and templates cuts down on time and efforts.

Where to Find more Is Medicare Part B Premium Reimbursement Taxable

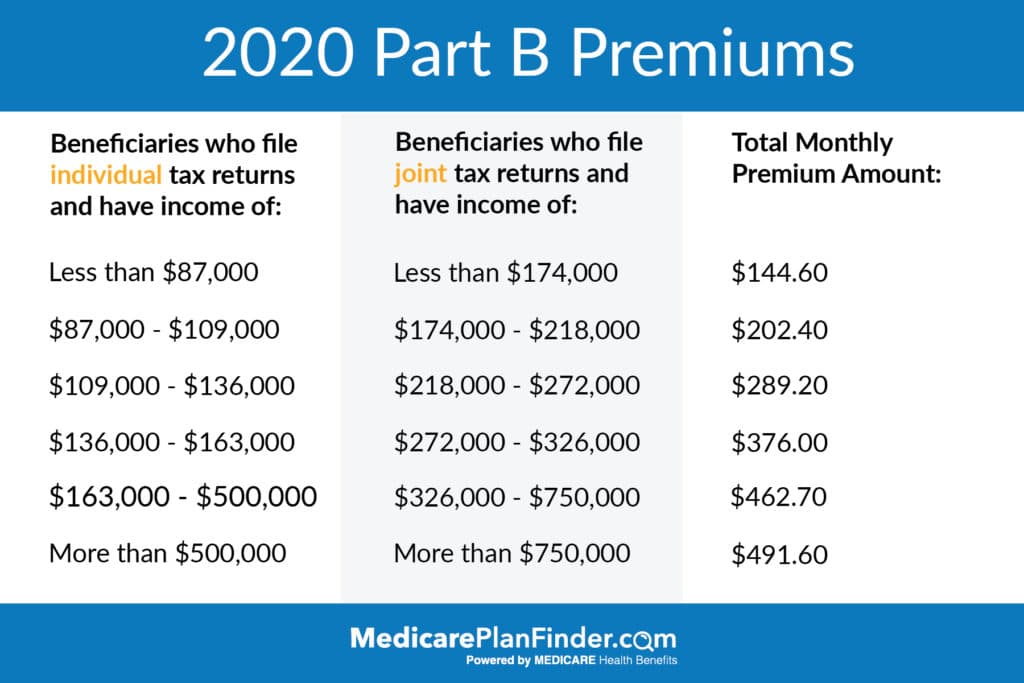

How Much Is Medicare Part B 2022

How Much Is Medicare Part B 2022

Verkko 4 jouluk 2020 nbsp 0183 32 Your Medicare Part B premiums will be automatically deducted from your Social Security benefits You ll typically pay the standard Part B premium which is 170 10 in 2022

Verkko 7 maalisk 2023 nbsp 0183 32 Part B premiums are tax deductible Part C premiums are tax deductible Part D premiums are tax deductible Medigap premiums are tax deductible 187 MORE What you ll pay for Medicare in

Now that we've ignited your interest in printables for free Let's see where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection in Is Medicare Part B Premium Reimbursement Taxable for different uses.

- Explore categories like interior decor, education, the arts, and more.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs covered cover a wide range of topics, starting from DIY projects to party planning.

Maximizing Is Medicare Part B Premium Reimbursement Taxable

Here are some new ways that you can make use use of Is Medicare Part B Premium Reimbursement Taxable:

1. Home Decor

- Print and frame stunning artwork, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Print worksheets that are free for teaching at-home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Is Medicare Part B Premium Reimbursement Taxable are an abundance of practical and imaginative resources catering to different needs and needs and. Their availability and versatility make them a great addition to your professional and personal life. Explore the plethora that is Is Medicare Part B Premium Reimbursement Taxable today, and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really absolutely free?

- Yes they are! You can print and download these tools for free.

-

Are there any free printables for commercial use?

- It depends on the specific rules of usage. Always verify the guidelines of the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues when you download Is Medicare Part B Premium Reimbursement Taxable?

- Some printables may contain restrictions on use. You should read the terms and conditions set forth by the designer.

-

How can I print Is Medicare Part B Premium Reimbursement Taxable?

- Print them at home with the printer, or go to the local print shops for premium prints.

-

What software do I need to run printables free of charge?

- The majority of PDF documents are provided with PDF formats, which is open with no cost programs like Adobe Reader.

Medicare Part B Premium 2021 Changes Medicare Life Health

What Is The Premium For Medicare Part B In 2021

Check more sample of Is Medicare Part B Premium Reimbursement Taxable below

How Much Is Medicare Part B Deductible For 2020 MedicareTalk

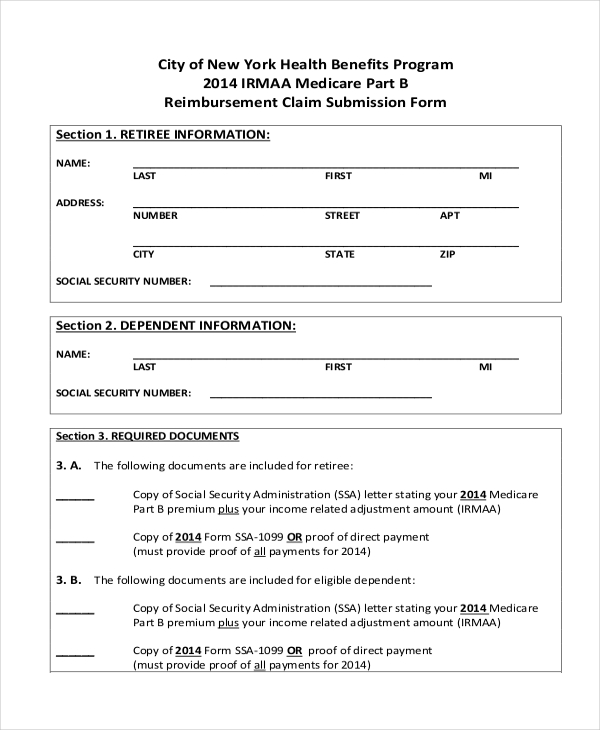

How To Apply For Medicare Part B Premium Reimbursement

What Is Medicare Part B Buy Back Give Back Are You Eligible

What Is The Medicare Part B Premium Give Back Total Benefit

Medicare Part B Medical Insurance Liberty Medicare

What Is Medicare Medicare Hero

https://ttlc.intuit.com/community/retirement/discussion/i-am...

Verkko 31 maalisk 2022 nbsp 0183 32 Probably nothing needed Medicare part B and D premiums are carried to your medical expenses for itemized deduction If you take the standard deduction then you are not gaining a deduction so no need to include the reimbursement

https://www.answers.com/Q/Are_Medicare_part_B_reimbursements_ta…

Verkko The Service has ruled in technical advice that amounts paid to retired employees for Medicare Part B premiums are not excludable from gross income under sections 106 or 105 b In the case

Verkko 31 maalisk 2022 nbsp 0183 32 Probably nothing needed Medicare part B and D premiums are carried to your medical expenses for itemized deduction If you take the standard deduction then you are not gaining a deduction so no need to include the reimbursement

Verkko The Service has ruled in technical advice that amounts paid to retired employees for Medicare Part B premiums are not excludable from gross income under sections 106 or 105 b In the case

What Is The Medicare Part B Premium Give Back Total Benefit

How To Apply For Medicare Part B Premium Reimbursement

Medicare Part B Medical Insurance Liberty Medicare

What Is Medicare Medicare Hero

What Is Medicaid Part B MedicAidTalk

Part What Is Medicare Part B

Part What Is Medicare Part B

How To Claim To Get Pay For Medicare Part B