In a world with screens dominating our lives, the charm of tangible printed material hasn't diminished. If it's to aid in education project ideas, artistic or just adding a personal touch to your space, Is Ppf Interest Taxable In Income Tax are now a vital resource. For this piece, we'll take a dive into the world of "Is Ppf Interest Taxable In Income Tax," exploring what they are, how to locate them, and the ways that they can benefit different aspects of your lives.

Get Latest Is Ppf Interest Taxable In Income Tax Below

Is Ppf Interest Taxable In Income Tax

Is Ppf Interest Taxable In Income Tax -

While the interest earned on a Public Provident Fund PPF is tax free it is still important for taxpayers to understand how to report this income in their Income Tax Return ITR Here is a step by step guide to help you report PPF

Interest amount and the maturity amount received from recognised provident fund are exempt from income tax under the new tax regime also by virtue of Section 10 11 and Section 10 12

Is Ppf Interest Taxable In Income Tax cover a large collection of printable resources available online for download at no cost. These resources come in many formats, such as worksheets, coloring pages, templates and much more. The appealingness of Is Ppf Interest Taxable In Income Tax is their flexibility and accessibility.

More of Is Ppf Interest Taxable In Income Tax

Tax On Provident Fund Interest Will Interest On PPF GPF CPF

Tax On Provident Fund Interest Will Interest On PPF GPF CPF

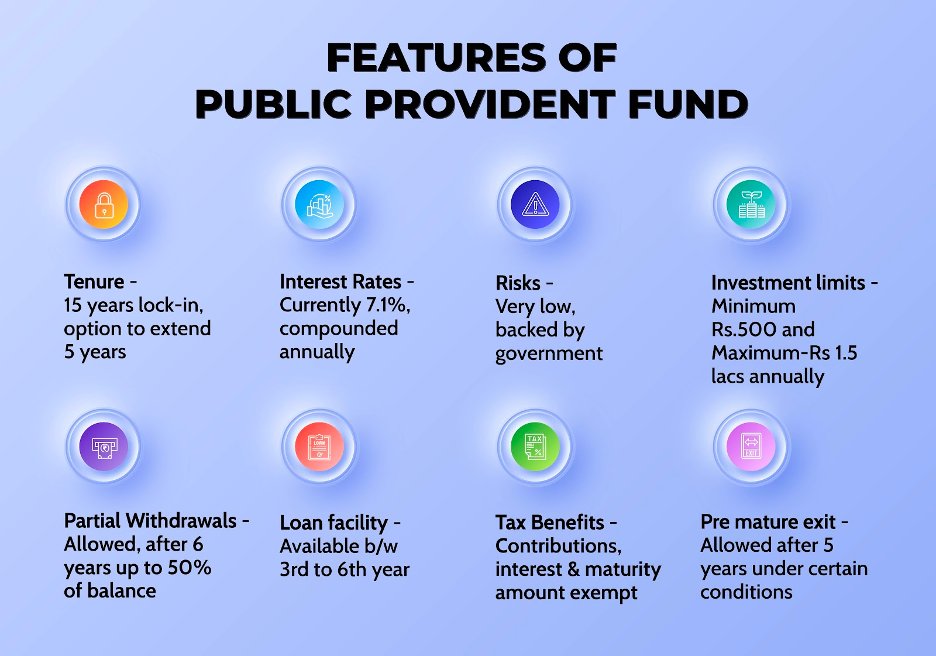

Tax benefit PPF investment comes under the EEE Exempt Exempt Exempt category This means the amount invested interest earned and maturity amount are tax free Partial withdrawal It has a lock in period of 15 years but it also comes with a partial withdrawal facility upto some specified limit 7 Tax Benefits of PPF

The answer is no to whether PPF interest is taxable or not PPF falls under the exempt exempt exempt EEE category This means the principal amount the interest earned and the maturity amount of PPF is completely tax free

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

The ability to customize: The Customization feature lets you tailor printables to fit your particular needs whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Printables for education that are free can be used by students of all ages, making these printables a powerful device for teachers and parents.

-

It's easy: Quick access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Is Ppf Interest Taxable In Income Tax

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

PUBLIC PROVIDENT FUND PPF SCHEME INCOME TAX BENEFIT INVESTMENT LIMIT

Interest on PPF is completely tax free without any limit It is not taxable at the time of accrual nor at the time of receipt under Section 10 11 Maturity as well as premature withdrawal is also exempt from tax under Section 10 11

While the interest earned on the PPF is not taxable it has to be reported in the tax return filed by the individual Withdrawals are tax free too and do not affect tax liability of the individual However as per a new rule introduced in 2020 withdrawals of over Rs 20 lakh from PPF can be slapped with TDS of 2 5 if the individual has not

We hope we've stimulated your interest in printables for free We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of Is Ppf Interest Taxable In Income Tax suitable for many reasons.

- Explore categories such as decorating your home, education, organization, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free, flashcards, and learning materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- These blogs cover a broad array of topics, ranging all the way from DIY projects to party planning.

Maximizing Is Ppf Interest Taxable In Income Tax

Here are some ideas that you can make use use of Is Ppf Interest Taxable In Income Tax:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free for reinforcement of learning at home as well as in the class.

3. Event Planning

- Designs invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Is Ppf Interest Taxable In Income Tax are a treasure trove with useful and creative ideas that cater to various needs and interests. Their access and versatility makes these printables a useful addition to both professional and personal lives. Explore the wide world of Is Ppf Interest Taxable In Income Tax to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Ppf Interest Taxable In Income Tax truly cost-free?

- Yes you can! You can download and print these free resources for no cost.

-

Can I make use of free printables for commercial use?

- It is contingent on the specific conditions of use. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions on their use. Check the conditions and terms of use provided by the author.

-

How do I print Is Ppf Interest Taxable In Income Tax?

- You can print them at home with your printer or visit a local print shop for high-quality prints.

-

What software do I require to view printables at no cost?

- The majority of PDF documents are provided in PDF format. They can be opened with free software like Adobe Reader.

All About Public Provident Fund Is PPF Interest Taxable Bharti AXA

Public Provident Fund Know All About PPF Is PPF Interest Taxable 2023

Check more sample of Is Ppf Interest Taxable In Income Tax below

Solved Chuck A Single Taxpayer Earns 76 800 In Taxable Chegg

Solved Please Note That This Is Based On Philippine Tax System Please

Investment Expenses What s Tax Deductible Charles Schwab

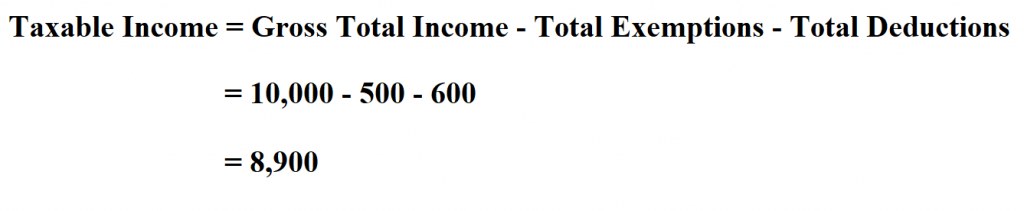

What Is Taxable Income Explanation Importance Calculation Bizness

Solved Please Note That This Is Based On Philippine Tax System Please

How To Calculate Taxable Income

https://www.financialexpress.com › money › income-tax...

Interest amount and the maturity amount received from recognised provident fund are exempt from income tax under the new tax regime also by virtue of Section 10 11 and Section 10 12

https://www.taxscan.in › article › taxability-of...

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

Interest amount and the maturity amount received from recognised provident fund are exempt from income tax under the new tax regime also by virtue of Section 10 11 and Section 10 12

Contribution to the PPF scheme is governed by Section 2 11 of the Income Tax Act According to Section 10 11 any sum relating to contribution made in provident fund constituted by the central government is exempted

What Is Taxable Income Explanation Importance Calculation Bizness

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

How To Calculate Taxable Income

Is Interest On Minor s PPF Account Taxable TechiAzi

PPF Interest Rate For 2019 20 What Amount You Will Get In Public

PPF Interest Rate For 2019 20 What Amount You Will Get In Public

The Government Recently Hiked Interest Rates Of All Small Savings