In the age of digital, where screens have become the dominant feature of our lives however, the attraction of tangible printed products hasn't decreased. Whatever the reason, whether for education project ideas, artistic or simply adding personal touches to your home, printables for free have proven to be a valuable resource. In this article, we'll take a dive through the vast world of "Is Sovereign Gold Bond Tax Exemption Under Section 80c," exploring what they are, how they are available, and how they can enrich various aspects of your daily life.

Get Latest Is Sovereign Gold Bond Tax Exemption Under Section 80c Below

Is Sovereign Gold Bond Tax Exemption Under Section 80c

Is Sovereign Gold Bond Tax Exemption Under Section 80c -

Sovereign Gold Bonds offer investors a tax efficient way to invest in gold While the tax treatment of redemptions is favorable selling SGBs in the secondary market may have capital gains implications Understanding

Nope FDs are not tax exempt Only investments in long term FDs are eligible for tax deduction under 80C And even that deduction is subject to overall limit of 1 50 Lakh per yr including

Is Sovereign Gold Bond Tax Exemption Under Section 80c include a broad range of printable, free content that can be downloaded from the internet at no cost. They are available in numerous forms, including worksheets, coloring pages, templates and many more. The beauty of Is Sovereign Gold Bond Tax Exemption Under Section 80c is in their variety and accessibility.

More of Is Sovereign Gold Bond Tax Exemption Under Section 80c

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

How Much Amount Can Be Claimed For Tax Exemption Under Section 80C

MintGenie explains Even though the interest accrued on SGBs is subject to taxation the capital gains exemption after eight years coupled with the potential for long term capital gains

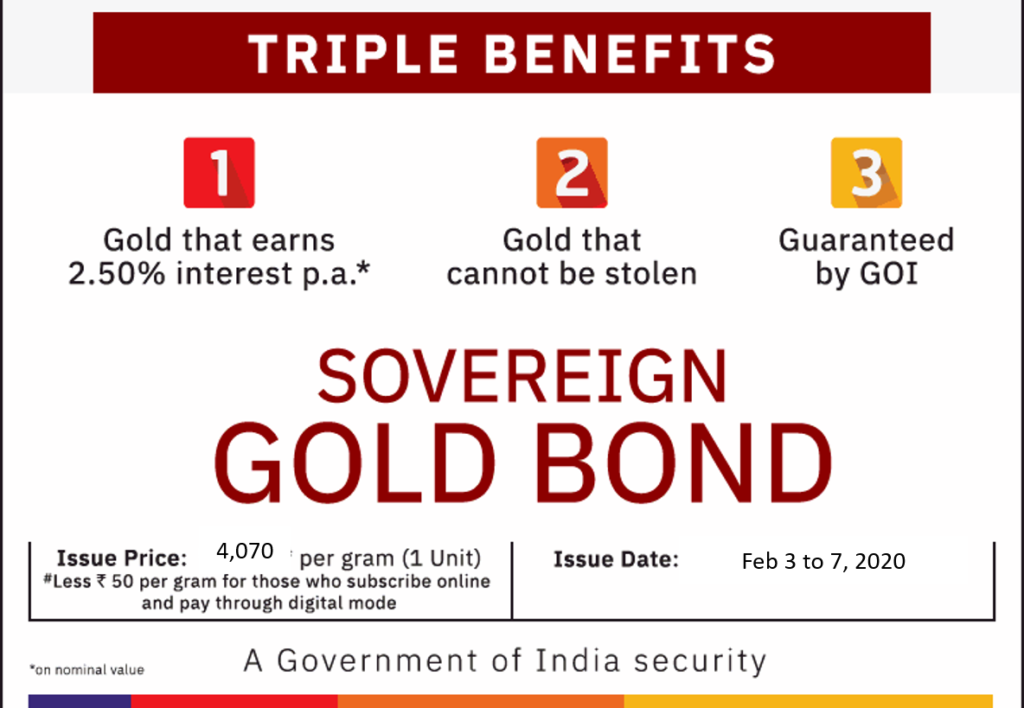

In addition to the potential benefit of rising gold prices these bonds provide investors a fixed 2 5 interest rate on their investments Semi annual interest payments are made Therefore it is crucial that you know how

The Is Sovereign Gold Bond Tax Exemption Under Section 80c have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor printing templates to your own specific requirements, whether it's designing invitations, organizing your schedule, or decorating your home.

-

Educational Value Free educational printables can be used by students from all ages, making them a great device for teachers and parents.

-

Simple: You have instant access an array of designs and templates helps save time and effort.

Where to Find more Is Sovereign Gold Bond Tax Exemption Under Section 80c

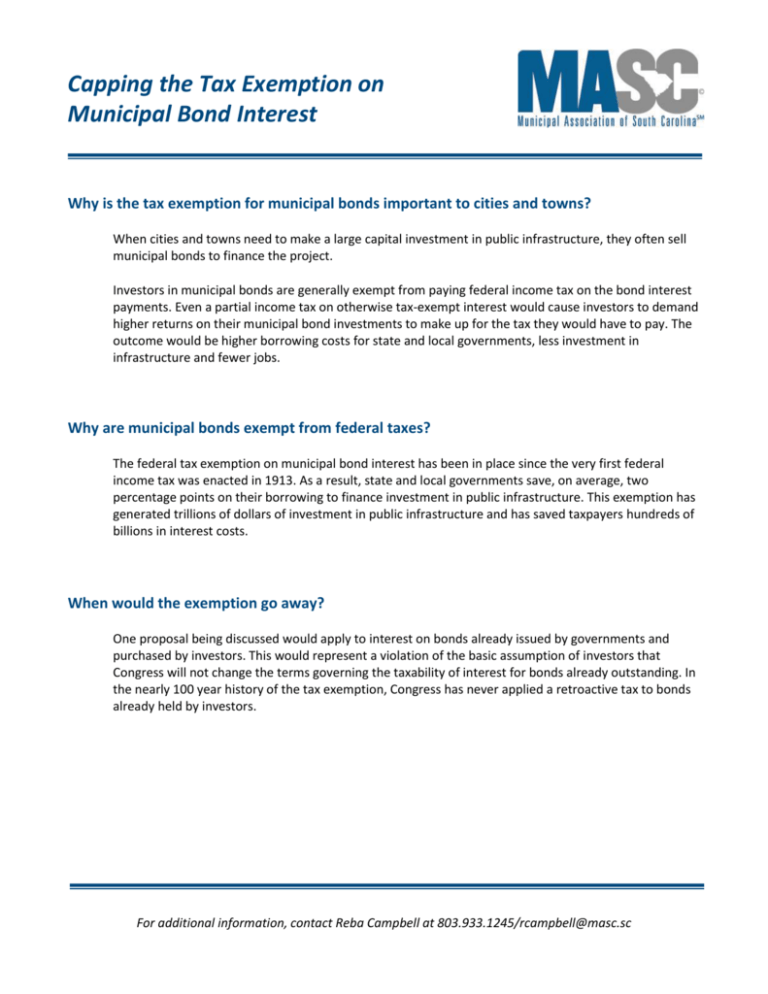

Municipal Bond Tax Exemption FAQ

Municipal Bond Tax Exemption FAQ

Tax implications include tax free redemption proceeds and exempt capital gains on maturity while interest income is taxable SGBs are also subject to capital gains tax

Tax Efficient Investment Sovereign Gold Bonds are a tax efficient investment option for investors Sovereign Gold Bonds are taxable with capital gain tax and interest benefits However the interest income received is

We've now piqued your interest in printables for free Let's find out where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Is Sovereign Gold Bond Tax Exemption Under Section 80c designed for a variety goals.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs covered cover a wide range of topics, all the way from DIY projects to planning a party.

Maximizing Is Sovereign Gold Bond Tax Exemption Under Section 80c

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free for reinforcement of learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings and birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Sovereign Gold Bond Tax Exemption Under Section 80c are an abundance of practical and imaginative resources for a variety of needs and interests. Their accessibility and versatility make them an invaluable addition to any professional or personal life. Explore the many options of Is Sovereign Gold Bond Tax Exemption Under Section 80c now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Sovereign Gold Bond Tax Exemption Under Section 80c truly for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I utilize free printables for commercial purposes?

- It's dependent on the particular rules of usage. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright problems with Is Sovereign Gold Bond Tax Exemption Under Section 80c?

- Some printables may contain restrictions in their usage. Always read the terms and condition of use as provided by the creator.

-

How can I print Is Sovereign Gold Bond Tax Exemption Under Section 80c?

- You can print them at home with your printer or visit the local print shops for premium prints.

-

What software is required to open printables at no cost?

- Many printables are offered in PDF format. These can be opened with free software such as Adobe Reader.

Capital Gain Exemption Section 54EC Bond Discontinued By NHAI

Tax Exemption On Income Through Sovereign Wealth Funds IT Dept

Check more sample of Is Sovereign Gold Bond Tax Exemption Under Section 80c below

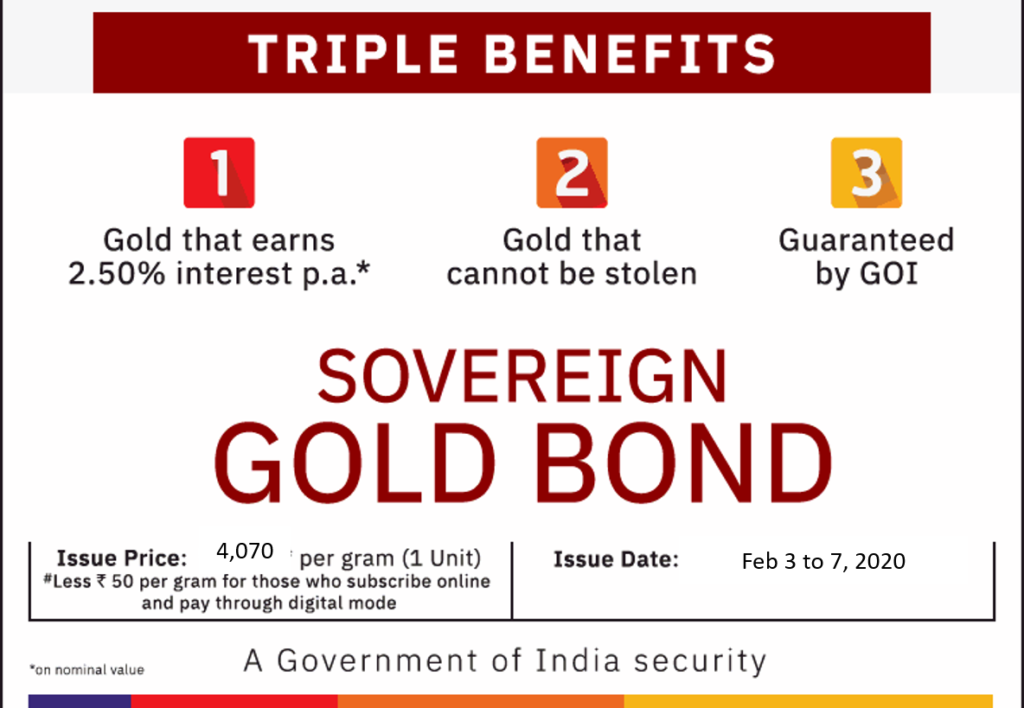

What Is Sovereign Gold Bond What Are The Benefits Of Investing In Gold

Sovereign Gold Bond February 2020 How To Buy Tax Benefits

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

Secure Your Future By Investing Wisely Invest In Public Provident

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

https://www.reddit.com/r/IndiaInvestments/comments/...

Nope FDs are not tax exempt Only investments in long term FDs are eligible for tax deduction under 80C And even that deduction is subject to overall limit of 1 50 Lakh per yr including

https://www.icicidirect.com/ilearn/currency...

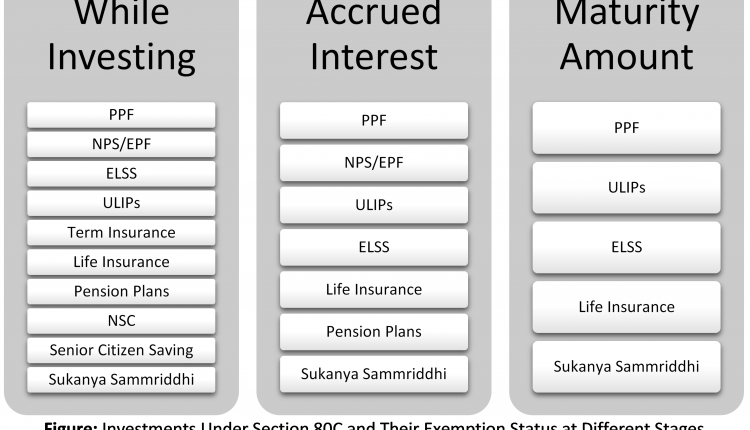

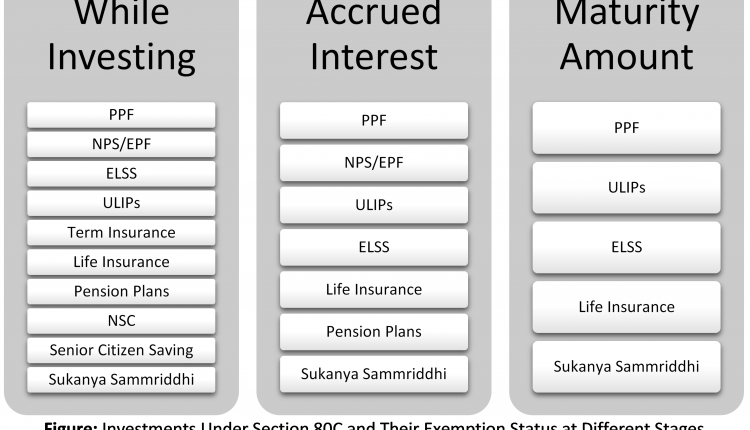

Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs The interest earned on SGB deposits

Nope FDs are not tax exempt Only investments in long term FDs are eligible for tax deduction under 80C And even that deduction is subject to overall limit of 1 50 Lakh per yr including

Under Section 80C of the Income Tax Act there are no tax benefits available for the lump sum deposit of Sovereign Gold Bonds SGBs The interest earned on SGB deposits

Secure Your Future By Investing Wisely Invest In Public Provident

Sovereign Gold Bond February 2020 How To Buy Tax Benefits

Income Tax Exemption Up To Rs 3 Lakh Under Section 80C Among Top Budget

Section 80C And 80D Exemption Apart From Section 80C And 80D How Many

Finance Minister Should Consider Liberalising Section 80C And Increase

Tax Saving Options Under Section 80C For Salaried Others TheSWO

Tax Saving Options Under Section 80C For Salaried Others TheSWO

Sovereign Gold Bond Tax Exemption In 2023 STCG LTCG TDS