Today, when screens dominate our lives The appeal of tangible printed objects isn't diminished. If it's to aid in education as well as creative projects or simply adding the personal touch to your area, Is Student Loan Interest A Deduction Or Credit are now a vital source. With this guide, you'll take a dive in the world of "Is Student Loan Interest A Deduction Or Credit," exploring what they are, where they can be found, and ways they can help you improve many aspects of your lives.

Get Latest Is Student Loan Interest A Deduction Or Credit Below

Is Student Loan Interest A Deduction Or Credit

Is Student Loan Interest A Deduction Or Credit -

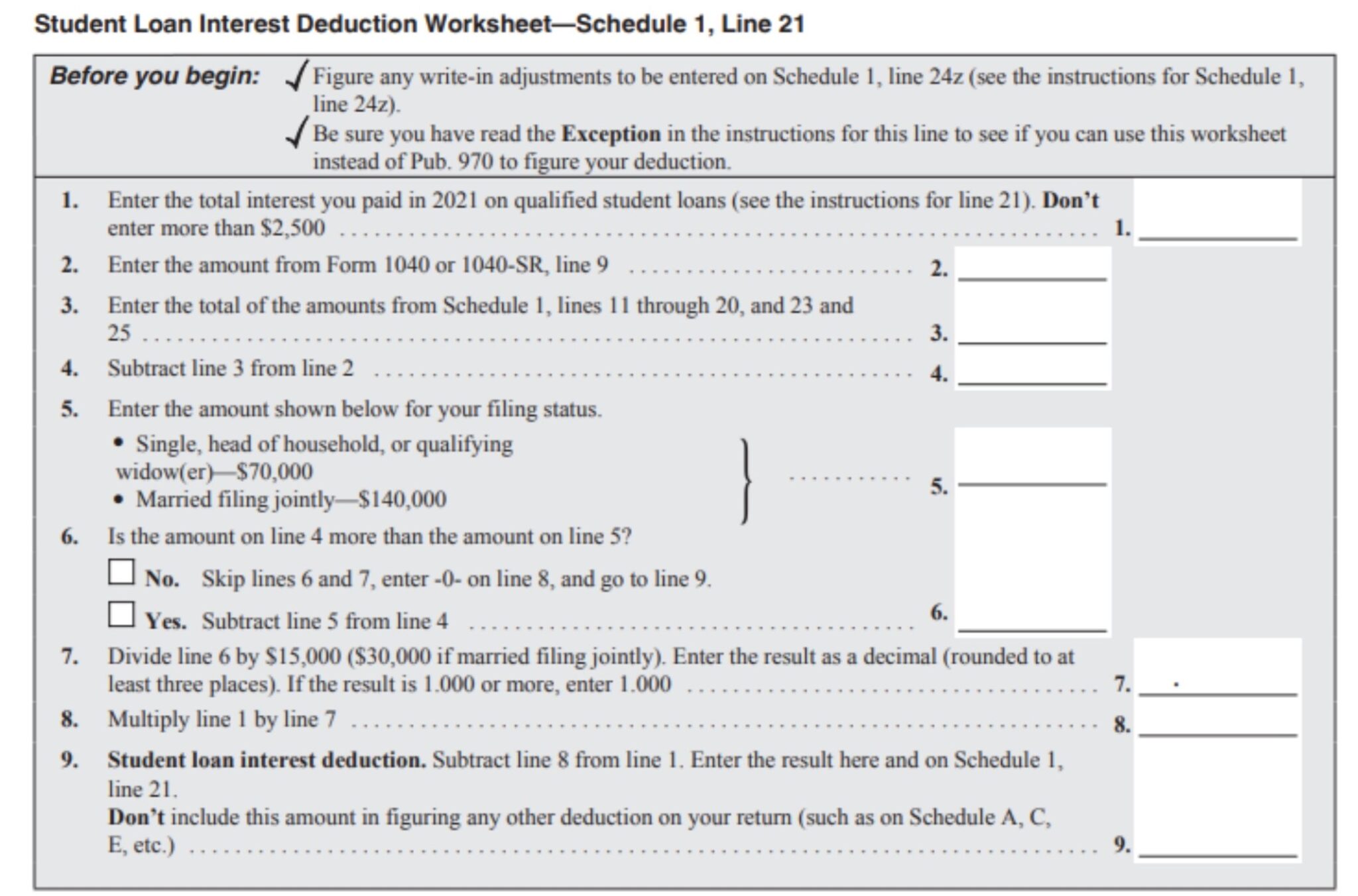

Student loan interest deduction You can t deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under an educational assistance program See chapter 4 Student loan

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the

The Is Student Loan Interest A Deduction Or Credit are a huge array of printable materials online, at no cost. These printables come in different styles, from worksheets to coloring pages, templates and many more. One of the advantages of Is Student Loan Interest A Deduction Or Credit is their flexibility and accessibility.

More of Is Student Loan Interest A Deduction Or Credit

Student Loan Interest Rates Update Plan 1 2 Etc CIPP

Student Loan Interest Rates Update Plan 1 2 Etc CIPP

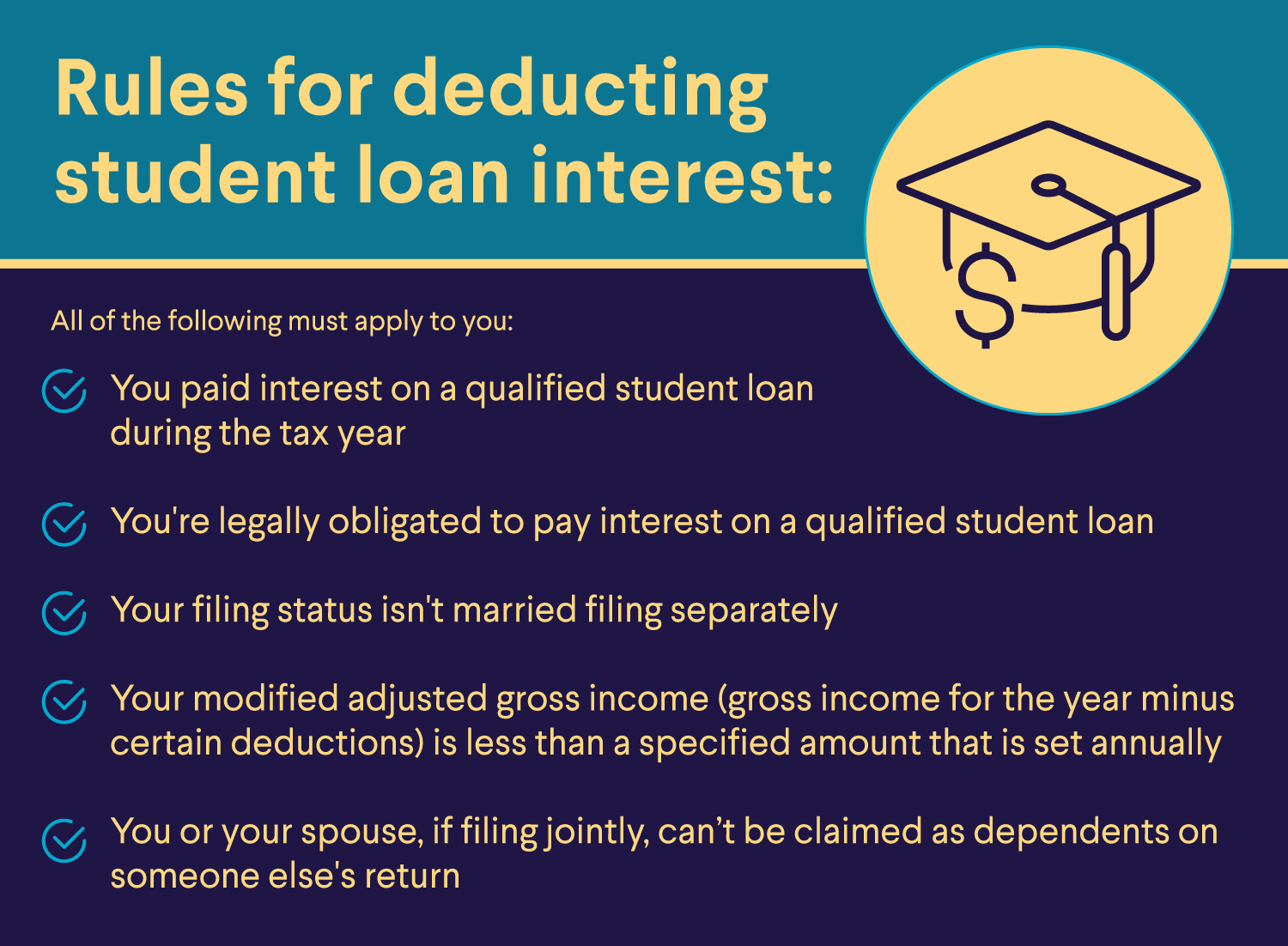

If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a student loan interest deduction

This interview will help you determine if you can deduct the interest you paid on a student or educational loan Information you ll need Filing status Basic income information

Is Student Loan Interest A Deduction Or Credit have garnered immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: We can customize the design to meet your needs whether it's making invitations or arranging your schedule or even decorating your home.

-

Educational Use: The free educational worksheets provide for students of all ages, which makes these printables a powerful tool for teachers and parents.

-

Simple: immediate access various designs and templates can save you time and energy.

Where to Find more Is Student Loan Interest A Deduction Or Credit

Studentloanify Is Student Loan Interest A Tax Credit Or Deduction

Studentloanify Is Student Loan Interest A Tax Credit Or Deduction

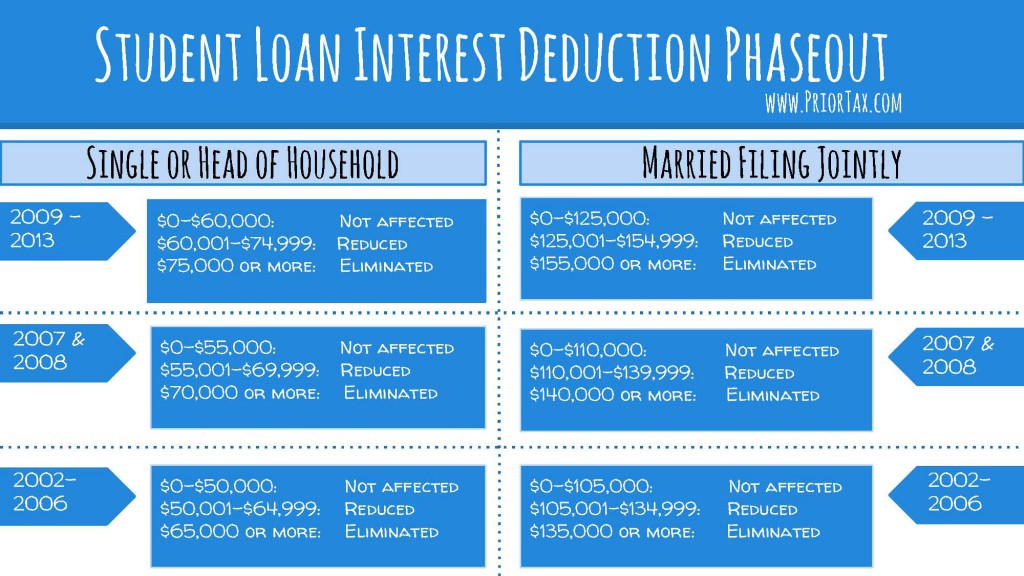

The student loan interest deduction is available whether you have federal or private loans Your taxable income can be reduced by up to 2 500 annually with the student

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

Now that we've ignited your interest in printables for free Let's find out where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Is Student Loan Interest A Deduction Or Credit for all objectives.

- Explore categories such as furniture, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing, flashcards, and learning materials.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs covered cover a wide spectrum of interests, ranging from DIY projects to party planning.

Maximizing Is Student Loan Interest A Deduction Or Credit

Here are some new ways that you can make use use of Is Student Loan Interest A Deduction Or Credit:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Be organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Student Loan Interest A Deduction Or Credit are an abundance filled with creative and practical information catering to different needs and pursuits. Their accessibility and versatility make them a great addition to any professional or personal life. Explore the many options of Is Student Loan Interest A Deduction Or Credit now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really cost-free?

- Yes they are! You can print and download these files for free.

-

Can I use free printables for commercial use?

- It's all dependent on the rules of usage. Make sure you read the guidelines for the creator before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may contain restrictions in use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home using any printer or head to the local print shops for top quality prints.

-

What program is required to open printables free of charge?

- The majority of printables are in the format PDF. This is open with no cost software, such as Adobe Reader.

How To Get The Interest Deduction On Your Student Loan

Student Loan Interest Deduction 2013 PriorTax Blog

Check more sample of Is Student Loan Interest A Deduction Or Credit below

Claiming The Student Loan Interest Deduction

The Federal Student Loan Interest Deduction

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

How A Student Loan Can Affect Your Taxes LaptrinhX News

What Credit Score Is Needed For A Student Loan Student Loan Planner

Student Loan Interest Deduction H R Block

Student Loan Interest Deduction A Tax Move You Must Make

https://www.irs.gov › taxtopics

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the

https://www.nerdwallet.com › article › loans › student-loans

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in interest paid

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in interest paid

What Credit Score Is Needed For A Student Loan Student Loan Planner

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

Student Loan Interest Deduction H R Block

Student Loan Interest Deduction A Tax Move You Must Make

Are You Eligible To Deduct Student Loan Interest Payments MLR

What Is A Grace Period For Student Loans MoneyTips

What Is A Grace Period For Student Loans MoneyTips

Do You Qualify For 8 7 Billion Of Student Loan Forgiveness