In a world where screens dominate our lives it's no wonder that the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes, creative projects, or simply adding a personal touch to your area, Is Student Loan Interest Tax Deductible For Parents have become a valuable resource. For this piece, we'll dive deeper into "Is Student Loan Interest Tax Deductible For Parents," exploring what they are, where to locate them, and how they can enrich various aspects of your daily life.

Get Latest Is Student Loan Interest Tax Deductible For Parents Below

Is Student Loan Interest Tax Deductible For Parents

Is Student Loan Interest Tax Deductible For Parents -

If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a student loan interest deduction Below are some questions and answers to help you learn more about reporting student loan interest payments from IRS Form 1098 E on your 2023 taxes

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

Is Student Loan Interest Tax Deductible For Parents include a broad assortment of printable, downloadable content that can be downloaded from the internet at no cost. They come in many types, such as worksheets coloring pages, templates and more. One of the advantages of Is Student Loan Interest Tax Deductible For Parents is in their versatility and accessibility.

More of Is Student Loan Interest Tax Deductible For Parents

Is Your Interest Tax Deductible ShineWing TY TEOH

Is Your Interest Tax Deductible ShineWing TY TEOH

Claiming the Parent PLUS Loan Tax Deduction is straightforward allowing eligible borrowers and cosigners to reduce their taxable income Here s a step by step guide to ensure you qualify and know how to claim the student loan tax deduction Step 1 Obtain Form 1098 E from Your Student Loan Servicer

Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

customization: The Customization feature lets you tailor the design to meet your needs, whether it's designing invitations making your schedule, or decorating your home.

-

Educational Benefits: The free educational worksheets cater to learners of all ages. This makes them a great device for teachers and parents.

-

Easy to use: You have instant access an array of designs and templates can save you time and energy.

Where to Find more Is Student Loan Interest Tax Deductible For Parents

How Do Student Loans Affect Your Taxes Earnest

How Do Student Loans Affect Your Taxes Earnest

Dependent student loan interest can be claimed on your tax return under certain circumstances You can claim interest on a qualified student loan you took out for your dependent as long you meet both of these The loan was in your name You paid the interest on it

Student loan interest deduction You can t deduct as interest on a student loan any interest paid by your employer after March 27 2000 and before January 1 2026 under an educational assistance program See chapter 4 Student loan forgiveness

Now that we've piqued your interest in printables for free Let's look into where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Is Student Loan Interest Tax Deductible For Parents for a variety applications.

- Explore categories like decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing including flashcards, learning materials.

- It is ideal for teachers, parents or students in search of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a wide selection of subjects, all the way from DIY projects to planning a party.

Maximizing Is Student Loan Interest Tax Deductible For Parents

Here are some creative ways ensure you get the very most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print free worksheets to build your knowledge at home or in the classroom.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is Student Loan Interest Tax Deductible For Parents are a treasure trove of creative and practical resources catering to different needs and pursuits. Their availability and versatility make they a beneficial addition to both professional and personal lives. Explore the vast array of Is Student Loan Interest Tax Deductible For Parents to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly available for download?

- Yes they are! You can print and download these documents for free.

-

Can I make use of free printouts for commercial usage?

- It's all dependent on the conditions of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns with Is Student Loan Interest Tax Deductible For Parents?

- Some printables may come with restrictions in use. Make sure you read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home with any printer or head to the local print shop for more high-quality prints.

-

What software must I use to open printables for free?

- Most PDF-based printables are available in the PDF format, and can be opened with free software, such as Adobe Reader.

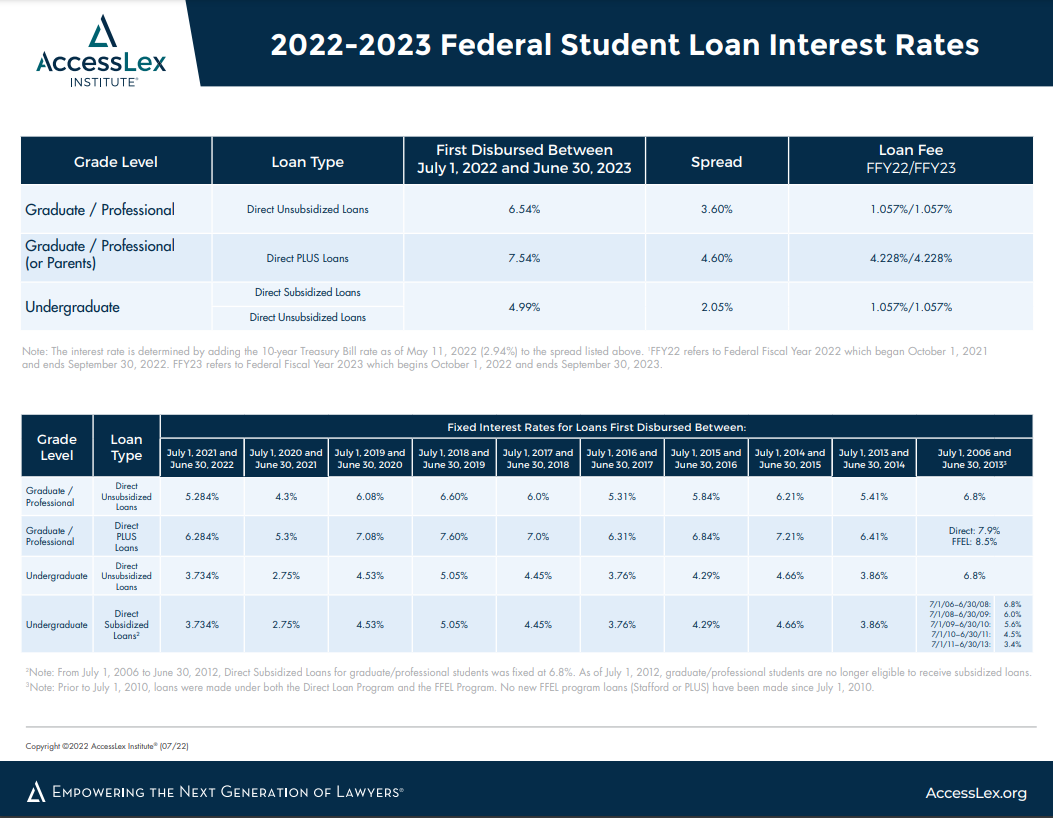

Federal Student Loan Interest Rates AccessLex

How To Claim The Student Loan Interest Deduction Tomcaligist

Check more sample of Is Student Loan Interest Tax Deductible For Parents below

Guide To Student Loan Interest Rates And How Much You Will Pay

Is Student Loan Interest Tax Deductible

Student Loan Interest Deduction 2013 PriorTax Blog

The Deduction Of Interest On Mortgages Is More Delicate With The New

Student Loan Interest Tax Deduction Milliken Perkins Brunelle

Petition Make Student Loan Payments Tax Deductible To ALL Not Just

https://www.irs.gov › taxtopics

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

https://www.thebalancemoney.com

If you are personally liable for repaying the student loan you can deduct the interest even if your child is no longer a dependent You must be the one who pays the student loan and its accompanying interest in order to deduct the interest payments from your taxes

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year

If you are personally liable for repaying the student loan you can deduct the interest even if your child is no longer a dependent You must be the one who pays the student loan and its accompanying interest in order to deduct the interest payments from your taxes

The Deduction Of Interest On Mortgages Is More Delicate With The New

Is Student Loan Interest Tax Deductible

Student Loan Interest Tax Deduction Milliken Perkins Brunelle

Petition Make Student Loan Payments Tax Deductible To ALL Not Just

The Important Tax Deduction Tip Every Parent Needs To Read Student

How To Get The Student Loan Interest Deduction NerdWallet

How To Get The Student Loan Interest Deduction NerdWallet

Solved Please Note That This Is Based On Philippine Tax System Please