Today, with screens dominating our lives and our lives are dominated by screens, the appeal of tangible printed material hasn't diminished. In the case of educational materials such as creative projects or simply adding some personal flair to your area, Is Student Loan Tax Deductible are now a vital resource. With this guide, you'll take a dive to the depths of "Is Student Loan Tax Deductible," exploring the benefits of them, where they are available, and how they can add value to various aspects of your lives.

Get Latest Is Student Loan Tax Deductible Below

Is Student Loan Tax Deductible

Is Student Loan Tax Deductible -

Borrowers who have Federal student loans in income driven repayment IDR plans and have accumulated the equivalent of either 20 or 25 years of qualified payments will receive loan forgiveness for the remaining balance

You claim this deduction as an adjustment to income so you don t need to itemize your deductions You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan

Is Student Loan Tax Deductible encompass a wide assortment of printable documents that can be downloaded online at no cost. These printables come in different styles, from worksheets to coloring pages, templates and much more. The great thing about Is Student Loan Tax Deductible is their flexibility and accessibility.

More of Is Student Loan Tax Deductible

Student Loan Tax Deduction Milliken Perkins Brunelle

Student Loan Tax Deduction Milliken Perkins Brunelle

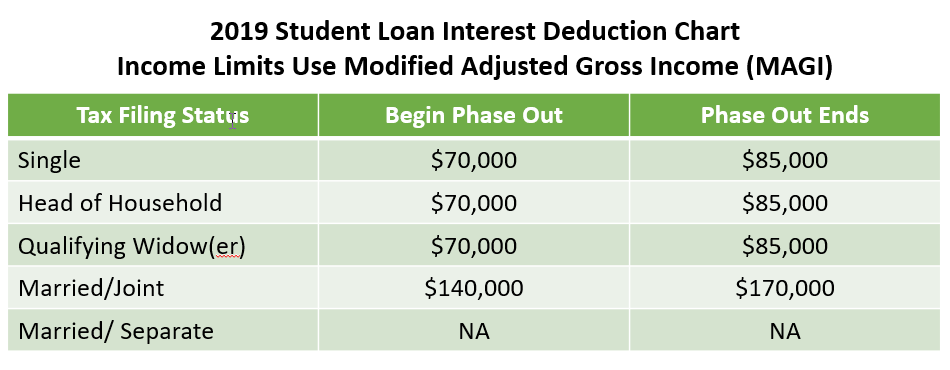

The tax benefits of your student loan don t end with the above credits A deduction is also available for the interest payments you make when you start repaying your loan As of 2023 the deduction is available to the following filers

The answer is yes In fact federal student loan borrowers could qualify to deduct up to 2 500 of student loan interest per tax return per tax year You can claim the student loan interest tax deduction as an adjustment to income You don t need to itemize deductions to claim it What is student loan interest

The Is Student Loan Tax Deductible have gained huge popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization You can tailor print-ready templates to your specific requirements, whether it's designing invitations planning your schedule or even decorating your house.

-

Educational Impact: Free educational printables provide for students from all ages, making the perfect tool for parents and educators.

-

Affordability: The instant accessibility to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Is Student Loan Tax Deductible

3 Situations In Which Personal Loan Interest Is Tax Deductible

3 Situations In Which Personal Loan Interest Is Tax Deductible

Reporting the amount of student loan interest you paid in 2023 on your federal tax return may count as a deduction A deduction reduces the amount of your income that is subject to tax which may benefit you by reducing the amount of tax you may have to pay

The student loan interest deduction is a federal tax deduction that lets you deduct up to 2 500 of the student loan interest you paid during the year It reduces your taxable income which

We hope we've stimulated your interest in printables for free Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Is Student Loan Tax Deductible designed for a variety motives.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets, flashcards, and learning tools.

- Great for parents, teachers and students in need of additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs are a vast range of interests, starting from DIY projects to planning a party.

Maximizing Is Student Loan Tax Deductible

Here are some unique ways of making the most of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print worksheets that are free for teaching at-home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Make sure you are organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is Student Loan Tax Deductible are an abundance of fun and practical tools which cater to a wide range of needs and hobbies. Their accessibility and versatility make these printables a useful addition to the professional and personal lives of both. Explore the world of Is Student Loan Tax Deductible and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I use free printables for commercial uses?

- It's all dependent on the usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations in use. Be sure to review the terms and condition of use as provided by the designer.

-

How do I print Is Student Loan Tax Deductible?

- You can print them at home with any printer or head to any local print store for more high-quality prints.

-

What program must I use to open printables at no cost?

- The majority of PDF documents are provided in the PDF format, and can be opened with free programs like Adobe Reader.

How Much Student Loan Interest Is Deductible PayForED

Mortgage Interest Tax Deduction 2020 Calculator JunaidKaleah

Check more sample of Is Student Loan Tax Deductible below

How To Claim The Student Loan Interest Tax Deduction In 2021

Are Business Loan Payments Tax Deductible

Best Rv Parks In Austin Tx All Well Day

Is Your Student Loan Tax Deductible Post Office Employees Credit Union

Pin On Finances

Student Loan Interest Deduction Worksheet

https://www.irs.gov/taxtopics/tc456

You claim this deduction as an adjustment to income so you don t need to itemize your deductions You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan

https://www.investopedia.com/terms/s/slid.asp

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans

You claim this deduction as an adjustment to income so you don t need to itemize your deductions You can claim the deduction if all of the following apply You paid interest on a qualified student loan in tax year 2023 You re legally obligated to pay interest on a qualified student loan

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans

Is Your Student Loan Tax Deductible Post Office Employees Credit Union

Are Business Loan Payments Tax Deductible

Pin On Finances

Student Loan Interest Deduction Worksheet

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Student Loan Interest Deduction 2013 PriorTax Blog

Student Loan Interest Deduction 2013 PriorTax Blog

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments