In a world where screens have become the dominant feature of our lives and the appeal of physical printed items hasn't gone away. Be it for educational use in creative or artistic projects, or simply adding a personal touch to your area, Is Tds Applicable On Gift Vouchers can be an excellent resource. For this piece, we'll dive to the depths of "Is Tds Applicable On Gift Vouchers," exploring the different types of printables, where they can be found, and what they can do to improve different aspects of your life.

Get Latest Is Tds Applicable On Gift Vouchers Below

Is Tds Applicable On Gift Vouchers

Is Tds Applicable On Gift Vouchers -

If you receive any bonus incentive gift or prize for meeting the sales target or making purchases more than the specified limit then you will have to pay tax on it This rule is going to come into effect from July 1 2022

In other words business gifts perquisites and incentives shall now be liable to TDS which otherwise were not being offered to tax by the recipient such as distributors dealers masons and influencers

Is Tds Applicable On Gift Vouchers include a broad assortment of printable documents that can be downloaded online at no cost. These resources come in various formats, such as worksheets, templates, coloring pages and much more. The beauty of Is Tds Applicable On Gift Vouchers is their flexibility and accessibility.

More of Is Tds Applicable On Gift Vouchers

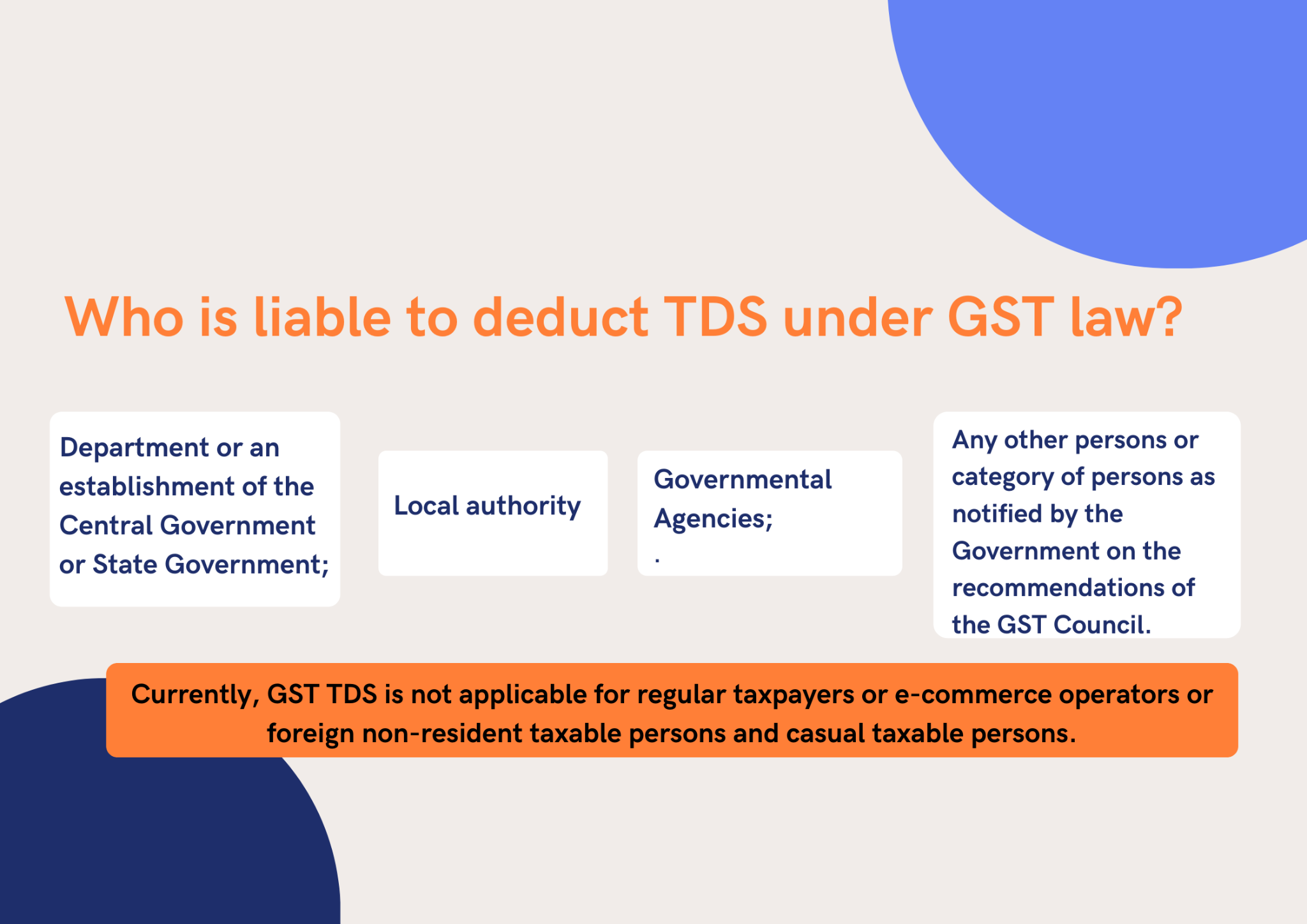

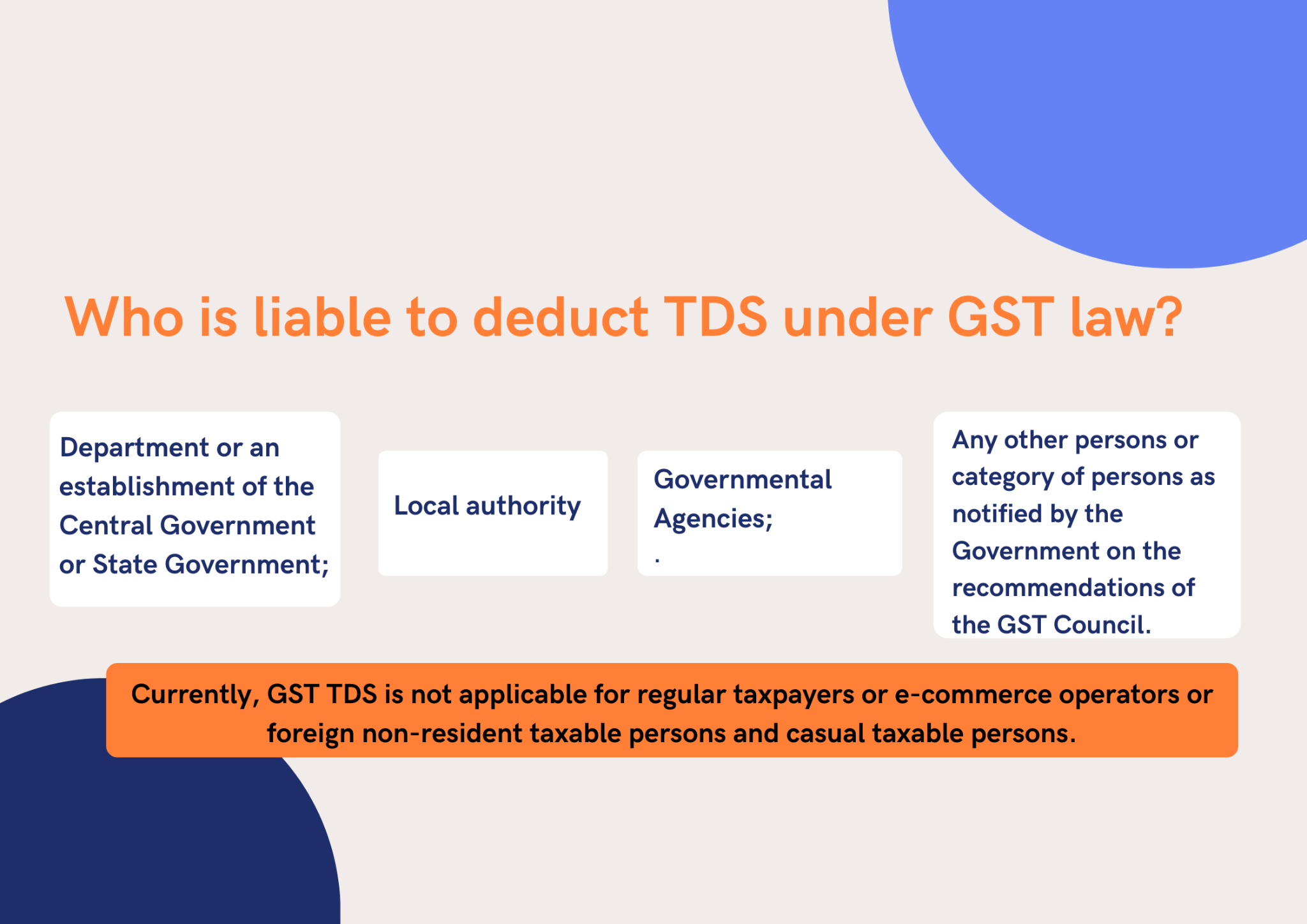

All About TDS Under India GST

All About TDS Under India GST

TDS Rate Applicable on Section 194R This section came into effect on 1 July 2022 and the applicable TDS rate is 10 Businesses or professionals should deduct TDS 10 if the monetary value of such gift or perquisites exceeds INR 20 000 during the financial year of each recipient Non applicability of TDS u s 194R

Will Section 194R be applicable in case of gifts benefits or perks received during special occasions such as festivals or a marriage ceremony No Section 194R will be applicable only in the case of those benefits or

Is Tds Applicable On Gift Vouchers have garnered immense popularity for several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring the templates to meet your individual needs for invitations, whether that's creating them and schedules, or even decorating your house.

-

Educational Worth: The free educational worksheets cater to learners of all ages, making these printables a powerful tool for parents and educators.

-

The convenience of instant access numerous designs and templates reduces time and effort.

Where to Find more Is Tds Applicable On Gift Vouchers

Is TDS Applicable On Mutual Funds mutualfunds swp YouTube

Is TDS Applicable On Mutual Funds mutualfunds swp YouTube

For example if a business entity gifts valuable items cars etc to its resident customers no tax shall be deducted under Section 194R if a resident customer is not carrying on any business or profession

As per Section 194R of the Incom Tax Act a person or corporate giving gifts promotional material sponsorship or gift vouchers that value over Rs 20 000 has to deduct 10 TDS against the PAN Card of the recipient

Since we've got your curiosity about Is Tds Applicable On Gift Vouchers we'll explore the places you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with Is Tds Applicable On Gift Vouchers for all applications.

- Explore categories like decorating your home, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- These blogs cover a wide spectrum of interests, all the way from DIY projects to party planning.

Maximizing Is Tds Applicable On Gift Vouchers

Here are some unique ways that you can make use use of Is Tds Applicable On Gift Vouchers:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print free worksheets for reinforcement of learning at home (or in the learning environment).

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Tds Applicable On Gift Vouchers are a treasure trove of creative and practical resources catering to different needs and interest. Their accessibility and versatility make them an invaluable addition to each day life. Explore the plethora of Is Tds Applicable On Gift Vouchers right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Tds Applicable On Gift Vouchers really cost-free?

- Yes you can! You can download and print these items for free.

-

Can I utilize free printables to make commercial products?

- It's based on the usage guidelines. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright issues with Is Tds Applicable On Gift Vouchers?

- Some printables may have restrictions regarding their use. Always read these terms and conditions as set out by the creator.

-

How can I print Is Tds Applicable On Gift Vouchers?

- Print them at home with the printer, or go to the local print shops for superior prints.

-

What software must I use to open printables free of charge?

- The majority of printables are with PDF formats, which can be opened with free programs like Adobe Reader.

TDS On NRI Deposits Is TDS Applicable For NRE Fixed Deposits DBS

Why Do Real Estate Developers Get Special Tax Breaks S Ehrlich

Check more sample of Is Tds Applicable On Gift Vouchers below

TDS On Maintenance Charges Section 194C Of Income Tax Act Sorting Tax

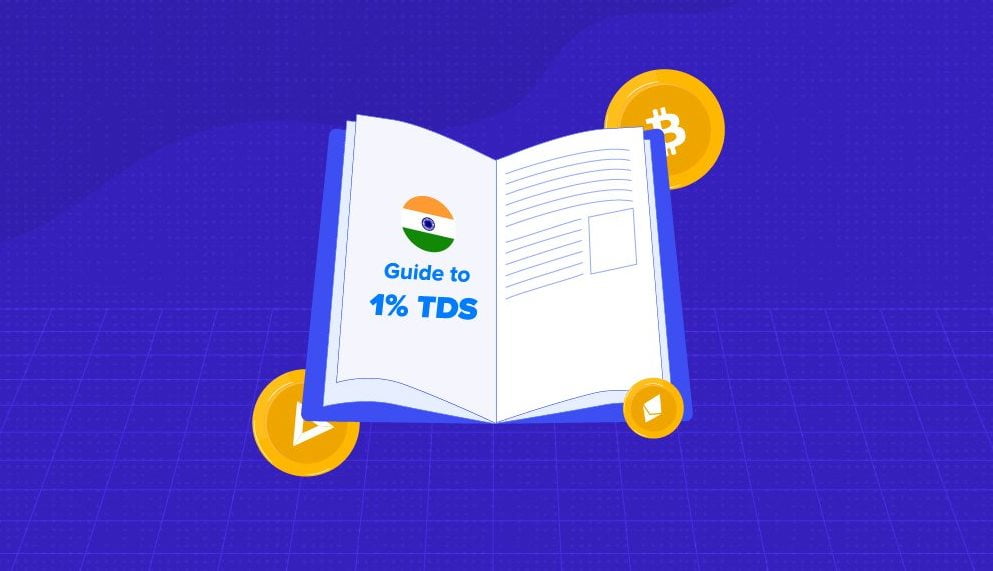

FAQs On Crypto TDS SimBizz

Types Of TDS Different Types Of TDS Deduction Angel One

What Is 1 TDS On Crypto Trade In CoinDCX Pro App Crypto TDS India

What Is TDS On The Rent Limit 2022 What Is The TDS Applicable On Rent

What Is TDS On The Rent Limit 2023 Homebazaar

https://www.telegraphindia.com/business/tds...

In other words business gifts perquisites and incentives shall now be liable to TDS which otherwise were not being offered to tax by the recipient such as distributors dealers masons and influencers

https://www.taxmann.com/post/blog/guide-to...

Since TDS under section 194R of the Act is applicable on all forms of benefit perquisite tax is required to be deducted However it is seen that subjecting these to tax deduction would put seller to difficulty

In other words business gifts perquisites and incentives shall now be liable to TDS which otherwise were not being offered to tax by the recipient such as distributors dealers masons and influencers

Since TDS under section 194R of the Act is applicable on all forms of benefit perquisite tax is required to be deducted However it is seen that subjecting these to tax deduction would put seller to difficulty

What Is 1 TDS On Crypto Trade In CoinDCX Pro App Crypto TDS India

FAQs On Crypto TDS SimBizz

What Is TDS On The Rent Limit 2022 What Is The TDS Applicable On Rent

What Is TDS On The Rent Limit 2023 Homebazaar

Creating A TDS Expense Ledger

GST TDS Rates 2023 Applicability

GST TDS Rates 2023 Applicability

TDS On Sale Of Property Under Section 194IA In 2023 2023