In this digital age, where screens have become the dominant feature of our lives yet the appeal of tangible, printed materials hasn't diminished. For educational purposes for creative projects, simply to add an element of personalization to your home, printables for free are now a useful source. For this piece, we'll take a dive into the sphere of "Is The Arizona Solar Tax Credit Refundable," exploring their purpose, where they are available, and how they can add value to various aspects of your daily life.

Get Latest Is The Arizona Solar Tax Credit Refundable Below

Is The Arizona Solar Tax Credit Refundable

Is The Arizona Solar Tax Credit Refundable -

The solar tax credit is non refundable The system owner s tax liability must cover the full amount of the tax credit Any unused credit amount can carry over to future tax bills

Credit for Solar Energy Devices Did you install solar panels on your house A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayer s residence located in Arizona

Is The Arizona Solar Tax Credit Refundable include a broad selection of printable and downloadable materials that are accessible online for free cost. They are available in a variety of styles, from worksheets to coloring pages, templates and many more. One of the advantages of Is The Arizona Solar Tax Credit Refundable is their versatility and accessibility.

More of Is The Arizona Solar Tax Credit Refundable

Arizona Solar Tax Credit And Solar Incentives 2022 Guide

Arizona Solar Tax Credit And Solar Incentives 2022 Guide

When you purchase solar equipment for your home and have tax liability you generally can claim a solar tax credit to lower your tax bill The Residential Clean Energy Credit is non refundable meaning that it can offset your income tax liability dollar for dollar but any excess credit won t be refunded

The credit is nonrefundable so the credit amount you receive can t exceed the amount you owe in tax You can carry forward any excess unused credit though and apply it to reduce the tax you owe in future years

Is The Arizona Solar Tax Credit Refundable have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization The Customization feature lets you tailor printables to fit your particular needs, whether it's designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: Free educational printables are designed to appeal to students from all ages, making these printables a powerful tool for teachers and parents.

-

It's easy: You have instant access a myriad of designs as well as templates saves time and effort.

Where to Find more Is The Arizona Solar Tax Credit Refundable

Solar Tax Incentives In Arizona 2022 Guide

Solar Tax Incentives In Arizona 2022 Guide

1 Best answer This is claimed on Arizona Form 310 Credit for Solar Energy Devices To claim this credit you must also complete Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture and include both forms with your tax return

Learn about Arizona solar incentives solar panel pricing tax credits and local rebates in our solar panels for Arizona 2024 guide

In the event that we've stirred your curiosity about Is The Arizona Solar Tax Credit Refundable we'll explore the places the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Is The Arizona Solar Tax Credit Refundable for various motives.

- Explore categories like decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets with flashcards and other teaching materials.

- It is ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates, which are free.

- These blogs cover a wide array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Is The Arizona Solar Tax Credit Refundable

Here are some ways that you can make use use of Is The Arizona Solar Tax Credit Refundable:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Is The Arizona Solar Tax Credit Refundable are an abundance with useful and creative ideas designed to meet a range of needs and interests. Their availability and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast collection that is Is The Arizona Solar Tax Credit Refundable today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes you can! You can print and download these free resources for no cost.

-

Can I make use of free templates for commercial use?

- It is contingent on the specific conditions of use. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Some printables could have limitations concerning their use. Be sure to read the terms and conditions provided by the creator.

-

How do I print Is The Arizona Solar Tax Credit Refundable?

- You can print them at home with an printer, or go to an in-store print shop to get more high-quality prints.

-

What software is required to open printables at no cost?

- Many printables are offered in the format of PDF, which is open with no cost software, such as Adobe Reader.

Arizona Solar Tax Credits Total Solutions

How To Apply For Arizona s Refundable R D Tax Credit

Check more sample of Is The Arizona Solar Tax Credit Refundable below

Is Solar Tax Credit Refundable Claiming Your Solar Tax Credit Gov

Arizona Solar Incentives Barrier Insulation Energy LLC

2023 Arizona Solar Incentives Guide Tax Credits Rebates More

Arizona Solar Incentives Tax Credits For 2023 LeafScore

Is Solar Worth It In Arizona Solar USA

The Solar Industry Is Growing Saguaro Solar Is Tucson s Premier Solar

.png?format=1500w)

https://azdor.gov › forms › tax-credits-forms › credit...

Credit for Solar Energy Devices Did you install solar panels on your house A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayer s residence located in Arizona

https://resilient.az.gov › clean-energy-hub › ...

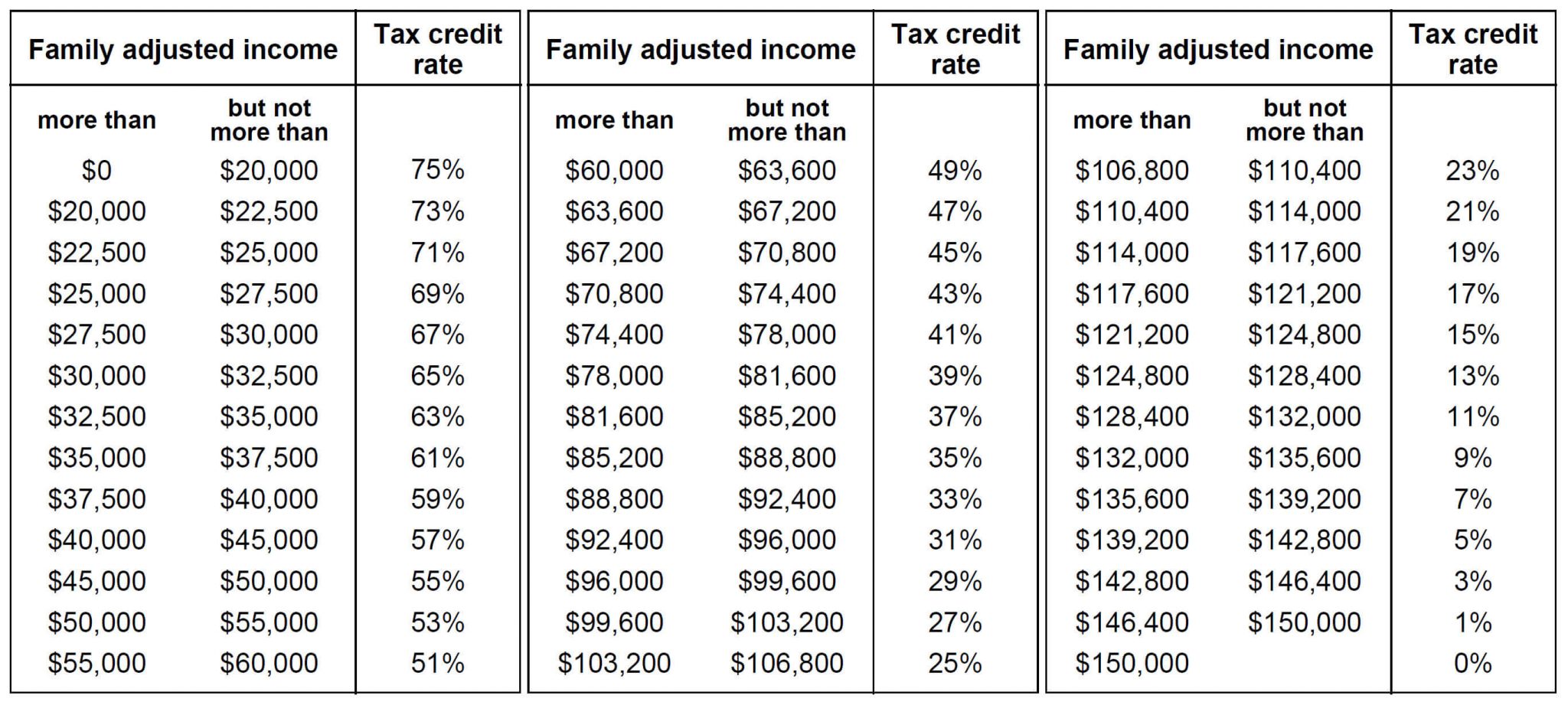

Taxpayers can subtract from their personal income tax an amount equal to 25 of the cost for purchasing a solar or wind energy device up to a maximum of 1 000 regardless of how many energy devices are installed

Credit for Solar Energy Devices Did you install solar panels on your house A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayer s residence located in Arizona

Taxpayers can subtract from their personal income tax an amount equal to 25 of the cost for purchasing a solar or wind energy device up to a maximum of 1 000 regardless of how many energy devices are installed

Arizona Solar Incentives Tax Credits For 2023 LeafScore

Arizona Solar Incentives Barrier Insulation Energy LLC

Is Solar Worth It In Arizona Solar USA

.png?format=1500w)

The Solar Industry Is Growing Saguaro Solar Is Tucson s Premier Solar

Arizona State R D Tax Credit

The Full Guide Solar Investment Tax Credit In 2022 Karla Dennis

The Full Guide Solar Investment Tax Credit In 2022 Karla Dennis

Ontario Childcare Tax Credit Refundable Tax Credit For Low income