In this digital age, in which screens are the norm The appeal of tangible printed material hasn't diminished. Be it for educational use or creative projects, or simply adding the personal touch to your space, Is The Federal Ev Tax Credit Refundable are now a useful resource. For this piece, we'll take a dive into the world of "Is The Federal Ev Tax Credit Refundable," exploring the benefits of them, where to get them, as well as what they can do to improve different aspects of your lives.

Get Latest Is The Federal Ev Tax Credit Refundable Below

Is The Federal Ev Tax Credit Refundable

Is The Federal Ev Tax Credit Refundable -

That s because the credit is applied against your tax bill for vehicles purchased in 2023 you ll get the credit when you file in 2024 and you don t get a refund if your tax credit is

The New Clean Vehicle Credit may be claimed only to the extent of reported tax due of the taxpayer and cannot be refunded The New Clean Vehicle Credit cannot be carried forward to the extent it is claimed for personal use on Form 1040 Schedule 3 Additional Credits and Payments

Is The Federal Ev Tax Credit Refundable include a broad range of printable, free materials that are accessible online for free cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The beauty of Is The Federal Ev Tax Credit Refundable lies in their versatility as well as accessibility.

More of Is The Federal Ev Tax Credit Refundable

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after Who qualifies You may qualify for a credit up to 7 500 for buying a qualified new car or light truck

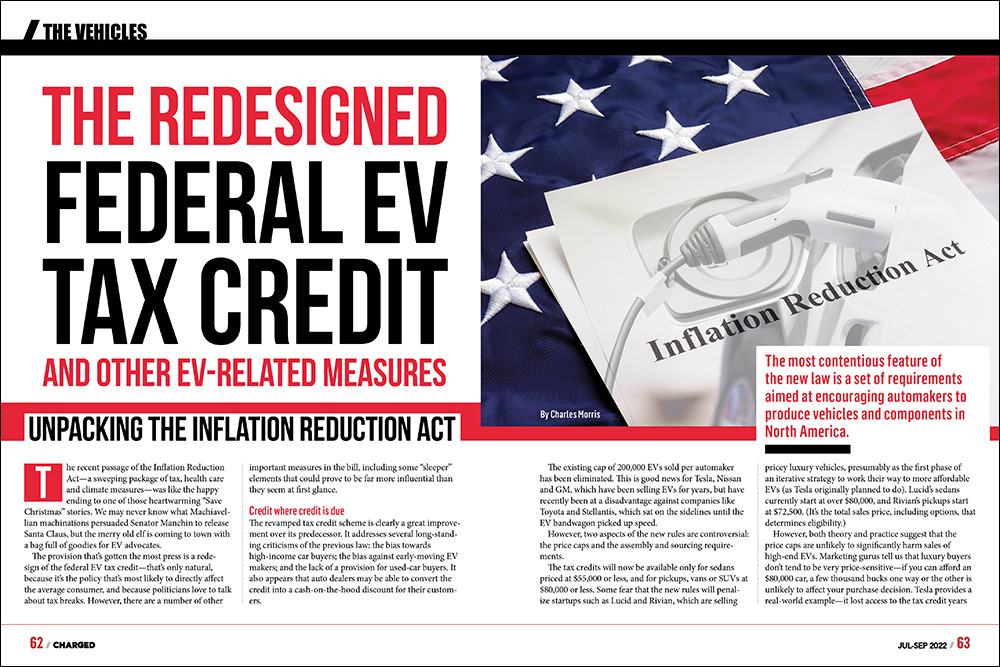

The federal tax credit of up to 7 500 for EVs came thanks to the Inflation Reduction Act IRA But ever since the electric vehicle tax credit was announced there have been questions

Print-friendly freebies have gained tremendous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Customization: This allows you to modify the templates to meet your individual needs in designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Worth: Printing educational materials for no cost offer a wide range of educational content for learners of all ages. This makes them a great tool for parents and teachers.

-

The convenience of Fast access numerous designs and templates cuts down on time and efforts.

Where to Find more Is The Federal Ev Tax Credit Refundable

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

The full EV credit is 7 500 but you d have to make about 65 000 to owe enough tax to receive the full credit That cuts a lot of folks out well more than a third of Americans make less than 50 000 annually The credit needs to be reworked Solution The Revised Middle Class EV Credit

If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier to access this year but fewer

After we've peaked your interest in printables for free Let's take a look at where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Is The Federal Ev Tax Credit Refundable designed for a variety objectives.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free including flashcards, learning tools.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- These blogs cover a broad range of interests, all the way from DIY projects to planning a party.

Maximizing Is The Federal Ev Tax Credit Refundable

Here are some inventive ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is The Federal Ev Tax Credit Refundable are an abundance of innovative and useful resources for a variety of needs and hobbies. Their availability and versatility make them an invaluable addition to your professional and personal life. Explore the world of Is The Federal Ev Tax Credit Refundable right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free gratis?

- Yes you can! You can download and print these documents for free.

-

Can I use free printing templates for commercial purposes?

- It's determined by the specific conditions of use. Always verify the guidelines provided by the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with Is The Federal Ev Tax Credit Refundable?

- Some printables may have restrictions regarding usage. Be sure to review the terms and condition of use as provided by the creator.

-

How can I print Is The Federal Ev Tax Credit Refundable?

- Print them at home using either a printer at home or in a local print shop for better quality prints.

-

What software must I use to open printables at no cost?

- The majority of printed documents are in the format of PDF, which can be opened using free software, such as Adobe Reader.

Has Federal EV Tax Credit Been Saved The Green Car Guy

Is The 2023 Toyota BZ4X Eligible For The Federal EV Tax Credit

Check more sample of Is The Federal Ev Tax Credit Refundable below

4 Ways How Does The Federal Ev Tax Credit Work Alproject

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

Attempt At Raising Ceiling For Federal EV Tax Credit By Tesla And GM

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

The Federal Electric Car Tax Credit OsVehicle

10 Cheapest EVs When Taking Advantage Of U S Federal EV Tax Credit

https://www.irs.gov/newsroom/topic-a-frequently...

The New Clean Vehicle Credit may be claimed only to the extent of reported tax due of the taxpayer and cannot be refunded The New Clean Vehicle Credit cannot be carried forward to the extent it is claimed for personal use on Form 1040 Schedule 3 Additional Credits and Payments

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

The New Clean Vehicle Credit may be claimed only to the extent of reported tax due of the taxpayer and cannot be refunded The New Clean Vehicle Credit cannot be carried forward to the extent it is claimed for personal use on Form 1040 Schedule 3 Additional Credits and Payments

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

List Of Vehicles Eligible For The New 7 500 Federal EV Tax Credit

The Federal Electric Car Tax Credit OsVehicle

10 Cheapest EVs When Taking Advantage Of U S Federal EV Tax Credit

Study Suggests Federal EV Tax Credit Should Favor Greener States

Charged EVs The Redesigned Federal EV Tax Credit And Other EV related

Charged EVs The Redesigned Federal EV Tax Credit And Other EV related

Federal EV Tax Credit Explained YouTube