In the digital age, where screens rule our lives but the value of tangible printed materials hasn't faded away. In the case of educational materials, creative projects, or just adding the personal touch to your area, Is There A Tax Deduction For Hybrid Vehicles are a great resource. Through this post, we'll dive into the sphere of "Is There A Tax Deduction For Hybrid Vehicles," exploring what they are, where they are available, and how they can be used to enhance different aspects of your daily life.

Get Latest Is There A Tax Deduction For Hybrid Vehicles Below

Is There A Tax Deduction For Hybrid Vehicles

Is There A Tax Deduction For Hybrid Vehicles -

The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

Is There A Tax Deduction For Hybrid Vehicles encompass a wide range of downloadable, printable materials that are accessible online for free cost. They are available in a variety of formats, such as worksheets, coloring pages, templates and much more. The attraction of printables that are free is in their versatility and accessibility.

More of Is There A Tax Deduction For Hybrid Vehicles

2022 Last Minute Vehicle Purchases To Save On Taxes Morris D Angelo

2022 Last Minute Vehicle Purchases To Save On Taxes Morris D Angelo

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive

A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive a tax credit of

The Is There A Tax Deduction For Hybrid Vehicles have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or costly software.

-

Personalization You can tailor printed materials to meet your requirements whether you're designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Value Educational printables that can be downloaded for free can be used by students of all ages, making them an invaluable tool for parents and teachers.

-

Affordability: The instant accessibility to various designs and templates, which saves time as well as effort.

Where to Find more Is There A Tax Deduction For Hybrid Vehicles

Is There A Tax Credit For A Whole House Generator

Is There A Tax Credit For A Whole House Generator

A tax deduction is subtracted from your income before taxes however So a deduction of 500 reduces your taxable earnings to 39 500 and 10 percent of 39 500 will leave you owing 3 950 So right off the bat

Commercial fleets and tax exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit per vehicle these include all electric plug in hybrid

If we've already piqued your curiosity about Is There A Tax Deduction For Hybrid Vehicles Let's take a look at where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection and Is There A Tax Deduction For Hybrid Vehicles for a variety objectives.

- Explore categories like decorating your home, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free, flashcards, and learning tools.

- Perfect for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- The blogs covered cover a wide selection of subjects, starting from DIY projects to party planning.

Maximizing Is There A Tax Deduction For Hybrid Vehicles

Here are some ways ensure you get the very most use of Is There A Tax Deduction For Hybrid Vehicles:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Is There A Tax Deduction For Hybrid Vehicles are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and interests. Their accessibility and flexibility make them an invaluable addition to both personal and professional life. Explore the wide world of Is There A Tax Deduction For Hybrid Vehicles to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is There A Tax Deduction For Hybrid Vehicles truly free?

- Yes you can! You can print and download the resources for free.

-

Does it allow me to use free printables in commercial projects?

- It's based on the rules of usage. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may come with restrictions on their use. Make sure to read the terms and regulations provided by the designer.

-

How can I print printables for free?

- You can print them at home with either a printer or go to the local print shops for top quality prints.

-

What program do I need to run printables free of charge?

- Most PDF-based printables are available in the format PDF. This can be opened using free software like Adobe Reader.

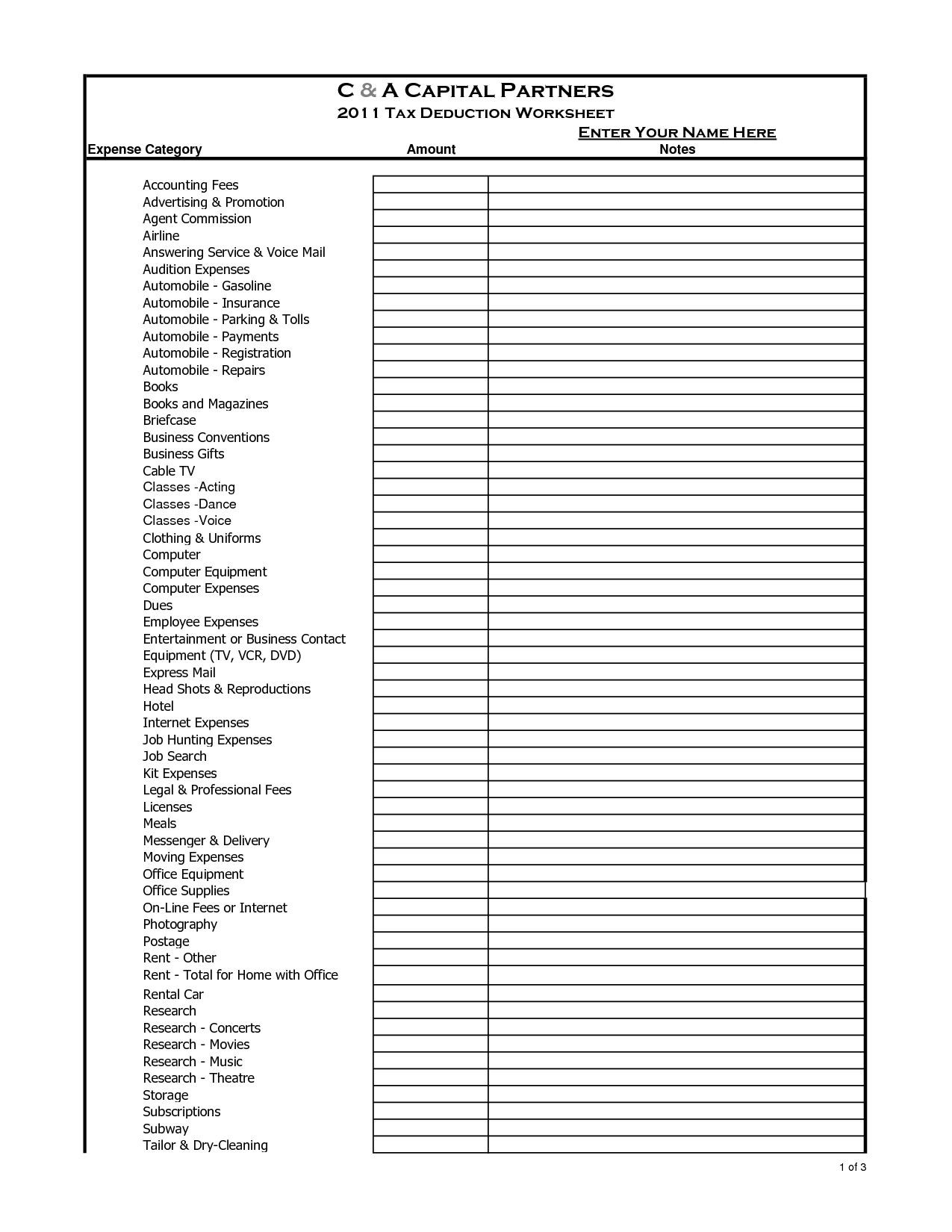

10 Business Tax Deductions Worksheet Worksheeto

10 Best Vehicles For Income Tax Deduction In 2022

Check more sample of Is There A Tax Deduction For Hybrid Vehicles below

How Much Do You Need To Donate For Tax Deduction

Rep Rutherford Indicates It s Time To Phase Out Tax Deduction For

Vehicles That Qualify For 6000 Lb Tax Credit

Vehicle Tax Deduction Section 179 Explained How To Write Off A

Is There A Tax Tax On Electric Bicycles Electric Bike Guide

Solved The U S federal Government Offers Homeowners A Tax Chegg

https://www.cars.com/articles/heres-which-hybrids...

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

https://insideevs.com/news/702784/ev-t…

A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a federal tax credit of up to 7 500 provided it was manufactured in North America But the rules

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids

A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a federal tax credit of up to 7 500 provided it was manufactured in North America But the rules

Vehicle Tax Deduction Section 179 Explained How To Write Off A

Rep Rutherford Indicates It s Time To Phase Out Tax Deduction For

Is There A Tax Tax On Electric Bicycles Electric Bike Guide

Solved The U S federal Government Offers Homeowners A Tax Chegg

Is There A Tax Credit For Electric Bicycle Electric Bike Guide

Business Use Of Vehicles Maximize Your Tax Deduction Rosenberg Chesnov

Business Use Of Vehicles Maximize Your Tax Deduction Rosenberg Chesnov

What Is The Standard Federal Tax Deduction Ericvisser