In the age of digital, where screens dominate our lives however, the attraction of tangible, printed materials hasn't diminished. In the case of educational materials for creative projects, just adding the personal touch to your space, Is There Any Deduction In New Tax Regime have become an invaluable source. The following article is a take a dive through the vast world of "Is There Any Deduction In New Tax Regime," exploring what they are, where to locate them, and how they can enhance various aspects of your daily life.

Get Latest Is There Any Deduction In New Tax Regime Below

Is There Any Deduction In New Tax Regime

Is There Any Deduction In New Tax Regime -

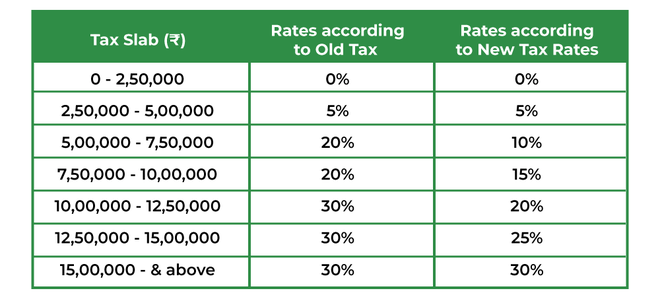

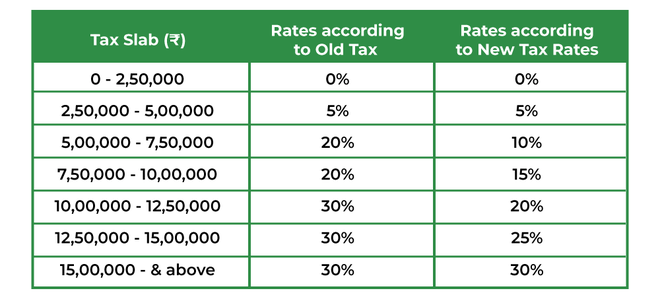

The Budget 2020 introduces a new regime under Section 115BAC giving individuals and HUF taxpayers an option to pay income tax at lower rates with fewer exemptions and deductions to claim Keep reading to learn more about Section 115BAC of

Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer has to keep in mind that for the AY 2024 25 standard deduction for salaried individuals will remain 50 000

Printables for free cover a broad variety of printable, downloadable documents that can be downloaded online at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages and more. One of the advantages of Is There Any Deduction In New Tax Regime lies in their versatility and accessibility.

More of Is There Any Deduction In New Tax Regime

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

Standard Deduction Tax Rebate EXPLAINED In New Tax Regime With

Budget 2024 has increased the standard deduction under the new tax regime to 75 000 The family pension deduction has also been increased from 15 000 to 25 000 With the revised tax structure the taxpayer will save 17 500 Let s look at both regimes and see which regime to opt for in 2024

What deductions are still not allowed in the revised new tax regime effective April 2023 Under the revised new tax regime the individual will forego 70 deductions and tax exemptions which includes HRA tax exemption LTA tax exemption deduction up to Rs 1 5 lakh under Section 80C

Is There Any Deduction In New Tax Regime have garnered immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Flexible: The Customization feature lets you tailor the templates to meet your individual needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Education Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them an invaluable aid for parents as well as educators.

-

Simple: Fast access the vast array of design and templates helps save time and effort.

Where to Find more Is There Any Deduction In New Tax Regime

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

What does deduction mean in the new tax regime A standard deduction implies a flat rebate from taxpayers gross salary Taxpayers do not need to apply through a form to claim the deduction

Budget 2023 proposes to make the following deductions available to eligible individuals under the new tax regime from April 1 2023 ii Deduction under Section 80CCD 2 for employer s contribution to employee s National Pension System NPS account iii Deduction for contribution made to Agniveer Corpus Fund

In the event that we've stirred your curiosity about Is There Any Deduction In New Tax Regime Let's see where you can locate these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer an extensive collection with Is There Any Deduction In New Tax Regime for all objectives.

- Explore categories such as design, home decor, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free as well as flashcards and other learning materials.

- The perfect resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates at no cost.

- The blogs are a vast range of topics, starting from DIY projects to planning a party.

Maximizing Is There Any Deduction In New Tax Regime

Here are some inventive ways to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print free worksheets to reinforce learning at home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Is There Any Deduction In New Tax Regime are an abundance of innovative and useful resources for a variety of needs and needs and. Their availability and versatility make them an invaluable addition to any professional or personal life. Explore the wide world of Is There Any Deduction In New Tax Regime and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes you can! You can print and download the resources for free.

-

Can I make use of free printables in commercial projects?

- It's determined by the specific rules of usage. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables could have limitations in use. Check the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home using either a printer at home or in the local print shops for superior prints.

-

What software will I need to access printables that are free?

- Many printables are offered as PDF files, which can be opened using free software, such as Adobe Reader.

Difference Between Old Vs New Tax Regime Which Is Better Vrogue

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

Check more sample of Is There Any Deduction In New Tax Regime below

Changes In New Tax Regime All You Need To Know

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

Old Tax Regime Vs New Tax Regime GeeksforGeeks

How To Excel In Art Of Deduction Mainmake

Budget 2023 Deduction Allowed In New Tax Regime CA Yogesh Katariya

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer has to keep in mind that for the AY 2024 25 standard deduction for salaried individuals will remain 50 000

https://www.incometax.gov.in/iec/foportal/sites...

Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards 6 In the new tax regime can I claim deductions under chapter VIA like section 80C 80D 80DD 80G

Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer has to keep in mind that for the AY 2024 25 standard deduction for salaried individuals will remain 50 000

Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards 6 In the new tax regime can I claim deductions under chapter VIA like section 80C 80D 80DD 80G

Old Tax Regime Vs New Tax Regime GeeksforGeeks

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

How To Excel In Art Of Deduction Mainmake

Budget 2023 Deduction Allowed In New Tax Regime CA Yogesh Katariya

New Tax Regime Vs Old Tax Regime 2023 Tds Deduction Calculation On

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

New Tax Regime Vs Old Which Is Better For You Rupiko Peoplesoft