In the digital age, when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. If it's to aid in education and creative work, or just adding the personal touch to your space, Kansas Estate Tax Return have become a valuable resource. For this piece, we'll take a dive into the world of "Kansas Estate Tax Return," exploring their purpose, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Kansas Estate Tax Return Below

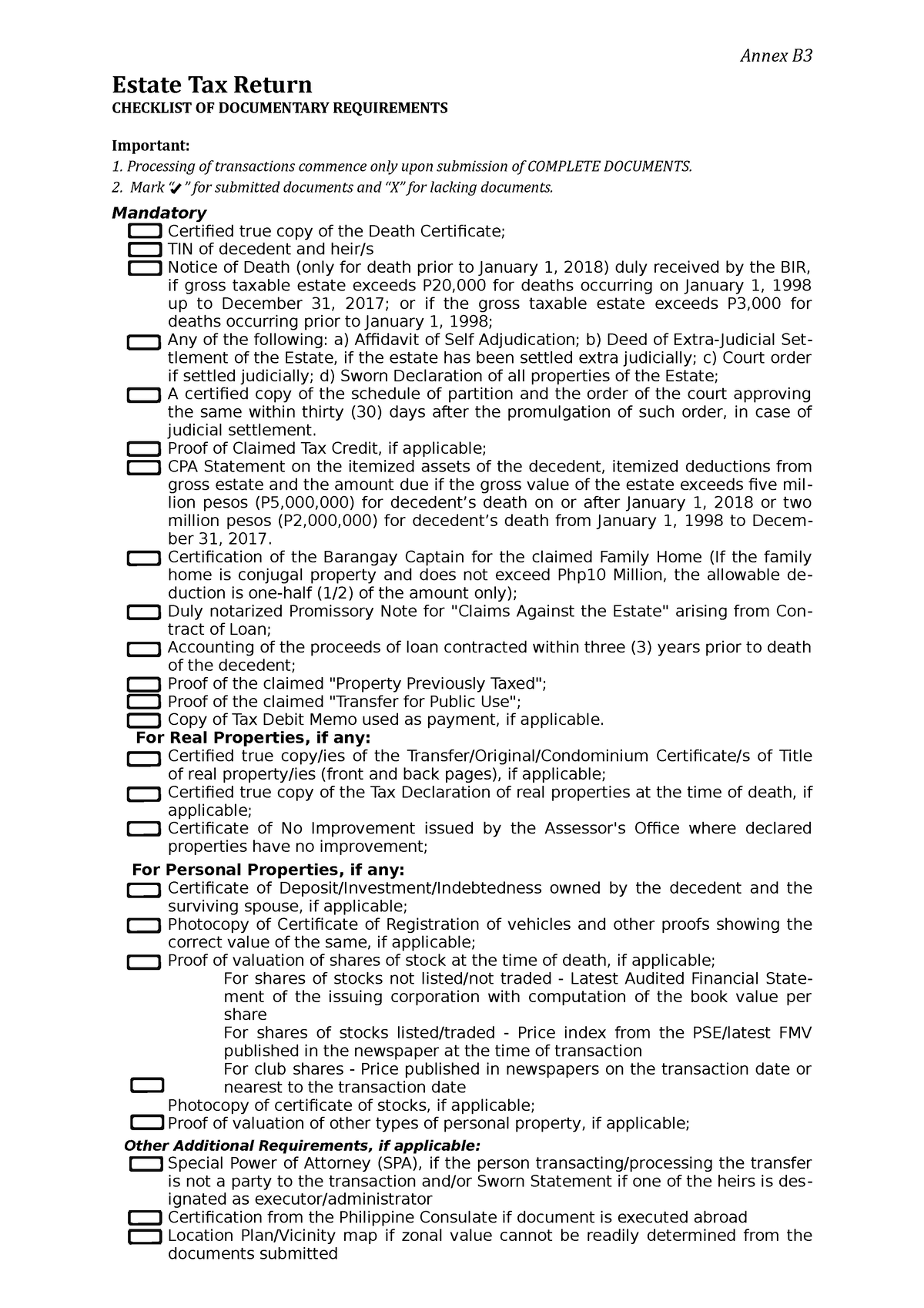

Kansas Estate Tax Return

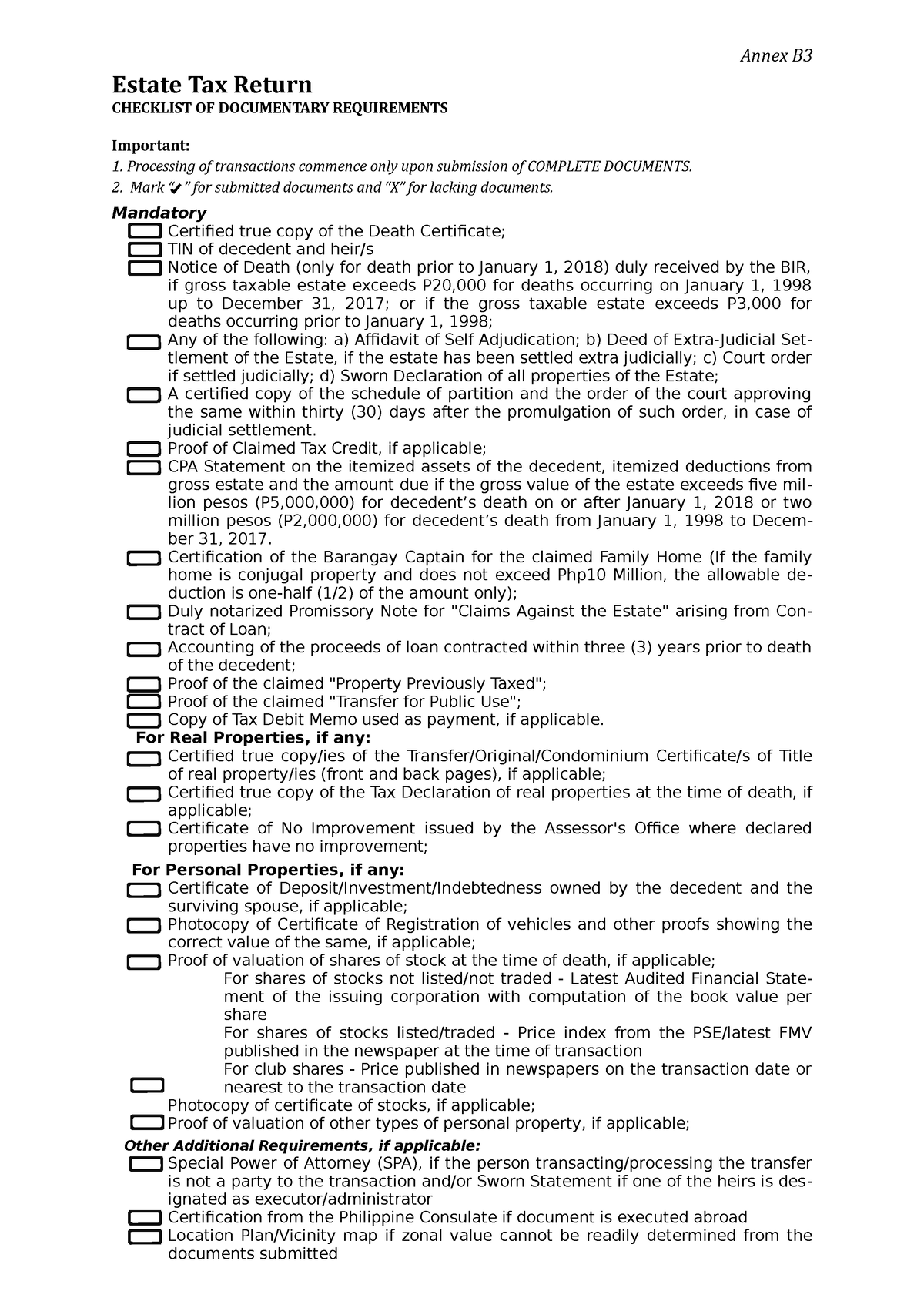

Kansas Estate Tax Return -

The fiduciary of a nonresident estate or trust must file a Kansas Fiduciary Income Tax return if the estate or trust had taxable income or gain derived from Kansas sources

The fiduciary of a nonresident estate or trust must file a Kansas Fiduciary Income Tax Return if the estate or trust had taxable income or gain derived from Kansas sources This includes

Kansas Estate Tax Return provide a diverse array of printable material that is available online at no cost. The resources are offered in a variety types, like worksheets, coloring pages, templates and much more. The appeal of printables for free is their versatility and accessibility.

More of Kansas Estate Tax Return

Kansas Estate Elder Law KS Estate Elder Law

Kansas Estate Elder Law KS Estate Elder Law

In this detailed guide of Kansas inheritance laws we break down intestate succession probate taxes what makes a will valid and more Learn more here

Unlike many states Kansas does not impose an estate tax when its residents pass away and it has some of the most generous tax laws regarding inheritance and gifts However federal estate tax laws may still

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization We can customize designs to suit your personal needs whether it's making invitations to organize your schedule or decorating your home.

-

Educational Value: Downloads of educational content for free provide for students from all ages, making the perfect tool for teachers and parents.

-

The convenience of The instant accessibility to the vast array of design and templates cuts down on time and efforts.

Where to Find more Kansas Estate Tax Return

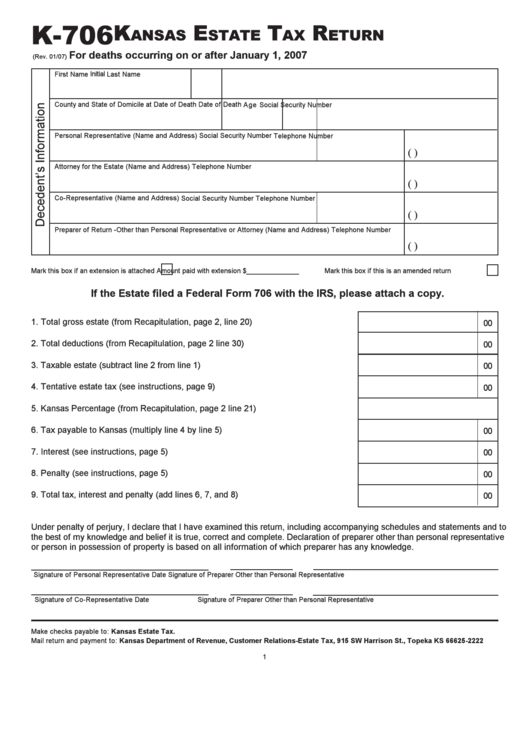

Form K 706 Kansas Estate Tax Return Kansas Deparetment Of Revenue

Form K 706 Kansas Estate Tax Return Kansas Deparetment Of Revenue

Estates of decedents dying prior to July 1 1998 should file an inheritance tax return on Form IH 80 IH 90 or IH 100 Please contact the Department of Revenue for more information about

If you live in Kansas your estate will not be subject to a state estate tax when you pass away Despite the absence of a state estate tax Kansas residents still need to know a

In the event that we've stirred your curiosity about Kansas Estate Tax Return Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of applications.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- These blogs cover a wide array of topics, ranging starting from DIY projects to planning a party.

Maximizing Kansas Estate Tax Return

Here are some fresh ways in order to maximize the use use of Kansas Estate Tax Return:

1. Home Decor

- Print and frame gorgeous artwork, quotes as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to reinforce learning at home or in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Kansas Estate Tax Return are an abundance of innovative and useful resources for a variety of needs and interest. Their availability and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the world of Kansas Estate Tax Return and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Kansas Estate Tax Return truly free?

- Yes they are! You can download and print these tools for free.

-

Does it allow me to use free printouts for commercial usage?

- It's all dependent on the conditions of use. Always review the terms of use for the creator before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Certain printables could be restricted concerning their use. You should read the conditions and terms of use provided by the creator.

-

How can I print Kansas Estate Tax Return?

- Print them at home with an printer, or go to any local print store for high-quality prints.

-

What program do I need to run printables at no cost?

- The majority of printables are as PDF files, which can be opened with free software like Adobe Reader.

Kansas Estate Tax Everything You Need To Know SmartAsset

Do You Have To Pay Inheritance Tax In Kansas Randy Mattingly

Check more sample of Kansas Estate Tax Return below

Kansas Estate Taxes 2017 Kansas Inheritance Taxes Guide

Kansas Living Trust Attorney

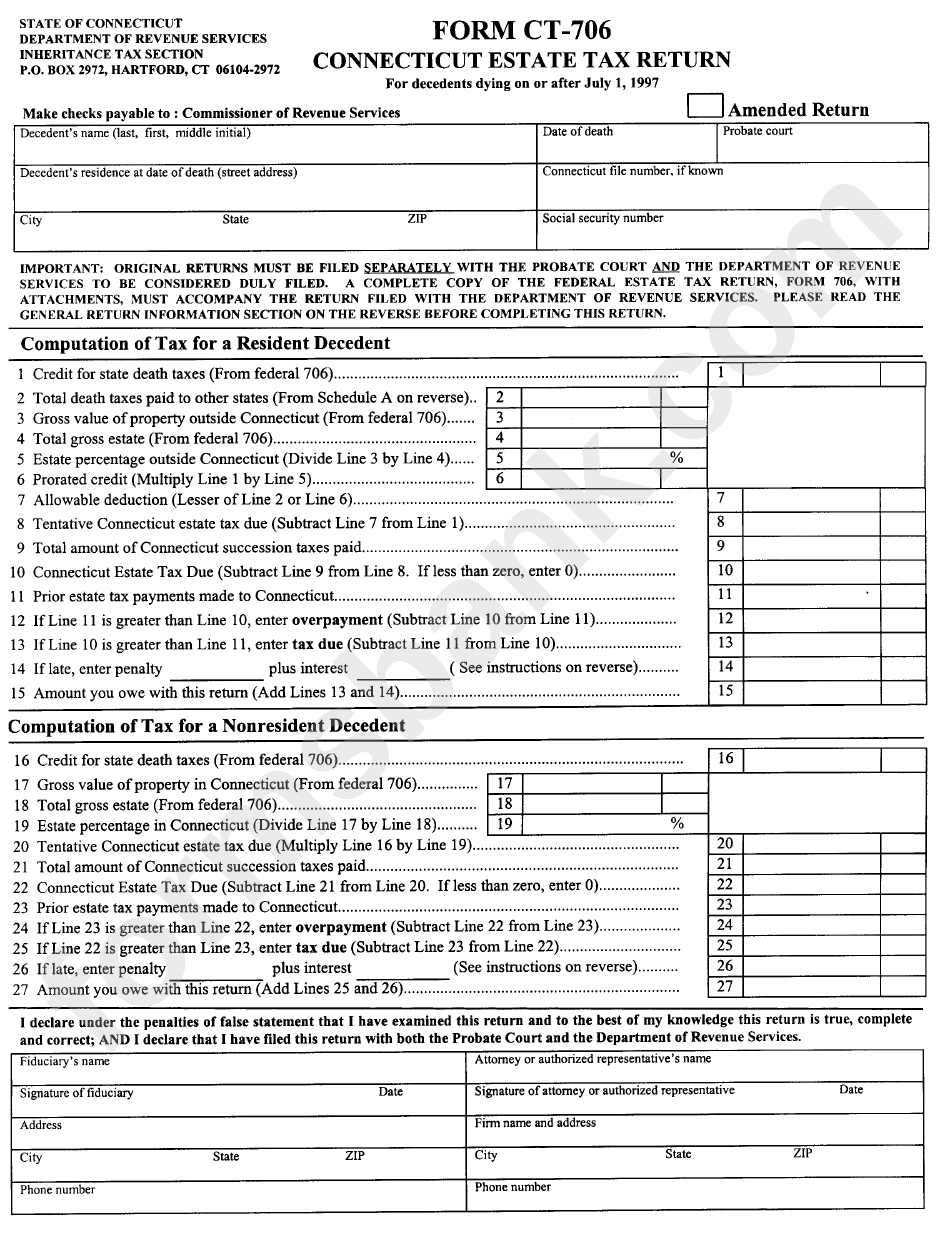

Form Ct 706 Nt Fillable Printable Forms Free Online

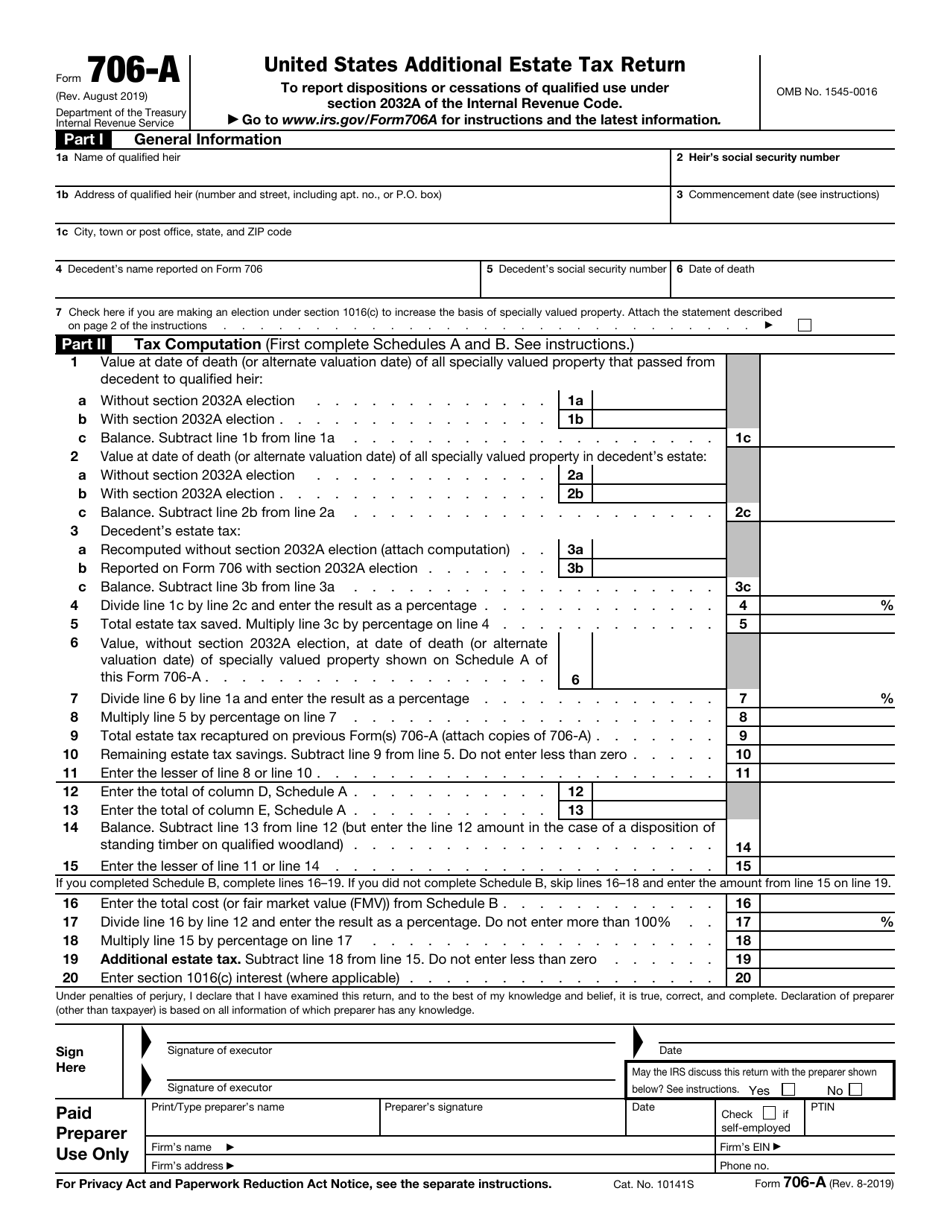

Form 706 Free Fillable Form Printable Forms Free Online

11 Million Kansas Estate With Incredible Backyard Homes Of The Rich

Do You Have To Pay Inheritance Tax In Kansas Randy Mattingly

https://www.ksrevenue.gov

The fiduciary of a nonresident estate or trust must file a Kansas Fiduciary Income Tax Return if the estate or trust had taxable income or gain derived from Kansas sources This includes

https://www.itrlaw.com › kansas-inheritance-laws

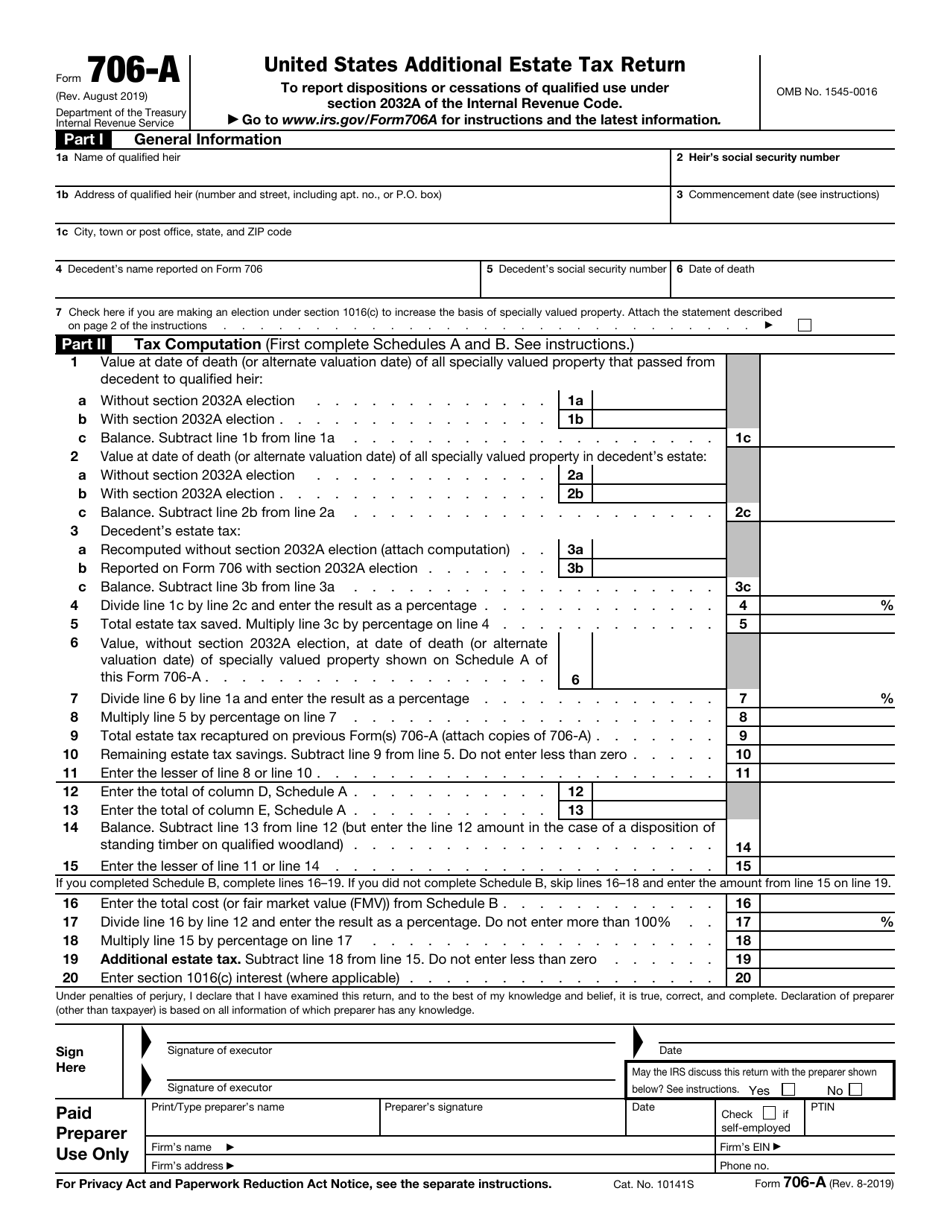

Federal estate tax return this is only for very large estates and is due nine months after the individual s death an automatic six month extension is available if requested

The fiduciary of a nonresident estate or trust must file a Kansas Fiduciary Income Tax Return if the estate or trust had taxable income or gain derived from Kansas sources This includes

Federal estate tax return this is only for very large estates and is due nine months after the individual s death an automatic six month extension is available if requested

Form 706 Free Fillable Form Printable Forms Free Online

Kansas Living Trust Attorney

11 Million Kansas Estate With Incredible Backyard Homes Of The Rich

Do You Have To Pay Inheritance Tax In Kansas Randy Mattingly

Why Billions Of Dollars In Estate Taxes Go Uncollected NBC News

Printable New York State Tax Forms Printable Forms Free Online

Printable New York State Tax Forms Printable Forms Free Online

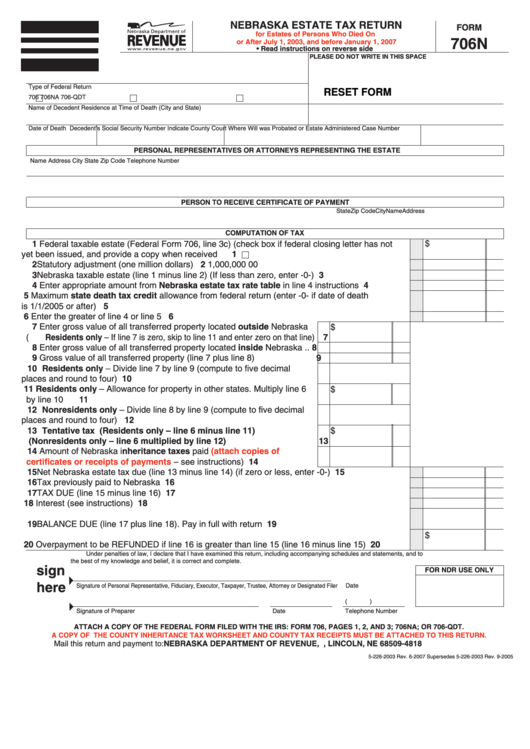

Fillable Form 706n Nebraska Estate Tax Return Printable Pdf Download