In a world with screens dominating our lives but the value of tangible printed material hasn't diminished. For educational purposes in creative or artistic projects, or just adding personal touches to your home, printables for free have proven to be a valuable resource. For this piece, we'll take a dive into the world "Lic Pension Plan Tax Benefit," exploring what they are, where to locate them, and how they can improve various aspects of your daily life.

Get Latest Lic Pension Plan Tax Benefit Below

Lic Pension Plan Tax Benefit

Lic Pension Plan Tax Benefit -

The tax advantage of an immediate annuity plan is that while the principal of the investment is tax free the interest is taxed as ordinary income The payments however will be completely taxable after you have received the entire principal sum

C some important income tax benefits available under various plans of life insurance ARE HIGHLIGHTED BELOW 1 Deduction allowable from Income for payment of Life Insurance Premium Section 80C

Printables for free include a vast assortment of printable resources available online for download at no cost. They are available in a variety of kinds, including worksheets coloring pages, templates and more. The great thing about Lic Pension Plan Tax Benefit lies in their versatility and accessibility.

More of Lic Pension Plan Tax Benefit

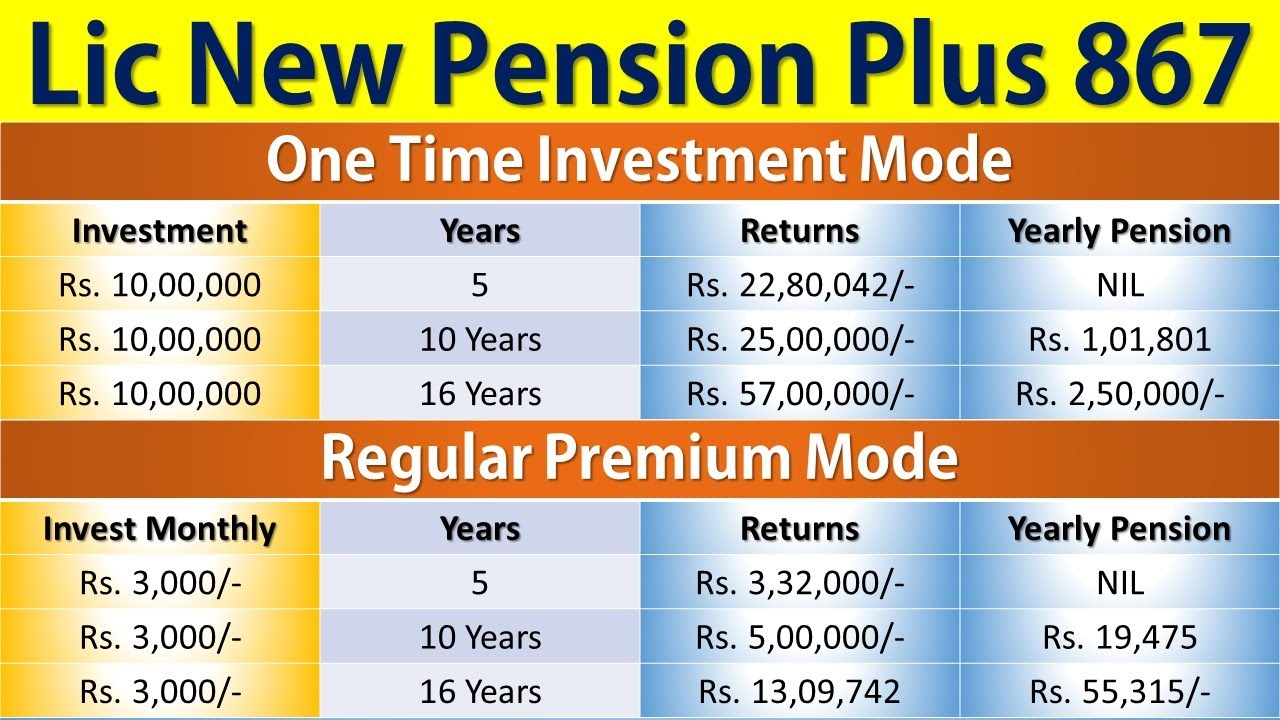

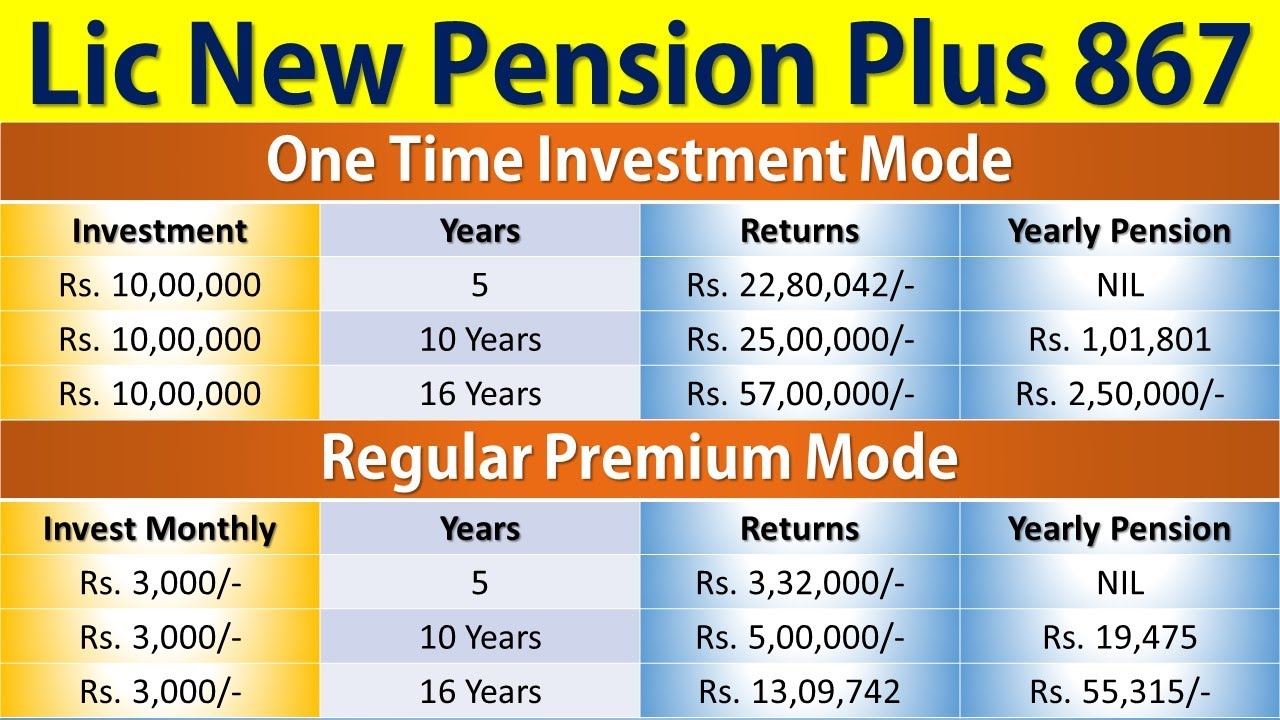

Lic New Pension Plan 867 Lic Pension Plan 2022 Lic New Pension Plus

Lic New Pension Plan 867 Lic Pension Plan 2022 Lic New Pension Plus

Under existing rules tax deductions are allowed for individuals who make contributions to an annuity plan of Life Insurance Corporation LIC or any other pension fund offered by registered insurance companies in India

Deduction is allowed if the assessee has paid any amount towards any annuity plan of Life Insurance Corporation of India LIC or any other insurer for receiving pension from pension fund Pension received from the policy is also considered as part of taxable income

Lic Pension Plan Tax Benefit have risen to immense popularity due to numerous compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: There is the possibility of tailoring print-ready templates to your specific requirements, whether it's designing invitations or arranging your schedule or even decorating your home.

-

Educational Use: Free educational printables offer a wide range of educational content for learners from all ages, making the perfect resource for educators and parents.

-

Accessibility: instant access numerous designs and templates saves time and effort.

Where to Find more Lic Pension Plan Tax Benefit

Itt Az j Minim lis B rek F ggetlen H r gyn ks g Pensions Salary

Itt Az j Minim lis B rek F ggetlen H r gyn ks g Pensions Salary

As per Section 10 10D of the Income Tax Act 1961 any sum received under a Life Insurance Policy including the sum allocated by way of bonus on such policy is exempt from tax where the sum is received as a death benefit

CBDT notifies vide Notification No 134 2021 Income Tax Dated 06 12 2021 that Jeevan Akshay VII Plan of the Life Insurance Corporation of India qualifies for deduction under section 80C of Income Tax Act 1961

Now that we've ignited your curiosity about Lic Pension Plan Tax Benefit, let's explore where they are hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Lic Pension Plan Tax Benefit suitable for many objectives.

- Explore categories like furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a broad array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Lic Pension Plan Tax Benefit

Here are some innovative ways to make the most use of Lic Pension Plan Tax Benefit:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets for reinforcement of learning at home or in the classroom.

3. Event Planning

- Design invitations, banners, and other decorations for special occasions like weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Lic Pension Plan Tax Benefit are an abundance of practical and innovative resources that meet a variety of needs and interests. Their accessibility and versatility make them a wonderful addition to the professional and personal lives of both. Explore the vast collection of Lic Pension Plan Tax Benefit now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes they are! You can print and download these documents for free.

-

Can I download free printables for commercial uses?

- It's contingent upon the specific usage guidelines. Always review the terms of use for the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may contain restrictions concerning their use. Be sure to check the terms of service and conditions provided by the author.

-

How do I print Lic Pension Plan Tax Benefit?

- You can print them at home using an printer, or go to the local print shop for the highest quality prints.

-

What program is required to open printables that are free?

- The majority of printables are with PDF formats, which is open with no cost software like Adobe Reader.

LIC Pension Plan Details In Kannada LIC Jeevan Shanti Pension Plan

LIC New Pension Plus Plan Launched Guaranteed Income After Retirement

Check more sample of Lic Pension Plan Tax Benefit below

LIC PENSION PLUS Plan No 803 A New Pension Plan From LIC

LIC Pension Plan Get Rs 12 000 Monthly Pension On One time Investment

LIC Pension Plan Big News You Will Get 10 12 More Pension In These

LIC New Jeevan Shanti Revised Pension Plan Calculator LIC Insurance

LIC Pension Plan 2021 LIC Jeevan Akshya Pension Plan LIC Best Pension

LIC Jeevan Shanti Plan No 850 Pension Plan PunitShet

https://licindia.in/documents/20121/130633/INCOME...

C some important income tax benefits available under various plans of life insurance ARE HIGHLIGHTED BELOW 1 Deduction allowable from Income for payment of Life Insurance Premium Section 80C

https://cleartax.in/s/section-80ccc

Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for contributions made by an individual to designated pension plans provided by life insurance The deduction is within the combined limit along with deductions under Section 80C and Section 80CCD 1

C some important income tax benefits available under various plans of life insurance ARE HIGHLIGHTED BELOW 1 Deduction allowable from Income for payment of Life Insurance Premium Section 80C

Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for contributions made by an individual to designated pension plans provided by life insurance The deduction is within the combined limit along with deductions under Section 80C and Section 80CCD 1

LIC New Jeevan Shanti Revised Pension Plan Calculator LIC Insurance

LIC Pension Plan Get Rs 12 000 Monthly Pension On One time Investment

LIC Pension Plan 2021 LIC Jeevan Akshya Pension Plan LIC Best Pension

LIC Jeevan Shanti Plan No 850 Pension Plan PunitShet

LIC New Jeevan Shanti Plan LIC New Pension Plan 858 MoneyManch

BEST LIC Saral Pension Plan Features Benefits Calculator

BEST LIC Saral Pension Plan Features Benefits Calculator

LIC 50 000