In the age of digital, where screens dominate our lives yet the appeal of tangible printed products hasn't decreased. Whatever the reason, whether for education such as creative projects or just adding the personal touch to your area, Limited Company Tax Refund can be an excellent source. The following article is a take a dive deep into the realm of "Limited Company Tax Refund," exploring the different types of printables, where they can be found, and the ways that they can benefit different aspects of your life.

Get Latest Limited Company Tax Refund Below

Limited Company Tax Refund

Limited Company Tax Refund -

Feb 7 14 min read How to Claim a Corporation Tax Refund Claiming a corporation tax refund in the UK is a process that businesses may need to undertake if they have

You can make a claim to carry back a trading loss when you submit your Company Tax Return for the period when you made the loss

Printables for free cover a broad range of downloadable, printable material that is available online at no cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and more. The appeal of printables for free is in their variety and accessibility.

More of Limited Company Tax Refund

Uk Limited Company Tax Calculator CALCULATORUK DFE

Uk Limited Company Tax Calculator CALCULATORUK DFE

If you believe you should get a corporation tax refund then you should use your company corporation tax return to inform HMRC that a refund is due and how you

Lower profit means less tax but because you ve already paid tax on the full 19 000 you ll get a rebate for the difference Our video below explains how Corporation Tax works in more detail but the same

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Flexible: The Customization feature lets you tailor designs to suit your personal needs, whether it's designing invitations and schedules, or even decorating your home.

-

Educational Value These Limited Company Tax Refund are designed to appeal to students of all ages. This makes them a great tool for parents and educators.

-

Easy to use: Instant access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more Limited Company Tax Refund

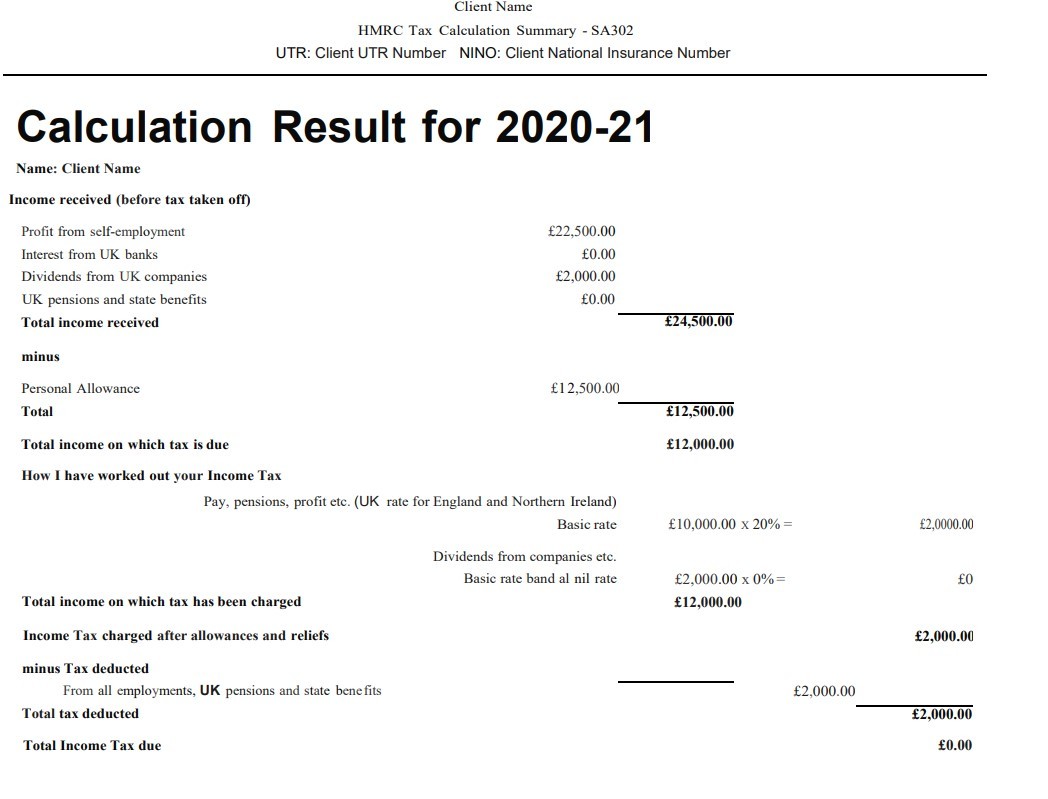

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

How To Access Your SA302 s And Tax Year Overviews As Income Proof For

A limited company in the UK can claim back CIS Construction Industry Scheme tax that has been deducted from payments made to subcontractors by following these steps Register for CIS with

If your limited company pays too much Corporation Tax you can ask HMRC for a Corporation Tax refund i e a repayment of the amount that you overpay You may

In the event that we've stirred your curiosity about Limited Company Tax Refund, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of Limited Company Tax Refund for various applications.

- Explore categories such as decorations for the home, education and management, and craft.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free as well as flashcards and other learning tools.

- Great for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs with templates and designs for free.

- These blogs cover a wide range of topics, ranging from DIY projects to planning a party.

Maximizing Limited Company Tax Refund

Here are some fresh ways ensure you get the very most use of Limited Company Tax Refund:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home also in the classes.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Limited Company Tax Refund are an abundance of creative and practical resources for a variety of needs and preferences. Their access and versatility makes they a beneficial addition to both professional and personal lives. Explore the vast array that is Limited Company Tax Refund today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use free printables for commercial purposes?

- It's based on the rules of usage. Always review the terms of use for the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Certain printables might have limitations regarding usage. You should read the terms and conditions set forth by the author.

-

How do I print Limited Company Tax Refund?

- Print them at home with any printer or head to a local print shop for higher quality prints.

-

What program do I require to open Limited Company Tax Refund?

- The majority of printed documents are in PDF format. These is open with no cost software such as Adobe Reader.

Proof Of Income Documents For Self Employed IncomeProTalk

How To Close A Limited Company Without Paying Any Tax

Check more sample of Limited Company Tax Refund below

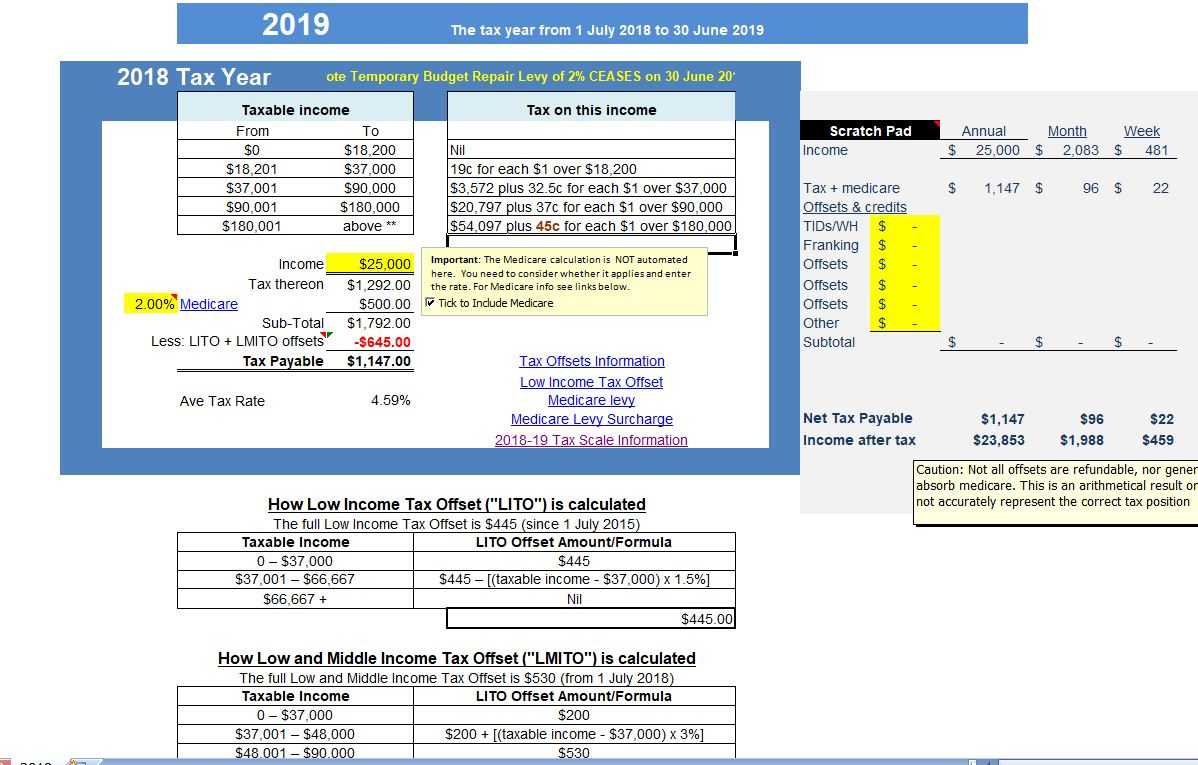

Limited Company Tax Calculator Spreadsheet Google Spreadshee Limited

Limited Company Tax The Practical Guide To UK Ltd Company Tax

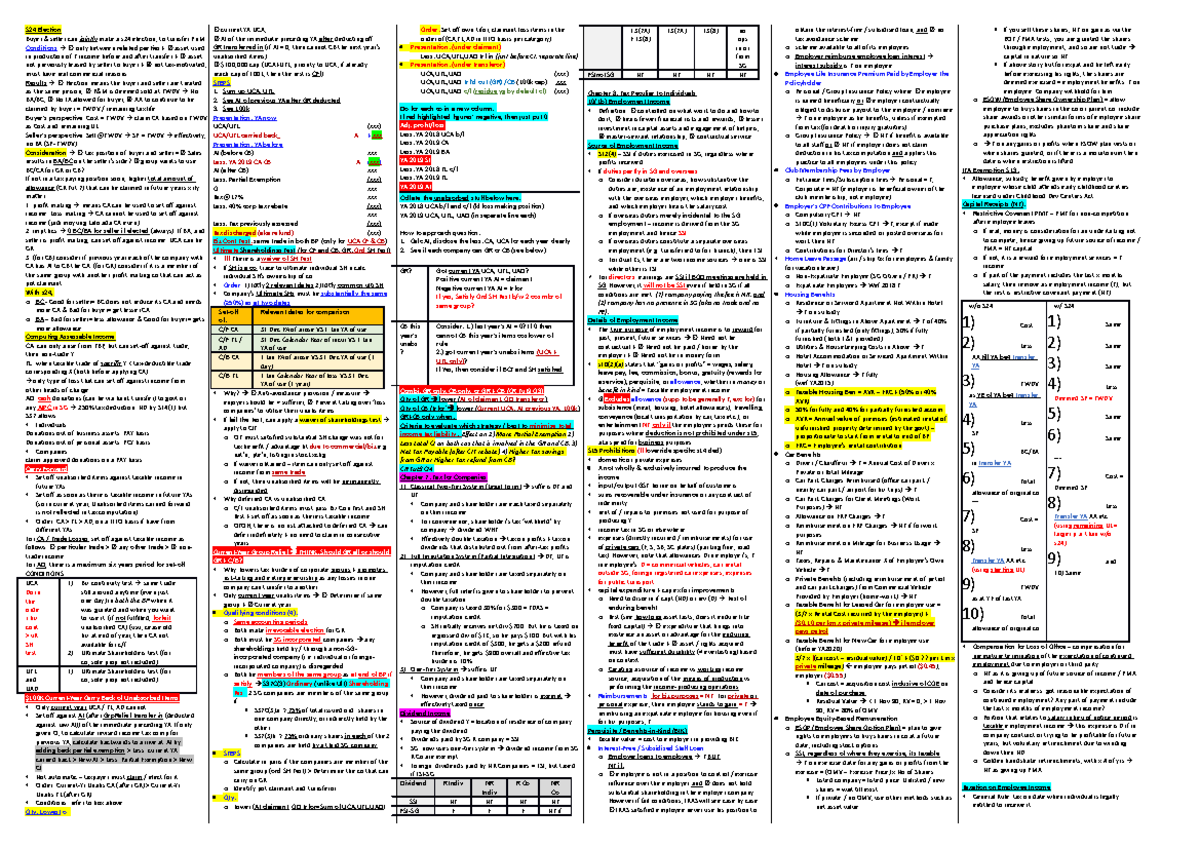

Tax Cheat Sheet S24 Election Buyer Seller Can Jointly Make A S24

Limited Company Tax How What Where Why When

2022 Tax Planning Equity Transfer Tax Rate IMedia

How To Print Your SA302 Or Tax Year Overview From HMRC Love

https://www.gov.uk/guidance/corporation-tax...

You can make a claim to carry back a trading loss when you submit your Company Tax Return for the period when you made the loss

https://www.gov.uk/get-refund-interest-corporation-tax

Running a limited company Get a refund or interest if your company pays too much Corporation Tax or pays it early

You can make a claim to carry back a trading loss when you submit your Company Tax Return for the period when you made the loss

Running a limited company Get a refund or interest if your company pays too much Corporation Tax or pays it early

Limited Company Tax How What Where Why When

Limited Company Tax The Practical Guide To UK Ltd Company Tax

2022 Tax Planning Equity Transfer Tax Rate IMedia

How To Print Your SA302 Or Tax Year Overview From HMRC Love

2022 Tax Planning Equity Transfer Tax Rate IMedia

Limited Company Tax Return Swan Saunders

Limited Company Tax Return Swan Saunders

Limited Company Tax Calculator Spreadsheet Intended For Ato Tax