In this age of electronic devices, where screens dominate our lives it's no wonder that the appeal of tangible printed objects hasn't waned. Whatever the reason, whether for education, creative projects, or simply to add a personal touch to your space, Limited Company Tax Relief On Charity Donations are a great resource. We'll take a dive through the vast world of "Limited Company Tax Relief On Charity Donations," exploring their purpose, where they are available, and how they can add value to various aspects of your lives.

Get Latest Limited Company Tax Relief On Charity Donations Below

Limited Company Tax Relief On Charity Donations

Limited Company Tax Relief On Charity Donations -

See latest updates Companies are entitled to tax relief for qualifying charitable donations made to charities The donations are paid gross without the deduction of income tax The donations are deductible from the company s total profits in the year in which the donations are made

For Limited Companies that want to claim tax relief on charitable donations there are different ways in which they can do this depending on the nature of the donation Deducting from profits To claim tax relief on donations of money land property shares fill in the Qualifying Donations box with the total value of your donations in

The Limited Company Tax Relief On Charity Donations are a huge assortment of printable, downloadable materials available online at no cost. They come in many formats, such as worksheets, templates, coloring pages, and much more. The value of Limited Company Tax Relief On Charity Donations is their versatility and accessibility.

More of Limited Company Tax Relief On Charity Donations

Tax Relief On Charity Donations Dray Dray Israel Tax Guides

Tax Relief On Charity Donations Dray Dray Israel Tax Guides

Do this either through your Self Assessment tax return by asking HM Revenue and Customs HMRC to amend your tax code So for a donation of 10 the charity could claim 2 and you would get 2 in tax relief since the higher rate is 40 and the charity has already claimed 20 of that

Limited companies can pay less tax if they donate land or property or shares in another company to a charity The donation made is capital gains tax free and companies can deduct the amount of Gift from the profits to get a less taxable amount

Printables that are free have gained enormous popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: We can customize print-ready templates to your specific requirements whether you're designing invitations or arranging your schedule or even decorating your home.

-

Educational Value Printables for education that are free cater to learners of all ages, making the perfect tool for teachers and parents.

-

Simple: Instant access to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Limited Company Tax Relief On Charity Donations

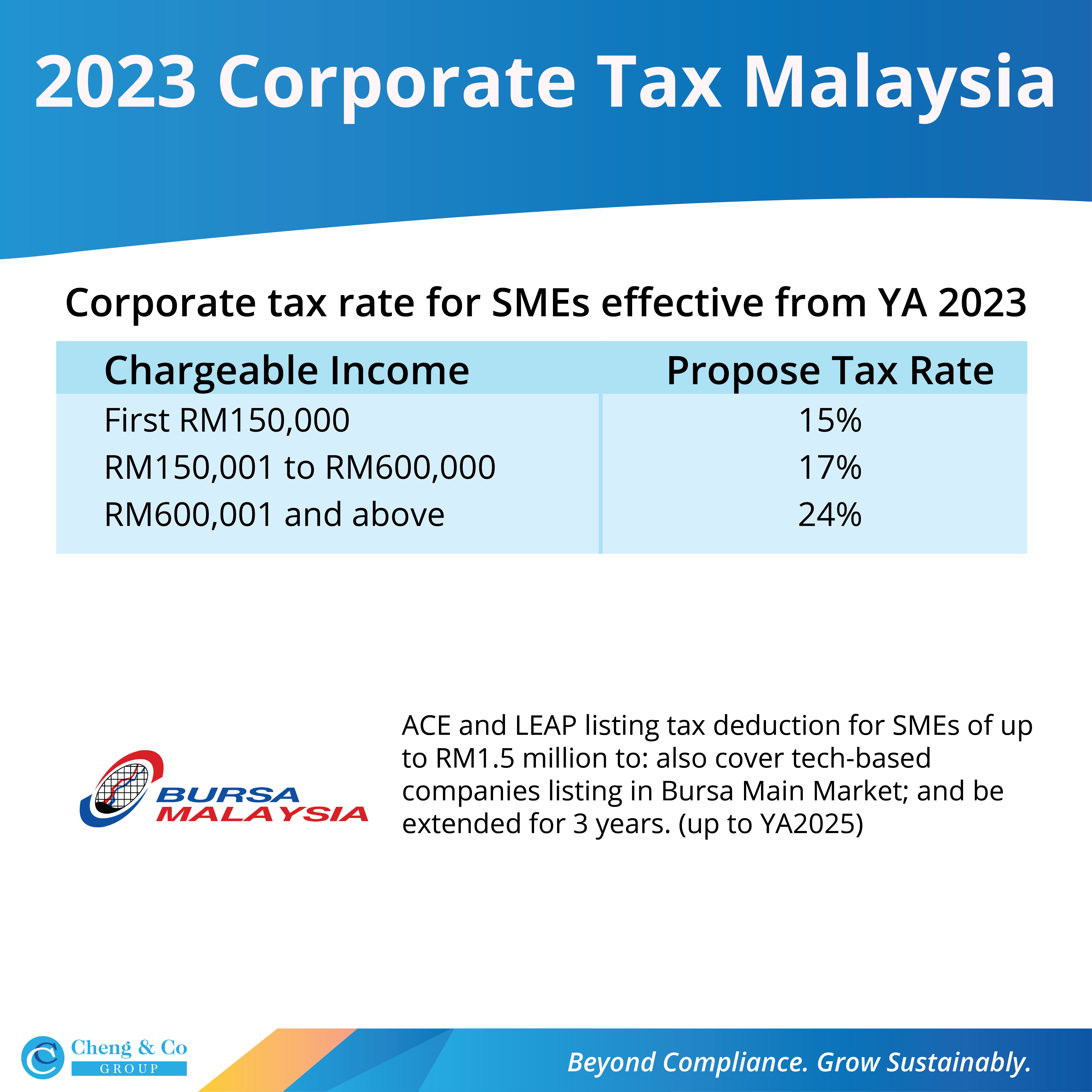

List Of Personal Tax Relief And Incentives In Malaysia 2023

List Of Personal Tax Relief And Incentives In Malaysia 2023

Through Gift Aid however a charity is able to reclaim the basic rate of tax of 20 on a donation with the other 20 or 25 available to be reclaimed by the person donating thereby reducing their income tax bill

CTA10 S189 provides for relief to companies for qualifying donations payments to any of the following qualifying bodies a charity within the meaning of FA10 SCH6 PARA1 or an eligible

In the event that we've stirred your interest in Limited Company Tax Relief On Charity Donations, let's explore where you can find these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Limited Company Tax Relief On Charity Donations for different reasons.

- Explore categories like interior decor, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students in need of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates at no cost.

- The blogs covered cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Limited Company Tax Relief On Charity Donations

Here are some new ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Limited Company Tax Relief On Charity Donations are a treasure trove with useful and creative ideas that cater to various needs and preferences. Their access and versatility makes them a fantastic addition to both professional and personal lives. Explore the vast world of Limited Company Tax Relief On Charity Donations right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free completely free?

- Yes, they are! You can print and download these documents for free.

-

Can I use the free printables for commercial use?

- It's determined by the specific conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations regarding their use. Check the terms and conditions set forth by the creator.

-

How can I print Limited Company Tax Relief On Charity Donations?

- Print them at home with an printer, or go to an in-store print shop to get more high-quality prints.

-

What software will I need to access printables at no cost?

- Most PDF-based printables are available in PDF format, which is open with no cost software like Adobe Reader.

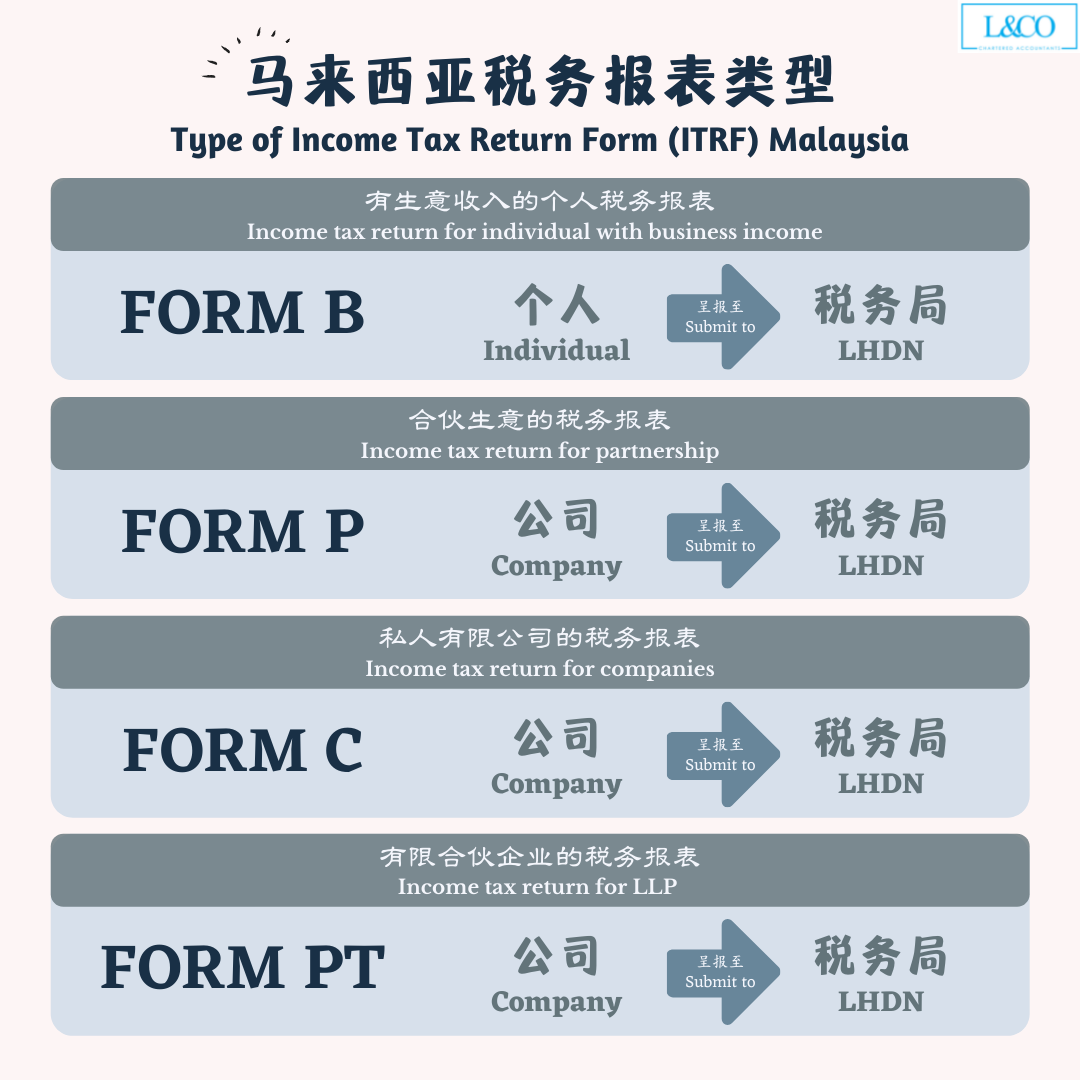

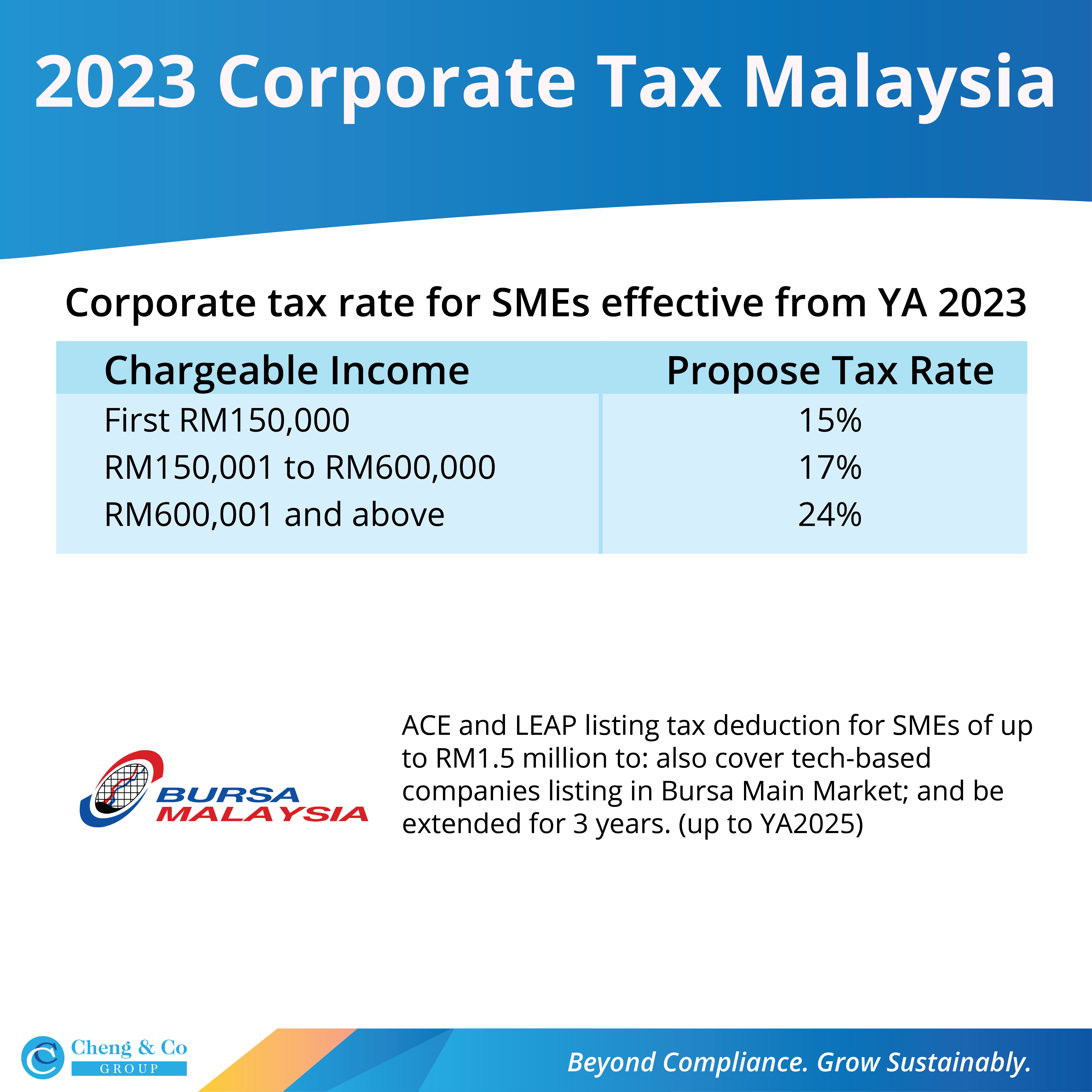

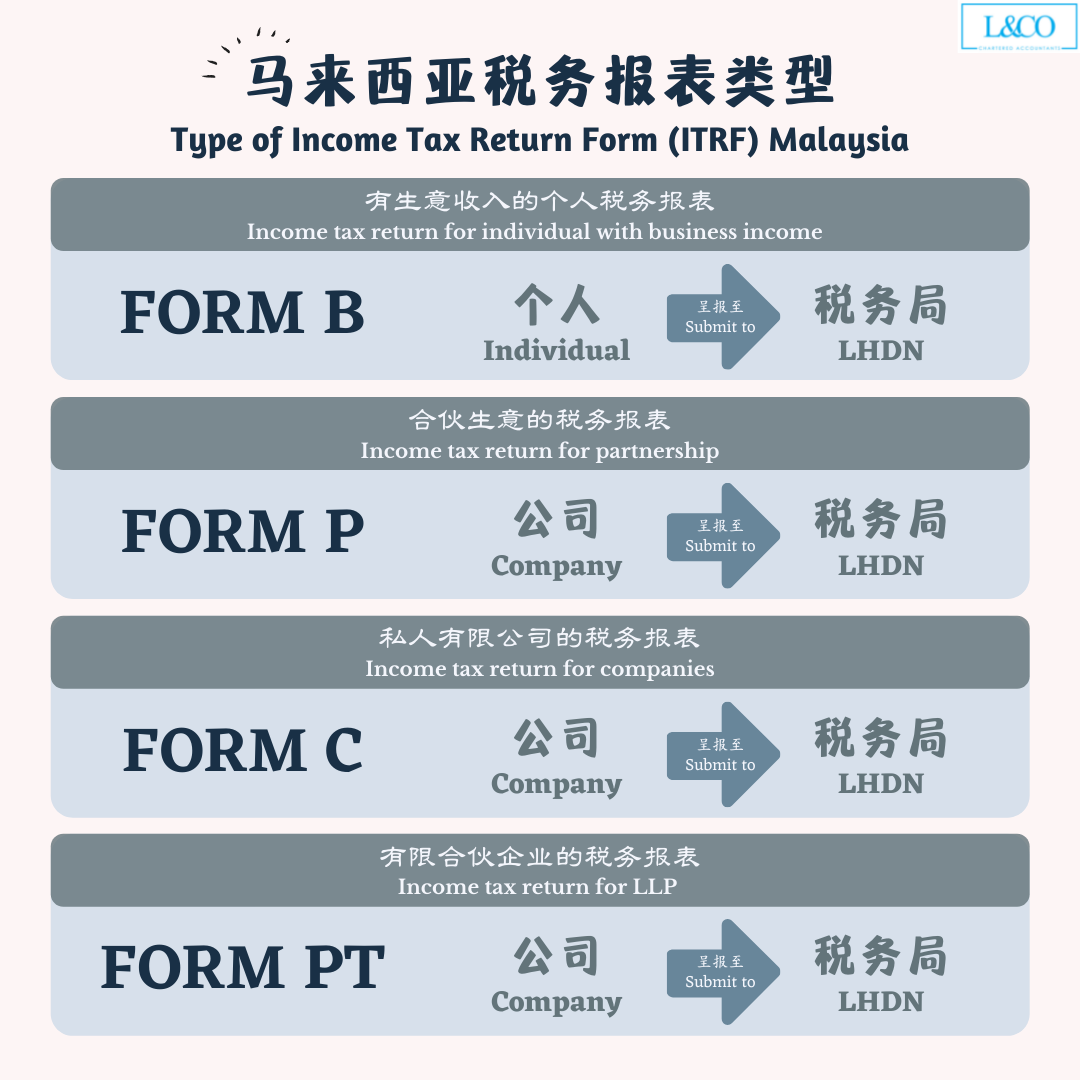

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Harapan Pushes For Increase In Federal Grants To States In Budget Document

Check more sample of Limited Company Tax Relief On Charity Donations below

What Is The Disasters Emergency Committee Giving Is Great

Tax Relief On Donations To Charity Part 1 YouTube

Short Essay On Charity

Income Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Nick Clegg Coalition Is in A Rut As Every Good Story Turns Bad

Latest Budget 2023 Malaysia Summary Cheng Co Group

https://www.crunch.co.uk/knowledge/article/tax...

For Limited Companies that want to claim tax relief on charitable donations there are different ways in which they can do this depending on the nature of the donation Deducting from profits To claim tax relief on donations of money land property shares fill in the Qualifying Donations box with the total value of your donations in

https://www.gov.uk/hmrc-internal-manuals/company...

CTA10 S189 1 and 2 allow the deduction of qualifying charitable donations from a company s total profits as reduced by any other relief except group relief in computing CT

For Limited Companies that want to claim tax relief on charitable donations there are different ways in which they can do this depending on the nature of the donation Deducting from profits To claim tax relief on donations of money land property shares fill in the Qualifying Donations box with the total value of your donations in

CTA10 S189 1 and 2 allow the deduction of qualifying charitable donations from a company s total profits as reduced by any other relief except group relief in computing CT

Income Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Tax Relief On Donations To Charity Part 1 YouTube

Nick Clegg Coalition Is in A Rut As Every Good Story Turns Bad

Latest Budget 2023 Malaysia Summary Cheng Co Group

Ireland Limited Company Tax Calculator

Mark s Thoughts Tax Relief On Charity Donations

Mark s Thoughts Tax Relief On Charity Donations

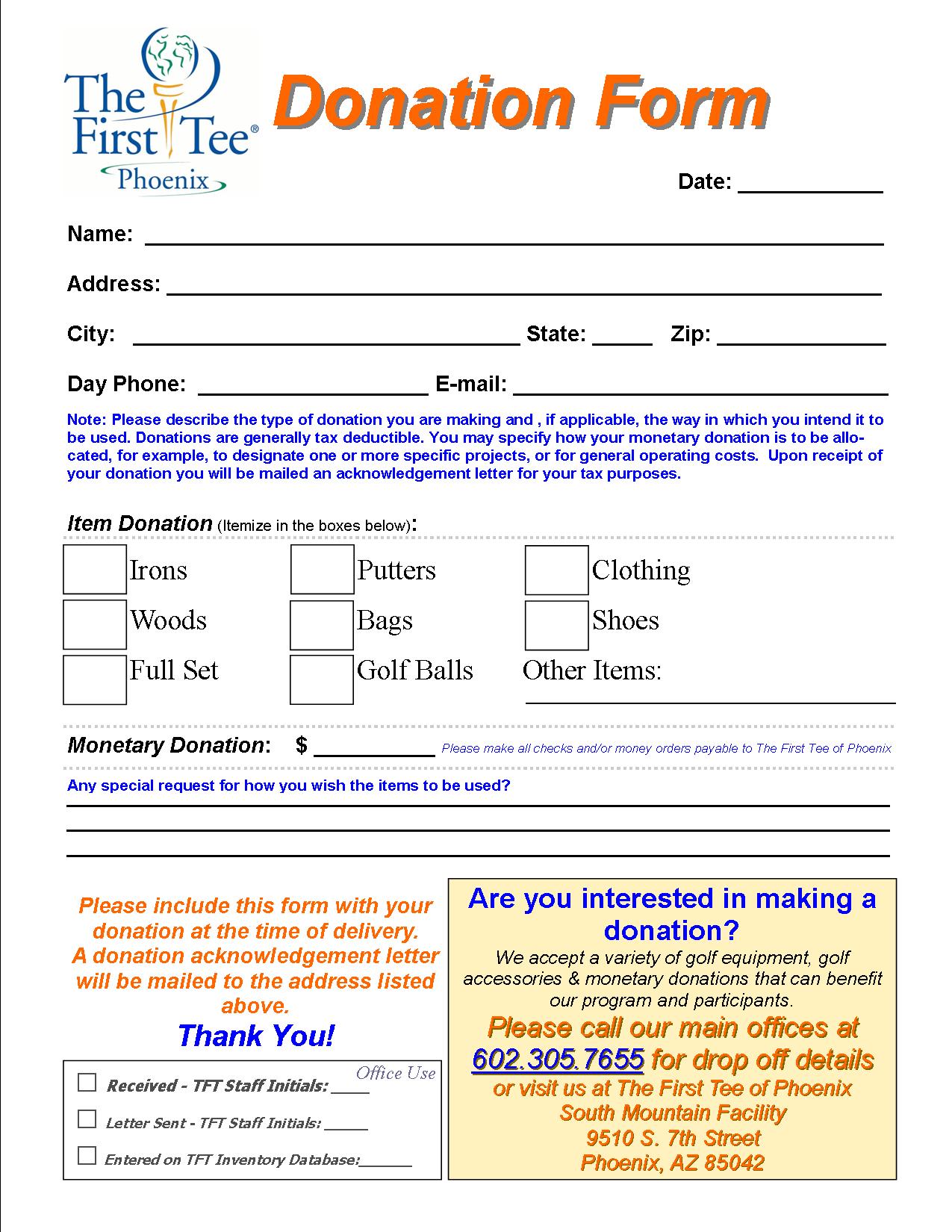

Charity Donation Card Template