In this digital age, where screens have become the dominant feature of our lives and our lives are dominated by screens, the appeal of tangible printed materials isn't diminishing. No matter whether it's for educational uses for creative projects, just adding some personal flair to your area, Loan Deduction In Income Tax are now a useful source. In this article, we'll dive into the sphere of "Loan Deduction In Income Tax," exploring the benefits of them, where they are, and how they can enrich various aspects of your life.

Get Latest Loan Deduction In Income Tax Below

Loan Deduction In Income Tax

Loan Deduction In Income Tax -

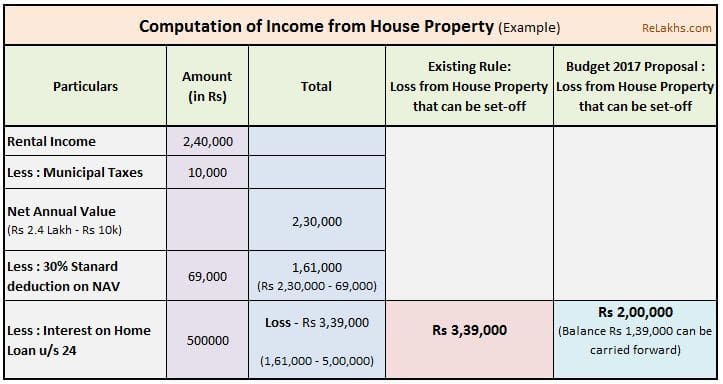

A tax deduction on home loan can be claimed if it is taken for the purchase or construction of a house Step by Step Guide to Claim Home Loan Tax Benefits Step 1 Familiarise Yourself with the Applicable Sections The Income Tax Act provides home loan income tax benefit under various sections

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at length how these sections help a

Loan Deduction In Income Tax cover a large selection of printable and downloadable material that is available online at no cost. They come in many styles, from worksheets to templates, coloring pages, and many more. The benefit of Loan Deduction In Income Tax is in their variety and accessibility.

More of Loan Deduction In Income Tax

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

Income Tax Deductions List FY 2018 19 List Of Important Income Tax

In this article we will look at the various tax benefits for home loans Save income tax with medical expenses Taxpayers who obtained a house loan in FY 2016 17 were entitled for an additional tax deduction of up to Rs 50 000 under Section 80EE Currently under Section 24 a house loan borrower who pays interest on the loan can

Section 80EE of the Income tax Act 1961 allows deductions on the interest component of a home loan This section allows a deduction of up to Rs 50 000 annually until the loan is fully repaid Taxpayers can claim the benefit under Section 80EE only if they serviced a home loan between April 1 2016 and March 31 2017

Loan Deduction In Income Tax have gained immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: The Customization feature lets you tailor printables to your specific needs in designing invitations, organizing your schedule, or decorating your home.

-

Educational value: Printing educational materials for no cost provide for students of all ages, making them a useful tool for teachers and parents.

-

It's easy: instant access a variety of designs and templates cuts down on time and efforts.

Where to Find more Loan Deduction In Income Tax

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction On Salary Ay 2021 22 Standard Deduction 2021

Find out whether interest on personal loans is tax deductible and what types of loan interest can be used to reduce your taxable income The deduction can lower the amount of income subject to

Education Loans interest allows tax deduction u s 80E of the Income Tax Act Know the tax benefits deductions you can avail on an Education Loan

After we've peaked your interest in Loan Deduction In Income Tax Let's see where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Loan Deduction In Income Tax designed for a variety reasons.

- Explore categories such as decorations for the home, education and organization, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free or flashcards as well as learning materials.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their imaginative designs with templates and designs for free.

- The blogs covered cover a wide array of topics, ranging ranging from DIY projects to party planning.

Maximizing Loan Deduction In Income Tax

Here are some fresh ways for you to get the best of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Print worksheets that are free to help reinforce your learning at home and in class.

3. Event Planning

- Design invitations and banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars, to-do lists, and meal planners.

Conclusion

Loan Deduction In Income Tax are an abundance of useful and creative resources that cater to various needs and desires. Their availability and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast world of Loan Deduction In Income Tax now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can print and download these documents for free.

-

Can I make use of free printables for commercial uses?

- It's contingent upon the specific rules of usage. Make sure you read the guidelines for the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues when you download Loan Deduction In Income Tax?

- Certain printables might have limitations regarding their use. You should read the terms of service and conditions provided by the author.

-

How can I print printables for free?

- Print them at home using printing equipment or visit the local print shops for better quality prints.

-

What software do I require to view printables free of charge?

- The majority of printables are in the format of PDF, which is open with no cost software like Adobe Reader.

Tax Benefits On Home Loan Know More At Taxhelpdesk

Can You Claim Both HRA And Home Loan Interest Deduction In Income Tax

Check more sample of Loan Deduction In Income Tax below

Section 24 Of Income Tax Act Deduction For Home Loan Interest

How To Calculate Standard Deduction In Income Tax Act Scripbox

Income Tax Deduction For Interest On Education Loan Section 80E TaxAdda

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

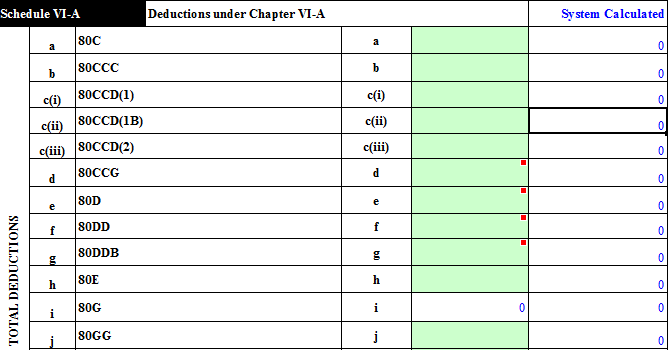

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction In Income Tax U s 80C To 80U Chapter VIA Tax Savings In ITR

https://housing.com/news/home-loans-guide-claiming-tax-benefits

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at length how these sections help a

https://cleartax.in/s/section-80ee-income-tax-deduction-for...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year You can continue to claim this deduction until you have fully repaid the loan

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at length how these sections help a

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year You can continue to claim this deduction until you have fully repaid the loan

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

How To Calculate Standard Deduction In Income Tax Act Scripbox

Deduction In Income Tax deduction Under 80c To 80u 80u 80jja 80qqb

Deduction In Income Tax U s 80C To 80U Chapter VIA Tax Savings In ITR

Material Requirement Form House Rent Deduction In Income Tax Section

Standard Deduction In Income Tax With Examples InstaFiling

Standard Deduction In Income Tax With Examples InstaFiling

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar